Spurts in prices of cryptocurrencies and initial coin offerings over the last two years, with start-ups raising millions in minutes, have raised excitement and regulatory attention amid fear of “bubble” and potential losses.

January 08, 2018 | Neeti Aggarwal- The significant interest in the potential of blockchain technology remains one of the key reasons behind its growth

- The surge in small unknown companies raising millions of dollars within minutes is raising fears of a bubble burst similar to the dot.com era

- The surge in prices of digital currencies and initial coin offerings have led to many regulatory directives to protect investor interests

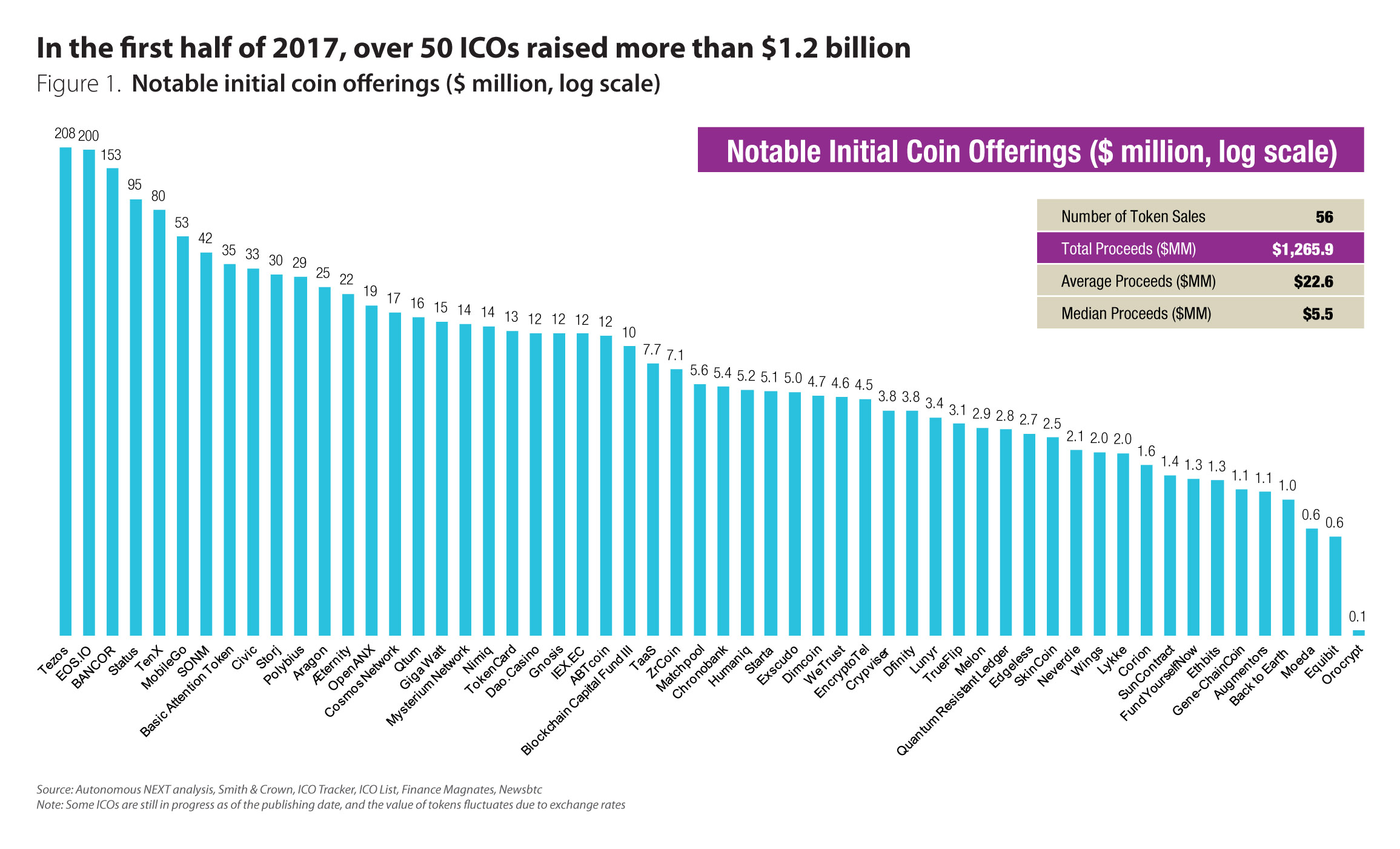

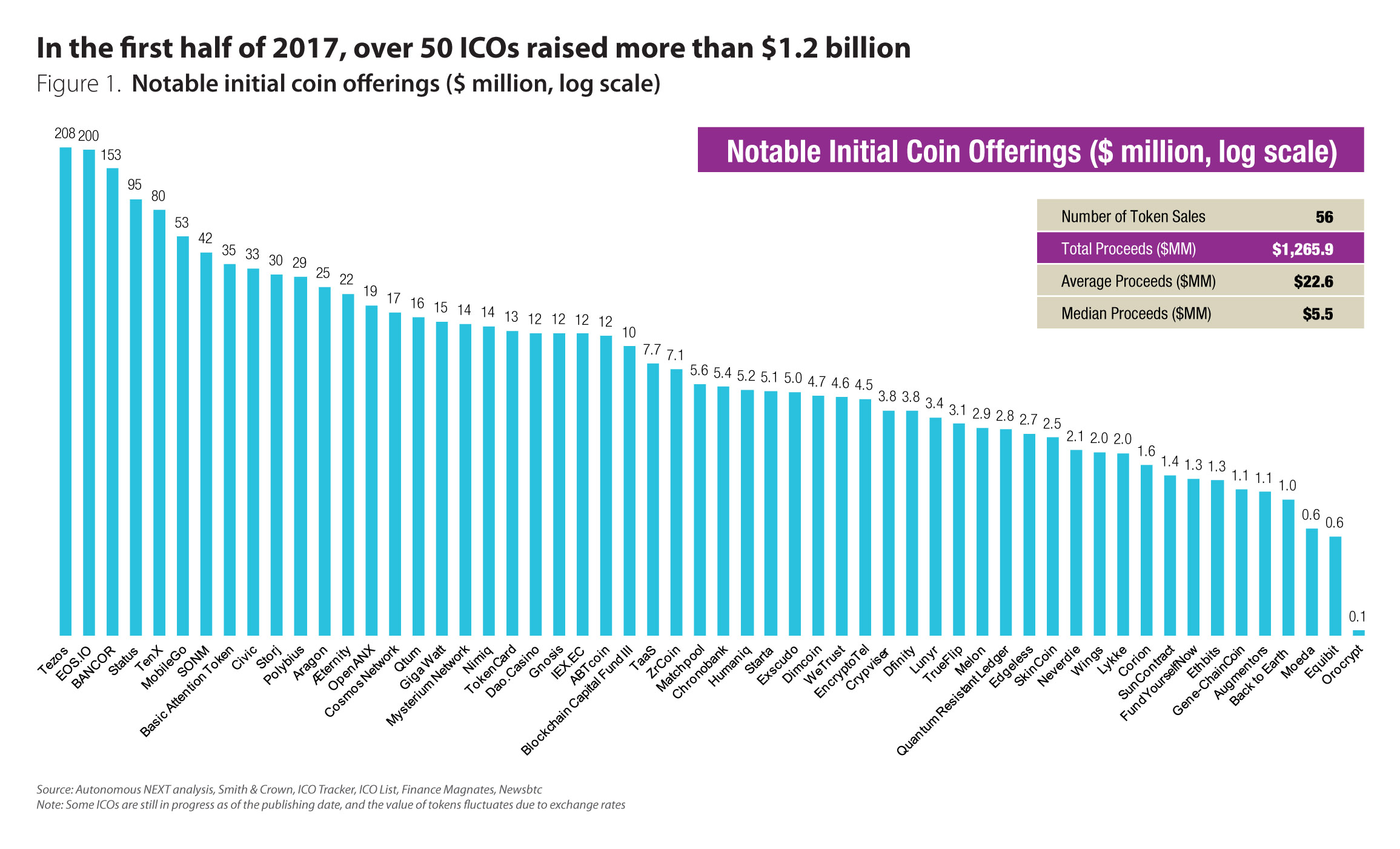

It has been an eventful year for cryptocurrencies with an exponential growth in initial coin offerings (ICO) raising over $1.2billion in the first half of 2017, an explosion in bitcoin and ethereum prices coupled with the spinoff of bitcoin to “bitcoin cash”.

Cryptocurrency prices have soared to new heights gaining rapid attention of regulators with mixed response. The People’s Bank of China stopped operations of digital currency trading platforms in Beijing and Shanghai in mid-September over concerns that the unregulated markets could pose major financial risk and banned raising funds through ICOs.

On the other hand, in a significant move that brings bitcoin closer to mainstream, the U.S. Commodity Futures Trading Commission allowed Chicago Mercantile Exchange (CME) and CBOE Global Markets to list Bitcoin futures. This action will enable investors to participate in the cryptocurrency