Vladislav Solodkiy, managing partner, Life.SREDA, talks about key issues and challenges to financial technology growth in Asia and existing infrastructure gaps that hinder the scaling of fintech in the region.

April 25, 2017 | Neeti Aggarwal- Global fintech investments did not grow in 2016, although venture capital funding remains robust

- It usually takes 80% of resources and 12 months to launch a fintech in Asia as compared to 20% resources and 3 months in the US

- Several key infrastructure issues such as lack of API integration must be resolved to enable the scaling of fintech in Asia

As fintech brings new innovative technologies to the financial services sector, investment into these companies has risen rapidly, especially in the US and China.

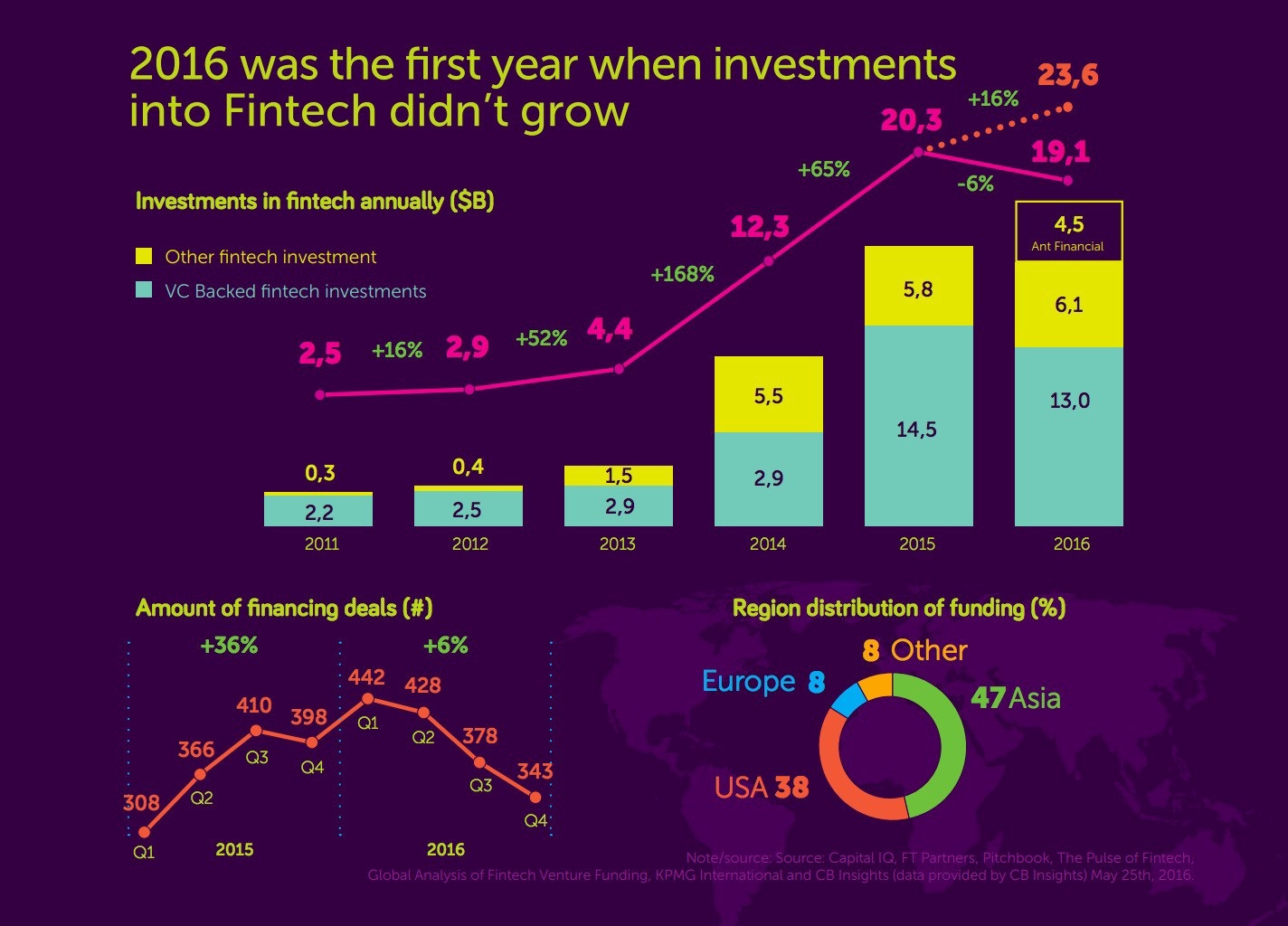

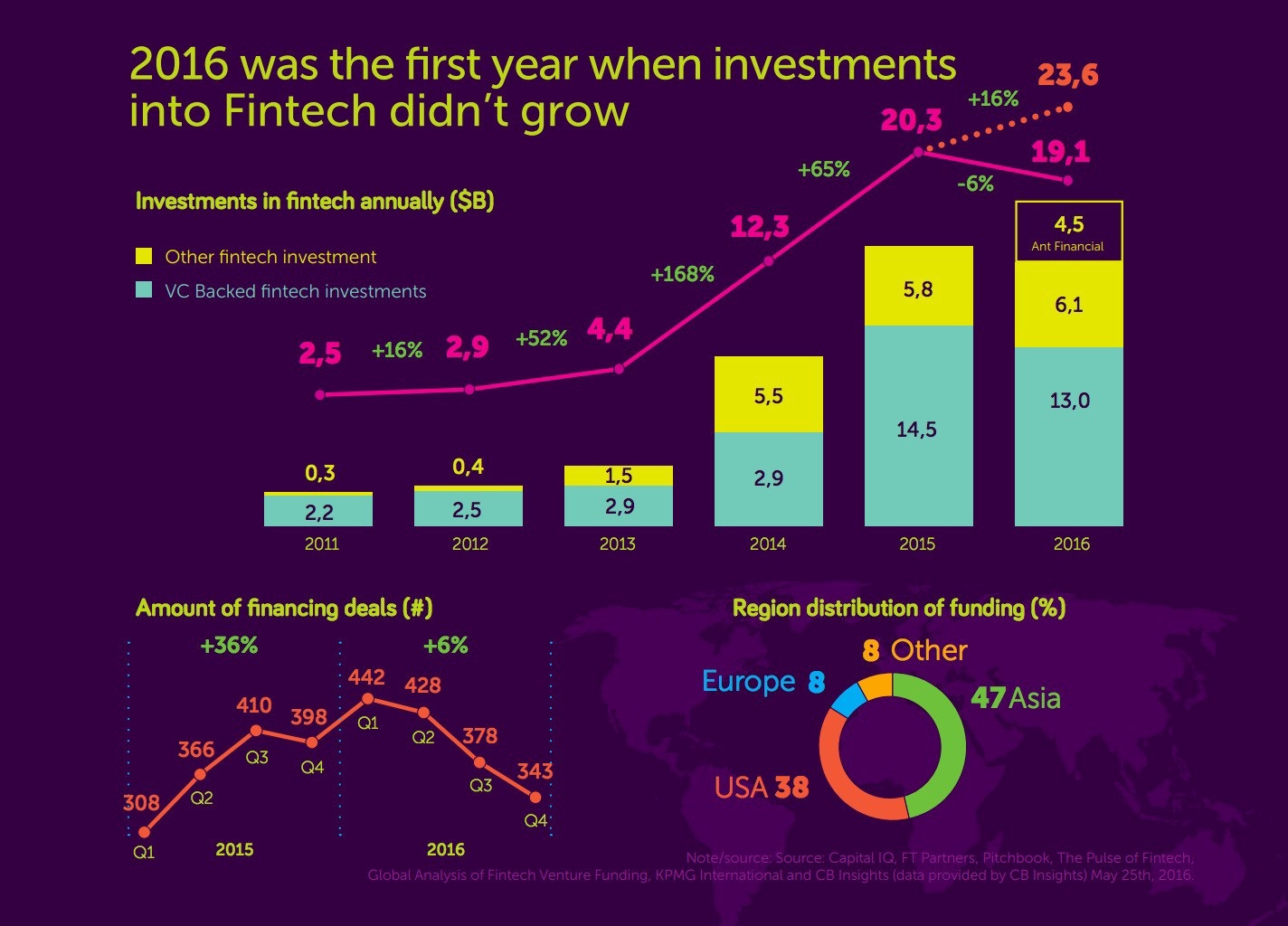

However, financing growth witnessed a dip in 2016 after the boom in 2015. According to KPMG analysis using Pitch Book data, investments and merger value declined, taking overall global fintech investments down from $46.7 billion in 2015 to $24.7 billion in 2016, across 1,076 deals.

"Money of the Future" report by Life.SREDA highlights that the amount of venture capital (VC) investment in fintech in 2016 was $23.6 billion, 16% higher than in 2015. Excluding the$4.5-billion Ant Financial investment deal (unusual for the whole tech industry), fintech market investments actually went down 6% in 2016.

Life.SREDA is an early-stage fintech venture capital fund that has invested in 22 companies, of which 13 are in the US and in Europe and has already exited from seven companies. It set up shop in Singapore one and a half years ago and has invested in eight companies in Asia.

