Despite current economic challenges, Vietnam’s banking sector has promising longer term potential due to its relatively young and increasingly affluent population.

May 27, 2016 | Shenming WangVietnam’s banking sector suffers from problems of inefficiency, undercapitalisation, and increasing cross-ownership among banks, all of which have been escalating the potential of contagion in the past few years. However, considerable changes have also taken place in the banking sector. State-owned commercial banks have maintained their dominance in Vietnam while joint stock commercial banks are also on the rise.

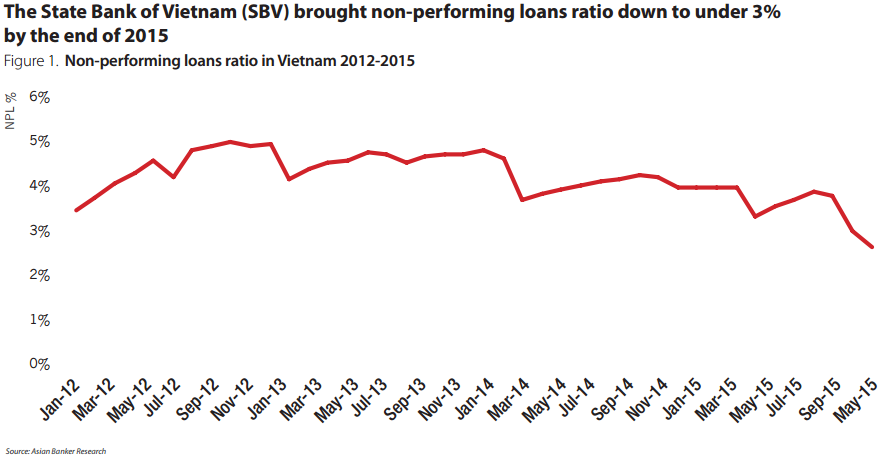

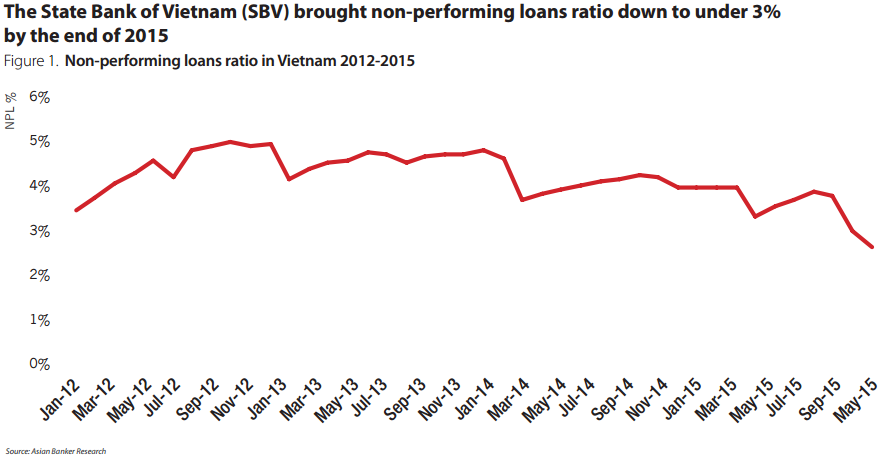

After the recession in 2012, Vietnam’s banking sector underwent restructuring as well as mergers and acquisitions. The State Bank of Vietnam (SBV) adopted a series of policies to stabilise the macro economy and inflation rates. SBV has forced lenders to merge and others to go bankrupt as it plans to reduce the total number of banks to as few as 15 by 2017 from almost 40. It also played an important role in reducing bad debt and the nonperforming loan (NPL) ratio, bringing it down to under 3% by the end of 2015. At the same time, net profit and other indicators improved (Figure 1).

Banks in Vietnam are restructuring through mergers and acquisitions and retail banking is being bolstered. With a 60 percent of Vietnamese under the age of 35, customer group demand more convenient, consistent and accessible financial services, especially in personal loans, credit cards and wealth management. Among all local banks, the performance of two major, long-established Vietnamese banks—Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) and Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank)—best demonstrate how banks are adapting to new retail banking trends and strengthening their competencies and brands in both domestic and international markets. Meanwhile, Tien Phong Commercial Joint Stock Bank, which is relatively new in the industry, is blazing trails in the adoption of technology to enhance its banking services.

