As Chinese banks continue to dominate the list of largest banks, others in Asia Pacific face mounting pressure to sustain performance

October 16, 2019 | Wendy WengAmong the top ten largest banks in this year’s Asian Banker 500, the six Chinese banks registered average asset growth of 6.6% in 2018, slower than that of 7.3% in 2017, while asset growth of the four Japanese banks slowed to 0.3% from 1.2% in the previous year. The Asian Banker 500 (AB 500) 2019 is an evaluation of the 500 largest banks in the Asia Pacific region for the financial year 2018.

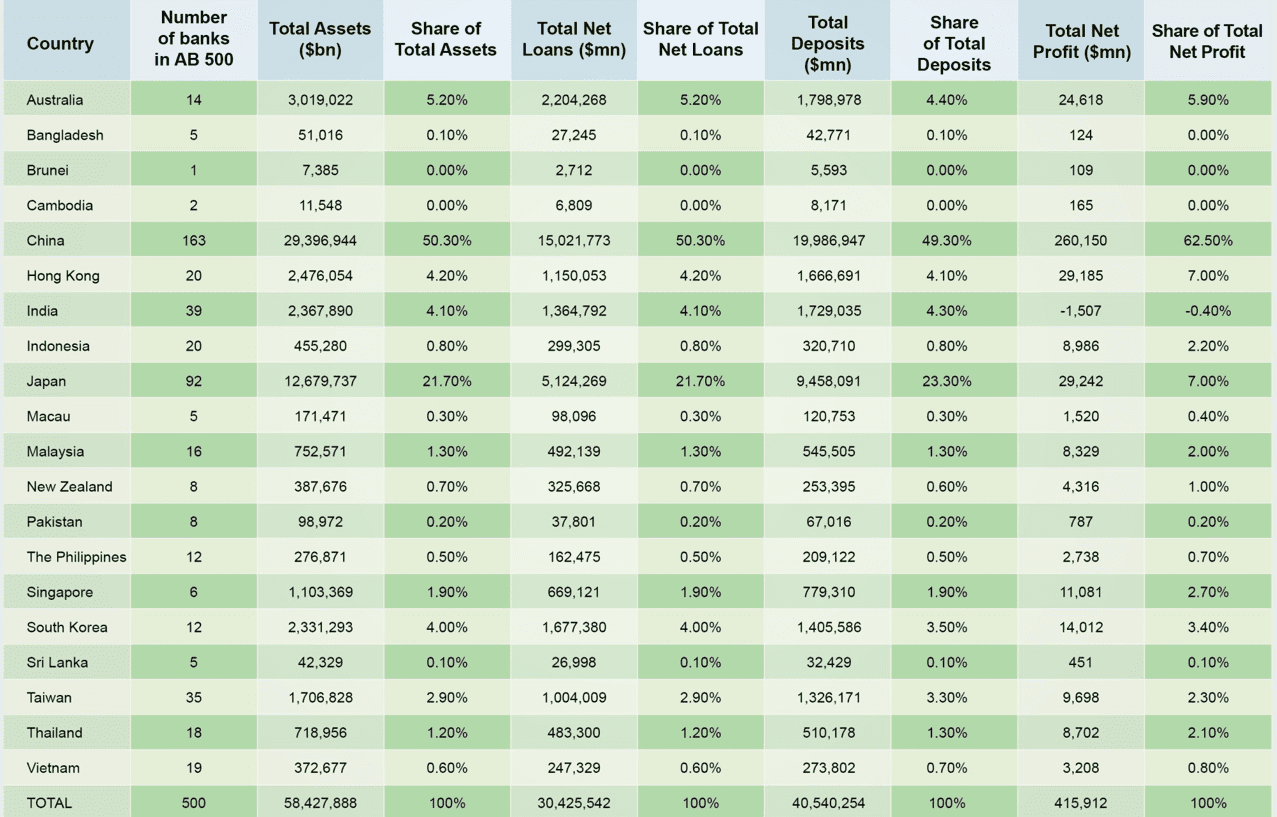

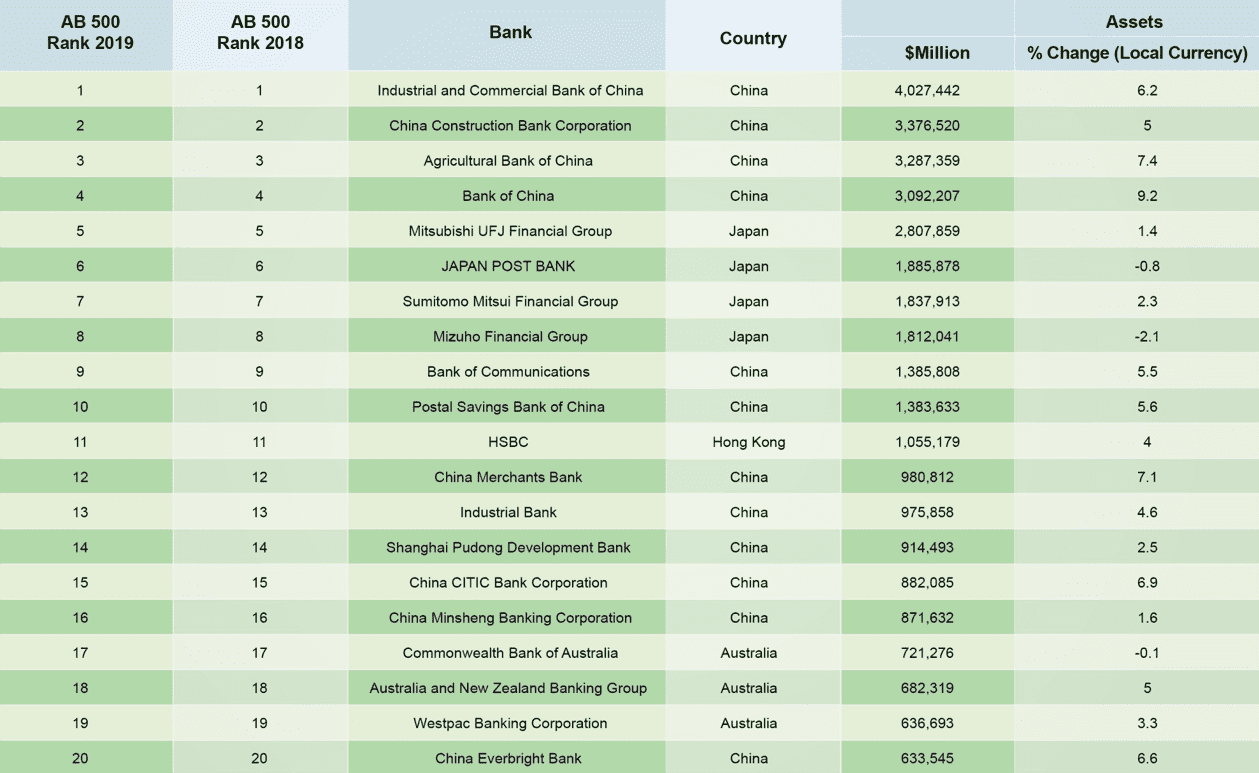

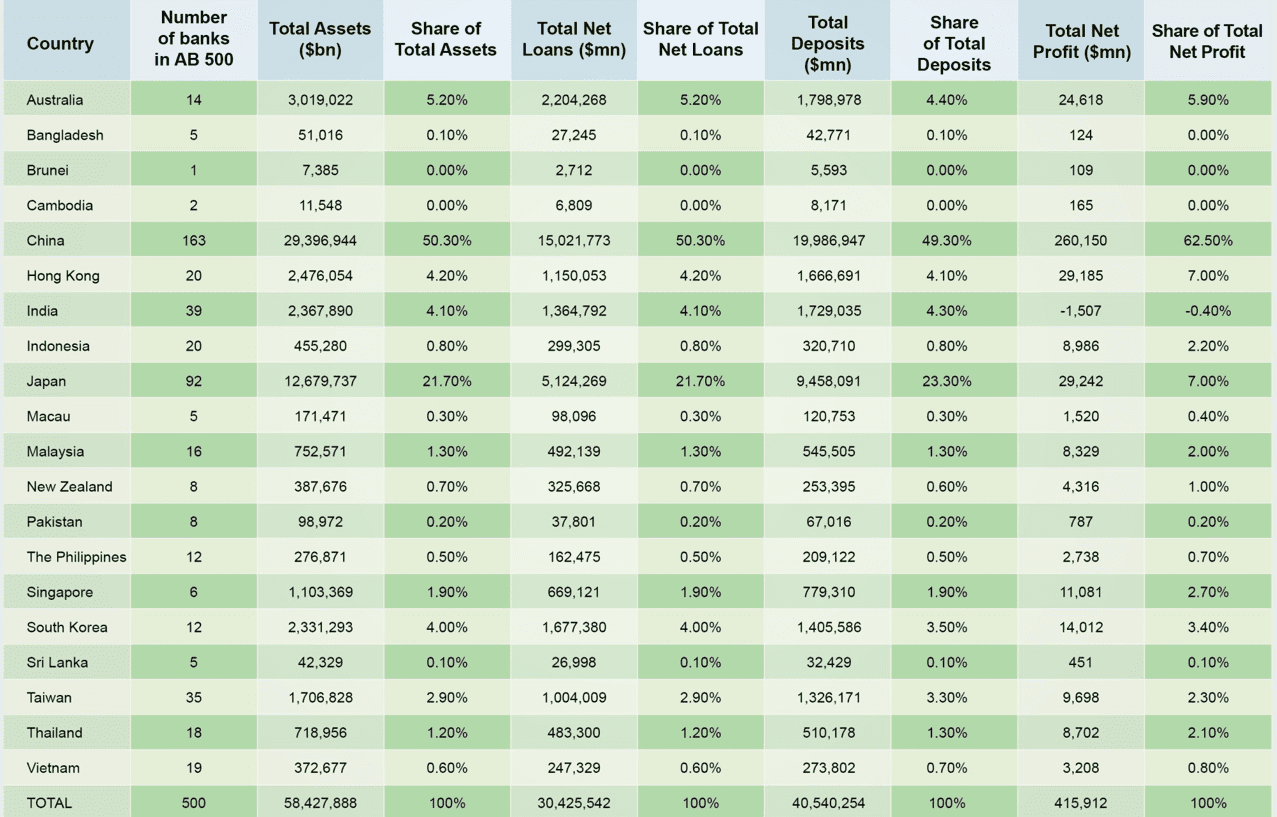

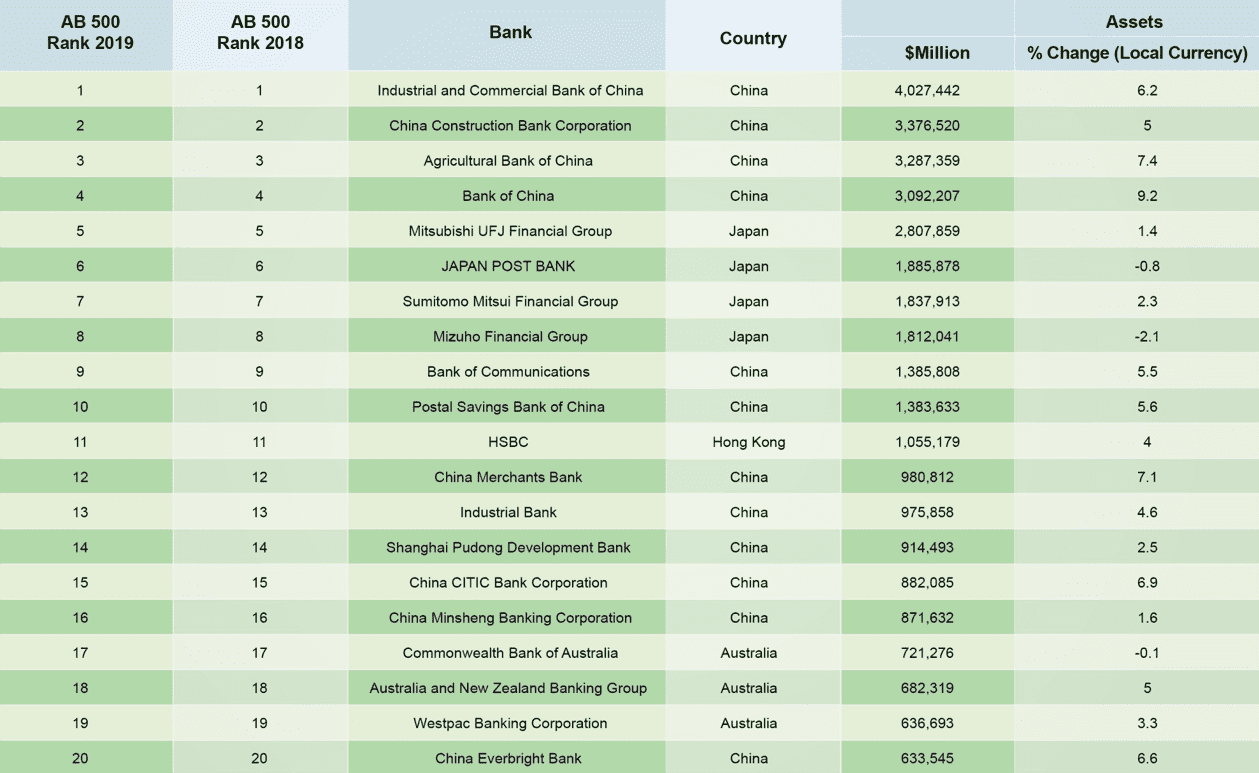

This year’s evaluation covers the 500 largest banks, from 20 countries and territories, with a combined $58.4 trillion in assets, $30.4 trillion in net loans, $40.5 trillion in deposits and $416 billion in net profit. Industrial and Commercial Bank of China remained the largest bank in the region. Meanwhile, the top ten ranking remains relatively unchanged, with the only exception of Sumitomo Mitsui Financial Group moving up the ranks to seventh place, overtaking Mizuho Group. There are two Cambodian banks on this year’s list, including Canadia Bank that has a strong asset growth of 34% year-on-year (yoy).