A dip in fintech financing growth was registered in 2016

Figure 1. Annual investments in fintech

Source: Money of the Future by Life.SREDA

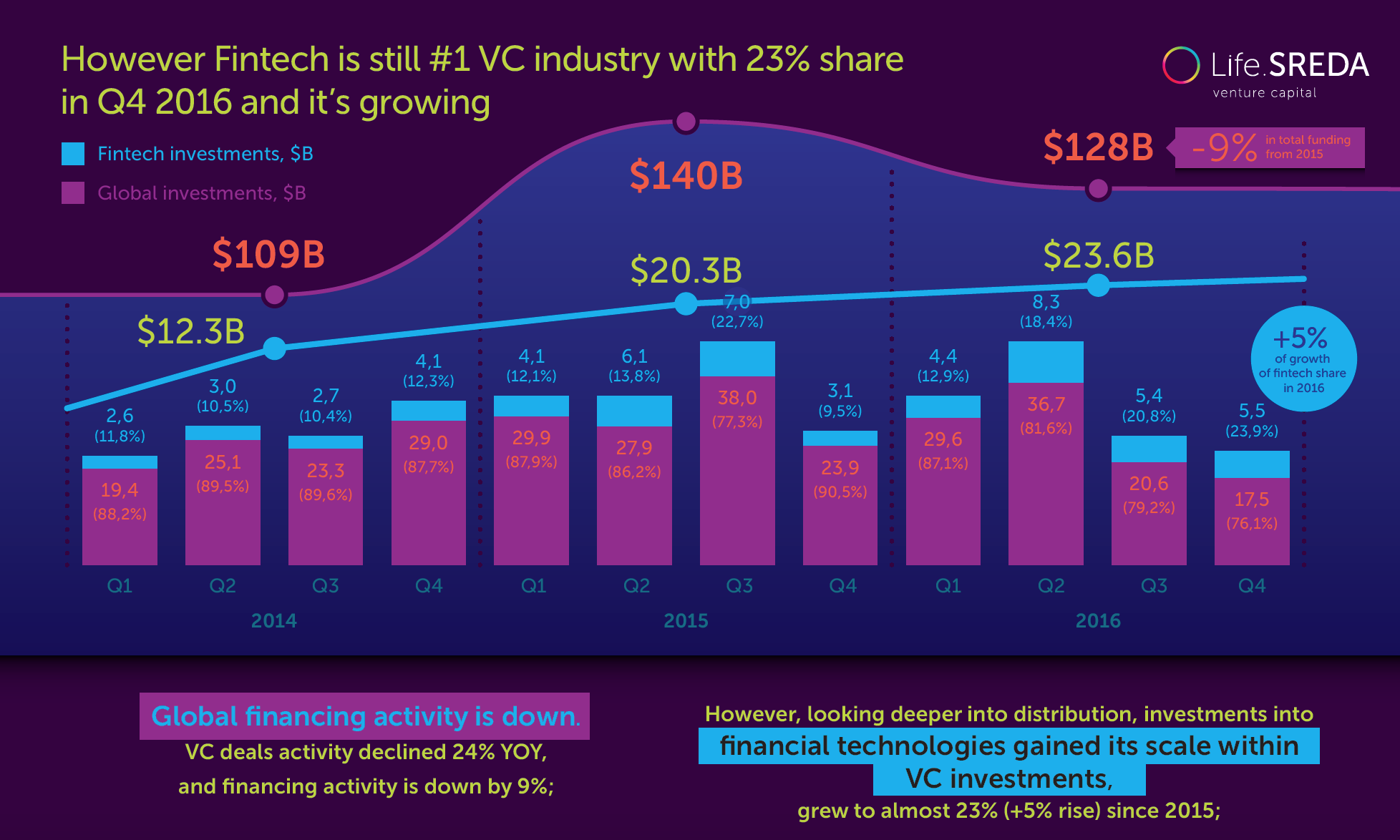

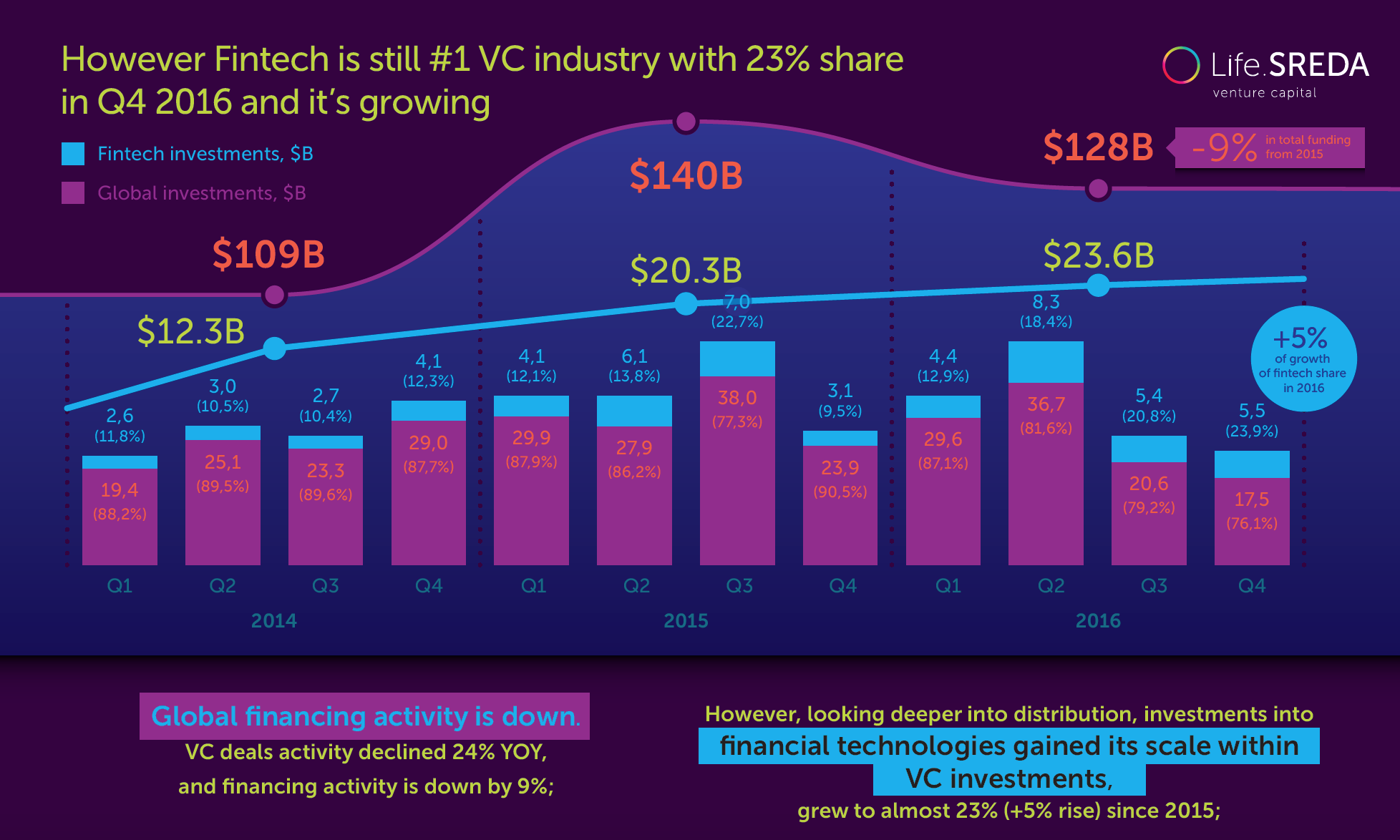

The industry’s venture capital financing still remains strong

Figure 2. Quarterly venture capital global and fintech investment

Source: Money of the Future by Life.SREDA

Macro-economic uncertainty, including Brexit and the US elections are some of the key reasons attributed to this decline in the industry’s growth rate. The dip is probably also a result of below expectation performance of financial and business metrics of fintech as many have yet to breakeven.

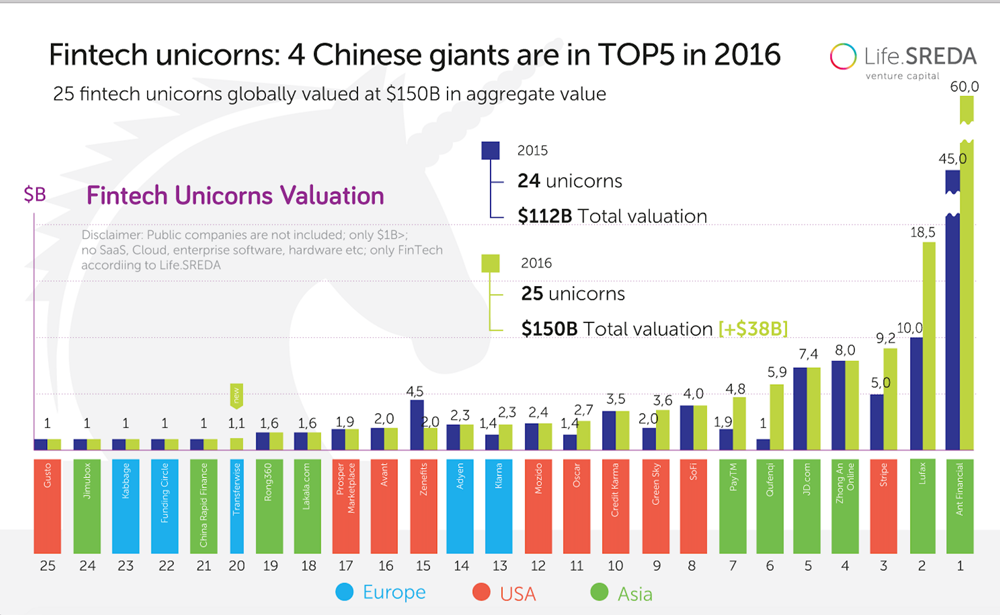

Asia became the top fintech market in the world with almost a 50% share of global VC volume (Asia’s share of global fintech investment is 47% in 2016). Pushing China ahead of the US and other countries were notable deals like Ant Financial, arm of ecommerce giant Alibaba raising $4.5 billion, one of the biggest fintech VC round in history and peer-to-peer (P2P) lending company Lufax, which raised $1.8 billion in series B funding in 2016. In fact, China companies lead in number among the top unicorns (start-up valued at over $1 billion).

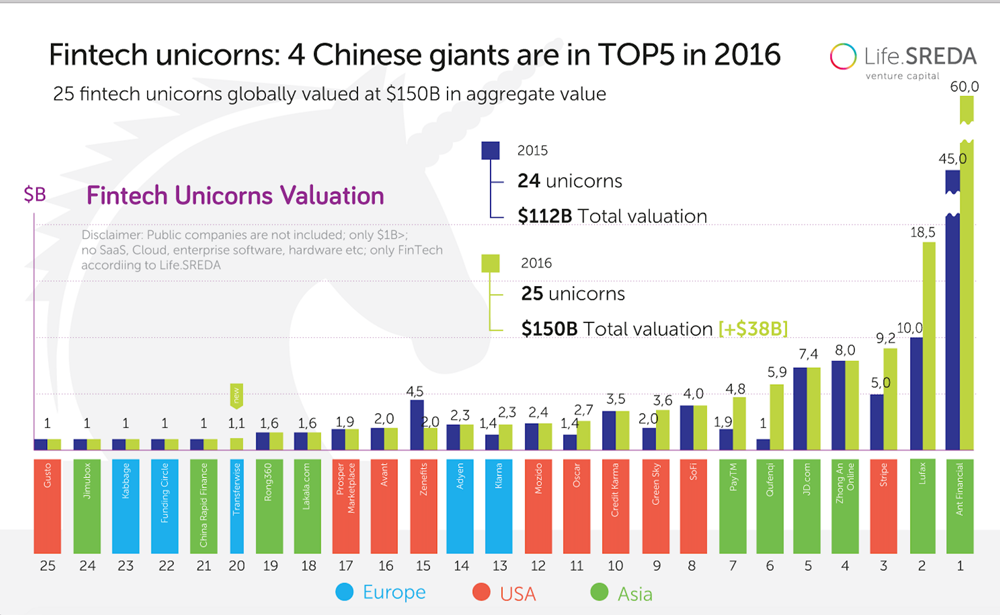

China fintech leads among the highest valued unicorns

Figure 3. Fintech unicorn valuations

Source: Money of the Future by Life.SREDA

According to the report, lending, payments, wealth management and e-wallets are the top four sectors that made almost 50% of all investments, interestingly, within Asia. Although China dominated the funding amount, the total number of companies funded was highest in India at 35%, (compared to 23% of companies in China). India, China and Singapore comprised 60% of the companies funded in Asia.

Challenges to Asian fintech growth

While fintech investments in Asia are growing, expansion in this market has its own set of challenges.

Solodkiy pointed: “In the US, to set up a company you spend a couple of weeks to discuss with banks that you know will support fintech. After which, they will send you an open application programming interface (API) via email that you can plug in. Within three months and with 20% of your resources, you can launch it. In Asia, fintech will spend more than three months to discuss with different business teams, and thereafter, with an IT team. After six months, it will need to go onsite with physical infrastructure to integrate with the bank’s systems. The whole process will take 12 months and 80% of resources. If you want to launch from the US to the UK, it will also take three months, but in Asia, to launch from one country to another, you will need another year.”

“In Asia, each country is so unique. You have to meet start-ups, banks, regulators and a layman to learn about customer behaviour, to try to bring fintech knowledge and experience and understand how to localise it in each country. Asia is about execution and distribution, how to marry online solutions with offline world,” he added.

Fintech is part of digital work and needs to scale. Most markets in Asia lack an API and a bank-as-a-service (BaaS) platform to easily facilitate the integration of banks with fintech. Having the ability to plug and play with open API can enable banks to rapidly bring new services for their customers. Conversely, as infrastructure is not geared towards integration of services, fintech needs to invest in more expensive resources over a longer period to scale their business across Asia, which often face problems in acquiring series B funding.

“Right now we are focused on how to solve infrastructure issues in the market. There is a problem of scaling in Asian market. To launch a company is hard and expensive, and when you decide to go to another market, you need to repeat the entire process for each Asian country. We are trying for the whole start-up system across the region to set up middleware between markets,” he explained.

“If you solve the infrastructure gap you will create a huge market, much bigger than the Chinese or the US market and local start-ups will have the ability to scale faster and bring in right talent from abroad,” he added.

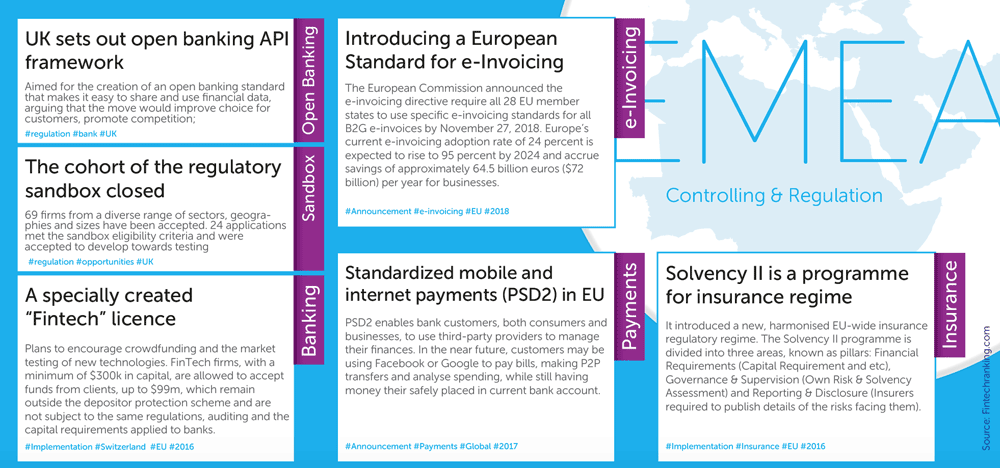

Regulators become more active

Both the private sector, as well as regulators, will have to join hands to solve this infrastructure integration. Several regulators are already open to support local players and to integrate different markets.

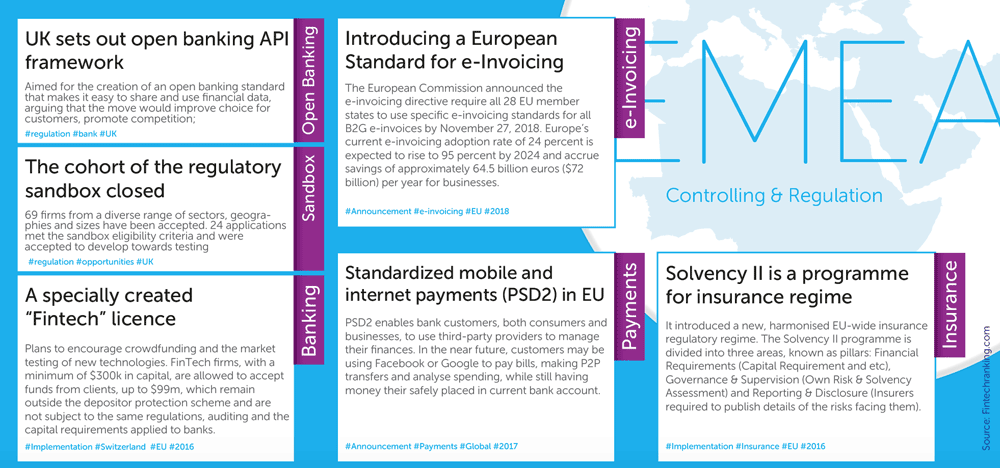

In Europe, regulators are promoting an open banking framework

Figure 4. Key initiatives by regulators in Europe, Middle East and Africa

Source: Money of the Future by Life.SREDA

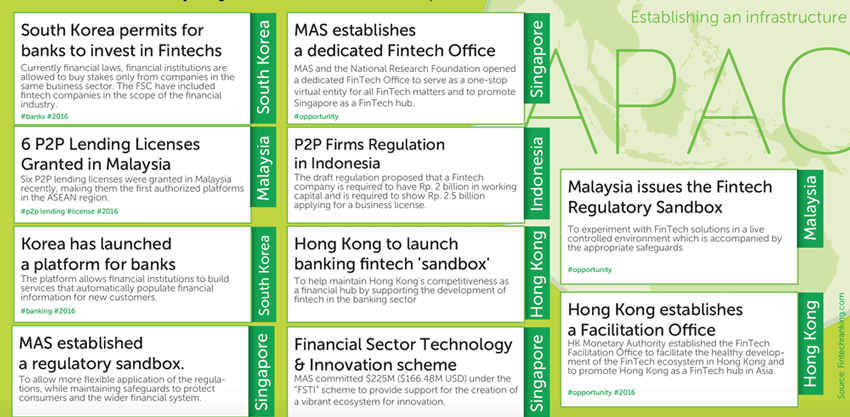

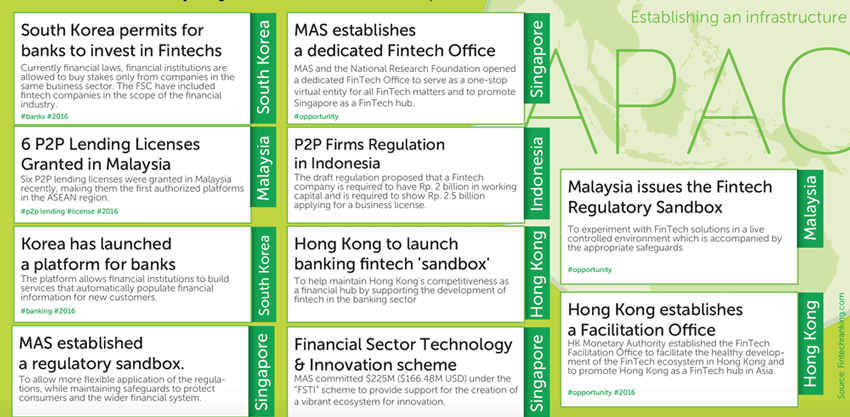

Asian regulators bring to the fore new initiatives including sandboxes

Figure 5. Key initiatives by regulators in Asia Pacific

Source: Money of the Future by Life.SREDA

Different regulatory efforts are now visible in locations such as Singapore, Hong Kong and Malaysia, where regulatory sandboxes have been set up. These regulatory sandboxes will allow innovators to test their products in a live environment for a limited time, subject to certain conditions.

Many regulators are favouring sandbox, though there are varying views on their efficacy in promoting fintech innovation within Asia. “Sandbox is a bit of a wrong step as this is more about how to establish within a specific country, but not about unifying the requirements and infrastructure across markets to scale faster and cheaper,” opined Solodkiy.

“Sandbox is a legal and kind way to say ‘no’. In Asia, fintechs need to collaborate with banks. However, banks are not yet clear on what they want to do with fintech,” he added.

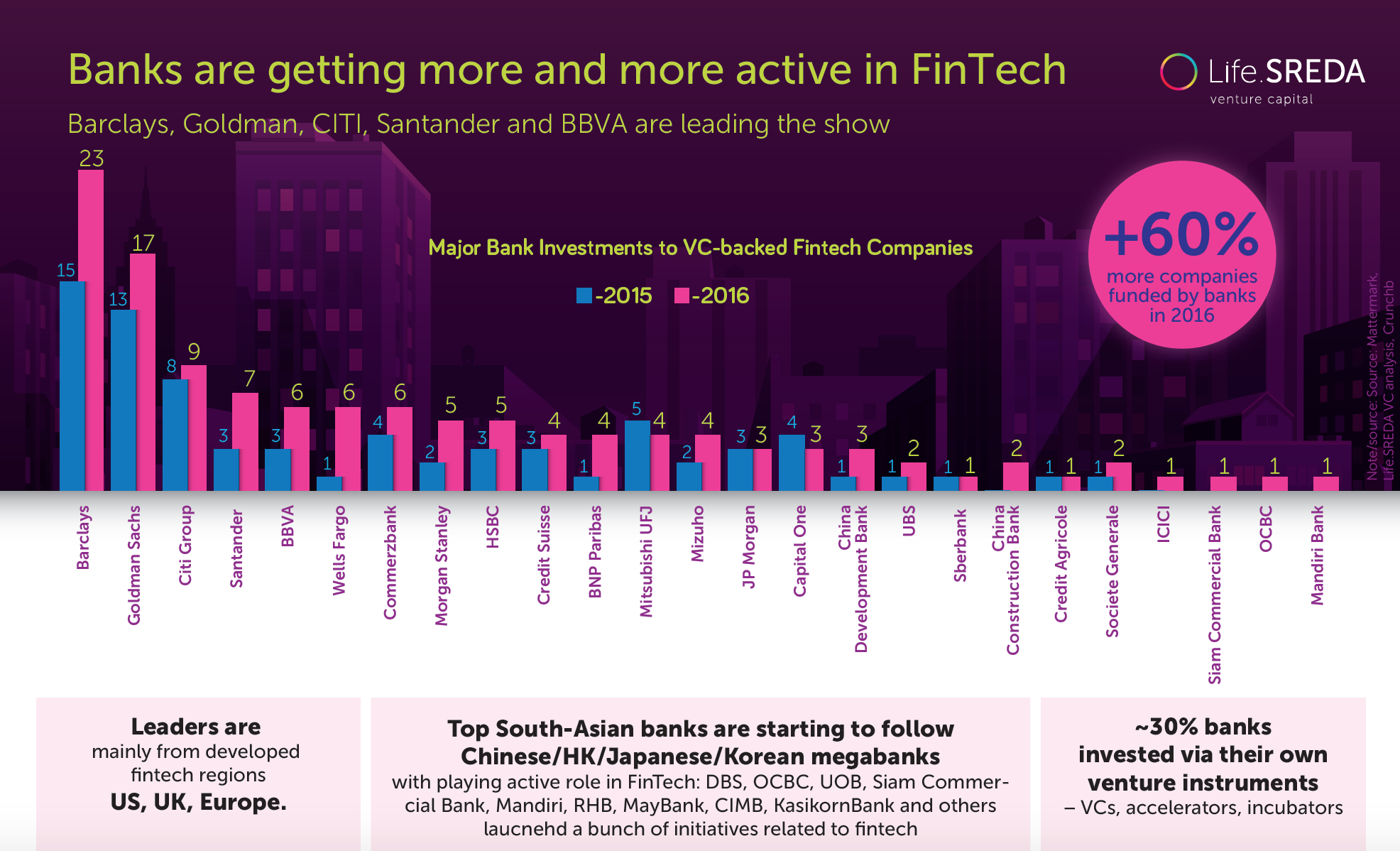

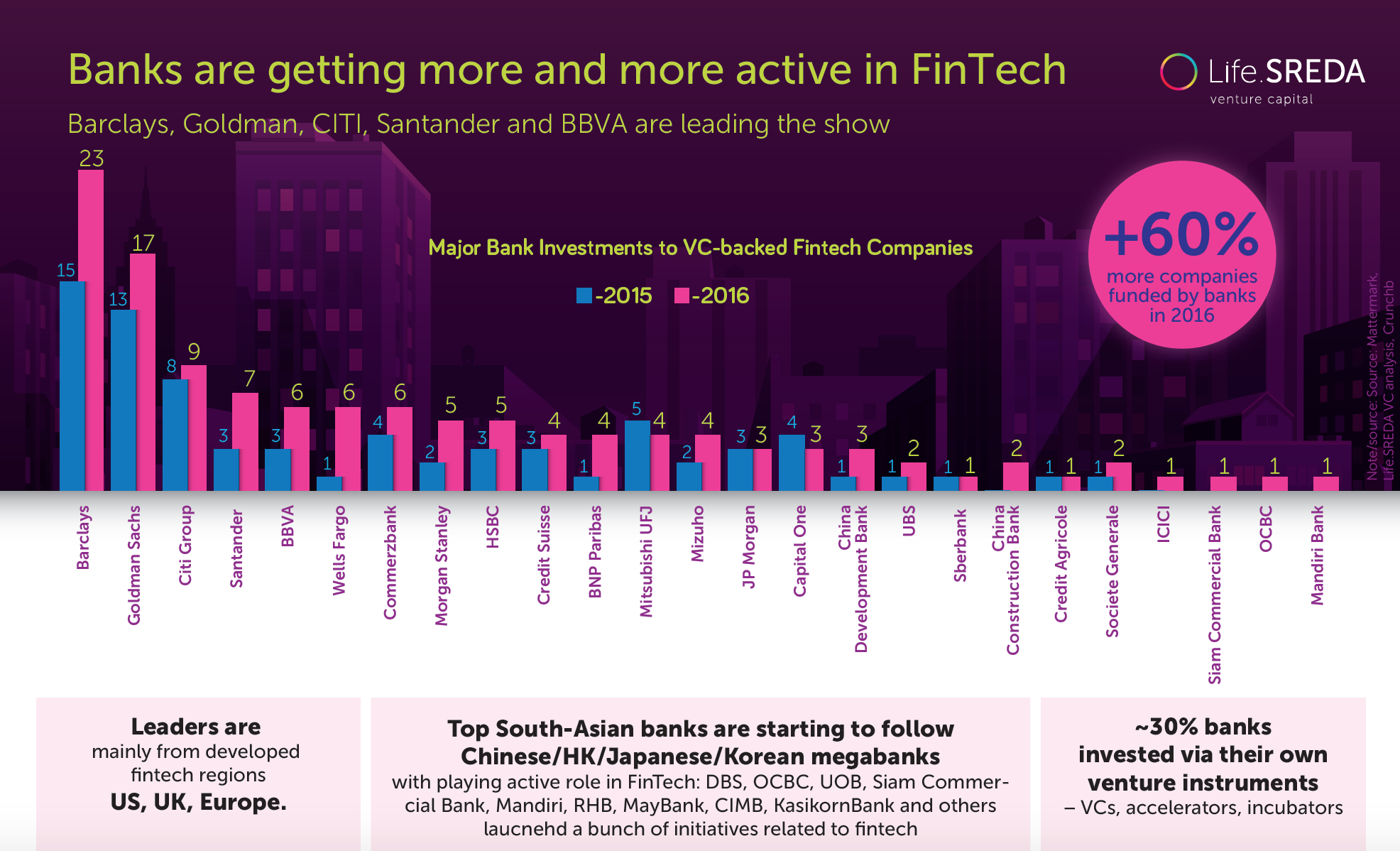

Bank-fintech partnership

Banks and fintech partnerships are increasingly growing to bring new innovations and improve customer journeys, especially in areas like P2P services, wealth management and blockchain. Some banks from the UK and the US are actively investing in fintech, including their own VCs, while leading Asian banks are playing an active role in new fintech initiatives, which include hackathon, incubators and fintech start-ups.

Leading banks are actively investing into fintech

Figure 6. Major bank investments to VC-backed fintechs

Source: Money of the Future by Life.SREDA

The fintech sector is gaining maturity as regulators increase their focus on its growth and financial institutions increase their investments and partnership with fintechs.

Besides fintech initiatives, banks also need to reinvent their own systems. With new challenger banks and fintechs, it is becoming imperative for traditional banks to shed their traditional inefficient processes and legacy systems to invest in differentiating customer experience. “Companies need to reinvent or disrupt themselves every 10-15 years as the life cycle of the companies is becoming shorter,” pointed Solodkiy.

