Best banks are those that capitalise on analytical insights by successfully translating them into meaningful business outcomes.

July 21, 2015 | Neeti AggarwalThe combination of analytics, Big Data and mobility has produced a game changer for banking sector. Financial institutions are increasingly learning and seeking to develop Big Data and analytics capability using real-time access via digital channels to build a competitive edge and offer differentiated services to customers that are progressively individual. The best banks are those that capitalise on analytical insights by successfully translating them into meaningful business outcomes.

Building real-time data and analytics

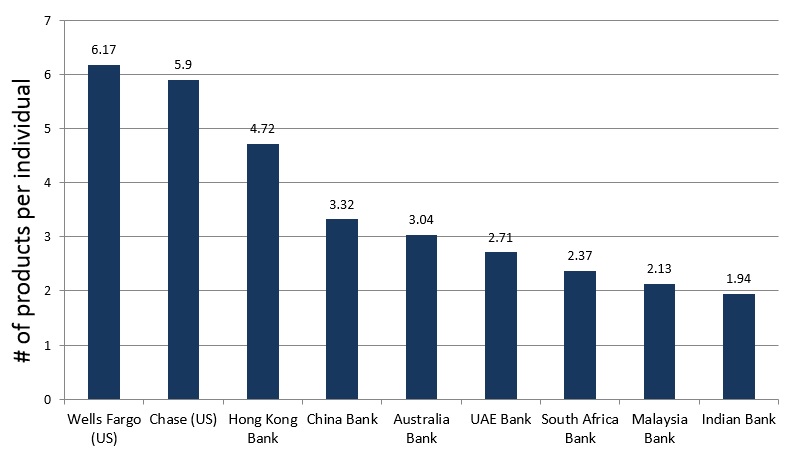

Many banks in the Asia Pacific region are investing to strengthen data integration that, often and unfortunately, currently resides in silos. Leading banks are overcoming this and creating a truly customer-centric and 360 degree view across products, channels and interactions through various initiatives. This includes deploying fully integrated and standardised analytics platforms that utilise real-time data integration and replication. Such platforms are also capable of generating simultaneous analytical insight that empowers the bank to target the right customer with right product at right time. This if harnessed well has a strong potential to improve the cross selling capability of banks, something that many Asian banks lag compared to global counterparts.

Fig 1. Average cross-sell ratio in retail banking (2013)

Source: Asian Banker Research

Note: Average cross-sell is defined as the number of product per individual for mass and wealth management (excluding private banking). Product groups are counted as one product. Cross sell does not include ATM cards and services such as online or mobile unless otherwise stated.

Banks increasingly seek to achieve service differentiation with the effective use of real-time insights. For instance, the ...

Categories:

Channels, Customer Centricity, Data & Analytics, Data Management, Innovation, Mobile Banking, Retail Banking, Technology & Operations, Wealth ManagementKeywords:Axis Bank, CTBC Bank, CIMB, DBS, Kookmin Bank, Big Data, MIS, Social Media, IBM Watson

Best banks are those that capitalise on analytical insights by successfully translating them into meaningful business outcomes.

July 21, 2015 | Neeti AggarwalThe combination of analytics, Big Data and mobility has produced a game changer for banking sector. Financial institutions are increasingly learning and seeking to develop Big Data and analytics capability using real-time access via digital channels to build a competitive edge and offer differentiated services to customers that are progressively individual. The best banks are those that capitalise on analytical insights by successfully translating them into meaningful business outcomes.

Building real-time data and analytics

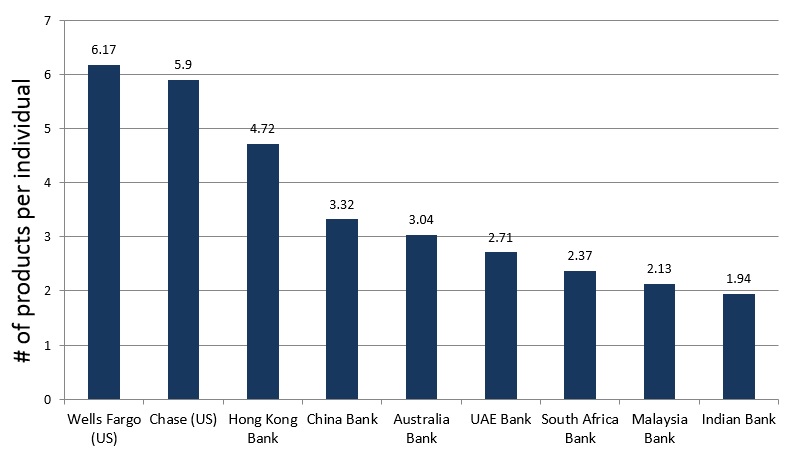

Many banks in the Asia Pacific region are investing to strengthen data integration that, often and unfortunately, currently resides in silos. Leading banks are overcoming this and creating a truly customer-centric and 360 degree view across products, channels and interactions through various initiatives. This includes deploying fully integrated and standardised analytics platforms that utilise real-time data integration and replication. Such platforms are also capable of generating simultaneous analytical insight that empowers the bank to target the right customer with right product at right time. This if harnessed well has a strong potential to improve the cross selling capability of banks, something that many Asian banks lag compared to global counterparts.

Fig 1. Average cross-sell ratio in retail banking (2013)

Source: Asian Banker Research

Note: Average cross-sell is defined as the number of product per individual for mass and wealth management (excluding private banking). Product groups are counted as one product. Cross sell does not include ATM cards and services such as online or mobile unless otherwise stated.

Banks increasingly seek to achieve service differentiation with the effective use of real-time insights. For instance, the ...

Categories:

Channels, Customer Centricity, Data & Analytics, Data Management, Innovation, Mobile Banking, Retail Banking, Technology & Operations, Wealth ManagementKeywords:Axis Bank, CTBC Bank, CIMB, DBS, Kookmin Bank, Big Data, MIS, Social Media, IBM Watson