Chinese banks continue to dominate the list with a representation of 163 banks. Their total assets accounted for 50.3% of the combined assets of the 500 largest banks in Asia Pacific. There was a noticeable drop in the number of Japanese banks recorded from 99 in the previous year’s evaluation to 92 this year, and thus Japanese banks’ share of total asset fell to 21.7% from 22.5% last year. The drop can be partially attributed to regional bank mergers in Japan. Some struggling Japanese banks such as Mie Bank and Daisan Bank have consolidated as they seek to enhance efficiency and competitiveness.

Siam Commercial Bank overtook Bangkok Bank to become the largest bank in Thailand. KASIKORNBANK is now the second-largest bank in the country and Bangkok Bank is the third. Total assets of Siam Commercial Bank and KASIKORNBANK expanded by 5.4% and 8.8% in 2018, respectively, while Bangkok Bank’s total assets only increased by 1.3%. Nonetheless, it remains to be seen whether Siam Commercial Bank will remain the largest.

Chinese banks continue to dominate the list, while the number of Japanese banks fell, partially due to Japanese regional bank mergers

Figure 1: Aggregate total assets, net loans, deposits and net profits

Source: Asian Banker Research

Japanese banks face challenges

Japanese banks reported the slowest asset growth, and their profitability was also among the lowest, highlighting the challenges faced by the banking system. The profitability of Japanese banks weakened further in the financial year through March 2019, due to the deteriorating environment. Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group and Mizuho Financial Group all posted a decline in their annual profits, as they are struggled in their domestic operations.

They overtook Bangladeshi banks with the highest average cost to income ratio in the region at 65.5%, which was 0.2% higher than that in the prior year. Meanwhile, Japanese banks recorded the average return on assets (ROA) of 0.24%, compared to 0.31% in the previous year. Their average return on equity (ROE) weakened from 5.6% to 4.3%, higher than that of Indian banks. As a result, they saw their average capital adequacy ratio (CAR) fall slightly from 15.7% to 15.5%. The asset quality of banks will be affected if the trend continues.

Banks in Japan, especially regional banks, have been struggling with sluggish loan demand due to an ageing and shrinking population, and their profitability has suffered as years of ultra-low interest rates in the country have continued to depress bank margins. Financial regulators in Japan have urged regional banks to cut operational costs and increase fee incomes to improve their financial health, but it remains tough for them to establish sustainable business models. Regional banks have begun consolidation efforts since the 1990s, but the approval process is lengthy due to current antitrust legislation. The rules are expected to be relaxed to make it easier for regional banks to merge, but consolidation won’t solve the problems completely.

Top 10 Largest Banks ranking remains relatively unchanged

Figure 2: Top 20 Largest Banks in Asia Pacific

Source: Asian Banker Research

Adverse impacts on Hong Kong banks

Hong Kong banks demonstrated sustained financial strength. They have remained well capitalised coupled with strong asset quality and profitability. However, they face a tougher operating environment in 2019. The slowdown in China and the US-China trade war have continued to exert a negative influence on the financial performance of Hong Kong banking system.

