As the role of corporate treasury evolves beyond its traditional core functions of cash and liquidity management, banks are making substantial investments into new technologies to simplify corporate to multi-bank connectivity.

October 03, 2019 | Siddharth ChandaniIn the latest Asian Banker annual survey of cash management trends across Asia-Pacific, focus on meeting automation needs of corporate treasury and demand for bank agnostic channels supporting wider industry-standard formats emerged as key themes. Uncertainty around trade flows, rates normalisation, regulation and new technology innovations have increased demand for more visibility into global liquidity, enhanced workflows and control internally, as corporates look for simplified connectivity to balance cost and financial risks.

Corporate concerns have also mounted on maintaining day-to-day liquidity as enterprises spend considerable efforts on short-term cash-flow forecasting. In ensuring the adequacy of funds in operating accounts, the dynamic role of corporate treasury has thus transformed from basic cash management to more complex and centralised treasury functions. Solutions targeted at cash concentration, sweeping, and pooling make best use of internal liquidity, whilst minimising reliance on external borrowing. However, as Asian corporates expand globally and extend their business and customer networks, treasury management is bound to gain complexity.

This has driven banks to build solutions, specifically catering to a cross-border and cash light transaction economy. From leveraging machine learning for cash-flow forecasting to minimising idle float, or optimising account structures for adequate cash positioning, banks identified quickto-market and tailored solutions and industry standards built on harmonised communication as critical cash management needs

Automation of treasury function and achieving operational efficiency through common industry standards are top priorities amongst banks

