Workbench project is a wireless tablet banking architecture that aims at real time connectivity and straight through processing of services and products to increase sales and productivity.

May 27, 2015 | ResearchWhilst reviving a once great franchise both globally and in Asia Pacific may well take some time, Standard Chartered still has the drive to deliver key innovations from within its core markets such as Singapore and Hong Kong. In June 2014, the bank introduced ‘Retail Workbench’ in Korea, a tablet-based sales and service platform that allows bank staff to provide a banking experience at a customer’s environment. There are plans later in 2015 to roll out the programme across other markets in the Asia Pacific region. Current branch set ups require dedicated lines to servers at remote locations, are full of cluttered fixed location IT devices, and often result in high initial investment per branch. The workbench operates over a secure commercial 4G LTE line, the latest broadband development for the fast delivery of data, which does not require physical connections, and thus enables a flexible branch layout design. Standard Chartered believes this development can deliver cost savings that can facilitate the redirection of capital to customer servicing and product innovation.

With its ‘workbench’, branch staff are no longer tied to their desks. The workbench enables paperless processes such as customer account opening or loan applications in a wireless environment, aiding what increasingly matters to banks - close customer proximity banking that increases process efficiency and ultimately improves customer service and bottom line performance in particular to its South Korean and Singaporean unit which has seen decline or losses in since 2013.

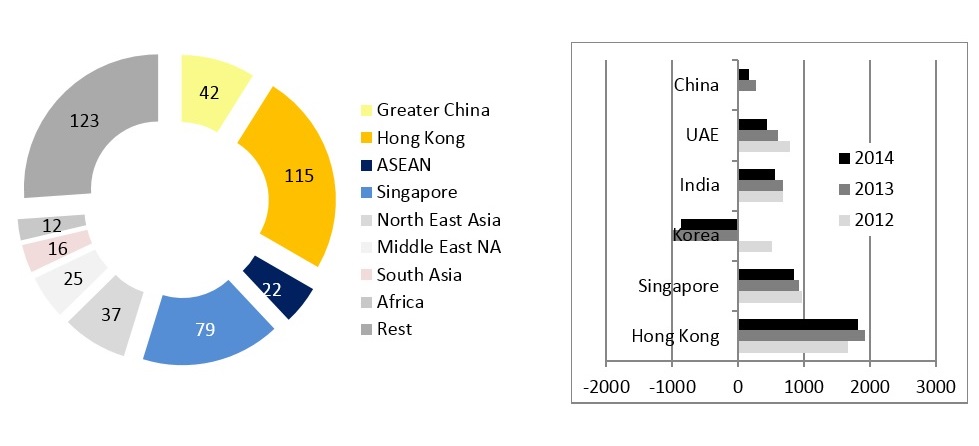

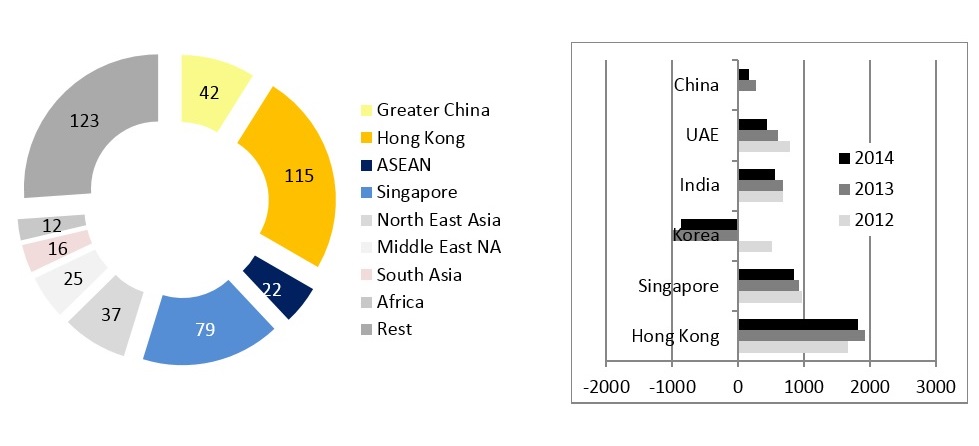

Fig 1. Group Deposit Structure ($, billion, 2014) Fig 2. Total Operating Profit ($, million)