Meanwhile, the emergence of virtual banks will increase competition in the Hong Kong banking sector, which is already highly competitive. The eight virtual banks have been preparing to build their deposit bases from scratch. Some banks such as HSBC, Hang Seng Bank, Bank of China (Hong Kong) have cut fees in response to the potential threat of these branchless, internet-only banks. Overall, the impacts on traditional banks will be limited in the next one or two years.

Besides, the political uncertainty has weighed heavily on Hong Kong banks’ financial results in 2019. The anti-government protests have caused damage to the city’s retail and tourism sectors. Consequently, economic growth has been slower. In the second quarter of 2019, Hong Kong saw its economy expand by just 0.5% year-on-year, the weakest growth rate in a decade. In August 2019, the government unveiled a $2.4 billion stimulus package to protect the city from a recession. The political turmoil and protests affected the operations of local banks, and fuelled concerns about the capital outflows.

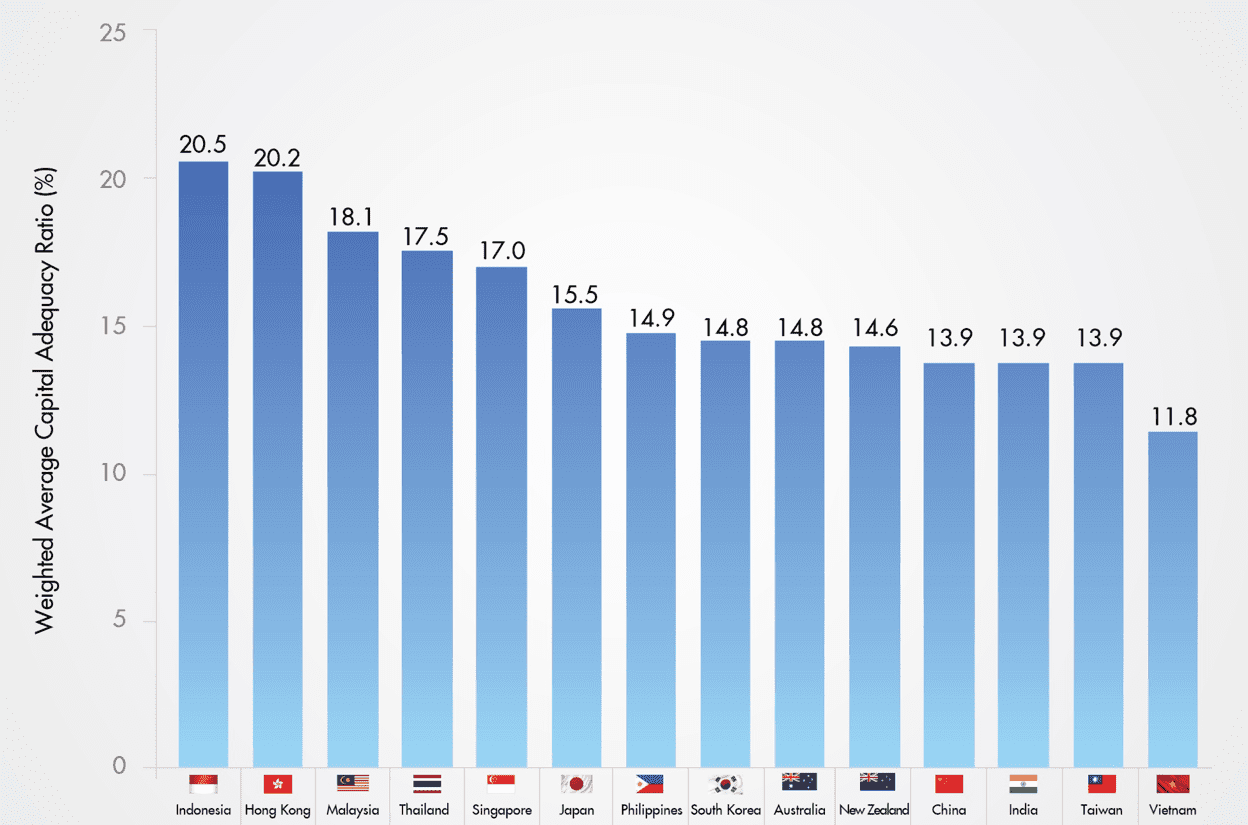

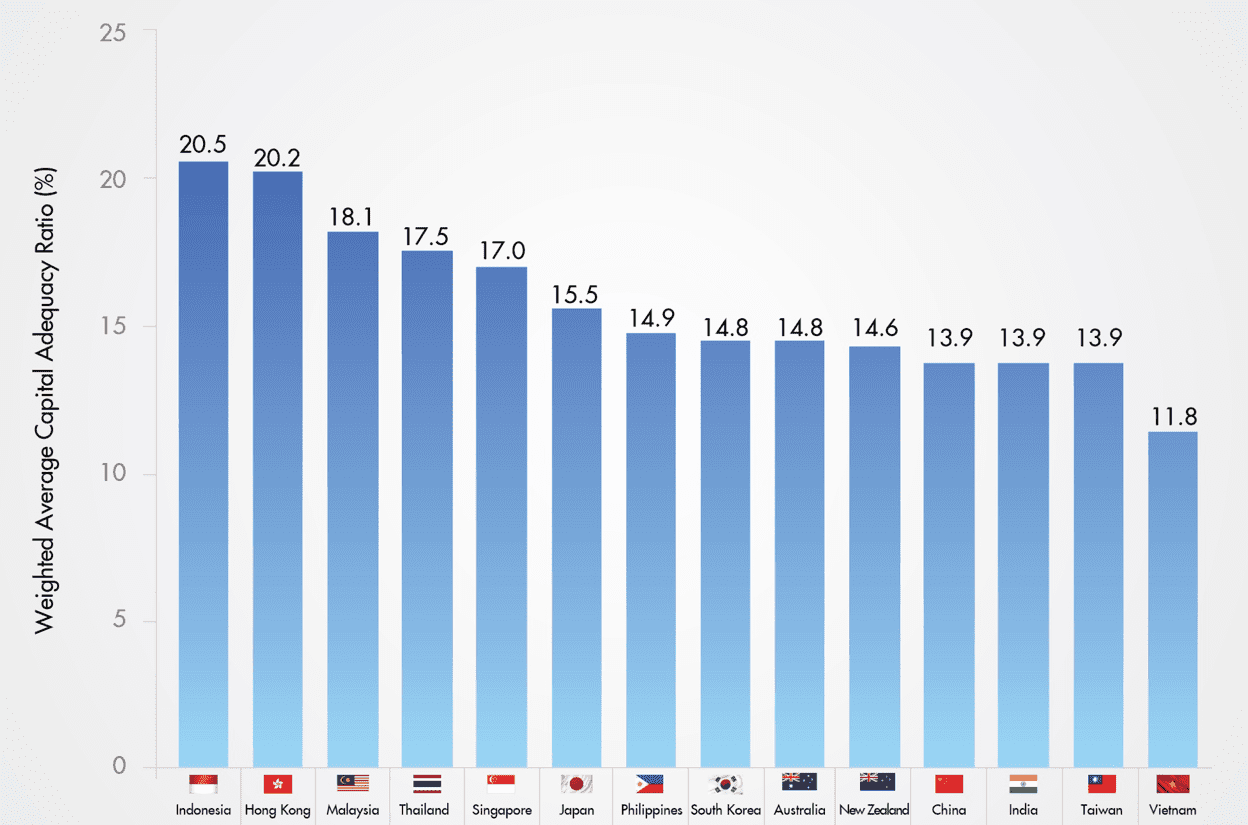

Banks in markets such as China, India and Vietnam are under pressure to raise capital

Figure 3: Weighted average capital adequency ratio (CAR) of banks in selected markets

Source: Asian Banker Research

Capital shortage

The capitalisation of Vietnamese banks remained weak, especially the state-owned commercial banks, but they must meet the CAR requirement of at least 8% as per the State Bank of Vietnam’s Basel II standards starting from January 1, 2020. The higher profitability and decelerated credit growth in 2018 have helped ease pressure on banks to build larger capital buffers, and the SBV set a credit growth target for 2019 at 14%. However, many local banks are still under enormous pressure to raise additional capital due to limited financial resources and the regulations on foreign ownership limit. In addition to offering higher rates to attract deposits, some banks seek capital from foreign investors, as the domestic stock market is underdeveloped. In 2020, some banks will be undercapitalised, and may become targets of acquisition.Besides, banks in China, India and Taiwan are also less capitalised. The weighted average CAR of banks in these three markets stood at around 13.9% in 2018. Indian banking sector delivered improved overall performance, but it is the only banking sector that posted negative ROA and ROE. The government of India has continued to inject more capital to maintain the capital levels of banks.

Chinese banks, especially the smaller ones, are becoming increasingly capital constrained, as bank lending growth has continued to outpace the growth of bank deposits and capital adequacy requirements have been stricter in the country. Despite the deleveraging campaign, they still reported a strong lending growth of 12.9% in 2018, as they are required to increase their lending to small and mid-sized businesses amid the deepening economic slowdown. As a result, they need to raise substantial capital, and some of them have already issued more capital instruments or established plans to raise additional funds. In July 2019, the banking regulator eased capital replenishment rules for unlisted banks, and thus unlisted banks can sell preferred shares to raise capital.

In addition to these challenges, the slowing economic growth and the ongoing US-China trade tension are posing a risk for Asia Pacific banking sector. Banks are also facing fiercer competition from new comers. Nonetheless, the banks in the region have been continuing their digital transformation and reshaping the business models to boost competitiveness.

Categories:

Asian Banker 500Keywords:Largest Banks, Bank Rankings, Bank Evaluation

As Chinese banks continue to dominate the list of largest banks, others in Asia Pacific face mounting pressure to sustain performance

October 16, 2019 | Wendy WengAmong the top ten largest banks in this year’s Asian Banker 500, the six Chinese banks registered average asset growth of 6.6% in 2018, slower than that of 7.3% in 2017, while asset growth of the four Japanese banks slowed to 0.3% from 1.2% in the previous year. The Asian Banker 500 (AB 500) 2019 is an evaluation of the 500 largest banks in the Asia Pacific region for the financial year 2018.

This year’s evaluation covers the 500 largest banks, from 20 countries and territories, with a combined $58.4 trillion in assets, $30.4 trillion in net loans, $40.5 trillion in deposits and $416 billion in net profit. Industrial and Commercial Bank of China remained the largest bank in the region. Meanwhile, the top ten ranking remains relatively unchanged, with the only exception of Sumitomo Mitsui Financial Group moving up the ranks to seventh place, overtaking Mizuho Group. There are two Cambodian banks on this year’s list, including Canadia Bank that has a strong asset growth of 34% year-on-year (yoy).

Chinese banks continue to dominate the list with a representation of 163 banks. Their total assets accounted for 50.3% of the combined assets of the 500 largest banks in Asia Pacific. There was a noticeable drop in the number of Japanese banks recorded from 99 in the previous year’s evaluation to 92 this year, and thus Japanese banks’ share of total asset fell to 21.7% from 22.5% last year. The drop can be partially attributed to regional bank mergers in Japan. Some struggling Japanese banks such as Mie Bank and Daisan Bank have consolidated as they seek to enhance efficiency and competitiveness.

Siam Commercial Bank overtook Bangkok Bank to become the largest bank in Thailand. KASIKORNBANK is now the second-largest bank in the country and Bangkok Bank is the third. Total assets of Siam Commercial Bank and KASIKORNBANK expanded by 5.4% and 8.8% in 2018, respectively, while Bangkok Bank’s total assets only increased by 1.3%. Nonetheless, it remains to be seen whether Siam Commercial Bank will remain the largest.

Chinese banks continue to dominate the list, while the number of Japanese banks fell, partially due to Japanese regional bank mergers

Figure 1: Aggregate total assets, net loans, deposits and net profits

Source: Asian Banker Research

Japanese banks face challenges

Japanese banks reported the slowest asset growth, and their profitability was also among the lowest, highlighting the challenges faced by the banking system. The profitability of Japanese banks weakened further in the financial year through March 2019, due to the deteriorating environment. Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group and Mizuho Financial Group all posted a decline in their annual profits, as they are struggled in their domestic operations.