market. In a similar move, Swiss bank Vontobel also started trading Switzerland’s first two mini futures on bitcoin. The cryptocurrencies now appear to be process of moving towards greater mainstream applications in countries like Japan where bitcoin is accepted as a legal mode of payment andis accepted across many retail stores.

There are companies partnering with retail stores facilitating people to use their bitcoin or ethereum for payment in the country leading to a network effect in growth of these currencies. Japan’s Financial Service Agency authorised four new virtual currency exchanges in the country, taking the total number of approved exchanges to 15.

The prices of leading cryptocurrencies such as bitcoin and ethereum have been soaring to new heights but with high volatility, for example bitcoin rose from$1000 earlier this year to $17,000 by December 2017 (rise of 1600%). Many regulators are warning the investors of the risks in cryptocurrencies.

“Right now, it’s purely supply-and-demand speculation. Because there is lack of advanced derivative product like options, futures, swap, etc. the volatility cannot be hedged. It’s still very early and when these financial instruments and products like ETFs develop and until the entire ecosystem evolves and matures, it’s still going to be volatile”, noted Mike Kayamori, chief executive officer (CEO) of Quoine Corporation.

With growing popularity of cryptocurrencies, ICO has rapidly emerged as a new crowd funding mechanism, where in cryptographic tokens issued by start-ups on a blockchain or distributed ledger are sold directly to participants to raise funds for project.

