While the automobile loan market in Thailand is highly competitive, Thanachart Bank has taken nearly one-third of the market. Other banks are seeking growth, though, with Krungsri Bank targeting a 25% market share by the end of 2017.

February 12, 2018 | Richard Hartung- Thanachart offers three types of loans for automobiles: new car loans, used car loans, and sale-and-lease-back loans under the CYC programme

- The bank used its original equipment manufacturer strategic partnerships to increase volumes of new car loans

- To improve the customer experience, Thanachart has worked to enhance back-end processes including credit approval, scoring, and infrastructure

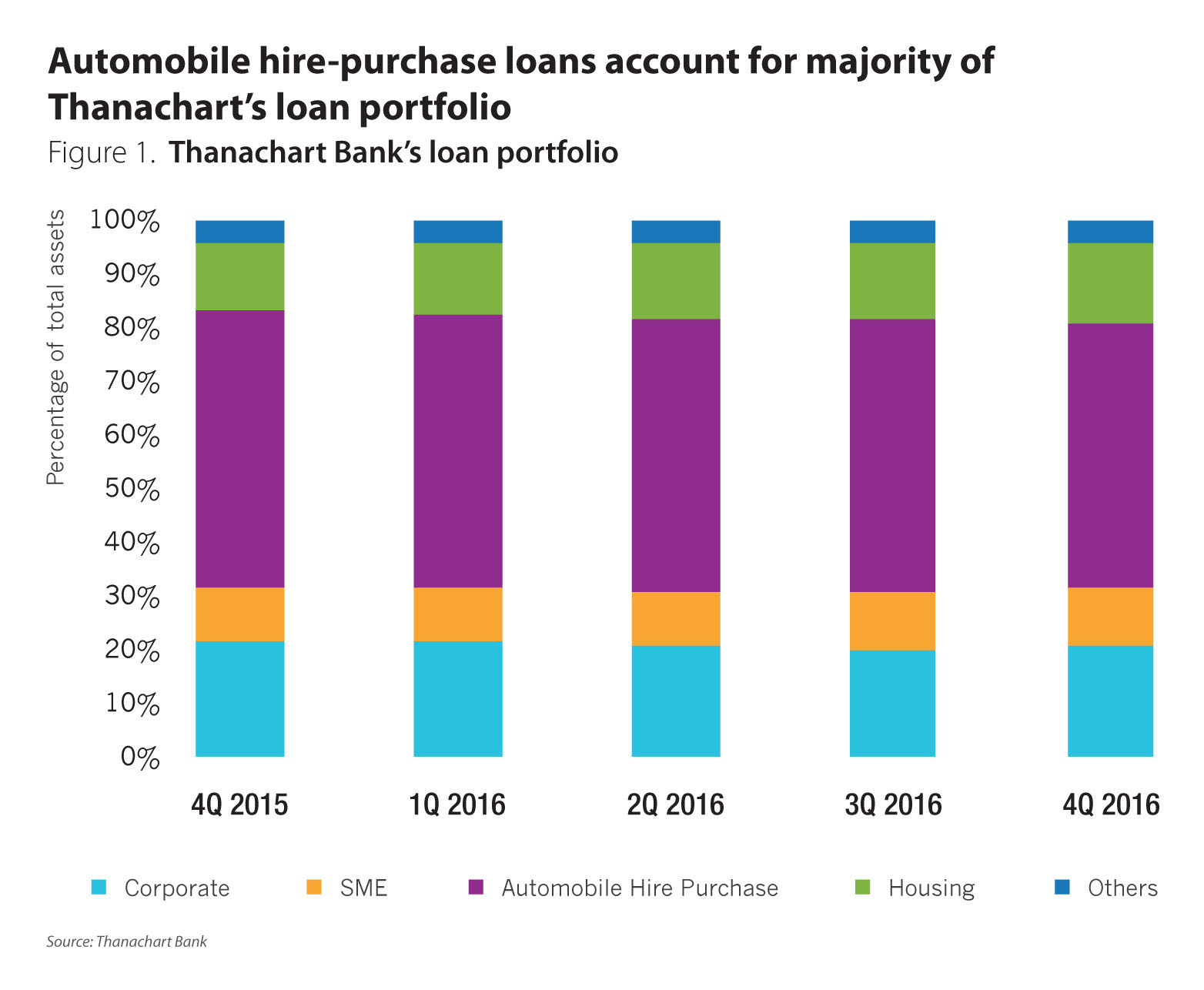

To develop a profitable automobile loan portfolio, Thanachart has shifted its strategy over the past several years. Reflecting a strategy that is quite different from many other banks, automobile hire purchase loans form a very large part of the entire loan portfolio at Thanachart Bank (Figure 1).