*Source: Asian Banker Research

‘Retail Workbench’ Project

Whilst tablet banking has been introduced by Korean banks and is touted by banks in Australia as the next big thing, though not introduced yet, it is Standard Chartered more than any other player in Asia Pacific that has made material progress in systems for rolling out a tablet-based platform regionally. In fact, when Citibank introduced the region’s first ‘smart’ multi-media digital branch concept in 2010 in Japan, it was already able to execute full end-to-end digital processing but this was still in a stationary environment for staff and customers. Tablet banking will further blur the line between ‘channels’ as the ‘digital’ is as much in the branch as the branch in the digital devices. In a multi-device environment, the determining factor will shift device communication from “independent” to “inter-dependence” and thus from channel to context.

From Concept to Implementation

Discussions around the ‘Retail Workbench’ project started as early as 2013 under Chris de Bruin, a South African national, when he served as head of regional Consumer Banking Korea and Japan between 2011 and 2014. Since April 2014, and now as global head of integrated distribution, De Bruin is one of the few employees left within Standard Chartered Bank who have been with the bank for more than a decade, and can foresee the changes digital can bring in the long term to financial organisations and its likely impact to Standard Chartered; he has the ability to implement innovation with an eye for business and productivity. In the case of ‘Retail Workbench’, De Bruin pulled together a team of 10 professionals to deliver the concept from the planning board into a real-life application; the team was comprised of facilitators/communicators, and process champions from both from the IT and business side, who were a mixture of skilled programmers and future users of the system, current front line employees .

Since a variety of projects compete for funding at any given time, and securing a buy in from key internal stakeholders is critical, De Bruin was the anchor facilitator and communicator. He forged a common purpose among stakeholders and resources from within and outside of the organization, and authorised the building of the first prototype in September 2013. He also included frontline employees from the outset of the project to achieve the right test design and UAT for the project.

“Communicating to different internal stakeholders through an ad-hoc workgroup was key. We had a bank digitisation committee that met every month updating stakeholders with the digitisation idea about progress. The workgroup later became a taskforce team. We were lucky to have Chris de Bruin who is keen on adopting new technologies and turning around our cost structure,” said Ryan Jong Hoon Kim, programme director and head of digital banking, North East Asia.

From conceptualisation to securing funding support, the team spent over one and a half years in planning and research. During the seven months of implementation, the project required bank-wide collaboration, and effective interdepartmental communication. The team encountered regulatory / technical / procedural nightmares, endless interdepartmental meetings, multiple visits to regulatory bodies, delivered hundreds of pages of meeting minutes but were on time to launch the Retail Workbench on July 1, 2014.

“We wanted to improve the life of the frontline, support their work and improve productivity. To do so, we had to make it very easy and truly digital. A lot of back-end transactions were already digital, but we realised that at the frontline working procedures were mainly manual and depending on how many products customers buy, you need to spend a lot of time on data entry while special requests always require additional manual handling. So, we wanted to reduce the administrative burden and simplify the processes for the front line because there is so much paper and manual processing. Our front line people spent too much time on this task, so instead, we wanted to create time to do more on planning/advice and needs based selling,” explained Joseph Cho, head of Retail Workbench, then quality assurance for the project.

Standard Chartered looked into various technologies such as advanced kiosks, portable branches, and internet-only banks whilst studying how to digitise its branch network.

“The bottom-line in our device selection came down to cost and scalability. Other technologies cost too much compared to our expectation, and scalability was limited. For instance, the full operational and capital cost of an advanced kiosk today is in the range of $150,000 to $200,000 with little buy in on sales and advice. A tablet PC based-solution to us was cost efficient and readily deployable at a moments notice. Going forward we expect the ‘Retail Workbench’ to replace our existing stationary terminal based workstations in all our branches in Korea and eventually in the region,” said Hyung Chan Chang, project manager, digital banking Korea.

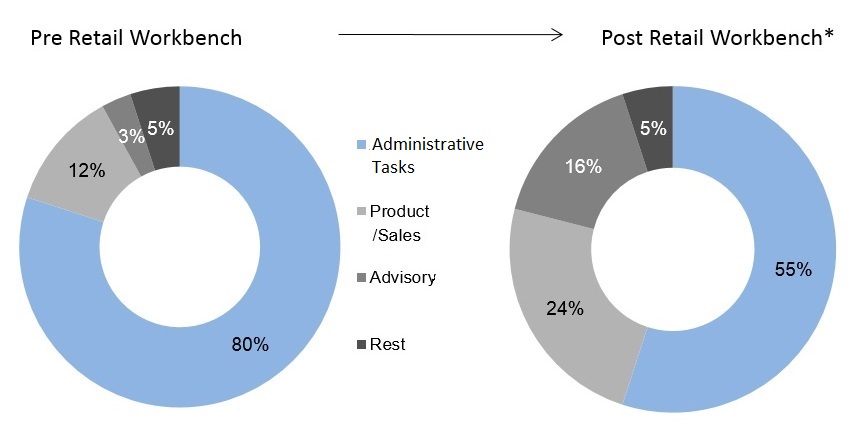

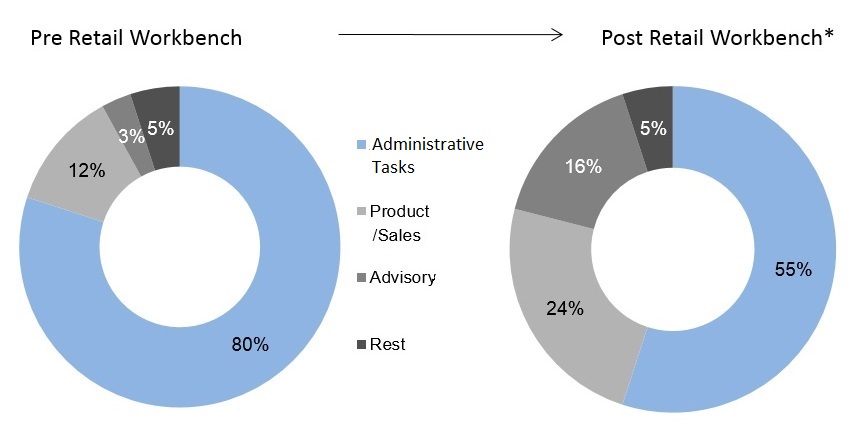

According to Standard Chartered Bank, the project also had an impact on how branch staff prioritizes time. Priority has been shifting from administrative to advisory and product recommendation.

Fig 3 Prioritisation of Tasks for In-Branch FTE before and after Implementation

*Source: Standard Chartered Bank

**Note: On average, including low performers. Not all products are currently available on Retail Workbench.

Access and Adoption

Standard Chartered choose Korea as the first test site as it has one of the most advanced and interconnected data infrastructures. It was regulatory support, government infrastructure and real time access to social security, telecom databases and inland revenue data supported a decision in favour of Korea instead of Singapore or Hong Kong. Standard Chartered Korea with 343 branches was the first bank in Korea to get full government approval for this system.

“If you are testing this device you need a real time 100% reliable connection to the whole ecosystem to enable proper identity verification and 24x7 connectivity. We will be introducing tablet banking in another 5 to10 markets by end of 2015, including Hong Kong and Singapore but we are taking a step by step approach. And once Korea and Asia is successful we want to take this globally. Currently, user adoption in Korea stands at 340 frontline sales people, which consists of about 18-19% of all full-time sales force and we are tracking the progress to meet client in and outside the branch. Ultimately, we would like to see a ratio of 50:50 of in-branch and out of branch transactions by end of 2015,” said Kim.

Standard Chartered Bank has not yet deployed a near real time event based marketing platform that is able to deliver next best offers to the front line devices. Instead, insights are processed semi-manually by an offering tool that utilises the bank’s customer statistics. All 340 devices are currently connected to this product offering engine.