They overtook Bangladeshi banks with the highest average cost to income ratio in the region at 65.5%, which was 0.2% higher than that in the prior year. Meanwhile, Japanese banks recorded the average return on assets (ROA) of 0.24%, compared to 0.31% in the previous year. Their average return on equity (ROE) weakened from 5.6% to 4.3%, higher than that of Indian banks. As a result, they saw their average capital adequacy ratio (CAR) fall slightly from 15.7% to 15.5%. The asset quality of banks will be affected if the trend continues.

Banks in Japan, especially regional banks, have been struggling with sluggish loan demand due to an ageing and shrinking population, and their profitability has suffered as years of ultra-low interest rates in the country have continued to depress bank margins. Financial regulators in Japan have urged regional banks to cut operational costs and increase fee incomes to improve their financial health, but it remains tough for them to establish sustainable business models. Regional banks have begun consolidation efforts since the 1990s, but the approval process is lengthy due to current antitrust legislation. The rules are expected to be relaxed to make it easier for regional banks to merge, but consolidation won’t solve the problems completely.

Top 10 Largest Banks ranking remains relatively unchanged

Figure 2: Top 20 Largest Banks in Asia Pacific

Source: Asian Banker Research

Adverse impacts on Hong Kong banks

Hong Kong banks demonstrated sustained financial strength. They have remained well capitalised coupled with strong asset quality and profitability. However, they face a tougher operating environment in 2019. The slowdown in China and the US-China trade war have continued to exert a negative influence on the financial performance of Hong Kong banking system.

Meanwhile, the emergence of virtual banks will increase competition in the Hong Kong banking sector, which is already highly competitive. The eight virtual banks have been preparing to build their deposit bases from scratch. Some banks such as HSBC, Hang Seng Bank, Bank of China (Hong Kong) have cut fees in response to the potential threat of these branchless, internet-only banks. Overall, the impacts on traditional banks will be limited in the next one or two years.

Besides, the political uncertainty has weighed heavily on Hong Kong banks’ financial results in 2019. The anti-government protests have caused damage to the city’s retail and tourism sectors. Consequently, economic growth has been slower. In the second quarter of 2019, Hong Kong saw its economy expand by just 0.5% year-on-year, the weakest growth rate in a decade. In August 2019, the government unveiled a $2.4 billion stimulus package to protect the city from a recession. The political turmoil and protests affected the operations of local banks, and fuelled concerns about the capital outflows.

Banks in markets such as China, India and Vietnam are under pressure to raise capital

Figure 3: Weighted average capital adequency ratio (CAR) of banks in selected markets

Source: Asian Banker Research

Capital shortage

The capitalisation of Vietnamese banks remained weak, especially the state-owned commercial banks, but they must meet the CAR requirement of at least 8% as per the State Bank of Vietnam’s Basel II standards starting from January 1, 2020. The higher profitability and decelerated credit growth in 2018 have helped ease pressure on banks to build larger capital buffers, and the SBV set a credit growth target for 2019 at 14%. However, many local banks are still under enormous pressure to raise additional capital due to limited financial resources and the regulations on foreign ownership limit. In addition to offering higher rates to attract deposits, some banks seek capital from foreign investors, as the domestic stock market is underdeveloped. In 2020, some banks will be undercapitalised, and may become targets of acquisition.Besides, banks in China, India and Taiwan are also less capitalised. The weighted average CAR of banks in these three markets stood at around 13.9% in 2018. Indian banking sector delivered improved overall performance, but it is the only banking sector that posted negative ROA and ROE. The government of India has continued to inject more capital to maintain the capital levels of banks.

Chinese banks, especially the smaller ones, are becoming increasingly capital constrained, as bank lending growth has continued to outpace the growth of bank deposits and capital adequacy requirements have been stricter in the country. Despite the deleveraging campaign, they still reported a strong lending growth of 12.9% in 2018, as they are required to increase their lending to small and mid-sized businesses amid the deepening economic slowdown. As a result, they need to raise substantial capital, and some of them have already issued more capital instruments or established plans to raise additional funds. In July 2019, the banking regulator eased capital replenishment rules for unlisted banks, and thus unlisted banks can sell preferred shares to raise capital.

In addition to these challenges, the slowing economic growth and the ongoing US-China trade tension are posing a risk for Asia Pacific banking sector. Banks are also facing fiercer competition from new comers. Nonetheless, the banks in the region have been continuing their digital transformation and reshaping the business models to boost competitiveness.

Categories:

Asian Banker 500Keywords:Largest Banks, Bank Rankings, Bank Evaluation