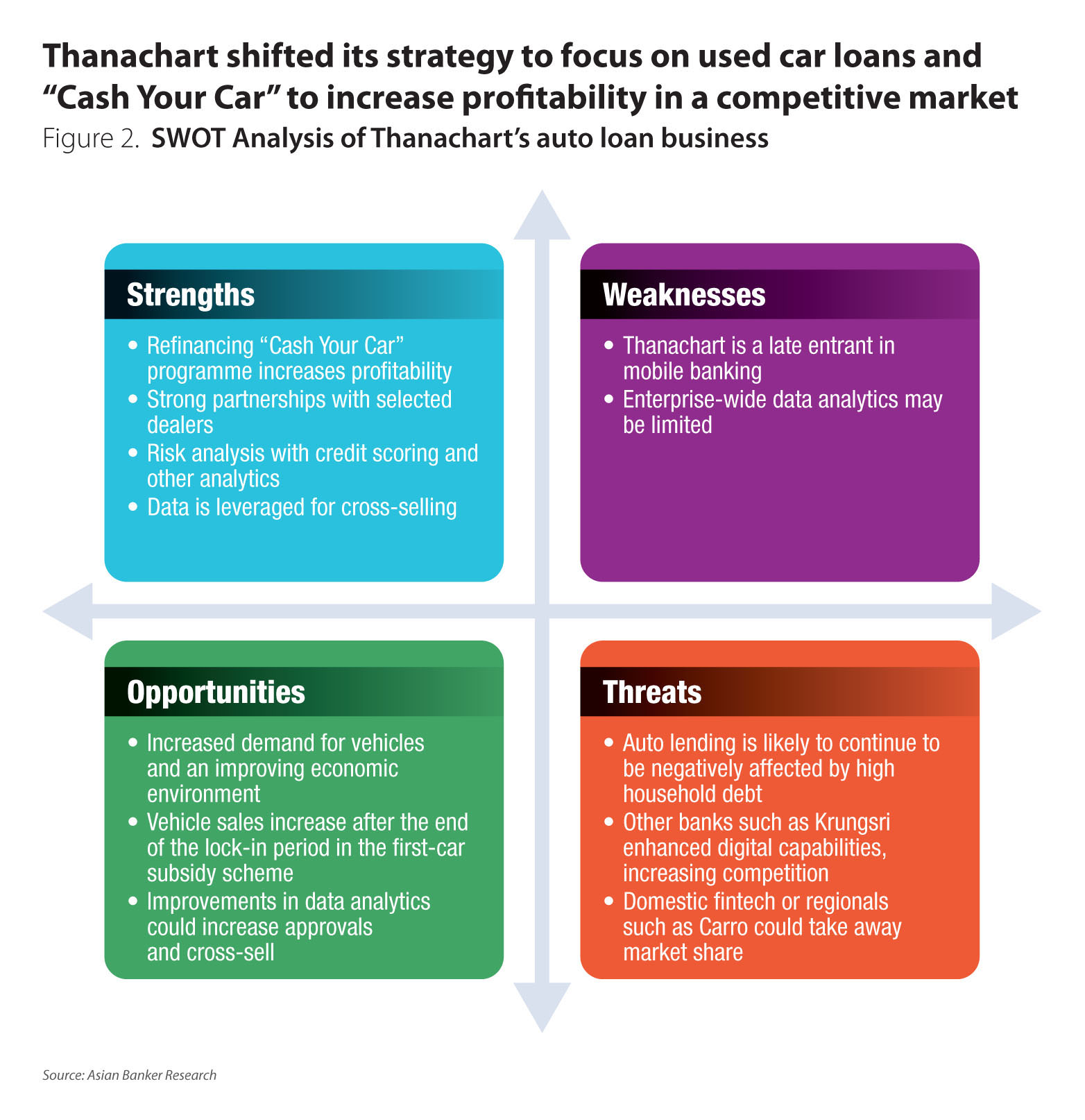

In the past, according to the bank’s executive vice president, Tirachart Chiracharasporn, about 70% of its automobile lending has been for new cars. Margins for new card loans are very thin, though, so Thanachart increased its focus on used car loans and “Cash Your Car” (CYC) to increase portfolio profitability. The three key drivers for the business growth have been the CYC Good Speed Retention programme, OEM strategic partnerships, and the implementation of credit bureau scoring.

The CYC product

Thanachart offers three types of loans for automobiles: new car loans (70%), used car loans (18%), and sale-and-lease-back loans under the CYC programme (12%). The bank has used the CYC programme, targeted at customers who need more cash, to deepen portfolio penetration and increase portfolio profitability. The CYC programme is an auto refinance model, whereby the bank converts new-car-loan customers to CYC customers.

When customers need more cash, they can go to Thanachart for another loan and receive additional financing before they pay off their loan. Customers can borrow an amount based on the appraised value of their car in exchange for ownership of the car. Customers can receive a higher credit line and a longer repayment tenor than for a standard consumer loan, with terms commensurate with their ability to repay.

While customers cannot transfer ownership during the first five years they own a car, Thanachart has established a mechanism for a transfer between buyer and seller to capture this segment. The bank used the process to launch the CYC Good Speed Programme in the second half of 2016. Target processing times have been reduced from about four days to 2.6 days. The bank also reduced documentation requirements, simplified income verification and disbursement processes, and simplified processes with the Department of Land Transport.

Thanachart also developed ads and a marketing campaign specifically to promote the growth of this segment. Business volume for CYC increased from 2,600 units in the 1st quarter of 2016 to 4,200 units in the 4th quarter. In the second half of 2017, the bank enhanced the product further by launching CYC Top Up, in which approval is easier and faster for the customer, since they simply use their ID card to get approved. Thanachart has also developed a “Thanachart Blue Book”, which it says has become a top reference for used cars in Thailand.

