Mobile payment apps have continued to proliferate in countries around the world, with Mercedes Pay soon likely to join the more familiar Apple Pay and Samsung Pay. Local apps in Asia, ranging from Paylah! in Singapore to Kakao in South Korea, offer mobile payments as well.

June 28, 2017 | Richard Hartung- While mobile wallets have become very popular in Kenya and China, few other markets have enjoyed such high levels of success

- Customers want fewer and near-ubiquitous payment solutions with a full wallet and a compelling value proposition, rather than just cool technology

- The next step for mobile wallets is leveraging local success to expand across borders

Despite the launch of these mobile payment services, few if any have enjoyed the success of M-PESA in Kenya or Alipay in China in becoming a digital wallet that can actually replace a consumer’s physical wallet. The key need for retail banks, then, is to determine how to create a successful wallet in their own market.

Mobile wallets offer more than payments

A good starting place when looking for successful wallets is to understand the difference between payments apps and wallets.

Mobile payments apps simply offer payment services via an app on a mobile phone. While there may be add-ons through links to retailers or other service providers, such as the Eventbrite and Airbnb links in Apple Pay, the key function is payments.

Mobile wallets, on the other hand, enable consumers to replace the full content of their physical wallet to store payment card details, identity documents or other data digitally, and to use their mobile phone for digital payments as well as other functions. Just as traditional wallets enable access to a broad range of services that consumers need to get through a day, so do the payments, loyalty, frequent flier, membership, identification and other digital cards in a mobile wallet also enable consumers to undertake a multitude of transactions.

Success stories

Whenever bankers look for successful mobile wallets, two examples constantly surface: M-PESA, in Kenya; and Alipay and Tencent’s WeChat Pay or Tenpay in China. Rather than providing best practices that may work elsewhere, however, these examples show that the services are largely unique to the local markets.

The Kenya catalyst

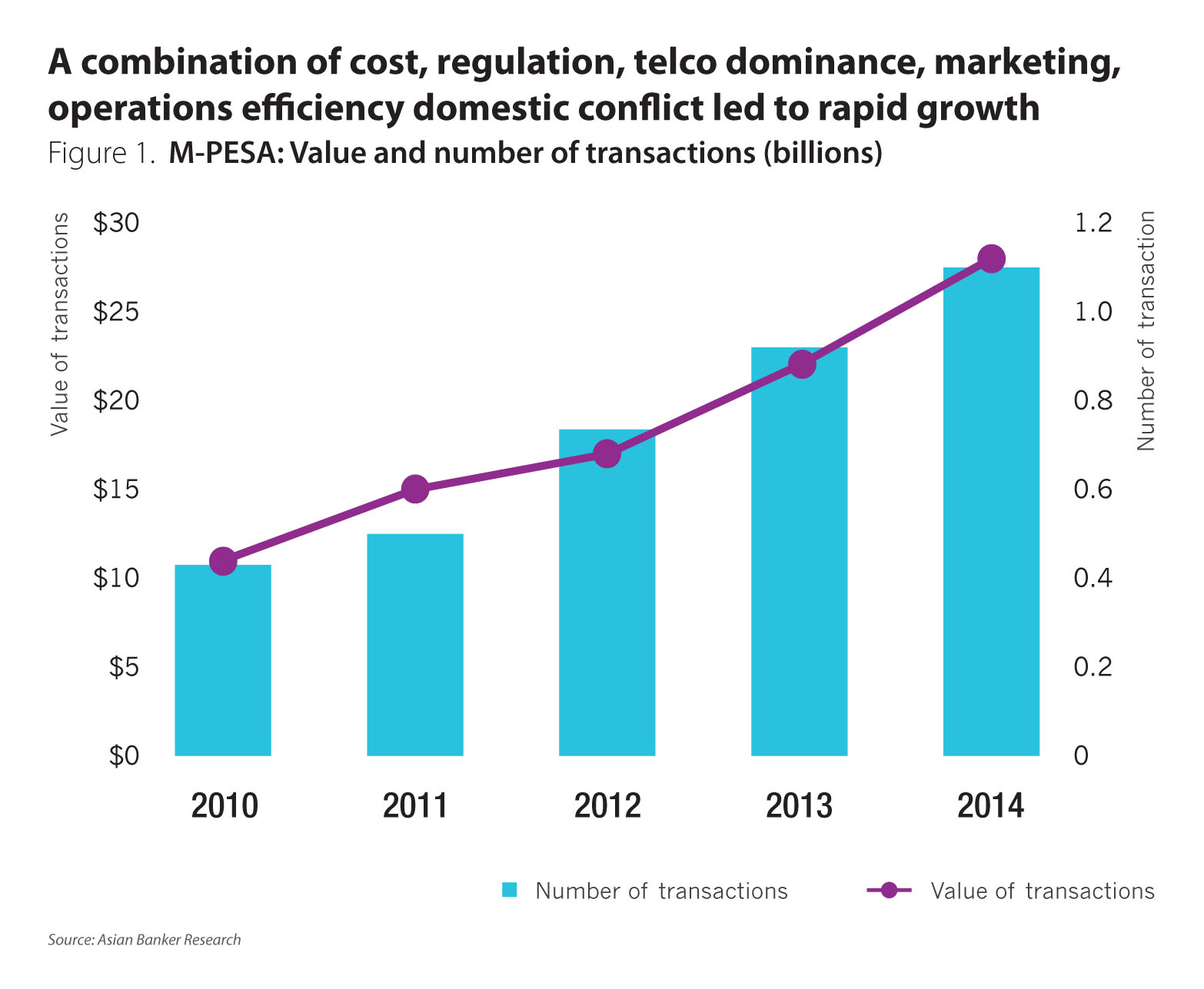

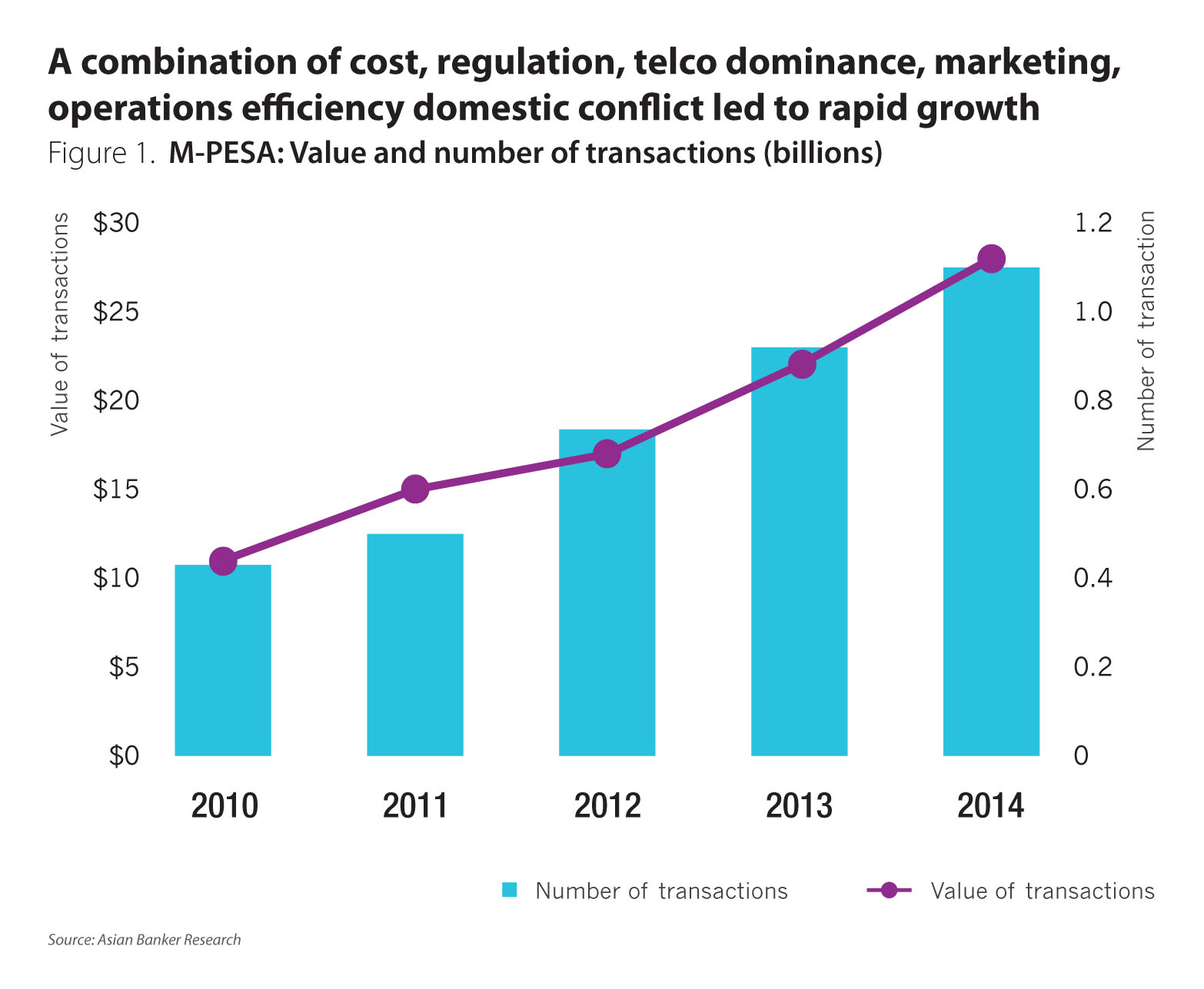

M-PESA in Kenya is routinely cited as one of the most successful mobile wallets globally and has grown so rapidly, since its launch in 2007 that the National Treasury in Kenya recently said, its “pivotal role in the economy” creates a plausible fiscal risk (Figure 1).

The factors behind the success of M-PESA are, however, almost unique to Kenya. Mobile operator Safaricom started by identifying consumer problems, the desire to send money from urban to rural areas and the high cost as well as the risks of doing so, and developed M-PESA to meet the needs. Aided by the regulator allowing the scheme to proceed on an experimental basis without formal approval and a strong marketing campaign, the service started to take off. Domestic violence after the elections in Kenya in 2008 led to even greater usage and to some consumers seeing M-PESA as being as reliable as banks, resulting in a network effect of rapidly growing usage.

While money transfer costs are high in other markets, factors such as local violence and easy regulatory approval are specific catalysts unlikely to be replicated elsewhere.

China soars

The other success story is China, where mobile payments sent through Alipay and Tenpay alone rose from about $81 billion in 2012 to almost $3 trillion in 2016. Success factors there, too, are almost unique to China.

The initial catalysts for mobile wallets in China included a lack of legacy infrastructure, the rapid growth in usage of mobile phones, and the rapidly-surging popularity of online marketplaces. Once consumers started using services such as Alibaba for shopping and WeChat for messaging, moving on to payments was a natural extension.

Along with offering payments, Alipay and Tencent quickly turned the apps into full-scale wallets. Alipay in particular combined everything from everyday payments and merchant discounts to mutual fund investments and messaging into a single app.

The result is that nearly 80% of respondents in a recent Ogilvy survey said that they pay water, electricity and other utility bills via mobile payment, and they find that convenience stores and supermarkets almost universally support mobile payments. “Using mobile wallets has become the ‘new normal’,” Ogilvy opined.

The China-specific combination of a full suite of services to replace the physical wallet and social connections, customised for local consumers, has resulted in tremendous success for mobile wallets.

Mobile payments in other markets

While mobile wallets have become very popular in Kenya and China, few other markets have enjoyed such high levels of success.

Developed markets

In many developed markets, consumers continue to use credit or debit cards for payments and mobile solutions have largely focused largely on payments rather than becoming wallets. Apple Pay had signed up more than 40 million users globally by the end of 2016, for instance, and some forecasters expect it to have more than 80 million customers by the end of 2017. Apple Pay has remained largely focused on payments, however, with integration with companies ranging from Airbnb and Uber to Kickstarter and Groupon offering add-on payments services rather than a wallet. Furthermore, even though Apple CEO Tim Cook said during Apple’s 4th quarter investor conference call in October that Apple Pay transactions were up 500% year-on-year, less than a third of iPhone users have reportedly downloaded Apple Pay, fewer have tried it and only a small percentage are regulator users.

Samsung Pay, Android Pay and PayPal similarly offer mobile payment apps. In Japan, NTT Docomo’s Osaifu-Keitai has more than 33 million subscribers for its payments app.

A fundamental question, then, is whether mobile wallets can succeed in developed markets in the short-to-medium term. “Successful wallets come from markets where the infrastructure isn’t there,” Adyen Asia Pacific vice president Warren Hayashi said recently at InnovFest in Singapore. Advanced countries are well-served with access to credit card and debit cards, so mobile wallets may not be needed anytime soon.

Emerging markets

For emerging markets such as India, on the other hand, Hayashi said the lack of a payments infrastructure is leading to the rise of digital wallets. Indeed, even though payment apps and wallets have not grown as fast in these other emerging markets as in Kenya or China, some solutions have large numbers of users.

India has led the surge, with demonetisation at the end of 2016 providing the push for market-leader Paytm to grow to more than 200 million subscribers by early 2017.

While it does not yet offer a full wallet solution, Paytm says it offers mobile payments, m-commerce, as well as deals to its customers.

Mobile payments apps in some other emerging markets have also signed up millions of subscribers, with bKash in Bangladesh having more than 24 million subscribers.

As in Kenya and China, the success in India and the growth in Bangladesh are driven by unique local factors.

The response by banks

In the face of financial technology (fintech) firms launching successful mobile payments apps and wallets in a growing number of markets, banks are releasing their own mobile payments services in an effort to compete. From giants such as Bank of America with more than 21 million mobile users to smaller local players such as Bank Mandiri in Indonesia or VietinBank in Vietnam, solutions abound.

Rather than being complete wallets with a full suite of services that consumers would find in their physical wallet or on Alipay, however, most banks offer a mobile banking suite that just provides banking services – including payments – from a single financial institution rather than a wallet.

As a result, success by banks has been limited. Even though growth in the value and volume of mobile payments transactions is accelerating globally, non-banks such as Alipay or Apple Pay account for a rising share.

Australia

Australia provides a case in point exemplifying the challenges facing both “pay” services and the banks. The four largest banks in Australia battled with Apple Pay collectively for mobile payments, with both sides trying to control the user experience. Apple recently won the battle, though, after the Australian Competition and Consumer Commission (ACCC) denied the banks the right to bargain with Apple Pay collectively because a consortium could reduce competition.

Despite the intensity of the fight, recent research from the Reserve Bank of Australia showed that mobile payments solutions were actually only used for 1% of point of sale (POS) transactions, while the share of payments made ith credit and debit cards increased by 52%.

As Swinburne University of Technology Adjunct Professor Steve Worthington explains it, “the very success of contactless payment cards in Australia means that consumers do not see what extra advantage there is in mobile payments. For mobile payments to become significantly more attractive than contactless card payments, it would require the wallets to have additional functionality to appeal to consumers.”

What it will take to succeed

What customers actually want, as the success of Alipay and Tencent in China as well as the lack of success in Australia demonstrate, is fewer and near-ubiquitous payment solutions with a full wallet and a compelling value proposition, rather than just cool technology. Those solutions need to be easy-to-use, provide added-value benefits such as rewards or discounts, offer a superb customer experience and be customised to meet specific local needs. Mobile wallets that require more effort and time than pulling out cards from a physical wallet are less likely to succeed.

More than just form changes from plastic to mobile phones, Thomas Kang, head of global outreach for M-DAQ, commented at InnovFest, wallets have to offer the range of services that enable them to become part of consumers’ lives and to be interoperable cross-border.

“That’s why Alipay is successful - it’s integrated into a wallet, a lifestyle platform.”

For now, services customers want are more often delivered by innovative fintechs that deliver a great user experience and added value on easy-to-use mobile-ready platforms. These companies deliver integrated solutions designed specifically for the local market that often make them more attractive than solutions from traditional financial institutions.

Wherever they are, wallet providers will also need to move fast. As Visa CEO Alfred Kelly said earlier this year, “My personal view is that there are too many wallets out there. Consumers are not going to ultimately want to have

50 wallets.”

Case studies

Paytm

The first steps Paytm took, Paytm Founder Vijay Sharma told The Asian Banker, were to create a wallet and also a digital contract that consumers could use to move money from their bank accounts. What was also important, he said, was the user experience – multilingual, local language technology that was massively scalable. To help improve user trust, Paytm created a network of Paytm ambassadors to teach people how it works. “We are evangelisers.”

A key boost for Paytm came from the Indian government’s demonetisation initiative in November 2016. Before demonetisation, Sharma said, “We were doing 16 million transactions a month,” and there was an average of 169 million debit card and credit card POS transactions per month on bank cards. In January, Paytm’s volumes leaped to 200 million payment transactions. “Paytm has become equal to all bank-owned cards in the country,” Sharma said.

Paytm has also partnered with banks, helping them build apps. Paytm has now also become a payment bank itself, though, so payment customers can potentially become bank customers. What Paytm is focusing on is creating a payments ecosystem, Sharma said. Consumers can pay utilities bills, purchase petrol, pay school fees, buy food, and more. “Paytm wallets created an ecosystem around P2P, transfers, everything money can do, except physical cash. You can live only on money in the Paytm account. You don’t need to use a card.”

The next disruption, Sharma expects, will come from developers who take payments into their apps. Paytm is partnering with social apps, for instance, and talking with Google about Paytm in the app store. Sharma also expects that consumers will be able to use Paytm for cross-border payments in the future.

“I believe we have an opportunity to bring financial inclusion, unlike any that happened before,” Sharma concluded. “We bring new things to the table.”

Ant Financial / Alipay in Japan

The idea for Alipay entering Japan, Genki Oka, Head of Japan at Ant Financial Services, told The Asian Banker, is to make sure it can bring its learnings and leverage it as an industry.

The market entry point in Japan has been the millions of inbound Chinese travellers coming to Japan. Going forward, Oka said, there are two key strategies for expansion. First, he wants to make sure the dominant position in China, usage, can be replicated in Japan.

“There are merchants that would like to get a piece of demand.” The second would be winning the hearts and minds of the local user base, which he believes will be difficult. “So, this leaves the task of identifying where there’s an unaddressed need in the local population.”

Alipay’s ability to serve both young and the old is important moving forward, Oka said, and taking out the complexity from transactions is a key recipe for success. While he does not expect that Alipay would be a dominant service provider, he does expect that there will be situations where partners identify use cases that enable Alipay to become habitual for daily use.

“The fact that we’ve been able to identify several, and several are interested in working with us, are early wins,” Oka said.

Banks need to redesign wallets

What’s clear from the success stories in markets around the globe is that simply offering technology is not enough. Success is driven by companies that develop consumer-focused services that solve specific problems and are tailored to the local market. The next step, as Alipay and Tencent as well as Paytm attest, is leveraging local success to expand across borders. With these lessons in mind, some retail banks may need to go back to the drawing board so they can design a wallet that will actually succeed.

Categories:

Financial Technology, Mobile Banking, Retail Banking, Technology & OperationsKeywords:Alipay, Ant Financial, Tencent, Ten Pay, Apple Pay, Paytm, ACCC, Fintech, Mobile Wallets

Mobile payment apps have continued to proliferate in countries around the world, with Mercedes Pay soon likely to join the more familiar Apple Pay and Samsung Pay. Local apps in Asia, ranging from Paylah! in Singapore to Kakao in South Korea, offer mobile payments as well.