How ICOs work

In a crowd funding model, digital token scan be designed differently to provide a stake in the start-up or have underlying business features such as right to goods or services in future, access to platform or right to underlying assets in the future. The investors buy these crypto-coins with a fiat or other digital currencies like bitcoin or ethereum in hope that the values and prices will rise as the project achieved success.

According to Vladislav Solodkiy, managing partner at Life.SREDA Venture Capital, many ICOs are marketed as “software presale tokens” akin to giving early access to an online game to early supporters. To avoid legal requirements that come with any form of a security sale, many ICOs use other languages such as “crowdsale” or “donation”(or initial token offering) instead of ICOs. The token can represent some sort of value or be of value itself. An ICO might involve attributing equity to a token.

The typical use case of a token issued in an ICO is the creation of an asset that gives a person access to the features of a particular project. Tokens are used to pay for goods and services from the ICO offer or instead of having cash or bitcoin. Hence, these token soften are similar to a store specific loyalty point, something one purchases with a general purpose digital currency and then used at a specific location.

The spurt in growth

Since the launch of ICOs four years ago, the blockchain phenomenon has gained exponential attention exploding in value in 2017, enabling numerous companies to rapidly fund their projects.

On an average, about 20 ICOs hit the market every month. According to Autonomous NEXT, more than $1.2 billion in cryptocurrency was raised through ICOs in the first half of 2017. This figure is well above $300 million made in the previous years. These pioneers have readily raised money creating network effects previously not seen in more traditional fund-raising activities such as IPOs.

The reason for popularity

The significant interest in the potential of blockchain technology remains one of the key reasons behind this growth. However, despite the buzz, the blockchain sector still remains underfinanced as it received only $500 million (2.2%) in financing compared to $23 billion invested into the financial technology (fintech) industry.

“Investors don’t believe in the blockchain space as a business. Most of these companies have technologies but they don’t have financial and business results. It was a real nightmare to raise money and now with ICOs they can raise money cost effectively. On the demand side there was areal lack of capital available for blockchain. There are now more than 900 different cryptocurrencies and crypto-assets on the market, with another one launching pretty much every day,” pointed Solodkiy.

“We are now starting to see blockchain being used to represent tokenised real assets. We have purchases going on in early stage of real projects that will see light of the day or production later this year which will involve blockchain technology to fractionalize ownership of real assets. This is real demand, real interest and real value,” noted Marcelo Garcia Casil, CEO of DX Markets.

There are several reasons for popularity of ICOs. ICOs come with inherent advantages as they provide efficient and low-cost funding to start-ups that is accessible to any participant across any geography reducing their entry barriers. They provide an opportunity of investments in a new and disruptive technology to gain on future potential of blockchain while allowing the participants to diversify their current exposures in crypto currencies along with high liquidity.

“The liquidity for cryptocurrencies is not high but with ICOs people were able to readily convert these currencies to services and goods and even stocks in start-ups. It is like a “helicopter money” for these companies and it also allows investors to diversify into cryptocurrency assets. In addition, there is a speculative mood in the industry where people are looking for high returns in short term from these ICOs,” explains Solodkiy.

The growth of ICOs is also associated to the surge in the prices of bitcoin and ethereum, two most popular digital currencies used for purchase of tokens. “Total market cap of cryptocurrency is currently over$100 billion but it can easily go up by100x. These started with speculations and one can now pay utilities, transfers with these currencies. The true network effect has still not yet kicked in so the potential(of cryptocurrencies) is tremendous. The companies are raising capital using cryptocurrency through ICOs and it does not touch fiat – that is happening and accelerating. The banks and financial institutions need to look into the future when our lives don’t touch fiat,” noted Kayamori.

“There are roughly around 10,000 to15,000 crypto-millionaires. These people have the average net worth of over $10million, some even more than $100 million, individually. They are crypto-millionaires through bitcoin and ethereum and other token sales. They understand that there’s risk but they fund the craziest ideas. They know that only maybe one out of 100 is going to make it, but that company could become$100 billion,” explained Kayamori.

The changing shape of the industry

Besides retail investors, new investment players such as venture capital funds and hedge funds are now participating in these ICOs. These along with service providers, market makers and exchanges are giving shape to ICO as a standalone industry. The hype and popularity are currently driven by retail crowdfunding participants, but in the mid-term institutional investors will be more important for the size of the market.

“Today, most investors which are in the industry are as new as those start-ups in the industry. There are about 8-10 venture capital funds and about 20 hedge funds involved in ICOs which look to identify and invest in credible companies,” Solodkiy added.