Partnerships drive volume

Another initiative over the past several years to grow automobile loan volumes has been original equipment manufacturer (OEM) partnerships. The bank used its OEM strategic partnerships to increase volumes of new car loans, increasing market share for Chevrolet from 42% to 72% and for Mazda from 24% to 35%. The bank also has partnerships with Volvo and with SAIC-MG for both wholesale and retail lending. Along with these OEM partnerships, it also helps other partners such as Isuzu, Toyota, Honda and Mitsubishi to grow their business through activities such as support for their marketing campaigns and dedicated sales officers. In addition to retail finance, Thanachart also supports wholesale financing through short-term loans to dealers, which in turn has helped the bank grow its portfolio.

Credit approval

To improve the customer experience, Thanachart has worked to enhance back-end processes including credit approval, scoring, and infrastructure. When the government launched a first car buyer programme and buyers shifted from purchasing used cars to purchasing new ones, for instance, good buyers who had money bought new cars and buyers with poor credit purchased used cars. Thanachart mitigated the risk by reducing the loan-to-value (LTV) ratio for used cars and by being selective about the dealers it worked with. The bank also tied credit insurance to its loans for used and new cars. After the government’s first car buyer programme ended, Thanachart mitigated risk by reducing the LTV ratio

for used cars because of their bad debt quality, which indirectly impacted the programme. After tightening its credit policy and reducing bad debt to 0.08% in 2015 led to drops in volume, however, the bank loosened its policy slightly and volumes recovered, with non-performing loans growing slightly to 0.14%. In 2016, Thanachart incorporated credit bureau scoring into its credit assessment and started using it for approval processes.