Joint Stock Commercial Bank for Investment and Development of Vietnam

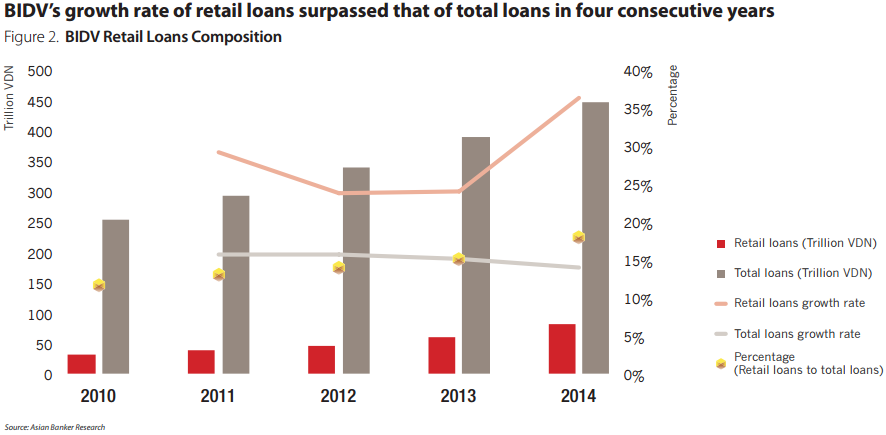

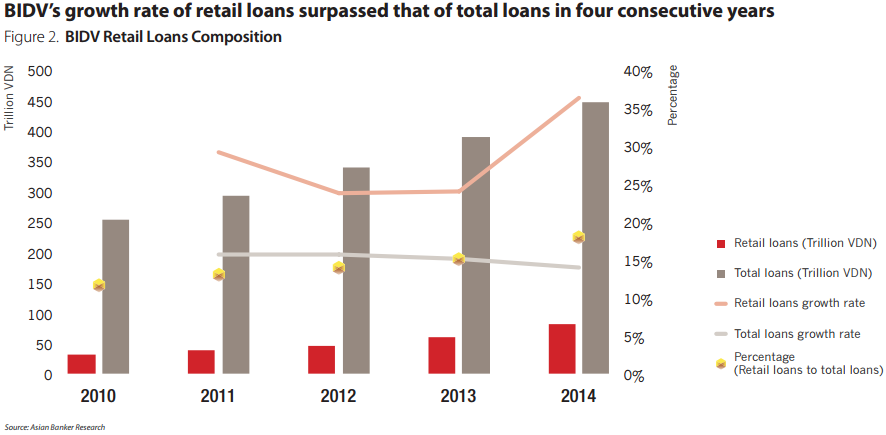

The BIDV is one of the leading retail banks in Vietnam. In 2015, BIDV and MHB merged, increasing 40,000 new mainly rural agri-retail banking customers in the Mekong River Delta and the bank has reached the number of more than 7.7 million retail customers. From 2010 to 2014, total loans grew from 254.2 trillion Vietnamese dong (VND) ($11.4 billion) in 2010, to VDN445.7 trillion ($20 billion) in 2014. The average growth rate of 15% from 2010 to 2014 in aggregate loans was due to improved credit quality as well as strengthened business objectives. Furthermore, the NPL ratio dropped from 2.9% in 2012, to 2.37% in 2013, to an even better 2.03% in 2014.

Retail loans also almost doubled from VDN29.7 trillion in 2010 to VDN58.8 trillion ($1.3 billion) in 2013; then rose further still to VDN80.2 trillion ($3.6 billion) in 2014, a growth rate surpassing that of total loans. The composition of retail loans to total loans was 14.0%, 15.0%, and 18.0% in 2012, 2013, and 2014, respectively (Figure 2). In 2015, retail customers totalled 7.7 million, and BIDV ranked first in retail deposit mobilisation (Figure 3). All these achievements have cemented BIDV’s status as one of the country’s leading retail banks.

The improvement of its retail business has made BIDV a leader in many aspects including retail credit, retail deposit, and retail services. Since 2010, BIDV has been expanding its network. particularly in the main regions across the north and south (particularly Hanoi and Ho Chi Minh City), as well as in the big cities and towns. BIDV now has 185 branches; 1,822 ATMs; and 13,054 POS machines.

To upgrade services and product capacities, BIDV also converted savings counters to transaction office. These actions stemmed from the State Bank of Vietnam’s review in 2013–2015, which sought to eliminate inefficient credit institutions. The streamlining of the BIDV network helped to increase effectiveness, risk control, and corporate governance, in accordance with BIDV’s motto, “Efficiency in business and safety in operation”.

Along with the development of traditional banking, e-banking services are taking shape at BIDV. It now has 1.1 million internet users and 3.3 active mobile users. BIDV has three mobile banking applications, namely, BIDV Smart Banking, BIDV Lifestyle, and BIDV Mobile. Starting 2012, BIDV’s online payment systems could link to service providers and partners including Vnpay and Onepay, as well as card services such as VISA, MasterCard credit cards, MasterCard debit card, BIDV Ready debit card, etc.

In 2014, the BIDV card system accepted Japan Credit Bureau (JCB) and made JCB the fourth international card that could be used through ATM/POS alongside Visa, MasterCard, and UnionPay. This cooperation with JCB broadened the bank’s product business and enlarged BIDV’s competitiveness in the Vietnamese card market.

Meanwhile, IT projects such as “Multilateral profit analysis system”, “Supplementing IBMB function”, and “Treasury system” were also implemented to serve customers better and meet the central bank’s governance requirements.

BIDV has been running the Rural Finance Project (RFP) I, II, and III funded by the World Bank, which aims to develop agriculture and rural areas, and eliminate poverty. The project benefits more than 135,000 low-income households and small businesses in rural areas. Additional funding from BIDV helps individuals access loans.

In the future, BIDV will continue developing its retail credit services and payment services as Vietnam experiences rising income per capita and greater demand for more professional products and services in the retail banking sector like consumer finance, credit cards and car loans and remittances.

Vietnam Joint Stock Commercial Bank for Industry and Trade

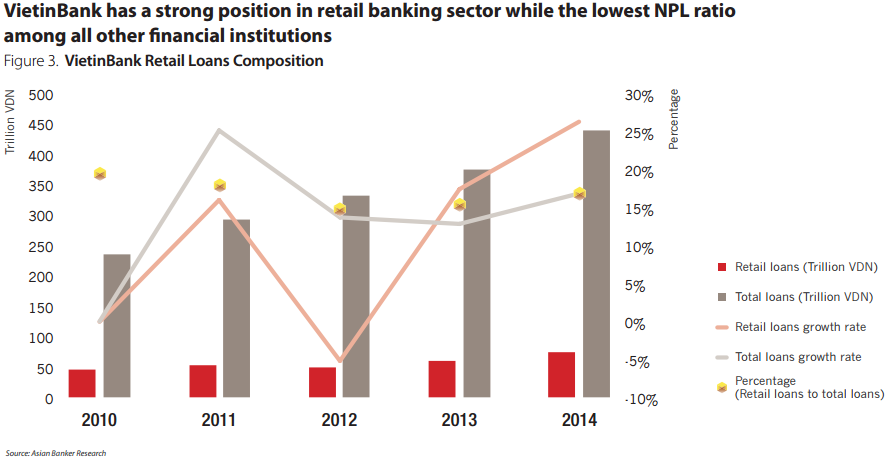

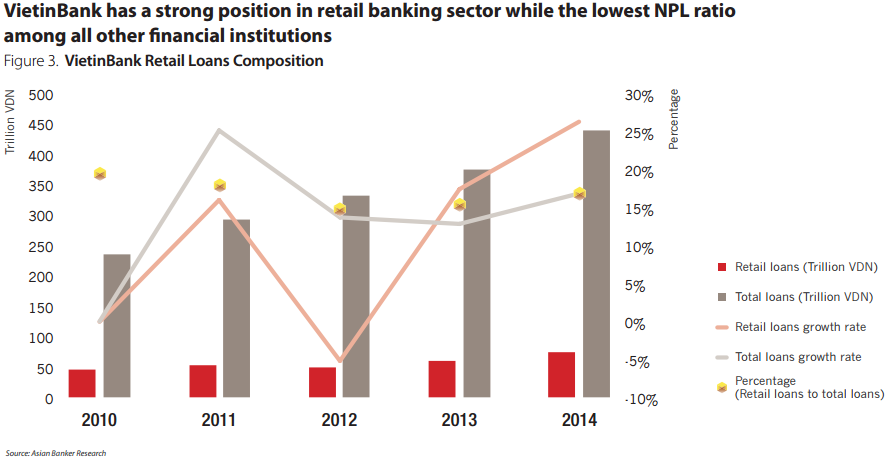

VietinBank is one of the four largest state-owned commercial banks in Vietnam, holding one-fifth of Vietnam’s banking assets. The bank is the most privatized among big four banks in Vietnam with a strong mortgage position. Total loans of VietinBank have improved from VDN234.2 trillion ($10.5 billion) in 2010 to VDN439.9 trillion ($19.7 billion) in 2014. Despite an unfavourable economic environment in Vietnam, VietinBank has strictly controlled asset quality and risk management. It has an NPL of 1.1%, which is much lower than the industry average and lowest among all other financial institutions.

Retail loans in 2010 were VDN45.4 trillion ($2.0 billion), VND58.4 trillion ($2.6 billion) in 2013, and VDN73.9 trillion ($3.3 billion) in 2014 (Figure 3). The growth rate of retail loans achieved between 2013 and 2014 was 27%. Real estate loans in 2014 totalled VDN27.2 trillion ($1.2 billion), compared to VDN24.8 trillion ($1.1 billion) in 2013. Loans to households also rose from VDN5.7 trillion ($0.3 billion) in 2013 to VDN11.1 trillion ($0.5 billion) in 2014.

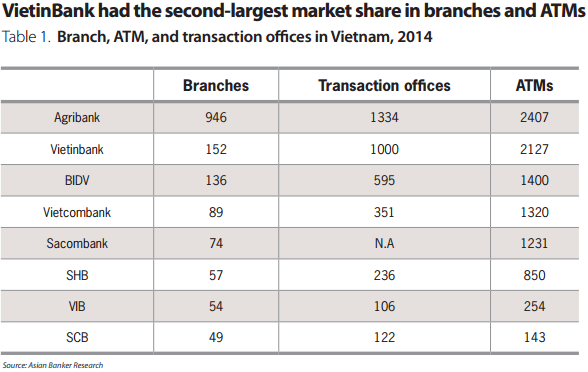

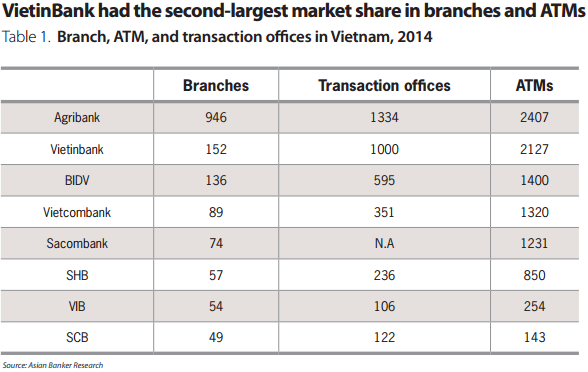

VietinBank has a smaller customer base of 3.5 million compared to BIDV’s more than 7 million. But VietinBank has a strong position in retail banking, especially in the retail loans sector, due mainly to its expansion on both scale and depth. Table 1 shows that in 2014, VietinBank had the second-largest market share in branches (152) and ATMs (2,127).

The bank’s extensive branch network was not only domestic but also reached out to international markets. Its strategy of increasing foreign branches in the Lao People’s Democratic Republic and Germany help Vietinbank integrate into deeper international financial markets and build correspondent relationship with more international financial institutions across the world. In 2014, Vietinbank actively collaborated with strategic partner BTMU and the International Finance Corporation to promote its management capacity, corporate finance, and operational quality especially in retail banking.

In terms of technological enhancement, Vietinbank has launched numerous IT projects, creating a better environment for its core business and supporting all aspects of its other businesses. Improvement of its e-bank system gave customers a convenient experience. VietinBank iPay is an updated version of Vietinbank’s Internet Banking service. This new service is designed for customers to make quicker bank account inquiries, conduct online transactions, as well as apply online without additional fees.

Utilizing OTP (one-time password) technology, customers can perform transactions and manage their account without difficulty anytime in any VietBank office. Looking forward, Vietinbank will adopt modern technology in retail payment systems and more retail services.

Tien Phong Commercial Joint Stock Bank

TPBank was founded in 2008 by shareholders that count among them the Vietnamese government, FPT Corporation, Vietnam Mobile Telecom Services, and Vietnam National Reinsurance. Though a relatively young bank, TPBank is a pioneering digital bank, known for embracing new, advanced technological innovations. TPBank was the first bank to provide electronic banking solutions for basic services of traditional banks; as well as innovations to address customers’ needs through an E-Counter.

TPBank’s strengths are in internet banking and auto loans. The bank’s automobile lending business in 2015 was estimated at VDN2.5 trillion ($0.11 billion), boasting of a turnaround time from application to approval of only two hours. The success of its automobile lending business can be credited to a strategy combining sales channel, efficient turnaround time, as well as compelling interest rate to gain market share. TPBank cooperates with car showrooms to introduce and sell auto loan products. It is also ambitiously developing its internet banking services to reach as many customers as possible.

Utilizing a low-fee or no-registration fee strategy with account management information, TPBank eBank encourages customers to use internet banking instead of some traditional banking channels like transaction offices and branches. With its low-fee strategy, TPBank has strengthened its customer base as well as built up its digital channels.

From 2015 onwards, there will be a strong demand for internet banking products as the new generation of young customers prefer more convenient, on-the-go, and 24/7 banking services. This is a challenge TPBank eBank believes it is successfully wired to meet.

Outlook for Vietnamese Banks

Although the Vietnam economy is facing challenges and difficulties, the banking industry in Vietnam has tremendous potential. Local banks hold 90 percent of the market share in retail services due to their larger networks and the retail banking market keeps looking for cost-effective ways to increase financial inclusions in non-urban centres which are geographically more isolated.

In the past, customers were deterred by high transaction fees and rising interest rates. However, an interest rate “war” that would impact banks’ bottom lines is no longer a major problem with the number of young, mass-affluent people in Vietnam rising. The concern has now shifted to locking in targeted customers in the retail sector. Retail channels have always played an essential role in linking customers and meeting customers’ needs. With most banks now extending mobile banking and internet banking services, technological application is key to the success of retail banks. Joint stock and private banks have replaced core banking system or are in the process of upgrading it.

In the future, retail banking in Vietnam will require more technological investment to engender new products and competiveness. Social media, mobile, analytics, and cloud technology would be a future trend to add value for retail investors. Further on, the next step for banks in Vietnam will have to function within the new ASEAN Economic Community and keep up with regional integration in the next five years.

Categories:

Channels, Internet Banking, Retail Banking, Technology & Operations, VietnamKeywords:Vietnam, SBV, BIDV, VietinBank, TPBank, Retail Banking, Technology, Retail Loans, Internet Banking, IT, JCB, Credit Cards, NPL, Channels

Despite current economic challenges, Vietnam’s banking sector has promising longer term potential due to its relatively young and increasingly affluent population.

May 27, 2016 | Shenming WangVietnam’s banking sector suffers from problems of inefficiency, undercapitalisation, and increasing cross-ownership among banks, all of which have been escalating the potential of contagion in the past few years. However, considerable changes have also taken place in the banking sector. State-owned commercial banks have maintained their dominance in Vietnam while joint stock commercial banks are also on the rise.

After the recession in 2012, Vietnam’s banking sector underwent restructuring as well as mergers and acquisitions. The State Bank of Vietnam (SBV) adopted a series of policies to stabilise the macro economy and inflation rates. SBV has forced lenders to merge and others to go bankrupt as it plans to reduce the total number of banks to as few as 15 by 2017 from almost 40. It also played an important role in reducing bad debt and the nonperforming loan (NPL) ratio, bringing it down to under 3% by the end of 2015. At the same time, net profit and other indicators improved (Figure 1).

Banks in Vietnam are restructuring through mergers and acquisitions and retail banking is being bolstered. With a 60 percent of Vietnamese under the age of 35, customer group demand more convenient, consistent and accessible financial services, especially in personal loans, credit cards and wealth management. Among all local banks, the performance of two major, long-established Vietnamese banks—Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) and Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank)—best demonstrate how banks are adapting to new retail banking trends and strengthening their competencies and brands in both domestic and international markets. Meanwhile, Tien Phong Commercial Joint Stock Bank, which is relatively new in the industry, is blazing trails in the adoption of technology to enhance its banking services.