In June 2015 Standard Chartered Korea will receive a 2nd upgrade to widen the device’s functionality; the banks wealth management business will come online for mutual funds processing. By this time it is expected that user adoption will rise to 40% of the full-time sales force.

Key Elements of Standard Chartered’s Workbench Architecture

1. Security

- FSS (Korean Banking supervisory) certified SmartWork infrastructure allows secure and safe mobile wireless banking environment over a 4G LTE network

- Mobile device management (MDM) solution adds additional safety measures in access control, data protection, theft control and more.

- The bank complies with standard safety measures in capturing customer photo ID, bank staff mobile phone verification and customer mobile phone verification. In addition, all completed customer application becomes certified with a time stamp provided by Korea Financial Telecommunication & Clearing Institute (KFTC).

2. Real Time Scoring

- Real time customer service advisory module: Upon customer agreement, bank staff can provide real-time credit score inquiry and customer benefit simulation. In the past, bank staff had to first fax customer agreement and call another bank staff to run customer credit score.

3. Customer ID Capture End-to-End Processing

- Customer information such as Photo ID and supplementary documents are captured using tablet PC camera and optical character recognition. The customer information on photo ID is automatically read using OCR and matched to bank database minimising additional data entry

4. Customer Service Tool Set

- Access to marketing and product library where staff can draw from

- Customer advisory module using needs a based conversation tool helps customer identify matching banking products

- Various other tool sets such as meeting room reservation, appointment management system

Differentiation to other Korean Banks

While Standard Chartered Bank Korea was the first to introduce an end-to-end assisted wireless banking experience to Korean customers in July 2014, Korean banks generally plan to roll-out tablet based end to end solutions by the first half of 2015. While Standard Chartered took a full end to end approach by offering straight through processes, end-to-end client on-boarding, account opening and loan applications, some local banks can take customer application in digital format but still transfer the file manually to the backend for additional processing. However, at Standard Chartered Bank Korea, customers can open a current account or apply for a loan or credit card instantly with no additional processing in the backend required. At the same time the bank has strengthened security measures that reduces the risk for sales made outside a branch.

Business Impact

“We believe that our Retail Workbench brings a fundamental change to our branch network. This is not just a one-time solution that will only last for 24 to 36 months. Retail Workbench fundamentally changes the way bank staff work. The work is no longer tied to a branch. This is the permanent game changer in retail banking”, said Chris de Bruin, Global Head of Integrated Distribution.

While process time for account activation have been reduced from 15-20 minutes to 5-7 minutes and clients can make immediate transfers into the account, cheque and debit card turnaround times currently stand between 48 and 72 hours. Customer turnaround time on the tablet device for a mortgage product is about 67 minutes on average, including advising and application write-up but excludes the underwriting process which still takes up to 48 hours.

Between the launch in July 2014 and April 2015, Retail Workbench has completed over 40,000 cases for sales and services requests.