After the National Credit Bureau (NCB) partnered with Transunion, Thanachart validated the scoring and started using the model to assess bank customers. It has also used data from Transunion to segment customers into green, yellow and red based on their payment history. While many loans are categorised as “green”, Thanachart has been able to approve some “yellow” loans at a higher price and lower LTV ratio. Thanachart has also been able to analyse used car dealers and segment them into normal, premium, and “HIT” (Honda, Isuzu, Toyota) categories. It tracks bad debt, including non-starters and buckets of 30, 60, and 90 days. By using credit bureau scoring and dealer segmentation, the bank has been able to expand its lending to higher risk segments, increase its pre-approval rate from 83% to 88% and double its volume of used car loans.

Leveraging data

Thanachart has begun leveraging data more in order to enhance its relationships with its four million customers. The bank uses data in a customer relationship management (CRM) system to establish cross-sell programmes for the full customer journey. Data from a data warehouse is used for real time analytics, based on data mining, campaign analysis and customer analysis. Customers are segmented into Premier, Achiever, Mass and NewGen.

After the bank develops a sufficient history, it uses that data and information developed during onboarding to offer credit cards, deposit accounts and other products. The bank also uses the data to send leads to the branch, which will see Next Best Offers for customers and call them to offer products. Sales staff may offer mutual funds to Prestige customers, for example, and would most likely offer other products to Achiever or Mass customers.

NewGen customers may receive offers for products such as a debit card with cartoon characters. Thanachart also enhanced its auto lending programme by enabling sales staff to use a tablet to capture 11 fields, including the customer’s ID and income. The bank uses that data and information such as the total debt servicing ratio, based on data from the national credit bureau, for faster initial approval before moving on to evaluate documents and income. The net result has been improved efficiency, faster service and stronger relationships with car makers and dealers. “We tailor products according to customer behaviour,” Chiracharasporn said, “because we know the next best offer.”

The cross-sell ratio is increasing because of CRM tools, since the bank can determine who its main bank customers are and offer the right products. Whereas many banks separate auto lending from branches, Chiracharasporn said “we invite them to come to our branch and let the branches service them for the customer journey, five to six years.”

Mobile banking

Mobile banking, which Thanachart launched in May 2016, has become an essential strategy as well. While about 10% of customers have started using mobile banking so far, the bank targets growing usage to 35%. Whereas other banks have 20% usage after ten years, Chiracharasporn noted proudly that Thanachart reached 10% after just one year

Automobile loans can increase profits

While automobile loans are usually considered neither a lead product nor highly profitable at many banks, they are the largest single type of loan at Thanachart and have become very attractive. As Thanachart’s experience demonstrates, an innovative strategy can turn a mundane product from a laggard into a leader.

Global comparison

Auto loan volumes globally are under pressure, due to factors ranging from rising delinquencies in the US to ride-sharing services cutting into car purchase volumes in some markets. And as investment advisory firm Schroders observed, the less sexy topic of auto lending and auto credit deterioration is commanding headline because speculation has been building that auto loans could be at the heart of the financial world’s next crisis.

Despite the concerns, the overall trend for automobile purchases and financing remain broadly positive. As earlier this year, favourable economic environments and increasing consumer purchasing power are some of the factors that will help sustain the growth of bank auto lending. The processes for financing in many markets, though, remain stubbornly inefficient. Although car manufacturers and dealers have started to revamp their processes, using everything from online solutions to virtual reality, the process for auto finance often remains very manual.

The processes for car purchases and financing are also often deeply interlinked, meaning that change and innovation will require collaboration between both sectors. Many dealers also work with multiple lenders, which means they need to follow multiple processes for financing. And in contrast to the sensitivity customers have towards interest rates for mortgage loans or even credit cards, consumers usually focus on the speed of getting the vehicle they want to purchase and see financing as simply an often unimportant method of payment. Despite inefficient processes and slow change, some lenders and dealers have started to enhance their practices so that they can improve the customer experience and gain market share. Lenders have started to offer solutions such as digital customer onboarding, cost-comparison shopping and better education for borrowers.

Dealers have begun to offer financing solutions such as online preapprovals, digital calculators so that customers can evaluate their buying capabilities and fees, and apps with more information. As the following examples indicate, leading players and recent upstarts are both moving quickly and could leave slower moving firms far behind.