Joint Stock Commercial Bank for Investment and Development of Vietnam

The BIDV is one of the leading retail banks in Vietnam. In 2015, BIDV and MHB merged, increasing 40,000 new mainly rural agri-retail banking customers in the Mekong River Delta and the bank has reached the number of more than 7.7 million retail customers. From 2010 to 2014, total loans grew from 254.2 trillion Vietnamese dong (VND) ($11.4 billion) in 2010, to VDN445.7 trillion ($20 billion) in 2014. The average growth rate of 15% from 2010 to 2014 in aggregate loans was due to improved credit quality as well as strengthened business objectives. Furthermore, the NPL ratio dropped from 2.9% in 2012, to 2.37% in 2013, to an even better 2.03% in 2014.

Retail loans also almost doubled from VDN29.7 trillion in 2010 to VDN58.8 trillion ($1.3 billion) in 2013; then rose further still to VDN80.2 trillion ($3.6 billion) in 2014, a growth rate surpassing that of total loans. The composition of retail loans to total loans was 14.0%, 15.0%, and 18.0% in 2012, 2013, and 2014, respectively (Figure 2). In 2015, retail customers totalled 7.7 million, and BIDV ranked first in retail deposit mobilisation (Figure 3). All these achievements have cemented BIDV’s status as one of the country’s leading retail banks.

The improvement of its retail business has made BIDV a leader in many aspects including retail credit, retail deposit, and retail services. Since 2010, BIDV has been expanding its network. particularly in the main regions across the north and south (particularly Hanoi and Ho Chi Minh City), as well as in the big cities and towns. BIDV now has 185 branches; 1,822 ATMs; and 13,054 POS machines.

To upgrade services and product capacities, BIDV also converted savings counters to transaction office. These actions stemmed from the State Bank of Vietnam’s review in 2013–2015, which sought to eliminate inefficient credit institutions. The streamlining of the BIDV network helped to increase effectiveness, risk control, and corporate governance, in accordance with BIDV’s motto, “Efficiency in business and safety in operation”.

Along with the development of traditional banking, e-banking services are taking shape at BIDV. It now has 1.1 million internet users and 3.3 active mobile users. BIDV has three mobile banking applications, namely, BIDV Smart Banking, BIDV Lifestyle, and BIDV Mobile. Starting 2012, BIDV’s online payment systems could link to service providers and partners including Vnpay and Onepay, as well as card services such as VISA, MasterCard credit cards, MasterCard debit card, BIDV Ready debit card, etc.

In 2014, the BIDV card system accepted Japan Credit Bureau (JCB) and made JCB the fourth international card that could be used through ATM/POS alongside Visa, MasterCard, and UnionPay. This cooperation with JCB broadened the bank’s product business and enlarged BIDV’s competitiveness in the Vietnamese card market.

Meanwhile, IT projects such as “Multilateral profit analysis system”, “Supplementing IBMB function”, and “Treasury system” were also implemented to serve customers better and meet the central bank’s governance requirements.

BIDV has been running the Rural Finance Project (RFP) I, II, and III funded by the World Bank, which aims to develop agriculture and rural areas, and eliminate poverty. The project benefits more than 135,000 low-income households and small businesses in rural areas. Additional funding from BIDV helps individuals access loans.

In the future, BIDV will continue developing its retail credit services and payment services as Vietnam experiences rising income per capita and greater demand for more professional products and services in the retail banking sector like consumer finance, credit cards and car loans and remittances.

Vietnam Joint Stock Commercial Bank for Industry and Trade

VietinBank is one of the four largest state-owned commercial banks in Vietnam, holding one-fifth of Vietnam’s banking assets. The bank is the most privatized among big four banks in Vietnam with a strong mortgage position. Total loans of VietinBank have improved from VDN234.2 trillion ($10.5 billion) in 2010 to VDN439.9 trillion ($19.7 billion) in 2014. Despite an unfavourable economic environment in Vietnam, VietinBank has strictly controlled asset quality and risk management. It has an NPL of 1.1%, which is much lower than the industry average and lowest among all other financial institutions.

Retail loans in 2010 were VDN45.4 trillion ($2.0 billion), VND58.4 trillion ($2.6 billion) in 2013, and VDN73.9 trillion ($3.3 billion) in 2014 (Figure 3). The growth rate of retail loans achieved between 2013 and 2014 was 27%. Real estate loans in 2014 totalled VDN27.2 trillion ($1.2 billion), compared to VDN24.8 trillion ($1.1 billion) in 2013. Loans to households also rose from VDN5.7 trillion ($0.3 billion) in 2013 to VDN11.1 trillion ($0.5 billion) in 2014.