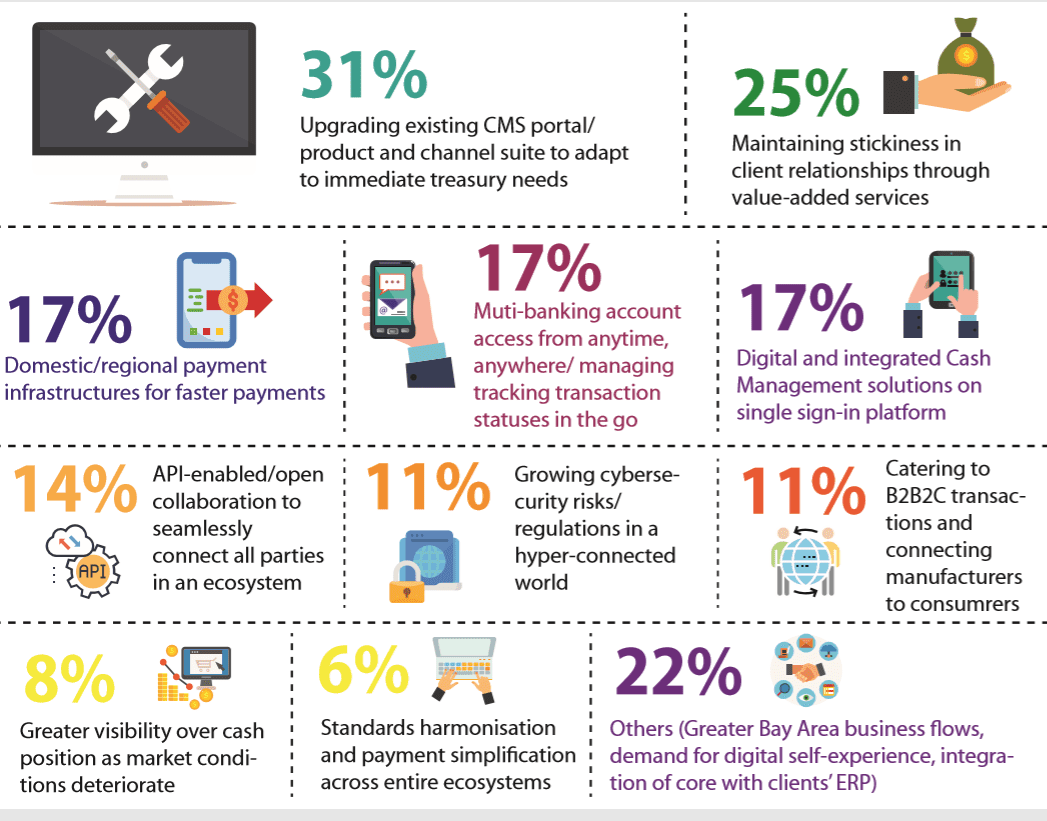

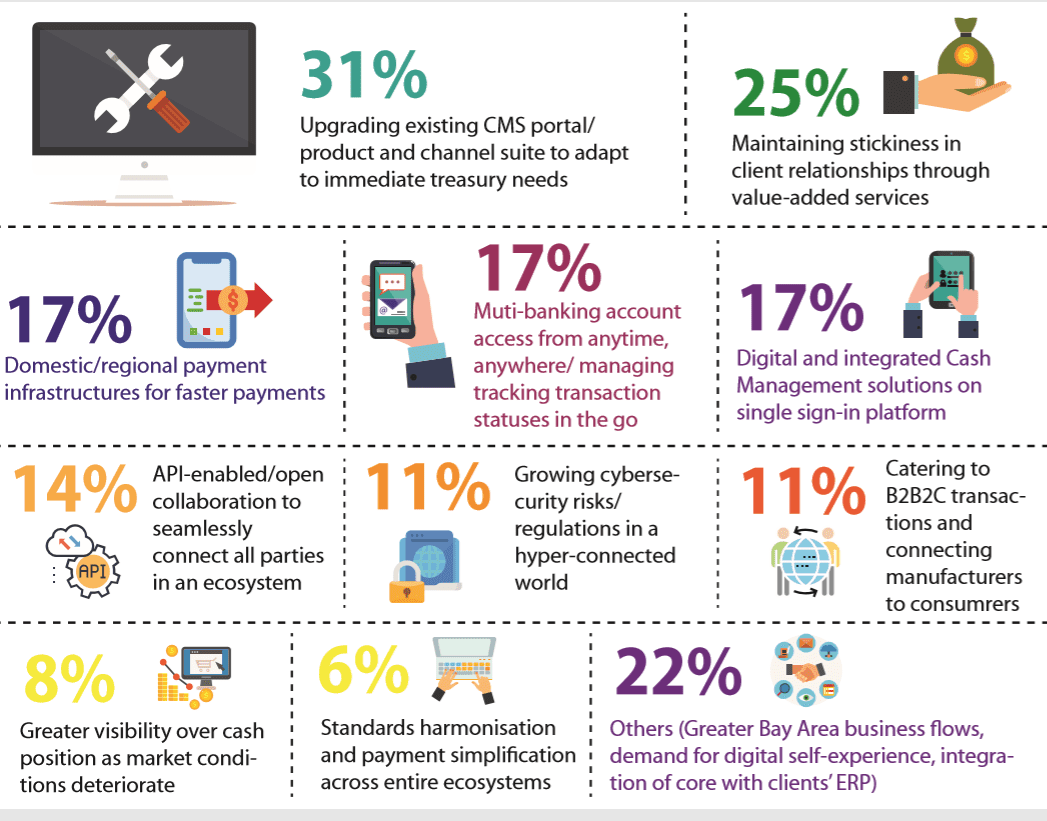

Figure 1. Emerging Key Themes in Cash Management 2019/2020 based on % of banks identifying them as important

Categories:

Keywords:

As the role of corporate treasury evolves beyond its traditional core functions of cash and liquidity management, banks are making substantial investments into new technologies to simplify corporate to multi-bank connectivity.

October 03, 2019 | Siddharth ChandaniIn the latest Asian Banker annual survey of cash management trends across Asia-Pacific, focus on meeting automation needs of corporate treasury and demand for bank agnostic channels supporting wider industry-standard formats emerged as key themes. Uncertainty around trade flows, rates normalisation, regulation and new technology innovations have increased demand for more visibility into global liquidity, enhanced workflows and control internally, as corporates look for simplified connectivity to balance cost and financial risks.

Corporate concerns have also mounted on maintaining day-to-day liquidity as enterprises spend considerable efforts on short-term cash-flow forecasting. In ensuring the adequacy of funds in operating accounts, the dynamic role of corporate treasury has thus transformed from basic cash management to more complex and centralised treasury functions. Solutions targeted at cash concentration, sweeping, and pooling make best use of internal liquidity, whilst minimising reliance on external borrowing. However, as Asian corporates expand globally and extend their business and customer networks, treasury management is bound to gain complexity.

This has driven banks to build solutions, specifically catering to a cross-border and cash light transaction economy. From leveraging machine learning for cash-flow forecasting to minimising idle float, or optimising account structures for adequate cash positioning, banks identified quickto-market and tailored solutions and industry standards built on harmonised communication as critical cash management needs

Automation of treasury function and achieving operational efficiency through common industry standards are top priorities amongst banks

Figure 1. Emerging Key Themes in Cash Management 2019/2020 based on % of banks identifying them as important

Categories:

Keywords: