China is changing the distribution of wealth across the region and rapidly developing its wealth management industry which is dominated by mega banks and trust companies

December 04, 2019 | Chris Georgiou- The number of Chinese adults in the $100,000 to $1 million wealth bracket grew by more than 80.8 million

- Clients want digital capabilities and managers alike need tools to optimise time allocation and services

- As personal wealth is at an all-time high and there are more billionaires than ever, charitable activities are also gaining traction among the wealthy

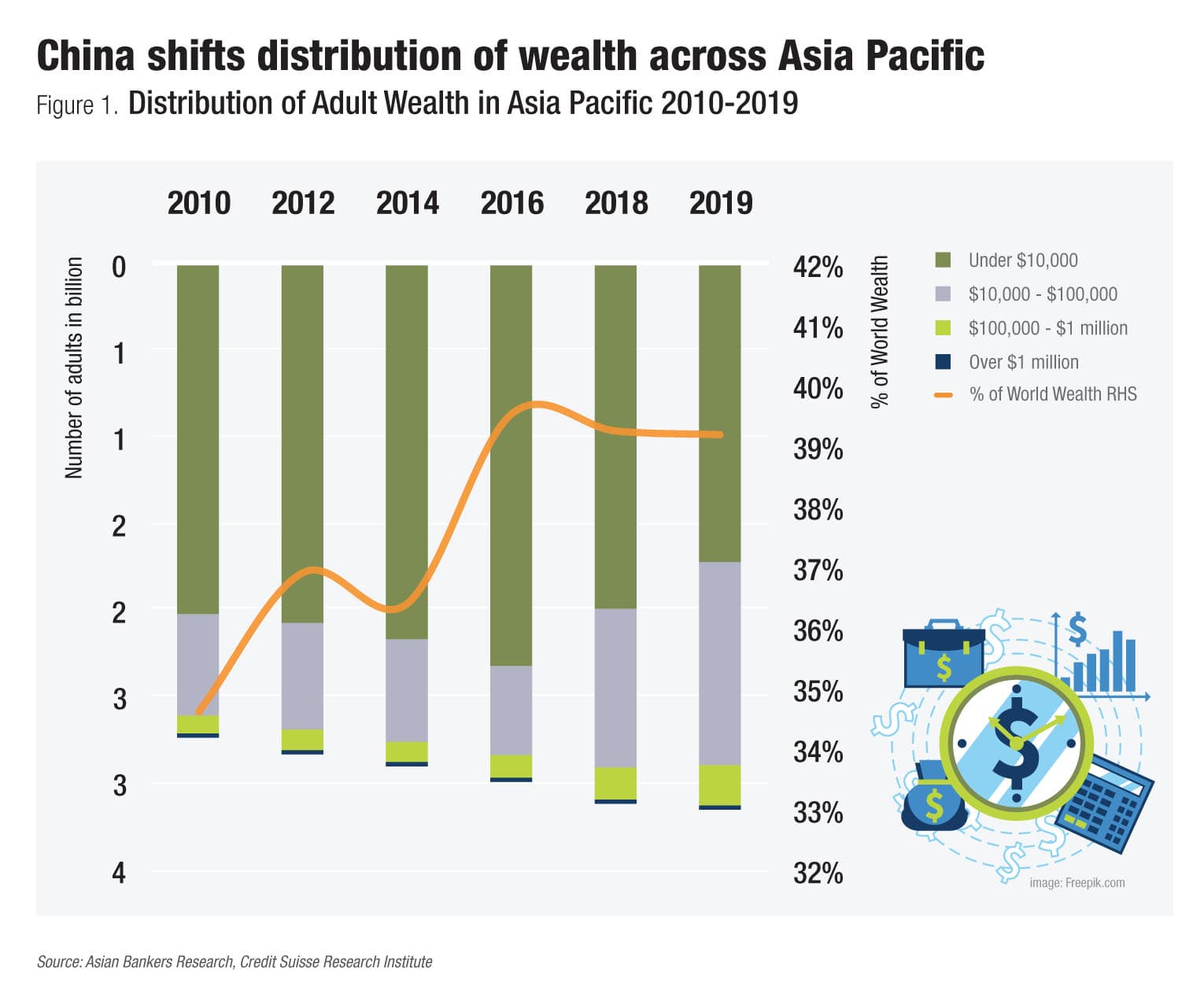

The distribution of household wealth in Asia Pacific has transposed upwards remarkably since 2016, particularly due to the rapid growth of China. It has profoundly changed the distribution of wealth across the region. Private banking and family office services are also beginning to be more understood and accepted by Chinese high net worth (HNW) individuals and their families.

Between 2016 and 2019, the number of Chinese adults in the $100,000 to $1 million wealth bracket grew by more than 80.8 million, from 28.1 million to almost 109 million – an increase of 287% and accounted for 46.7% of the total across Asia Pacific.

According to the 2019 Global Wealth Report released by Credit Suisse Research Institute, Asia Pacific saw its total household wealth grow by 2.4% to reach $141.2 trillion in mid-2019, to account for almost 39.1% of the total global wealth of $360.6 trillion.

China added a further 2.85 million millionaires (based on dollar) between 2016 and 2019 to reach a total of 4.47 million, a growth of 179.7%, and almost 35% of all millionaires in Asia Pacific.

Asia Pacific excluding India and China correspondingly added 1.46 million over the same period to reach a total of 7.50 million, while India reached 759,000 millionaires with a large leap of 581,000 over the two years...

Categories:

Keywords:

China is changing the distribution of wealth across the region and rapidly developing its wealth management industry which is dominated by mega banks and trust companies

December 04, 2019 | Chris Georgiou- The number of Chinese adults in the $100,000 to $1 million wealth bracket grew by more than 80.8 million

- Clients want digital capabilities and managers alike need tools to optimise time allocation and services

- As personal wealth is at an all-time high and there are more billionaires than ever, charitable activities are also gaining traction among the wealthy

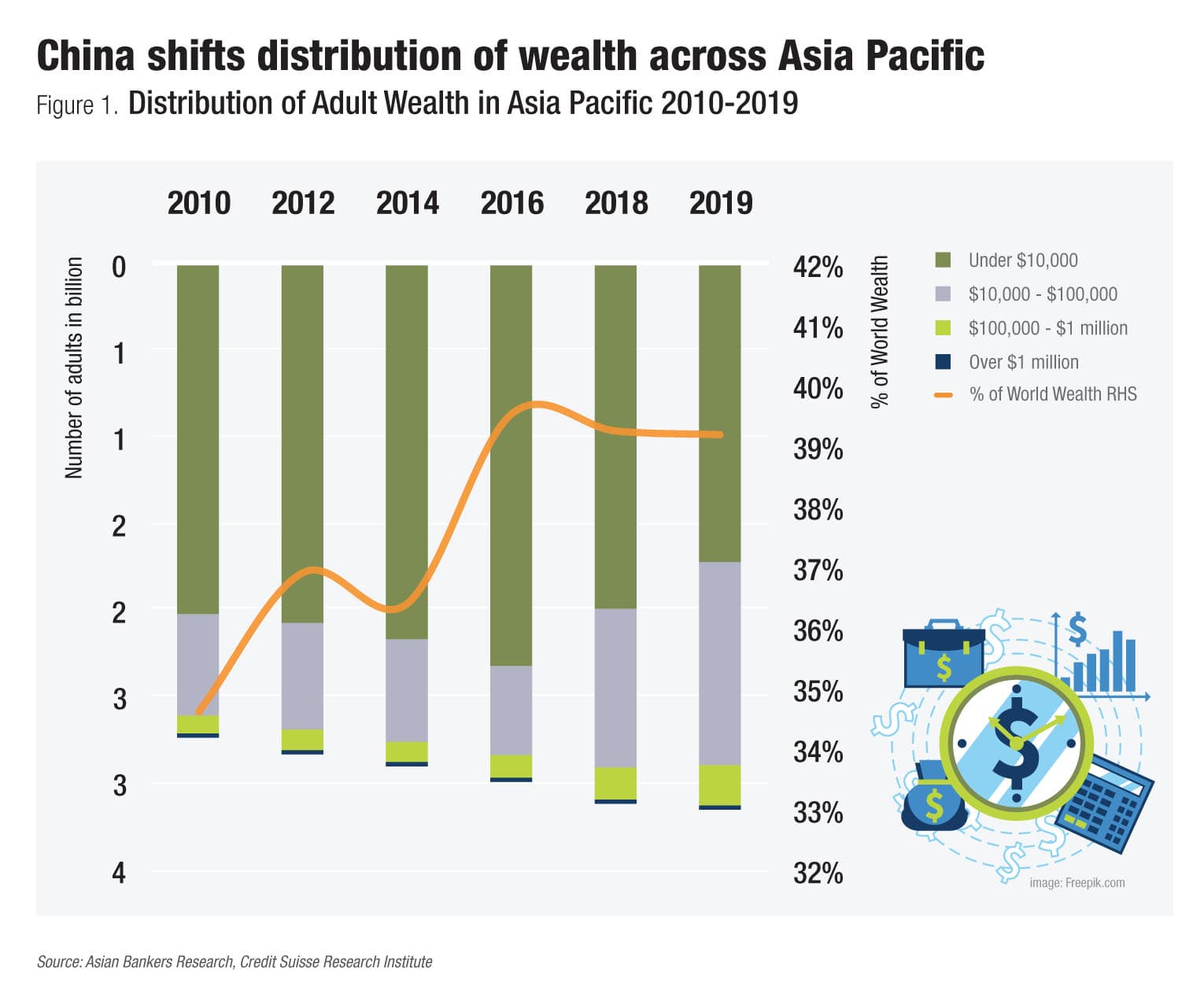

The distribution of household wealth in Asia Pacific has transposed upwards remarkably since 2016, particularly due to the rapid growth of China. It has profoundly changed the distribution of wealth across the region. Private banking and family office services are also beginning to be more understood and accepted by Chinese high net worth (HNW) individuals and their families.

Between 2016 and 2019, the number of Chinese adults in the $100,000 to $1 million wealth bracket grew by more than 80.8 million, from 28.1 million to almost 109 million – an increase of 287% and accounted for 46.7% of the total across Asia Pacific.

According to the 2019 Global Wealth Report released by Credit Suisse Research Institute, Asia Pacific saw its total household wealth grow by 2.4% to reach $141.2 trillion in mid-2019, to account for almost 39.1% of the total global wealth of $360.6 trillion.

China added a further 2.85 million millionaires (based on dollar) between 2016 and 2019 to reach a total of 4.47 million, a growth of 179.7%, and almost 35% of all millionaires in Asia Pacific.

Asia Pacific excluding India and China correspondingly added 1.46 million over the same period to reach a total of 7.50 million, while India reached 759,000 millionaires with a large leap of 581,000 over the two years...

Categories:

Keywords: