While fintechs may take some market share away in specific niches, the partnerships, analytics, and value-add that leading banks are developing can keep head of the game. Banks that fail to keep up could lose a significant share of their SME business

June 20, 2019 | Richard Hartung and Chris Kapfer- Fintechs’ and non-banks’ market share of SME lending is growing significantly

- Banks are fighting back with more flexible funding solutions, cash management services, and digital service initiatives

- Partnerships, analytics, and value-added services are core to banks’ new offerings

In countries around the world, challenger banks and fintechs are launching innovative solutions that are starting to take SME banking business away from traditional banks. In the US, for instance, Kabbage has enabled more than 170,000 SMEs to gain access to more than $6 billion in working capital. Volt Bank in Australia just received a banking license and will soon start to deliver faster and more personalised services, at a time when an inquiry by a Royal Commission exposed malfeasance that has led to trust in banks plummeting. And start-ups in Southeast Asia such as Funding Societies offer P2P lending, with volumes so far exceeding $2 billion, that reaches SMEs that are largely untouched by banks.

Challenger Banks Fill a Gap

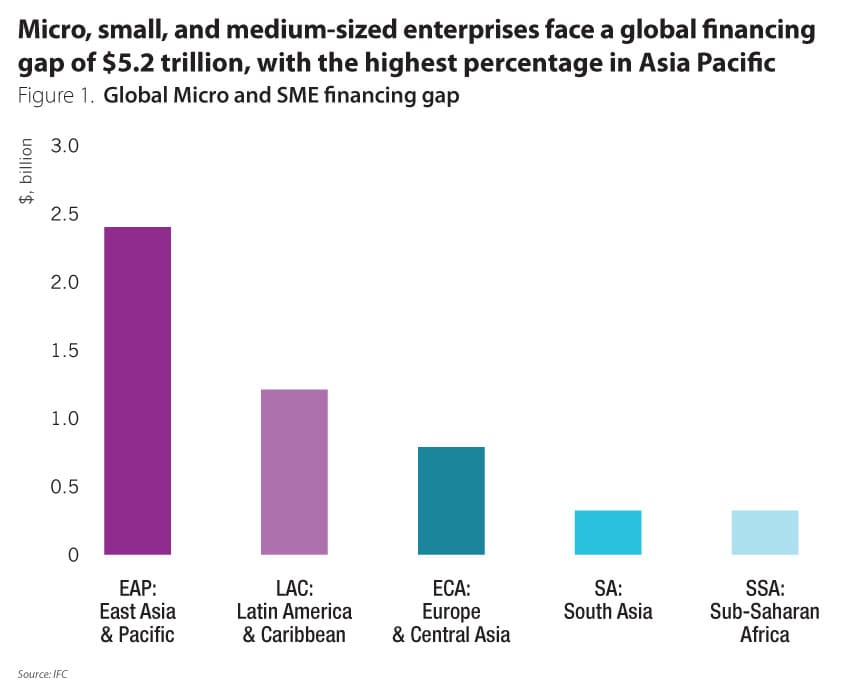

There is clearly a need for the services fintechs and challenger banks are providing. The IFC estimates that SMEs face a funding gap of $5.2 trillion globally, of which $2.4 trillion is in Asia alone, and 65 million MSMEs are credit-constrained.

Micro, small, and medium-sized enterprises face a global financing gap of $5.2 trillion, with the highest percentage in Asia Pacific

Figure 1: Global Micro and SME financing gap

Source: IFC

In Australia, 96% of SMEs face funding issues naming onerous loan conditions, having to provide property security, loan inflexibilities, and short loan tenures as their major concerns, according to the Scottish Pacific SME Growth Index. Currently, less than 20% of SMEs pick their bank as their main source of lending capital...