Risks and fears of “bubble” burst

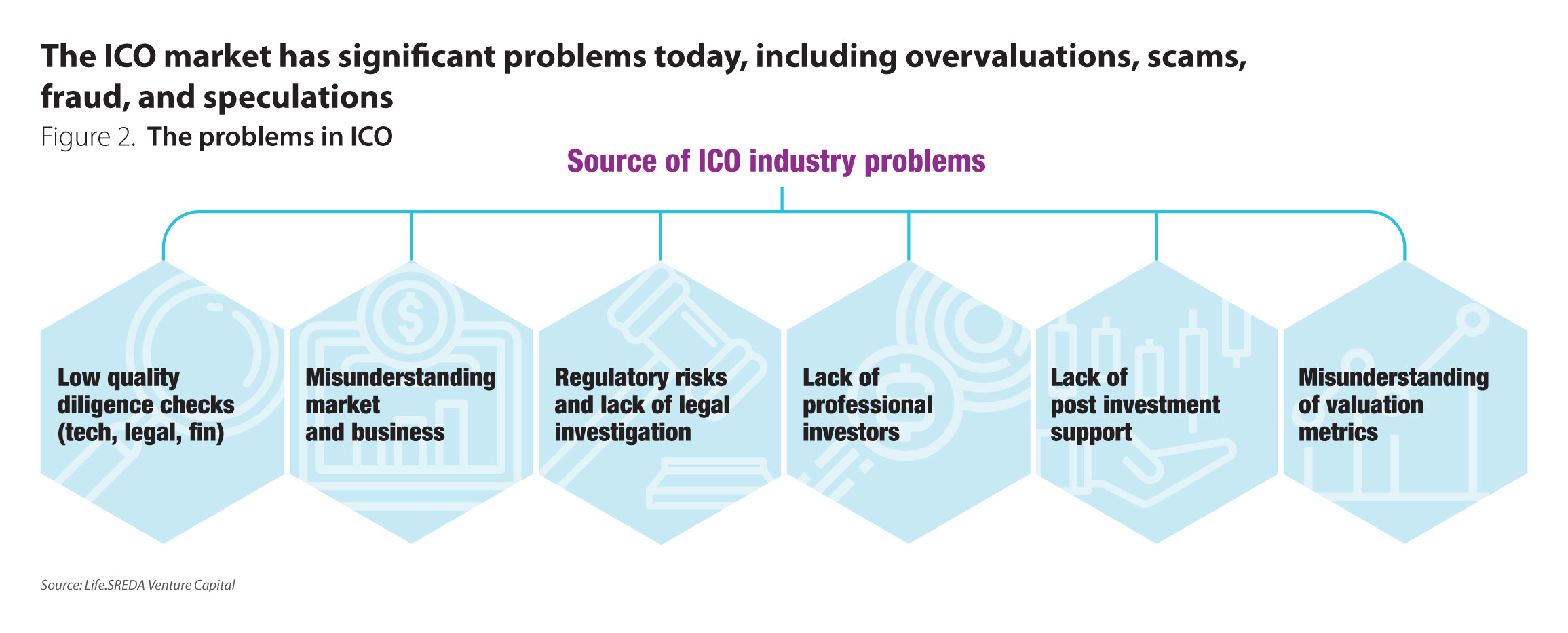

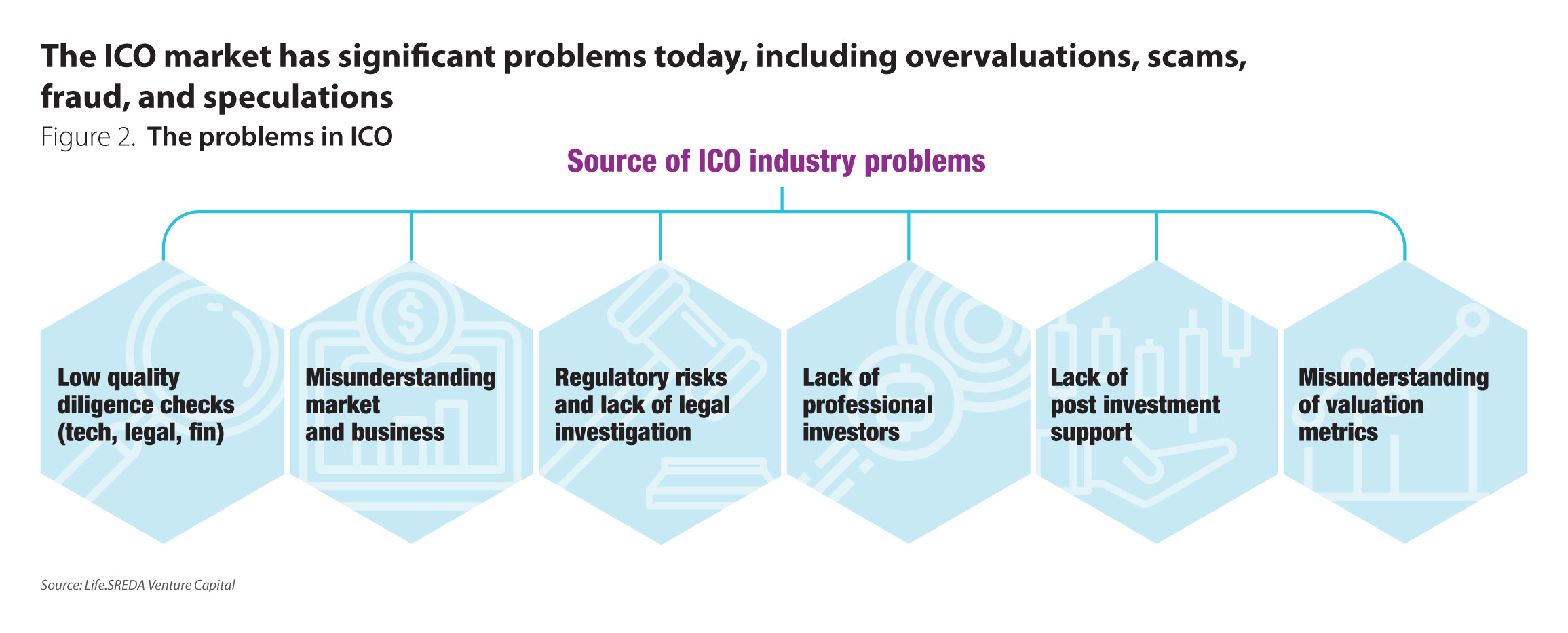

The surge in small unknown companies raising millions of dollars within minutes is raising fears of a bubble burst similar to thedot.com era. The risks are aplenty – many of these companies are just 1-2 years old with no track record, no traction or recognition in the market and have never raised money before. Many of them raised huge sums of money through these ICOs eventhough they do not have a proven viable product or a real utility to the underlying token as of now (Figure 2).

Lack of transparency around the issuance of such coins is a concern for both investors and regulators. The industry could face frauds with companies intending to take advantage of excitement in the ecosystem by leveraging social media to promote it and gain the support of early retail enthusiasts rather than professional investors. Lack of regulatory guidelines and enforceable consumer protection raise concerns as the ignorant investors could in cur significant losses without any recourse.

Unlike IPOs, ICO lack proper auditing of project funds and clear pricing mechanisms, increasing the risk of potential frauds. In most cases the projects are yet to take off and hence pose business as well as investment risks(with possibility of high volatility in prices).

One advantage however is that to hold an ICO the start-up needs to open source its code-base and if things go wrong and the founding team fails to execute, or in case of other problems, the community of developers can actually fork the code take it in a fresh direction and value is still retained — including the holdings of any investors.

In 2016, DAO, the crowdfunded vehicle on ethereum witnessed a $59 million hack and needed to be “hardforked” to retrieve the funds. The event highlighted the risks related to investments in new companies through ICOs.

“Right now it seems like a ‘bubble’ story, not unlike dotcom era, but this is also an evolutionary phase. Many small companies will die but the ones that will survive will be strong and will be infrastructure based solution rather than end user solution. We expect 5-10% companies to survive and these will change the industry and become the future leaders like the Google, Amazon and Facebook,” pointed Solodkiy.

Pointing to the changing face of this industry, Igor Pesin, partner at Life.SREDA, expects the industry to become a more viable and regulated instrument over time. He said“ICO as a tool has lots of advantages like security and liquidity that it brings to venture capital players but lots of people will be disappointed with the unprofessional investments made in ICO without proper businesse valuations. We expect the market to mature, become more transparent as mature players like VC come into the market. These funds will be regulatory compliant and will filter companies that has no potential or reason for investment. There will be new infrastructure platforms that will provide technology to host ICO for preliminary due diligence.”