Ford Motor Credit

Ford Motor Credit Company and ZestFinance announced earlier this year that they are developing machine learning credit approval models to enhance lending practices across the credit spectrum. The new practice results from a study that confirmed the predictive power of machine learning, which can lead to more approvals, an enhanced customer experience and lower credit losses. Ford said it will leverage the effectiveness of machine learning to predict risk in auto financing better, potentially expanding auto financing for millennials and other Americans with limited credit histories.

AutoFi

AutoFi is a US-based online automobile financing startup that connects consumers to a network of lenders so that they can purchase and finance vehicles entirely online. Customers can select a vehicle to purchase online from an AutoFi-enabled dealer, fill out an online application, get a financing decision in less than a minute, select the financing or insurance products that they want, securely sign documents online and arrange to pick up their new vehicle.

Carro

Singapore-based used-car marketplace Carro has established a subsidiary called Genie Financial Services to make automobile financing more accessible and help car buyers get financing. It built its own credit engine to underwrite loans. Based on the data it has gathered by buying and selling cars, and leveraging its own algorithms, Carro believes it has developed more accurate car values that what many banks have available and can price loans based on that information.

KBC Bank

KBC Bank in Belgium has begun using blockchain technology for its My Car loan to create a seamless experience, from the time the customer signs the order for their car to the moment they drive it away from the dealer.

Emirates NBD

Emirates NBD Bank in the UAE introduced on-the-spot approval in selected dealer showrooms, facilitating credit review with a credit underwriter in place and achieving faster turnaround times. The enhancement resulted in far greater dealer support. The bank also developed online loan creation through the Roads and Transports Authority portal, created an online banking tool for applying for an automobile loan, and sped up the process by enabling applicants to submit their identity and salary verification documents at the end of the loan process rather than with their loan application. A new business process management system, with document scanning and deal tracking from initiation until disbursement, has helped to speed up processes even further.

Categories:

Keywords:Auto Loans, Mobile Banking, Credit, Retail Banking, Technology, Innovation

While the automobile loan market in Thailand is highly competitive, Thanachart Bank has taken nearly one-third of the market. Other banks are seeking growth, though, with Krungsri Bank targeting a 25% market share by the end of 2017.

February 12, 2018 | Richard Hartung- Thanachart offers three types of loans for automobiles: new car loans, used car loans, and sale-and-lease-back loans under the CYC programme

- The bank used its original equipment manufacturer strategic partnerships to increase volumes of new car loans

- To improve the customer experience, Thanachart has worked to enhance back-end processes including credit approval, scoring, and infrastructure

To develop a profitable automobile loan portfolio, Thanachart has shifted its strategy over the past several years. Reflecting a strategy that is quite different from many other banks, automobile hire purchase loans form a very large part of the entire loan portfolio at Thanachart Bank (Figure 1).

In the past, according to the bank’s executive vice president, Tirachart Chiracharasporn, about 70% of its automobile lending has been for new cars. Margins for new card loans are very thin, though, so Thanachart increased its focus on used car loans and “Cash Your Car” (CYC) to increase portfolio profitability. The three key drivers for the business growth have been the CYC Good Speed Retention programme, OEM strategic partnerships, and the implementation of credit bureau scoring.

The CYC product

Thanachart offers three types of loans for automobiles: new car loans (70%), used car loans (18%), and sale-and-lease-back loans under the CYC programme (12%). The bank has used the CYC programme, targeted at customers who need more cash, to deepen portfolio penetration and increase portfolio profitability. The CYC programme is an auto refinance model, whereby the bank converts new-car-loan customers to CYC customers.

When customers need more cash, they can go to Thanachart for another loan and receive additional financing before they pay off their loan. Customers can borrow an amount based on the appraised value of their car in exchange for ownership of the car. Customers can receive a higher credit line and a longer repayment tenor than for a standard consumer loan, with terms commensurate with their ability to repay.

While customers cannot transfer ownership during the first five years they own a car, Thanachart has established a mechanism for a transfer between buyer and seller to capture this segment. The bank used the process to launch the CYC Good Speed Programme in the second half of 2016. Target processing times have been reduced from about four days to 2.6 days. The bank also reduced documentation requirements, simplified income verification and disbursement processes, and simplified processes with the Department of Land Transport.

Thanachart also developed ads and a marketing campaign specifically to promote the growth of this segment. Business volume for CYC increased from 2,600 units in the 1st quarter of 2016 to 4,200 units in the 4th quarter. In the second half of 2017, the bank enhanced the product further by launching CYC Top Up, in which approval is easier and faster for the customer, since they simply use their ID card to get approved. Thanachart has also developed a “Thanachart Blue Book”, which it says has become a top reference for used cars in Thailand.

Partnerships drive volume

Another initiative over the past several years to grow automobile loan volumes has been original equipment manufacturer (OEM) partnerships. The bank used its OEM strategic partnerships to increase volumes of new car loans, increasing market share for Chevrolet from 42% to 72% and for Mazda from 24% to 35%. The bank also has partnerships with Volvo and with SAIC-MG for both wholesale and retail lending. Along with these OEM partnerships, it also helps other partners such as Isuzu, Toyota, Honda and Mitsubishi to grow their business through activities such as support for their marketing campaigns and dedicated sales officers. In addition to retail finance, Thanachart also supports wholesale financing through short-term loans to dealers, which in turn has helped the bank grow its portfolio.

Credit approval

To improve the customer experience, Thanachart has worked to enhance back-end processes including credit approval, scoring, and infrastructure. When the government launched a first car buyer programme and buyers shifted from purchasing used cars to purchasing new ones, for instance, good buyers who had money bought new cars and buyers with poor credit purchased used cars. Thanachart mitigated the risk by reducing the loan-to-value (LTV) ratio for used cars and by being selective about the dealers it worked with. The bank also tied credit insurance to its loans for used and new cars. After the government’s first car buyer programme ended, Thanachart mitigated risk by reducing the LTV ratio

for used cars because of their bad debt quality, which indirectly impacted the programme. After tightening its credit policy and reducing bad debt to 0.08% in 2015 led to drops in volume, however, the bank loosened its policy slightly and volumes recovered, with non-performing loans growing slightly to 0.14%. In 2016, Thanachart incorporated credit bureau scoring into its credit assessment and started using it for approval processes.

After the National Credit Bureau (NCB) partnered with Transunion, Thanachart validated the scoring and started using the model to assess bank customers. It has also used data from Transunion to segment customers into green, yellow and red based on their payment history. While many loans are categorised as “green”, Thanachart has been able to approve some “yellow” loans at a higher price and lower LTV ratio. Thanachart has also been able to analyse used car dealers and segment them into normal, premium, and “HIT” (Honda, Isuzu, Toyota) categories. It tracks bad debt, including non-starters and buckets of 30, 60, and 90 days. By using credit bureau scoring and dealer segmentation, the bank has been able to expand its lending to higher risk segments, increase its pre-approval rate from 83% to 88% and double its volume of used car loans.

Leveraging data

Thanachart has begun leveraging data more in order to enhance its relationships with its four million customers. The bank uses data in a customer relationship management (CRM) system to establish cross-sell programmes for the full customer journey. Data from a data warehouse is used for real time analytics, based on data mining, campaign analysis and customer analysis. Customers are segmented into Premier, Achiever, Mass and NewGen.

After the bank develops a sufficient history, it uses that data and information developed during onboarding to offer credit cards, deposit accounts and other products. The bank also uses the data to send leads to the branch, which will see Next Best Offers for customers and call them to offer products. Sales staff may offer mutual funds to Prestige customers, for example, and would most likely offer other products to Achiever or Mass customers.

NewGen customers may receive offers for products such as a debit card with cartoon characters. Thanachart also enhanced its auto lending programme by enabling sales staff to use a tablet to capture 11 fields, including the customer’s ID and income. The bank uses that data and information such as the total debt servicing ratio, based on data from the national credit bureau, for faster initial approval before moving on to evaluate documents and income. The net result has been improved efficiency, faster service and stronger relationships with car makers and dealers. “We tailor products according to customer behaviour,” Chiracharasporn said, “because we know the next best offer.”

The cross-sell ratio is increasing because of CRM tools, since the bank can determine who its main bank customers are and offer the right products. Whereas many banks separate auto lending from branches, Chiracharasporn said “we invite them to come to our branch and let the branches service them for the customer journey, five to six years.”