“When banks are trying to do innovation, it is best to do that in parallel as a new business rather that inside the bank as the innovation will end up in the same corporate culture. With something new you need to run with it. I know of only one to two banks that are really successful with acquisition of fintech, for example BBVA,” he noted.

Categories:

Financial Technology, Innovation, Risk and Regulation, Technology & OperationsKeywords:Life.SREDA, Fintech, API, VC, Start-ups, Sandbox

Vladislav Solodkiy, managing partner, Life.SREDA, talks about key issues and challenges to financial technology growth in Asia and existing infrastructure gaps that hinder the scaling of fintech in the region.

April 25, 2017 | Neeti Aggarwal- Global fintech investments did not grow in 2016, although venture capital funding remains robust

- It usually takes 80% of resources and 12 months to launch a fintech in Asia as compared to 20% resources and 3 months in the US

- Several key infrastructure issues such as lack of API integration must be resolved to enable the scaling of fintech in Asia

As fintech brings new innovative technologies to the financial services sector, investment into these companies has risen rapidly, especially in the US and China.

However, financing growth witnessed a dip in 2016 after the boom in 2015. According to KPMG analysis using Pitch Book data, investments and merger value declined, taking overall global fintech investments down from $46.7 billion in 2015 to $24.7 billion in 2016, across 1,076 deals.

"Money of the Future" report by Life.SREDA highlights that the amount of venture capital (VC) investment in fintech in 2016 was $23.6 billion, 16% higher than in 2015. Excluding the$4.5-billion Ant Financial investment deal (unusual for the whole tech industry), fintech market investments actually went down 6% in 2016.