Regulators awaken

Until recently, the issuance of these tokens has been completely out of preview of regulatory oversight. It has been viewed as quick way of raising capital at an early stage without necessarily complying with requirements that come with other conventional funding means such as IPOs. However, the surge in prices of digital currencies and the ICOs have led to many directives to protect investor interests, most of these inconsistent across different jurisdictions.

US Securities and Exchange Commission has warned bitcoin and other cryptocurrency investors to beware of scams and criminal activity in the sector. The country however starts the bitcoin based derivatives trading in December this year. China banned trading in cryptocurrencies and all companies and individuals from raising funds through ICOs. South Korea also announced that it will ban ICOs and have stringent regulations for cryptocurrencies.

Japan and Australia on the other hand have moved to regulate the cryptocurrencies.MAS said that offering or issuing digital tokens in Singapore will be regulated if the digital tokens constitute products that are regulated under the Securities and FuturesAct (SFA). Moreover, they would also be subject to licensing requirements for securities vendors, and any digital token secondary market operators would have to gain regulatory approval from MAS. Earlier in June 2017, Singapore’s central bank’s move to tokenise its currency was seen as a positive validation by many in the crypto industry.

“The regulator has been open-minded towards new technology and provided lot of freedom to players, reviewed the risk before deciding to recommend regulations. This step by MAS is very good for the industry, it is not regressive or limiting. It is only logical that if you are selling shares then it is treated as securities and is regulated,” commented Solodkiy.

“If the company issues tokens with future benefits within the platform, right now we do not see higher risk that these will be treated as securities. These will be new type of investment tools so if they have to be regulated in future, it will need to be done differently and with new regulations,” added Pesin.

MAS’ clarification on ICO regulation comes just a week after the US Securities and Exchange Commission clarified that depending on the facts and circumstances of each individual ICO, the virtual coins or tokens that are offered or sold may be considered by it as securities. If they are considered as securities, the offer and sale of these virtual coins in an ICO will be subject to the federal securities laws. The commission stressed that those who offer and sell securities in the US are required to comply with federal securities laws, regardless of whether those securities are purchased with virtual currencies or distributed with blockchain technology.

Yet the fact remains that “digital has no boundaries” and a decentralised currency like bitcoin can move from one country to another as new regulation emerge in different jurisdictions.