Mobile banking

Mobile banking, which Thanachart launched in May 2016, has become an essential strategy as well. While about 10% of customers have started using mobile banking so far, the bank targets growing usage to 35%. Whereas other banks have 20% usage after ten years, Chiracharasporn noted proudly that Thanachart reached 10% after just one year

Automobile loans can increase profits

While automobile loans are usually considered neither a lead product nor highly profitable at many banks, they are the largest single type of loan at Thanachart and have become very attractive. As Thanachart’s experience demonstrates, an innovative strategy can turn a mundane product from a laggard into a leader.

Global comparison

Auto loan volumes globally are under pressure, due to factors ranging from rising delinquencies in the US to ride-sharing services cutting into car purchase volumes in some markets. And as investment advisory firm Schroders observed, the less sexy topic of auto lending and auto credit deterioration is commanding headline because speculation has been building that auto loans could be at the heart of the financial world’s next crisis.

Despite the concerns, the overall trend for automobile purchases and financing remain broadly positive. As earlier this year, favourable economic environments and increasing consumer purchasing power are some of the factors that will help sustain the growth of bank auto lending. The processes for financing in many markets, though, remain stubbornly inefficient. Although car manufacturers and dealers have started to revamp their processes, using everything from online solutions to virtual reality, the process for auto finance often remains very manual.

The processes for car purchases and financing are also often deeply interlinked, meaning that change and innovation will require collaboration between both sectors. Many dealers also work with multiple lenders, which means they need to follow multiple processes for financing. And in contrast to the sensitivity customers have towards interest rates for mortgage loans or even credit cards, consumers usually focus on the speed of getting the vehicle they want to purchase and see financing as simply an often unimportant method of payment. Despite inefficient processes and slow change, some lenders and dealers have started to enhance their practices so that they can improve the customer experience and gain market share. Lenders have started to offer solutions such as digital customer onboarding, cost-comparison shopping and better education for borrowers.

Dealers have begun to offer financing solutions such as online preapprovals, digital calculators so that customers can evaluate their buying capabilities and fees, and apps with more information. As the following examples indicate, leading players and recent upstarts are both moving quickly and could leave slower moving firms far behind.

Ford Motor Credit

Ford Motor Credit Company and ZestFinance announced earlier this year that they are developing machine learning credit approval models to enhance lending practices across the credit spectrum. The new practice results from a study that confirmed the predictive power of machine learning, which can lead to more approvals, an enhanced customer experience and lower credit losses. Ford said it will leverage the effectiveness of machine learning to predict risk in auto financing better, potentially expanding auto financing for millennials and other Americans with limited credit histories.

AutoFi

AutoFi is a US-based online automobile financing startup that connects consumers to a network of lenders so that they can purchase and finance vehicles entirely online. Customers can select a vehicle to purchase online from an AutoFi-enabled dealer, fill out an online application, get a financing decision in less than a minute, select the financing or insurance products that they want, securely sign documents online and arrange to pick up their new vehicle.

Carro

Singapore-based used-car marketplace Carro has established a subsidiary called Genie Financial Services to make automobile financing more accessible and help car buyers get financing. It built its own credit engine to underwrite loans. Based on the data it has gathered by buying and selling cars, and leveraging its own algorithms, Carro believes it has developed more accurate car values that what many banks have available and can price loans based on that information.

KBC Bank

KBC Bank in Belgium has begun using blockchain technology for its My Car loan to create a seamless experience, from the time the customer signs the order for their car to the moment they drive it away from the dealer.

Emirates NBD

Emirates NBD Bank in the UAE introduced on-the-spot approval in selected dealer showrooms, facilitating credit review with a credit underwriter in place and achieving faster turnaround times. The enhancement resulted in far greater dealer support. The bank also developed online loan creation through the Roads and Transports Authority portal, created an online banking tool for applying for an automobile loan, and sped up the process by enabling applicants to submit their identity and salary verification documents at the end of the loan process rather than with their loan application. A new business process management system, with document scanning and deal tracking from initiation until disbursement, has helped to speed up processes even further.

Categories:

Keywords:Auto Loans, Mobile Banking, Credit, Retail Banking, Technology, Innovation