Life.SREDA is an early-stage fintech venture capital fund that has invested in 22 companies, of which 13 are in the US and in Europe and has already exited from seven companies. It set up shop in Singapore one and a half years ago and has invested in eight companies in Asia.

A dip in fintech financing growth was registered in 2016

Figure 1. Annual investments in fintech

Source: Money of the Future by Life.SREDA

The industry’s venture capital financing still remains strong

Figure 2. Quarterly venture capital global and fintech investment

Source: Money of the Future by Life.SREDA

Macro-economic uncertainty, including Brexit and the US elections are some of the key reasons attributed to this decline in the industry’s growth rate. The dip is probably also a result of below expectation performance of financial and business metrics of fintech as many have yet to breakeven.

Asia became the top fintech market in the world with almost a 50% share of global VC volume (Asia’s share of global fintech investment is 47% in 2016). Pushing China ahead of the US and other countries were notable deals like Ant Financial, arm of ecommerce giant Alibaba raising $4.5 billion, one of the biggest fintech VC round in history and peer-to-peer (P2P) lending company Lufax, which raised $1.8 billion in series B funding in 2016. In fact, China companies lead in number among the top unicorns (start-up valued at over $1 billion).

China fintech leads among the highest valued unicorns

Figure 3. Fintech unicorn valuations

Source: Money of the Future by Life.SREDA

According to the report, lending, payments, wealth management and e-wallets are the top four sectors that made almost 50% of all investments, interestingly, within Asia. Although China dominated the funding amount, the total number of companies funded was highest in India at 35%, (compared to 23% of companies in China). India, China and Singapore comprised 60% of the companies funded in Asia.

Challenges to Asian fintech growth

While fintech investments in Asia are growing, expansion in this market has its own set of challenges.

Solodkiy pointed: “In the US, to set up a company you spend a couple of weeks to discuss with banks that you know will support fintech. After which, they will send you an open application programming interface (API) via email that you can plug in. Within three months and with 20% of your resources, you can launch it. In Asia, fintech will spend more than three months to discuss with different business teams, and thereafter, with an IT team. After six months, it will need to go onsite with physical infrastructure to integrate with the bank’s systems. The whole process will take 12 months and 80% of resources. If you want to launch from the US to the UK, it will also take three months, but in Asia, to launch from one country to another, you will need another year.”

“In Asia, each country is so unique. You have to meet start-ups, banks, regulators and a layman to learn about customer behaviour, to try to bring fintech knowledge and experience and understand how to localise it in each country. Asia is about execution and distribution, how to marry online solutions with offline world,” he added.

Fintech is part of digital work and needs to scale. Most markets in Asia lack an API and a bank-as-a-service (BaaS) platform to easily facilitate the integration of banks with fintech. Having the ability to plug and play with open API can enable banks to rapidly bring new services for their customers. Conversely, as infrastructure is not geared towards integration of services, fintech needs to invest in more expensive resources over a longer period to scale their business across Asia, which often face problems in acquiring series B funding.

“Right now we are focused on how to solve infrastructure issues in the market. There is a problem of scaling in Asian market. To launch a company is hard and expensive, and when you decide to go to another market, you need to repeat the entire process for each Asian country. We are trying for the whole start-up system across the region to set up middleware between markets,” he explained.

“If you solve the infrastructure gap you will create a huge market, much bigger than the Chinese or the US market and local start-ups will have the ability to scale faster and bring in right talent from abroad,” he added.

Regulators become more active

Both the private sector, as well as regulators, will have to join hands to solve this infrastructure integration. Several regulators are already open to support local players and to integrate different markets.

In Europe, regulators are promoting an open banking framework

Figure 4. Key initiatives by regulators in Europe, Middle East and Africa

Source: Money of the Future by Life.SREDA

Asian regulators bring to the fore new initiatives including sandboxes

Figure 5. Key initiatives by regulators in Asia Pacific

Source: Money of the Future by Life.SREDA

Different regulatory efforts are now visible in locations such as Singapore, Hong Kong and Malaysia, where regulatory sandboxes have been set up. These regulatory sandboxes will allow innovators to test their products in a live environment for a limited time, subject to certain conditions.

Many regulators are favouring sandbox, though there are varying views on their efficacy in promoting fintech innovation within Asia. “Sandbox is a bit of a wrong step as this is more about how to establish within a specific country, but not about unifying the requirements and infrastructure across markets to scale faster and cheaper,” opined Solodkiy.

“Sandbox is a legal and kind way to say ‘no’. In Asia, fintechs need to collaborate with banks. However, banks are not yet clear on what they want to do with fintech,” he added.

Bank-fintech partnership

Banks and fintech partnerships are increasingly growing to bring new innovations and improve customer journeys, especially in areas like P2P services, wealth management and blockchain. Some banks from the UK and the US are actively investing in fintech, including their own VCs, while leading Asian banks are playing an active role in new fintech initiatives, which include hackathon, incubators and fintech start-ups.

Leading banks are actively investing into fintech

Figure 6. Major bank investments to VC-backed fintechs

Source: Money of the Future by Life.SREDA

The fintech sector is gaining maturity as regulators increase their focus on its growth and financial institutions increase their investments and partnership with fintechs.

Besides fintech initiatives, banks also need to reinvent their own systems. With new challenger banks and fintechs, it is becoming imperative for traditional banks to shed their traditional inefficient processes and legacy systems to invest in differentiating customer experience. “Companies need to reinvent or disrupt themselves every 10-15 years as the life cycle of the companies is becoming shorter,” pointed Solodkiy.

“When banks are trying to do innovation, it is best to do that in parallel as a new business rather that inside the bank as the innovation will end up in the same corporate culture. With something new you need to run with it. I know of only one to two banks that are really successful with acquisition of fintech, for example BBVA,” he noted.

Categories:

Financial Technology, Innovation, Risk and Regulation, Technology & OperationsKeywords:Life.SREDA, Fintech, API, VC, Start-ups, Sandbox