Outlook in near future

As increasing number of ICOs hit the market and enable easy funding of new companies. New regulations are seen to bring greater compliance, transparency, and maturity within the industry. The impact of these and possible future regulations could be in weeding out of smaller companies intending to make quick bucks and bringing stronger companies and investors to the market. This could also mean entry of professional and institutional investors, venture capital funds with deeper pockets and new service providers towards compliance due diligence to provide greater maturity to this means of financing.

“People are getting overloaded with offers and the quality of the companies is going down. We expect to see some cooling down later this year and the future will see more professional players such as big funds, institutional investors and technology platform enter the market. Renaissance will come this year, when we expect to see lot of regulatory changes and the professional capital enter the market which will bring stability. In one and half year from today potentially we will have companies that will go out of market –companies that would have already spent all the money raised, unprofessional investment will not be successful. Founders of the companies will then be more mature and investors will be sophisticated with the pockets to invest several hundred million dollars in cryptocurrencies,” opined Pesin.

Overall, the current cyrptocurrencies market cap is still small and it needs robust secondary market to ensure liquidity to all cryptocurrencies and tokens. It will need investors and market players that can ensure liquidity and new market products and credit features. The ecosystem will need a lot more maturity and growing up. There is now also an emerging need for the more traditional institutions to create the capability and understanding in operating and investing in cryptocurrency market.

“I’m pretty confident that cryptocurrency and tokens, as an asset class, is already in the process of becoming mainstream. I see a lot of institutional investors, hedge funds, family offices, registering with our exchange to invest in the cryptocurrencies and also ICO funds. With the maturity of the token and the crypto economy, it’s just a matter of time”, concluded Kayamori.

Categories:

Financial Technology, Regulation, Retail Banking, Risk and Regulation, Technology & Operations, Transaction BankingKeywords:Life.SREDA, Quoine Corporation, ICO, MAS, US SEC, Cryptocurrencies, Bitcoin, Regulation, Technology

Spurts in prices of cryptocurrencies and initial coin offerings over the last two years, with start-ups raising millions in minutes, have raised excitement and regulatory attention amid fear of “bubble” and potential losses.

January 08, 2018 | Neeti Aggarwal- The significant interest in the potential of blockchain technology remains one of the key reasons behind its growth

- The surge in small unknown companies raising millions of dollars within minutes is raising fears of a bubble burst similar to the dot.com era

- The surge in prices of digital currencies and initial coin offerings have led to many regulatory directives to protect investor interests

It has been an eventful year for cryptocurrencies with an exponential growth in initial coin offerings (ICO) raising over $1.2billion in the first half of 2017, an explosion in bitcoin and ethereum prices coupled with the spinoff of bitcoin to “bitcoin cash”.

Cryptocurrency prices have soared to new heights gaining rapid attention of regulators with mixed response. The People’s Bank of China stopped operations of digital currency trading platforms in Beijing and Shanghai in mid-September over concerns that the unregulated markets could pose major financial risk and banned raising funds through ICOs.

On the other hand, in a significant move that brings bitcoin closer to mainstream, the U.S. Commodity Futures Trading Commission allowed Chicago Mercantile Exchange (CME) and CBOE Global Markets to list Bitcoin futures. This action will enable investors to participate in the cryptocurrency market. In a similar move, Swiss bank Vontobel also started trading Switzerland’s first two mini futures on bitcoin. The cryptocurrencies now appear to be process of moving towards greater mainstream applications in countries like Japan where bitcoin is accepted as a legal mode of payment andis accepted across many retail stores.

There are companies partnering with retail stores facilitating people to use their bitcoin or ethereum for payment in the country leading to a network effect in growth of these currencies. Japan’s Financial Service Agency authorised four new virtual currency exchanges in the country, taking the total number of approved exchanges to 15.

The prices of leading cryptocurrencies such as bitcoin and ethereum have been soaring to new heights but with high volatility, for example bitcoin rose from$1000 earlier this year to $17,000 by December 2017 (rise of 1600%). Many regulators are warning the investors of the risks in cryptocurrencies.

“Right now, it’s purely supply-and-demand speculation. Because there is lack of advanced derivative product like options, futures, swap, etc. the volatility cannot be hedged. It’s still very early and when these financial instruments and products like ETFs develop and until the entire ecosystem evolves and matures, it’s still going to be volatile”, noted Mike Kayamori, chief executive officer (CEO) of Quoine Corporation.

With growing popularity of cryptocurrencies, ICO has rapidly emerged as a new crowd funding mechanism, where in cryptographic tokens issued by start-ups on a blockchain or distributed ledger are sold directly to participants to raise funds for project.

How ICOs work

In a crowd funding model, digital token scan be designed differently to provide a stake in the start-up or have underlying business features such as right to goods or services in future, access to platform or right to underlying assets in the future. The investors buy these crypto-coins with a fiat or other digital currencies like bitcoin or ethereum in hope that the values and prices will rise as the project achieved success.

According to Vladislav Solodkiy, managing partner at Life.SREDA Venture Capital, many ICOs are marketed as “software presale tokens” akin to giving early access to an online game to early supporters. To avoid legal requirements that come with any form of a security sale, many ICOs use other languages such as “crowdsale” or “donation”(or initial token offering) instead of ICOs. The token can represent some sort of value or be of value itself. An ICO might involve attributing equity to a token.

The typical use case of a token issued in an ICO is the creation of an asset that gives a person access to the features of a particular project. Tokens are used to pay for goods and services from the ICO offer or instead of having cash or bitcoin. Hence, these token soften are similar to a store specific loyalty point, something one purchases with a general purpose digital currency and then used at a specific location.

The spurt in growth

Since the launch of ICOs four years ago, the blockchain phenomenon has gained exponential attention exploding in value in 2017, enabling numerous companies to rapidly fund their projects.

On an average, about 20 ICOs hit the market every month. According to Autonomous NEXT, more than $1.2 billion in cryptocurrency was raised through ICOs in the first half of 2017. This figure is well above $300 million made in the previous years. These pioneers have readily raised money creating network effects previously not seen in more traditional fund-raising activities such as IPOs.

The reason for popularity

The significant interest in the potential of blockchain technology remains one of the key reasons behind this growth. However, despite the buzz, the blockchain sector still remains underfinanced as it received only $500 million (2.2%) in financing compared to $23 billion invested into the financial technology (fintech) industry.

“Investors don’t believe in the blockchain space as a business. Most of these companies have technologies but they don’t have financial and business results. It was a real nightmare to raise money and now with ICOs they can raise money cost effectively. On the demand side there was areal lack of capital available for blockchain. There are now more than 900 different cryptocurrencies and crypto-assets on the market, with another one launching pretty much every day,” pointed Solodkiy.

“We are now starting to see blockchain being used to represent tokenised real assets. We have purchases going on in early stage of real projects that will see light of the day or production later this year which will involve blockchain technology to fractionalize ownership of real assets. This is real demand, real interest and real value,” noted Marcelo Garcia Casil, CEO of DX Markets.

There are several reasons for popularity of ICOs. ICOs come with inherent advantages as they provide efficient and low-cost funding to start-ups that is accessible to any participant across any geography reducing their entry barriers. They provide an opportunity of investments in a new and disruptive technology to gain on future potential of blockchain while allowing the participants to diversify their current exposures in crypto currencies along with high liquidity.

“The liquidity for cryptocurrencies is not high but with ICOs people were able to readily convert these currencies to services and goods and even stocks in start-ups. It is like a “helicopter money” for these companies and it also allows investors to diversify into cryptocurrency assets. In addition, there is a speculative mood in the industry where people are looking for high returns in short term from these ICOs,” explains Solodkiy.

The growth of ICOs is also associated to the surge in the prices of bitcoin and ethereum, two most popular digital currencies used for purchase of tokens. “Total market cap of cryptocurrency is currently over$100 billion but it can easily go up by100x. These started with speculations and one can now pay utilities, transfers with these currencies. The true network effect has still not yet kicked in so the potential(of cryptocurrencies) is tremendous. The companies are raising capital using cryptocurrency through ICOs and it does not touch fiat – that is happening and accelerating. The banks and financial institutions need to look into the future when our lives don’t touch fiat,” noted Kayamori.

“There are roughly around 10,000 to15,000 crypto-millionaires. These people have the average net worth of over $10million, some even more than $100 million, individually. They are crypto-millionaires through bitcoin and ethereum and other token sales. They understand that there’s risk but they fund the craziest ideas. They know that only maybe one out of 100 is going to make it, but that company could become$100 billion,” explained Kayamori.

The changing shape of the industry

Besides retail investors, new investment players such as venture capital funds and hedge funds are now participating in these ICOs. These along with service providers, market makers and exchanges are giving shape to ICO as a standalone industry. The hype and popularity are currently driven by retail crowdfunding participants, but in the mid-term institutional investors will be more important for the size of the market.

“Today, most investors which are in the industry are as new as those start-ups in the industry. There are about 8-10 venture capital funds and about 20 hedge funds involved in ICOs which look to identify and invest in credible companies,” Solodkiy added.

Risks and fears of “bubble” burst

The surge in small unknown companies raising millions of dollars within minutes is raising fears of a bubble burst similar to thedot.com era. The risks are aplenty – many of these companies are just 1-2 years old with no track record, no traction or recognition in the market and have never raised money before. Many of them raised huge sums of money through these ICOs eventhough they do not have a proven viable product or a real utility to the underlying token as of now (Figure 2).

Lack of transparency around the issuance of such coins is a concern for both investors and regulators. The industry could face frauds with companies intending to take advantage of excitement in the ecosystem by leveraging social media to promote it and gain the support of early retail enthusiasts rather than professional investors. Lack of regulatory guidelines and enforceable consumer protection raise concerns as the ignorant investors could in cur significant losses without any recourse.

Unlike IPOs, ICO lack proper auditing of project funds and clear pricing mechanisms, increasing the risk of potential frauds. In most cases the projects are yet to take off and hence pose business as well as investment risks(with possibility of high volatility in prices).

One advantage however is that to hold an ICO the start-up needs to open source its code-base and if things go wrong and the founding team fails to execute, or in case of other problems, the community of developers can actually fork the code take it in a fresh direction and value is still retained — including the holdings of any investors.