June 28, 2017 | Richard Hartung- While mobile wallets have become very popular in Kenya and China, few other markets have enjoyed such high levels of success

- Customers want fewer and near-ubiquitous payment solutions with a full wallet and a compelling value proposition, rather than just cool technology

- The next step for mobile wallets is leveraging local success to expand across borders

Despite the launch of these mobile payment services, few if any have enjoyed the success of M-PESA in Kenya or Alipay in China in becoming a digital wallet that can actually replace a consumer’s physical wallet. The key need for retail banks, then, is to determine how to create a successful wallet in their own market.

Mobile wallets offer more than payments

A good starting place when looking for successful wallets is to understand the difference between payments apps and wallets.

Mobile payments apps simply offer payment services via an app on a mobile phone. While there may be add-ons through links to retailers or other service providers, such as the Eventbrite and Airbnb links in Apple Pay, the key function is payments.

Mobile wallets, on the other hand, enable consumers to replace the full content of their physical wallet to store payment card details, identity documents or other data digitally, and to use their mobile phone for digital payments as well as other functions. Just as traditional wallets enable access to a broad range of services that consumers need to get through a day, so do the payments, loyalty, frequent flier, membership, identification and other digital cards in a mobile wallet also enable consumers to undertake a multitude of transactions.

Success stories

Whenever bankers look for successful mobile wallets, two examples constantly surface: M-PESA, in Kenya; and Alipay and Tencent’s WeChat Pay or Tenpay in China. Rather than providing best practices that may work elsewhere, however, these examples show that the services are largely unique to the local markets.

The Kenya catalyst

M-PESA in Kenya is routinely cited as one of the most successful mobile wallets globally and has grown so rapidly, since its launch in 2007 that the National Treasury in Kenya recently said, its “pivotal role in the economy” creates a plausible fiscal risk (Figure 1).

The factors behind the success of M-PESA are, however, almost unique to Kenya. Mobile operator Safaricom started by identifying consumer problems, the desire to send money from urban to rural areas and the high cost as well as the risks of doing so, and developed M-PESA to meet the needs. Aided by the regulator allowing the scheme to proceed on an experimental basis without formal approval and a strong marketing campaign, the service started to take off. Domestic violence after the elections in Kenya in 2008 led to even greater usage and to some consumers seeing M-PESA as being as reliable as banks, resulting in a network effect of rapidly growing usage.

While money transfer costs are high in other markets, factors such as local violence and easy regulatory approval are specific catalysts unlikely to be replicated elsewhere.

China soars

The other success story is China, where mobile payments sent through Alipay and Tenpay alone rose from about $81 billion in 2012 to almost $3 trillion in 2016. Success factors there, too, are almost unique to China.

The initial catalysts for mobile wallets in China included a lack of legacy infrastructure, the rapid growth in usage of mobile phones, and the rapidly-surging popularity of online marketplaces. Once consumers started using services such as Alibaba for shopping and WeChat for messaging, moving on to payments was a natural extension.

Along with offering payments, Alipay and Tencent quickly turned the apps into full-scale wallets. Alipay in particular combined everything from everyday payments and merchant discounts to mutual fund investments and messaging into a single app.

The result is that nearly 80% of respondents in a recent Ogilvy survey said that they pay water, electricity and other utility bills via mobile payment, and they find that convenience stores and supermarkets almost universally support mobile payments. “Using mobile wallets has become the ‘new normal’,” Ogilvy opined.

The China-specific combination of a full suite of services to replace the physical wallet and social connections, customised for local consumers, has resulted in tremendous success for mobile wallets.

Mobile payments in other markets

While mobile wallets have become very popular in Kenya and China, few other markets have enjoyed such high levels of success.

Developed markets

In many developed markets, consumers continue to use credit or debit cards for payments and mobile solutions have largely focused largely on payments rather than becoming wallets. Apple Pay had signed up more than 40 million users globally by the end of 2016, for instance, and some forecasters expect it to have more than 80 million customers by the end of 2017. Apple Pay has remained largely focused on payments, however, with integration with companies ranging from Airbnb and Uber to Kickstarter and Groupon offering add-on payments services rather than a wallet. Furthermore, even though Apple CEO Tim Cook said during Apple’s 4th quarter investor conference call in October that Apple Pay transactions were up 500% year-on-year, less than a third of iPhone users have reportedly downloaded Apple Pay, fewer have tried it and only a small percentage are regulator users.

Samsung Pay, Android Pay and PayPal similarly offer mobile payment apps. In Japan, NTT Docomo’s Osaifu-Keitai has more than 33 million subscribers for its payments app.

A fundamental question, then, is whether mobile wallets can succeed in developed markets in the short-to-medium term. “Successful wallets come from markets where the infrastructure isn’t there,” Adyen Asia Pacific vice president Warren Hayashi said recently at InnovFest in Singapore. Advanced countries are well-served with access to credit card and debit cards, so mobile wallets may not be needed anytime soon.

Emerging markets

For emerging markets such as India, on the other hand, Hayashi said the lack of a payments infrastructure is leading to the rise of digital wallets. Indeed, even though payment apps and wallets have not grown as fast in these other emerging markets as in Kenya or China, some solutions have large numbers of users.

India has led the surge, with demonetisation at the end of 2016 providing the push for market-leader Paytm to grow to more than 200 million subscribers by early 2017.

While it does not yet offer a full wallet solution, Paytm says it offers mobile payments, m-commerce, as well as deals to its customers.

Mobile payments apps in some other emerging markets have also signed up millions of subscribers, with bKash in Bangladesh having more than 24 million subscribers.

As in Kenya and China, the success in India and the growth in Bangladesh are driven by unique local factors.

The response by banks

In the face of financial technology (fintech) firms launching successful mobile payments apps and wallets in a growing number of markets, banks are releasing their own mobile payments services in an effort to compete. From giants such as Bank of America with more than 21 million mobile users to smaller local players such as Bank Mandiri in Indonesia or VietinBank in Vietnam, solutions abound.

Rather than being complete wallets with a full suite of services that consumers would find in their physical wallet or on Alipay, however, most banks offer a mobile banking suite that just provides banking services – including payments – from a single financial institution rather than a wallet.

As a result, success by banks has been limited. Even though growth in the value and volume of mobile payments transactions is accelerating globally, non-banks such as Alipay or Apple Pay account for a rising share.

Australia

Australia provides a case in point exemplifying the challenges facing both “pay” services and the banks. The four largest banks in Australia battled with Apple Pay collectively for mobile payments, with both sides trying to control the user experience. Apple recently won the battle, though, after the Australian Competition and Consumer Commission (ACCC) denied the banks the right to bargain with Apple Pay collectively because a consortium could reduce competition.

Despite the intensity of the fight, recent research from the Reserve Bank of Australia showed that mobile payments solutions were actually only used for 1% of point of sale (POS) transactions, while the share of payments made ith credit and debit cards increased by 52%.

As Swinburne University of Technology Adjunct Professor Steve Worthington explains it, “the very success of contactless payment cards in Australia means that consumers do not see what extra advantage there is in mobile payments. For mobile payments to become significantly more attractive than contactless card payments, it would require the wallets to have additional functionality to appeal to consumers.”

What it will take to succeed

What customers actually want, as the success of Alipay and Tencent in China as well as the lack of success in Australia demonstrate, is fewer and near-ubiquitous payment solutions with a full wallet and a compelling value proposition, rather than just cool technology. Those solutions need to be easy-to-use, provide added-value benefits such as rewards or discounts, offer a superb customer experience and be customised to meet specific local needs. Mobile wallets that require more effort and time than pulling out cards from a physical wallet are less likely to succeed.

More than just form changes from plastic to mobile phones, Thomas Kang, head of global outreach for M-DAQ, commented at InnovFest, wallets have to offer the range of services that enable them to become part of consumers’ lives and to be interoperable cross-border.

“That’s why Alipay is successful - it’s integrated into a wallet, a lifestyle platform.”

For now, services customers want are more often delivered by innovative fintechs that deliver a great user experience and added value on easy-to-use mobile-ready platforms. These companies deliver integrated solutions designed specifically for the local market that often make them more attractive than solutions from traditional financial institutions.

Wherever they are, wallet providers will also need to move fast. As Visa CEO Alfred Kelly said earlier this year, “My personal view is that there are too many wallets out there. Consumers are not going to ultimately want to have

50 wallets.”

Case studies

Paytm

The first steps Paytm took, Paytm Founder Vijay Sharma told The Asian Banker, were to create a wallet and also a digital contract that consumers could use to move money from their bank accounts. What was also important, he said, was the user experience – multilingual, local language technology that was massively scalable. To help improve user trust, Paytm created a network of Paytm ambassadors to teach people how it works. “We are evangelisers.”

A key boost for Paytm came from the Indian government’s demonetisation initiative in November 2016. Before demonetisation, Sharma said, “We were doing 16 million transactions a month,” and there was an average of 169 million debit card and credit card POS transactions per month on bank cards. In January, Paytm’s volumes leaped to 200 million payment transactions. “Paytm has become equal to all bank-owned cards in the country,” Sharma said.

Paytm has also partnered with banks, helping them build apps. Paytm has now also become a payment bank itself, though, so payment customers can potentially become bank customers. What Paytm is focusing on is creating a payments ecosystem, Sharma said. Consumers can pay utilities bills, purchase petrol, pay school fees, buy food, and more. “Paytm wallets created an ecosystem around P2P, transfers, everything money can do, except physical cash. You can live only on money in the Paytm account. You don’t need to use a card.”

The next disruption, Sharma expects, will come from developers who take payments into their apps. Paytm is partnering with social apps, for instance, and talking with Google about Paytm in the app store. Sharma also expects that consumers will be able to use Paytm for cross-border payments in the future.

“I believe we have an opportunity to bring financial inclusion, unlike any that happened before,” Sharma concluded. “We bring new things to the table.”

Ant Financial / Alipay in Japan

The idea for Alipay entering Japan, Genki Oka, Head of Japan at Ant Financial Services, told The Asian Banker, is to make sure it can bring its learnings and leverage it as an industry.

The market entry point in Japan has been the millions of inbound Chinese travellers coming to Japan. Going forward, Oka said, there are two key strategies for expansion. First, he wants to make sure the dominant position in China, usage, can be replicated in Japan.

“There are merchants that would like to get a piece of demand.” The second would be winning the hearts and minds of the local user base, which he believes will be difficult. “So, this leaves the task of identifying where there’s an unaddressed need in the local population.”

Alipay’s ability to serve both young and the old is important moving forward, Oka said, and taking out the complexity from transactions is a key recipe for success. While he does not expect that Alipay would be a dominant service provider, he does expect that there will be situations where partners identify use cases that enable Alipay to become habitual for daily use.

“The fact that we’ve been able to identify several, and several are interested in working with us, are early wins,” Oka said.

Banks need to redesign wallets

What’s clear from the success stories in markets around the globe is that simply offering technology is not enough. Success is driven by companies that develop consumer-focused services that solve specific problems and are tailored to the local market. The next step, as Alipay and Tencent as well as Paytm attest, is leveraging local success to expand across borders. With these lessons in mind, some retail banks may need to go back to the drawing board so they can design a wallet that will actually succeed.

Categories:

Financial Technology, Mobile Banking, Retail Banking, Technology & OperationsKeywords:Alipay, Ant Financial, Tencent, Ten Pay, Apple Pay, Paytm, ACCC, Fintech, Mobile Wallets