Alibaba's Singles' Day has surpassed global records for e-commerce sales, taking a total of $17.8 billion this year. However, there are concerns whether the one-day event held every 11th November can sustain its large growth in the coming years.

November 23, 2016 | Janine Marie Crisanto- Alibaba has generated record-breaking sales volume since 2009 during its annual online Singles’ Day event

- This year, Alibaba achieved a total of $17.8 billion in sales and one billion transactions during the Singles’ Day

- However, a slowdown in growth figures has cast skepticism on the future performance of the event

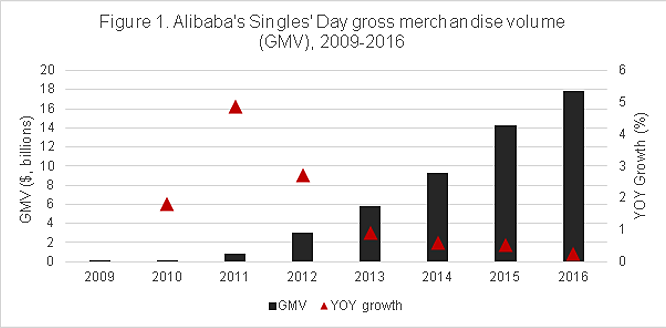

Once again, Alibaba broke its record during its annual Singles’ Day, the online shopping marathon that is said to be the largest globally. Held every 11th of November, this year’s Singles’ Day generated more than $1.47 billion of sales within the first ten minutes of the day and $7 billion in the first two hours. The 24-hour shopping gala ended with a total $17.8 billion worth of gross merchandise volume (GMV), which was 24% higher than last year’s $14.3 billion GMV (Figure 1).

Source: Alibaba

In Alibaba’s live blog, Daniel Zhang, group chief executive officer of Alibaba, shared that in the first hour of Singles' Day, 175,000 orders were coming per second. In 2013, the company’s GMV was only $5.14 billion, which Alibaba achieved within only one hour this year. The growth of the event has been staggering as shown by the number of participating retailers and brands. From 27 merchants in 2009, this year’s Singles’ Day gathered 100,000 participating retailers with more than 14,000 international brands. Some of the foreign brands that dominated sales include Apple, Nike, New Balance, Adidas, and Ugg. On the other hand, local Chinese home appliance brands such as Haier and Midea, and smartphone maker Meizu were the top sellers. Alibaba’s profit comes from commission and fees on brands’ advertising and sales.

Despite the record-breaking sales this year, the GMV was a little short of the expected $20 billion. In addition, this year’s growth pales in comparison with last year’s 60%, which reflects the increasing cautiousness and frugality among shoppers who were hunting for the lowest prices. Alibaba confirmed that cost per order declined to $27 (RMB 184) from approximately $28 (RMB 194) in 2015. Furthermore, Alibaba’s president Mike Evans said during an interview with Bloomberg, “it is highly unlikely we will continue to grow at 60% each year because the absolute numbers are becoming so large.”

Nevertheless, Alibaba uses the Singles’ Day to showcase the scalability of its e-commerce infrastructure as well as its advanced online payment technology.

Alipay, the company’s online payment service provider, recorded a 48% surge in its transactions during the event. Around 1.05 billion transactions were made through the payment app – peaking at 120,000 transactions per second. Alipay’s cross-border transactions has risen consistently as the event became more global in the past years. In fact, Ant Financial, Alibaba’s spin-off company and operator of Alipay, reported that cross-border payment transactions rose 60% this year. The company also reported that 235 countries completed cross-border transactions during the event. Russia contributed for 48% of the cross-border transaction volume, followed by Spain and Ukraine with 8% and 5.5%, respectively.

The large volume of transactions that the Singles’ Day event generated allowed Alipay to get a large amount of consumer data that are important in curating products and services – something that is very vital to merchants. And Alibaba has been very proud of it. “We will become the future of new retail. Product design and manufacturing will move in the direction of truly being driven by big data,” Zhang said.

Singles’ Day have also helped strengthen China’s mobile e-commerce industry. There are around 1.3 billion smartphone in the country, with 37% purchasing goods using their mobile devices – higher than the global average of 13%. According to Xinhua, the official press agency of the People’s Republic of China, 82% of the transactions during the event were made using mobile phones as compared to 70% in 2015. Although Alibaba’s rival JD.com did not post sales numbers, it registered 85% sales through mobile devices. The strongest usage growth in mobile transactions during the event originated from users in the country’s less developed central and western region.

November 11 (11.11) has been an “anti-valentine’s day” in China since the 1990s. In 2009, Jack Ma, founder and CEO of Alibaba, saw this as a commercial opportunity to promote discounts and “Double 11” deals to boost revenue during the lull sales period before the Chinese New Year. Since then, the marketing event has grown into a worldwide phenomenon which Alibaba has trademarked in December 2012. Today, Singles’ Day serves as a good example for other e-commerce platforms and financial institutions not only in terms of what makes a successful marketing and customer engagement. The event provides a remarkable model on how to leverage new technologies and infrastructure to manage a record-breaking influx of payments, gaining a large volume of digital sales.

Categories:

E-Commerce, Payments, Risk and Regulation, Risk Management, Sales, Technology & OperationsKeywords:Alibaba, Singles' Day, Alipay, Payments, E-commerce, GMV, China

Alibaba's Singles' Day has surpassed global records for e-commerce sales, taking a total of $17.8 billion this year. However, there are concerns whether the one-day event held every 11th November can sustain its large growth in the coming years.