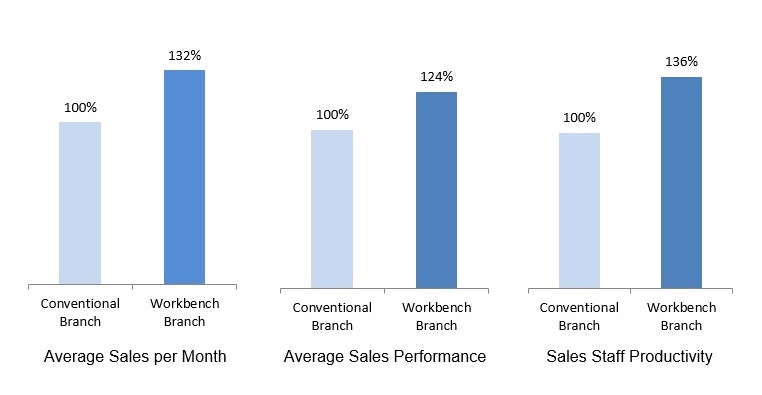

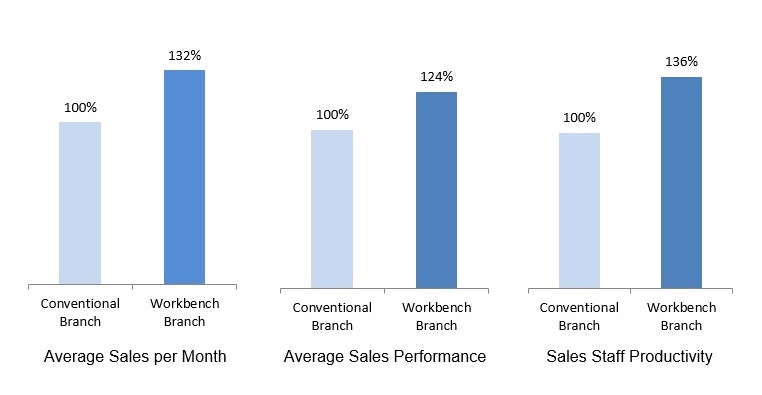

Within the current nine months observation period since introducing the workbench to the Korean market, average sales per month have increased by 32% in a work-bench branch, and average sales performance measured in number of product sales per employee per day increased by 24% with top performers achieving 132%. Comparing before and after, sales staff has increase productivity measured in number of sales by 36%.

“As of 1Q 2015 we are at about 42% ROI, considering being only 9 months in the market. We expect to reach 200% in April 2016 and surpass approximately 600% by 2019,” said Ryan Jong Hoon Kim.

Fig 4. Sales staff increased productivity measured in number of sales by 36%

*Source: Asian Banker Research

Categories:

Asia Pacific, Banks We Like, Branch Banking, Channels, Customer Centricity, Data & Analytics, Data Management, Innovation, Mobile Banking, Retail Banking, Technology & OperationsKeywords:Standard Chartered Bank, Tablet Banking, Retail Workbench

Workbench project is a wireless tablet banking architecture that aims at real time connectivity and straight through processing of services and products to increase sales and productivity.

May 27, 2015 | ResearchWhilst reviving a once great franchise both globally and in Asia Pacific may well take some time, Standard Chartered still has the drive to deliver key innovations from within its core markets such as Singapore and Hong Kong. In June 2014, the bank introduced ‘Retail Workbench’ in Korea, a tablet-based sales and service platform that allows bank staff to provide a banking experience at a customer’s environment. There are plans later in 2015 to roll out the programme across other markets in the Asia Pacific region. Current branch set ups require dedicated lines to servers at remote locations, are full of cluttered fixed location IT devices, and often result in high initial investment per branch. The workbench operates over a secure commercial 4G LTE line, the latest broadband development for the fast delivery of data, which does not require physical connections, and thus enables a flexible branch layout design. Standard Chartered believes this development can deliver cost savings that can facilitate the redirection of capital to customer servicing and product innovation.

With its ‘workbench’, branch staff are no longer tied to their desks. The workbench enables paperless processes such as customer account opening or loan applications in a wireless environment, aiding what increasingly matters to banks - close customer proximity banking that increases process efficiency and ultimately improves customer service and bottom line performance in particular to its South Korean and Singaporean unit which has seen decline or losses in since 2013.

Fig 1. Group Deposit Structure ($, billion, 2014) Fig 2. Total Operating Profit ($, million)

*Source: Asian Banker Research

‘Retail Workbench’ Project

Whilst tablet banking has been introduced by Korean banks and is touted by banks in Australia as the next big thing, though not introduced yet, it is Standard Chartered more than any other player in Asia Pacific that has made material progress in systems for rolling out a tablet-based platform regionally. In fact, when Citibank introduced the region’s first ‘smart’ multi-media digital branch concept in 2010 in Japan, it was already able to execute full end-to-end digital processing but this was still in a stationary environment for staff and customers. Tablet banking will further blur the line between ‘channels’ as the ‘digital’ is as much in the branch as the branch in the digital devices. In a multi-device environment, the determining factor will shift device communication from “independent” to “inter-dependence” and thus from channel to context.