Categories:

Keywords:Fintechs, SME, Start-ups, MSME, Non-bank, Frictionless, Neo-bank, Cross Border Payments, Digitalisation, KYC, API

While fintechs may take some market share away in specific niches, the partnerships, analytics, and value-add that leading banks are developing can keep head of the game. Banks that fail to keep up could lose a significant share of their SME business

June 20, 2019 | Richard Hartung and Chris Kapfer- Fintechs’ and non-banks’ market share of SME lending is growing significantly

- Banks are fighting back with more flexible funding solutions, cash management services, and digital service initiatives

- Partnerships, analytics, and value-added services are core to banks’ new offerings

In countries around the world, challenger banks and fintechs are launching innovative solutions that are starting to take SME banking business away from traditional banks. In the US, for instance, Kabbage has enabled more than 170,000 SMEs to gain access to more than $6 billion in working capital. Volt Bank in Australia just received a banking license and will soon start to deliver faster and more personalised services, at a time when an inquiry by a Royal Commission exposed malfeasance that has led to trust in banks plummeting. And start-ups in Southeast Asia such as Funding Societies offer P2P lending, with volumes so far exceeding $2 billion, that reaches SMEs that are largely untouched by banks.

Challenger Banks Fill a Gap

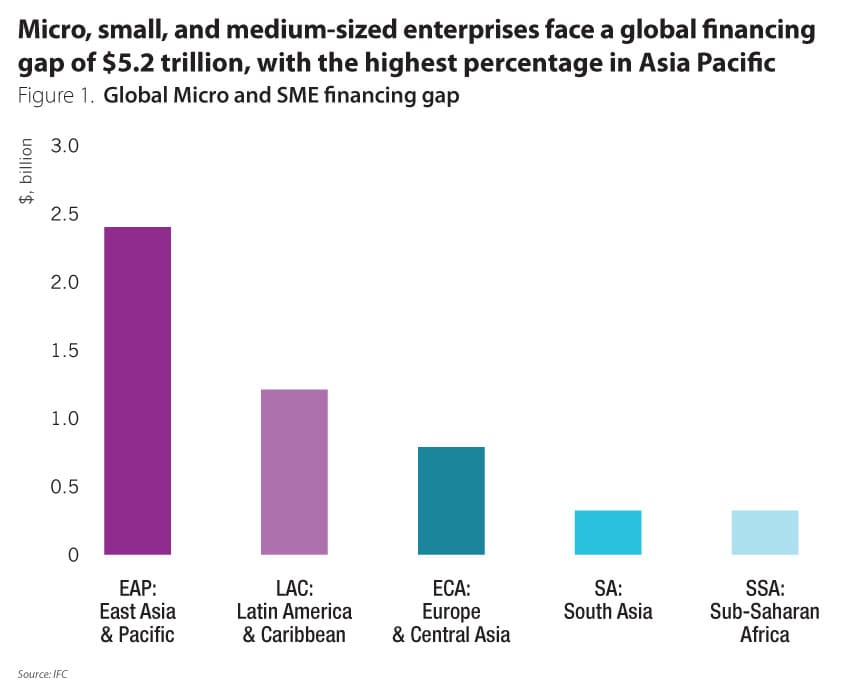

There is clearly a need for the services fintechs and challenger banks are providing. The IFC estimates that SMEs face a funding gap of $5.2 trillion globally, of which $2.4 trillion is in Asia alone, and 65 million MSMEs are credit-constrained.

Micro, small, and medium-sized enterprises face a global financing gap of $5.2 trillion, with the highest percentage in Asia Pacific

Figure 1: Global Micro and SME financing gap

Source: IFC

In Australia, 96% of SMEs face funding issues naming onerous loan conditions, having to provide property security, loan inflexibilities, and short loan tenures as their major concerns, according to the Scottish Pacific SME Growth Index. Currently, less than 20% of SMEs pick their bank as their main source of lending capital...

Categories:

Keywords:Fintechs, SME, Start-ups, MSME, Non-bank, Frictionless, Neo-bank, Cross Border Payments, Digitalisation, KYC, API