November 23, 2016 | Janine Marie Crisanto- Alibaba has generated record-breaking sales volume since 2009 during its annual online Singles’ Day event

- This year, Alibaba achieved a total of $17.8 billion in sales and one billion transactions during the Singles’ Day

- However, a slowdown in growth figures has cast skepticism on the future performance of the event

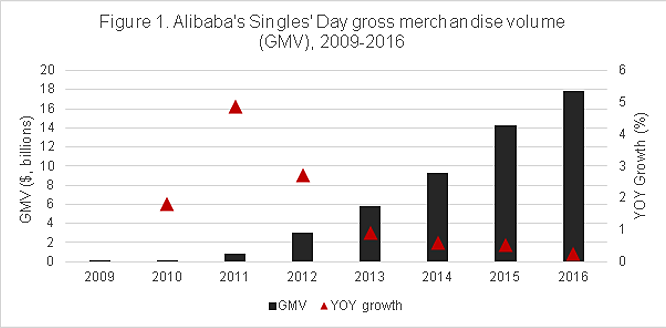

Once again, Alibaba broke its record during its annual Singles’ Day, the online shopping marathon that is said to be the largest globally. Held every 11th of November, this year’s Singles’ Day generated more than $1.47 billion of sales within the first ten minutes of the day and $7 billion in the first two hours. The 24-hour shopping gala ended with a total $17.8 billion worth of gross merchandise volume (GMV), which was 24% higher than last year’s $14.3 billion GMV (Figure 1).

Source: Alibaba

In Alibaba’s live blog, Daniel Zhang, group chief executive officer of Alibaba, shared that in the first hour of Singles' Day, 175,000 orders were coming per second. In 2013, the company’s GMV was only $5.14 billion, which Alibaba achieved within only one hour this year. The growth of the event has been staggering as shown by the number of participating retailers and brands. From 27 merchants in 2009, this year’s Singles’ Day gathered 100,000 participating retailers with more than 14,000 international brands. Some of the foreign brands that dominated sales include Apple, Nike, New Balance, Adidas, and Ugg. On the other hand, local Chinese home appliance brands such as Haier and Midea, and smartphone maker Meizu were the top sellers. Alibaba’s profit comes from commission and fees on brands’ advertising and sales.

Despite the record-breaking sales this year, the GMV was a little short of the expected $20 billion. In addition, this year’s growth pales in comparison with last year’s 60%, which reflects the increasing cautiousness and frugality among shoppers who were hunting for the lowest prices. Alibaba confirmed that cost per order declined to $27 (RMB 184) from approximately $28 (RMB 194) in 2015. Furthermore, Alibaba’s president Mike Evans said during an interview with Bloomberg, “it is highly unlikely we will continue to grow at 60% each year because the absolute numbers are becoming so large.”

Nevertheless, Alibaba uses the Singles’ Day to showcase the scalability of its e-commerce infrastructure as well as its advanced online payment technology.

Alipay, the company’s online payment service provider, recorded a 48% surge in its transactions during the event. Around 1.05 billion transactions were made through the payment app – peaking at 120,000 transactions per second. Alipay’s cross-border transactions has risen consistently as the event became more global in the past years. In fact, Ant Financial, Alibaba’s spin-off company and operator of Alipay, reported that cross-border payment transactions rose 60% this year. The company also reported that 235 countries completed cross-border transactions during the event. Russia contributed for 48% of the cross-border transaction volume, followed by Spain and Ukraine with 8% and 5.5%, respectively.

The large volume of transactions that the Singles’ Day event generated allowed Alipay to get a large amount of consumer data that are important in curating products and services – something that is very vital to merchants. And Alibaba has been very proud of it. “We will become the future of new retail. Product design and manufacturing will move in the direction of truly being driven by big data,” Zhang said.

Singles’ Day have also helped strengthen China’s mobile e-commerce industry. There are around 1.3 billion smartphone in the country, with 37% purchasing goods using their mobile devices – higher than the global average of 13%. According to Xinhua, the official press agency of the People’s Republic of China, 82% of the transactions during the event were made using mobile phones as compared to 70% in 2015. Although Alibaba’s rival JD.com did not post sales numbers, it registered 85% sales through mobile devices. The strongest usage growth in mobile transactions during the event originated from users in the country’s less developed central and western region.

November 11 (11.11) has been an “anti-valentine’s day” in China since the 1990s. In 2009, Jack Ma, founder and CEO of Alibaba, saw this as a commercial opportunity to promote discounts and “Double 11” deals to boost revenue during the lull sales period before the Chinese New Year. Since then, the marketing event has grown into a worldwide phenomenon which Alibaba has trademarked in December 2012. Today, Singles’ Day serves as a good example for other e-commerce platforms and financial institutions not only in terms of what makes a successful marketing and customer engagement. The event provides a remarkable model on how to leverage new technologies and infrastructure to manage a record-breaking influx of payments, gaining a large volume of digital sales.

Categories:

E-Commerce, Payments, Risk and Regulation, Risk Management, Sales, Technology & OperationsKeywords:Alibaba, Singles' Day, Alipay, Payments, E-commerce, GMV, China