In 2016, DAO, the crowdfunded vehicle on ethereum witnessed a $59 million hack and needed to be “hardforked” to retrieve the funds. The event highlighted the risks related to investments in new companies through ICOs.

“Right now it seems like a ‘bubble’ story, not unlike dotcom era, but this is also an evolutionary phase. Many small companies will die but the ones that will survive will be strong and will be infrastructure based solution rather than end user solution. We expect 5-10% companies to survive and these will change the industry and become the future leaders like the Google, Amazon and Facebook,” pointed Solodkiy.

Pointing to the changing face of this industry, Igor Pesin, partner at Life.SREDA, expects the industry to become a more viable and regulated instrument over time. He said“ICO as a tool has lots of advantages like security and liquidity that it brings to venture capital players but lots of people will be disappointed with the unprofessional investments made in ICO without proper businesse valuations. We expect the market to mature, become more transparent as mature players like VC come into the market. These funds will be regulatory compliant and will filter companies that has no potential or reason for investment. There will be new infrastructure platforms that will provide technology to host ICO for preliminary due diligence.”

Regulators awaken

Until recently, the issuance of these tokens has been completely out of preview of regulatory oversight. It has been viewed as quick way of raising capital at an early stage without necessarily complying with requirements that come with other conventional funding means such as IPOs. However, the surge in prices of digital currencies and the ICOs have led to many directives to protect investor interests, most of these inconsistent across different jurisdictions.

US Securities and Exchange Commission has warned bitcoin and other cryptocurrency investors to beware of scams and criminal activity in the sector. The country however starts the bitcoin based derivatives trading in December this year. China banned trading in cryptocurrencies and all companies and individuals from raising funds through ICOs. South Korea also announced that it will ban ICOs and have stringent regulations for cryptocurrencies.

Japan and Australia on the other hand have moved to regulate the cryptocurrencies.MAS said that offering or issuing digital tokens in Singapore will be regulated if the digital tokens constitute products that are regulated under the Securities and FuturesAct (SFA). Moreover, they would also be subject to licensing requirements for securities vendors, and any digital token secondary market operators would have to gain regulatory approval from MAS. Earlier in June 2017, Singapore’s central bank’s move to tokenise its currency was seen as a positive validation by many in the crypto industry.

“The regulator has been open-minded towards new technology and provided lot of freedom to players, reviewed the risk before deciding to recommend regulations. This step by MAS is very good for the industry, it is not regressive or limiting. It is only logical that if you are selling shares then it is treated as securities and is regulated,” commented Solodkiy.

“If the company issues tokens with future benefits within the platform, right now we do not see higher risk that these will be treated as securities. These will be new type of investment tools so if they have to be regulated in future, it will need to be done differently and with new regulations,” added Pesin.

MAS’ clarification on ICO regulation comes just a week after the US Securities and Exchange Commission clarified that depending on the facts and circumstances of each individual ICO, the virtual coins or tokens that are offered or sold may be considered by it as securities. If they are considered as securities, the offer and sale of these virtual coins in an ICO will be subject to the federal securities laws. The commission stressed that those who offer and sell securities in the US are required to comply with federal securities laws, regardless of whether those securities are purchased with virtual currencies or distributed with blockchain technology.

Yet the fact remains that “digital has no boundaries” and a decentralised currency like bitcoin can move from one country to another as new regulation emerge in different jurisdictions.

Outlook in near future

As increasing number of ICOs hit the market and enable easy funding of new companies. New regulations are seen to bring greater compliance, transparency, and maturity within the industry. The impact of these and possible future regulations could be in weeding out of smaller companies intending to make quick bucks and bringing stronger companies and investors to the market. This could also mean entry of professional and institutional investors, venture capital funds with deeper pockets and new service providers towards compliance due diligence to provide greater maturity to this means of financing.

“People are getting overloaded with offers and the quality of the companies is going down. We expect to see some cooling down later this year and the future will see more professional players such as big funds, institutional investors and technology platform enter the market. Renaissance will come this year, when we expect to see lot of regulatory changes and the professional capital enter the market which will bring stability. In one and half year from today potentially we will have companies that will go out of market –companies that would have already spent all the money raised, unprofessional investment will not be successful. Founders of the companies will then be more mature and investors will be sophisticated with the pockets to invest several hundred million dollars in cryptocurrencies,” opined Pesin.

Overall, the current cyrptocurrencies market cap is still small and it needs robust secondary market to ensure liquidity to all cryptocurrencies and tokens. It will need investors and market players that can ensure liquidity and new market products and credit features. The ecosystem will need a lot more maturity and growing up. There is now also an emerging need for the more traditional institutions to create the capability and understanding in operating and investing in cryptocurrency market.

“I’m pretty confident that cryptocurrency and tokens, as an asset class, is already in the process of becoming mainstream. I see a lot of institutional investors, hedge funds, family offices, registering with our exchange to invest in the cryptocurrencies and also ICO funds. With the maturity of the token and the crypto economy, it’s just a matter of time”, concluded Kayamori.

Categories:

Financial Technology, Regulation, Retail Banking, Risk and Regulation, Technology & Operations, Transaction BankingKeywords:Life.SREDA, Quoine Corporation, ICO, MAS, US SEC, Cryptocurrencies, Bitcoin, Regulation, Technology