VietinBank has a smaller customer base of 3.5 million compared to BIDV’s more than 7 million. But VietinBank has a strong position in retail banking, especially in the retail loans sector, due mainly to its expansion on both scale and depth. Table 1 shows that in 2014, VietinBank had the second-largest market share in branches (152) and ATMs (2,127).

The bank’s extensive branch network was not only domestic but also reached out to international markets. Its strategy of increasing foreign branches in the Lao People’s Democratic Republic and Germany help Vietinbank integrate into deeper international financial markets and build correspondent relationship with more international financial institutions across the world. In 2014, Vietinbank actively collaborated with strategic partner BTMU and the International Finance Corporation to promote its management capacity, corporate finance, and operational quality especially in retail banking.

In terms of technological enhancement, Vietinbank has launched numerous IT projects, creating a better environment for its core business and supporting all aspects of its other businesses. Improvement of its e-bank system gave customers a convenient experience. VietinBank iPay is an updated version of Vietinbank’s Internet Banking service. This new service is designed for customers to make quicker bank account inquiries, conduct online transactions, as well as apply online without additional fees.

Utilizing OTP (one-time password) technology, customers can perform transactions and manage their account without difficulty anytime in any VietBank office. Looking forward, Vietinbank will adopt modern technology in retail payment systems and more retail services.

Tien Phong Commercial Joint Stock Bank

TPBank was founded in 2008 by shareholders that count among them the Vietnamese government, FPT Corporation, Vietnam Mobile Telecom Services, and Vietnam National Reinsurance. Though a relatively young bank, TPBank is a pioneering digital bank, known for embracing new, advanced technological innovations. TPBank was the first bank to provide electronic banking solutions for basic services of traditional banks; as well as innovations to address customers’ needs through an E-Counter.

TPBank’s strengths are in internet banking and auto loans. The bank’s automobile lending business in 2015 was estimated at VDN2.5 trillion ($0.11 billion), boasting of a turnaround time from application to approval of only two hours. The success of its automobile lending business can be credited to a strategy combining sales channel, efficient turnaround time, as well as compelling interest rate to gain market share. TPBank cooperates with car showrooms to introduce and sell auto loan products. It is also ambitiously developing its internet banking services to reach as many customers as possible.

Utilizing a low-fee or no-registration fee strategy with account management information, TPBank eBank encourages customers to use internet banking instead of some traditional banking channels like transaction offices and branches. With its low-fee strategy, TPBank has strengthened its customer base as well as built up its digital channels.

From 2015 onwards, there will be a strong demand for internet banking products as the new generation of young customers prefer more convenient, on-the-go, and 24/7 banking services. This is a challenge TPBank eBank believes it is successfully wired to meet.

Outlook for Vietnamese Banks

Although the Vietnam economy is facing challenges and difficulties, the banking industry in Vietnam has tremendous potential. Local banks hold 90 percent of the market share in retail services due to their larger networks and the retail banking market keeps looking for cost-effective ways to increase financial inclusions in non-urban centres which are geographically more isolated.

In the past, customers were deterred by high transaction fees and rising interest rates. However, an interest rate “war” that would impact banks’ bottom lines is no longer a major problem with the number of young, mass-affluent people in Vietnam rising. The concern has now shifted to locking in targeted customers in the retail sector. Retail channels have always played an essential role in linking customers and meeting customers’ needs. With most banks now extending mobile banking and internet banking services, technological application is key to the success of retail banks. Joint stock and private banks have replaced core banking system or are in the process of upgrading it.

In the future, retail banking in Vietnam will require more technological investment to engender new products and competiveness. Social media, mobile, analytics, and cloud technology would be a future trend to add value for retail investors. Further on, the next step for banks in Vietnam will have to function within the new ASEAN Economic Community and keep up with regional integration in the next five years.

Categories:

Channels, Internet Banking, Retail Banking, Technology & Operations, VietnamKeywords:Vietnam, SBV, BIDV, VietinBank, TPBank, Retail Banking, Technology, Retail Loans, Internet Banking, IT, JCB, Credit Cards, NPL, Channels