From Concept to Implementation

Discussions around the ‘Retail Workbench’ project started as early as 2013 under Chris de Bruin, a South African national, when he served as head of regional Consumer Banking Korea and Japan between 2011 and 2014. Since April 2014, and now as global head of integrated distribution, De Bruin is one of the few employees left within Standard Chartered Bank who have been with the bank for more than a decade, and can foresee the changes digital can bring in the long term to financial organisations and its likely impact to Standard Chartered; he has the ability to implement innovation with an eye for business and productivity. In the case of ‘Retail Workbench’, De Bruin pulled together a team of 10 professionals to deliver the concept from the planning board into a real-life application; the team was comprised of facilitators/communicators, and process champions from both from the IT and business side, who were a mixture of skilled programmers and future users of the system, current front line employees .

Since a variety of projects compete for funding at any given time, and securing a buy in from key internal stakeholders is critical, De Bruin was the anchor facilitator and communicator. He forged a common purpose among stakeholders and resources from within and outside of the organization, and authorised the building of the first prototype in September 2013. He also included frontline employees from the outset of the project to achieve the right test design and UAT for the project.

“Communicating to different internal stakeholders through an ad-hoc workgroup was key. We had a bank digitisation committee that met every month updating stakeholders with the digitisation idea about progress. The workgroup later became a taskforce team. We were lucky to have Chris de Bruin who is keen on adopting new technologies and turning around our cost structure,” said Ryan Jong Hoon Kim, programme director and head of digital banking, North East Asia.

From conceptualisation to securing funding support, the team spent over one and a half years in planning and research. During the seven months of implementation, the project required bank-wide collaboration, and effective interdepartmental communication. The team encountered regulatory / technical / procedural nightmares, endless interdepartmental meetings, multiple visits to regulatory bodies, delivered hundreds of pages of meeting minutes but were on time to launch the Retail Workbench on July 1, 2014.

“We wanted to improve the life of the frontline, support their work and improve productivity. To do so, we had to make it very easy and truly digital. A lot of back-end transactions were already digital, but we realised that at the frontline working procedures were mainly manual and depending on how many products customers buy, you need to spend a lot of time on data entry while special requests always require additional manual handling. So, we wanted to reduce the administrative burden and simplify the processes for the front line because there is so much paper and manual processing. Our front line people spent too much time on this task, so instead, we wanted to create time to do more on planning/advice and needs based selling,” explained Joseph Cho, head of Retail Workbench, then quality assurance for the project.

Standard Chartered looked into various technologies such as advanced kiosks, portable branches, and internet-only banks whilst studying how to digitise its branch network.

“The bottom-line in our device selection came down to cost and scalability. Other technologies cost too much compared to our expectation, and scalability was limited. For instance, the full operational and capital cost of an advanced kiosk today is in the range of $150,000 to $200,000 with little buy in on sales and advice. A tablet PC based-solution to us was cost efficient and readily deployable at a moments notice. Going forward we expect the ‘Retail Workbench’ to replace our existing stationary terminal based workstations in all our branches in Korea and eventually in the region,” said Hyung Chan Chang, project manager, digital banking Korea.

According to Standard Chartered Bank, the project also had an impact on how branch staff prioritizes time. Priority has been shifting from administrative to advisory and product recommendation.

Fig 3 Prioritisation of Tasks for In-Branch FTE before and after Implementation

*Source: Standard Chartered Bank

**Note: On average, including low performers. Not all products are currently available on Retail Workbench.

Access and Adoption

Standard Chartered choose Korea as the first test site as it has one of the most advanced and interconnected data infrastructures. It was regulatory support, government infrastructure and real time access to social security, telecom databases and inland revenue data supported a decision in favour of Korea instead of Singapore or Hong Kong. Standard Chartered Korea with 343 branches was the first bank in Korea to get full government approval for this system.

“If you are testing this device you need a real time 100% reliable connection to the whole ecosystem to enable proper identity verification and 24x7 connectivity. We will be introducing tablet banking in another 5 to10 markets by end of 2015, including Hong Kong and Singapore but we are taking a step by step approach. And once Korea and Asia is successful we want to take this globally. Currently, user adoption in Korea stands at 340 frontline sales people, which consists of about 18-19% of all full-time sales force and we are tracking the progress to meet client in and outside the branch. Ultimately, we would like to see a ratio of 50:50 of in-branch and out of branch transactions by end of 2015,” said Kim.

Standard Chartered Bank has not yet deployed a near real time event based marketing platform that is able to deliver next best offers to the front line devices. Instead, insights are processed semi-manually by an offering tool that utilises the bank’s customer statistics. All 340 devices are currently connected to this product offering engine.

In June 2015 Standard Chartered Korea will receive a 2nd upgrade to widen the device’s functionality; the banks wealth management business will come online for mutual funds processing. By this time it is expected that user adoption will rise to 40% of the full-time sales force.

Key Elements of Standard Chartered’s Workbench Architecture

1. Security

- FSS (Korean Banking supervisory) certified SmartWork infrastructure allows secure and safe mobile wireless banking environment over a 4G LTE network

- Mobile device management (MDM) solution adds additional safety measures in access control, data protection, theft control and more.

- The bank complies with standard safety measures in capturing customer photo ID, bank staff mobile phone verification and customer mobile phone verification. In addition, all completed customer application becomes certified with a time stamp provided by Korea Financial Telecommunication & Clearing Institute (KFTC).

2. Real Time Scoring

- Real time customer service advisory module: Upon customer agreement, bank staff can provide real-time credit score inquiry and customer benefit simulation. In the past, bank staff had to first fax customer agreement and call another bank staff to run customer credit score.

3. Customer ID Capture End-to-End Processing

- Customer information such as Photo ID and supplementary documents are captured using tablet PC camera and optical character recognition. The customer information on photo ID is automatically read using OCR and matched to bank database minimising additional data entry

4. Customer Service Tool Set

- Access to marketing and product library where staff can draw from

- Customer advisory module using needs a based conversation tool helps customer identify matching banking products

- Various other tool sets such as meeting room reservation, appointment management system

Differentiation to other Korean Banks

While Standard Chartered Bank Korea was the first to introduce an end-to-end assisted wireless banking experience to Korean customers in July 2014, Korean banks generally plan to roll-out tablet based end to end solutions by the first half of 2015. While Standard Chartered took a full end to end approach by offering straight through processes, end-to-end client on-boarding, account opening and loan applications, some local banks can take customer application in digital format but still transfer the file manually to the backend for additional processing. However, at Standard Chartered Bank Korea, customers can open a current account or apply for a loan or credit card instantly with no additional processing in the backend required. At the same time the bank has strengthened security measures that reduces the risk for sales made outside a branch.

Business Impact

“We believe that our Retail Workbench brings a fundamental change to our branch network. This is not just a one-time solution that will only last for 24 to 36 months. Retail Workbench fundamentally changes the way bank staff work. The work is no longer tied to a branch. This is the permanent game changer in retail banking”, said Chris de Bruin, Global Head of Integrated Distribution.

While process time for account activation have been reduced from 15-20 minutes to 5-7 minutes and clients can make immediate transfers into the account, cheque and debit card turnaround times currently stand between 48 and 72 hours. Customer turnaround time on the tablet device for a mortgage product is about 67 minutes on average, including advising and application write-up but excludes the underwriting process which still takes up to 48 hours.

Between the launch in July 2014 and April 2015, Retail Workbench has completed over 40,000 cases for sales and services requests.

Within the current nine months observation period since introducing the workbench to the Korean market, average sales per month have increased by 32% in a work-bench branch, and average sales performance measured in number of product sales per employee per day increased by 24% with top performers achieving 132%. Comparing before and after, sales staff has increase productivity measured in number of sales by 36%.

“As of 1Q 2015 we are at about 42% ROI, considering being only 9 months in the market. We expect to reach 200% in April 2016 and surpass approximately 600% by 2019,” said Ryan Jong Hoon Kim.

Fig 4. Sales staff increased productivity measured in number of sales by 36%

*Source: Asian Banker Research

Categories:

Asia Pacific, Banks We Like, Branch Banking, Channels, Customer Centricity, Data & Analytics, Data Management, Innovation, Mobile Banking, Retail Banking, Technology & OperationsKeywords:Standard Chartered Bank, Tablet Banking, Retail Workbench