Composition of retail banking assets among Asia Pacific countries shows that mature markets have a higher average share of mortgages in retail lending than emerging markets, while banks in emerging markets have expanded their mortgage lending at a stronger pace.

May 15, 2017 | Wendy Weng- In Asia Pacific, mortgages as a share of retail lending, averaged 81% in mature markets and 51% in emerging markets in 2016

- Demand for residential mortgages in emerging markets will continue to grow, largely spurred by rapid urbanisation, relatively younger population, and the growing middle class

- Financial regulators have been introducing measures to control housing market risks

Residential mortgages represent the largest category of retail banking assets in most markets, but, there are significant variations between mature and emerging markets. In this report, Asian Banker Research compares the industry composition of retail banking assets among Asia Pacific markets and looks at some of the underlying industry trends that drive a specific composition. Banks recognise that when a customer apply for a mortgage, the experience can make or break a bank’s relationship with the customer because home purchases are often the most expensive, complex and emotional transactions people make in their lifetimes. The markets chosen for the comparative examination are Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, the Philippines, Singapore, Taiwan, and Thailand.

Retail banking asset structure in mature versus emerging markets

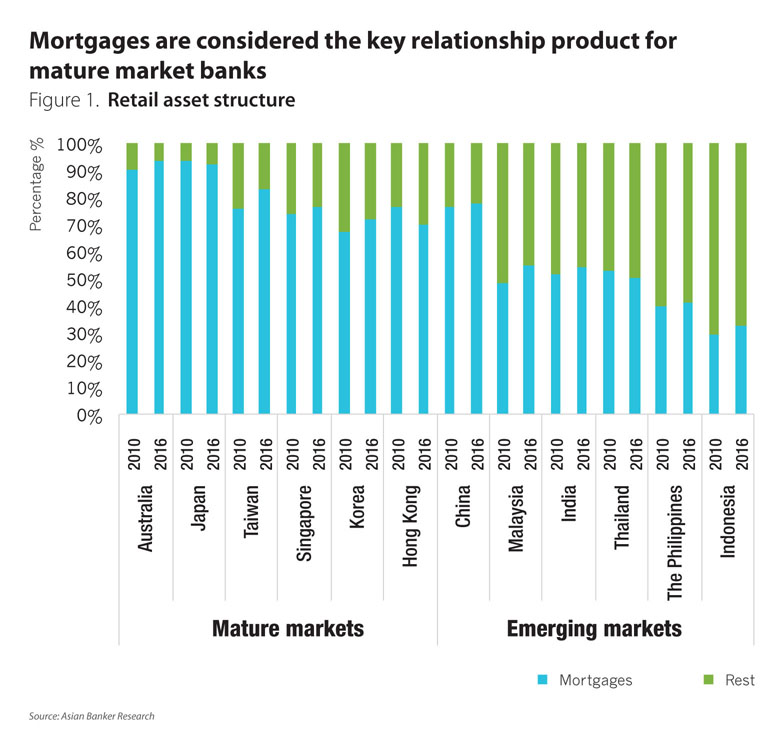

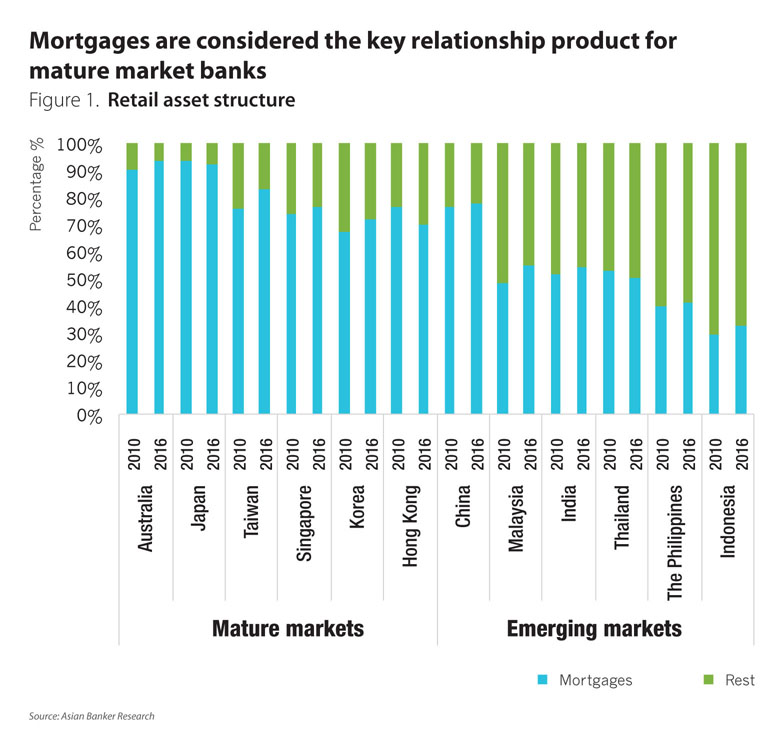

Mature markets have higher proportion of residential mortgages in their retail lending, while banks in emerging markets tend to hold relatively larger proportion of unsecured loans (Figure 1). Among mature markets, mortgage loans as a share of retail lending averaged 81% in 2016, compared to 51% in emerging markets. Low income capacity among buyers and affordability, banks’ credit risk management tools, a deficient legal infrastructure that presents difficulties in foreclosing on property and registering title and land, and lack of access to long-term finance are some of the key factors in low mortgage contribution in emerging markets. Accordingly, mortgage penetration is low compared to mature markets. For instance, total mortgage lending of banks was equivalent to 91% of GDP in Australia and 48% in Hong Kong and Singapore in 2016, while it amounted to only 3% of GDP in Indonesia and 4% in the Philippines.

In contrast, in mature markets, mortgages have become low margin commodity like services. Banks are aiming to differentiate by reducing the processing time and offering value added services in the pre-purchase and post origination stage such as property evaluations and auto appraisal systems, better integration with housing related third parties, matchmaking services between buyers and sellers, transparency in payment terms or preapproved refinancing loans. Financial regulators have been introducing measures to cool down the housing markets since 2010 with the effect that growth in outstanding mortgages has slowed materially, in particular in Hong Kong and Singapore. In addition, banks in Korea, Taiwan and Japan are increasingly pursuing a coherent online appraisal, underwriting and origination platform for mortgages, though the current contribution to total mortgage sales is less than 5%.

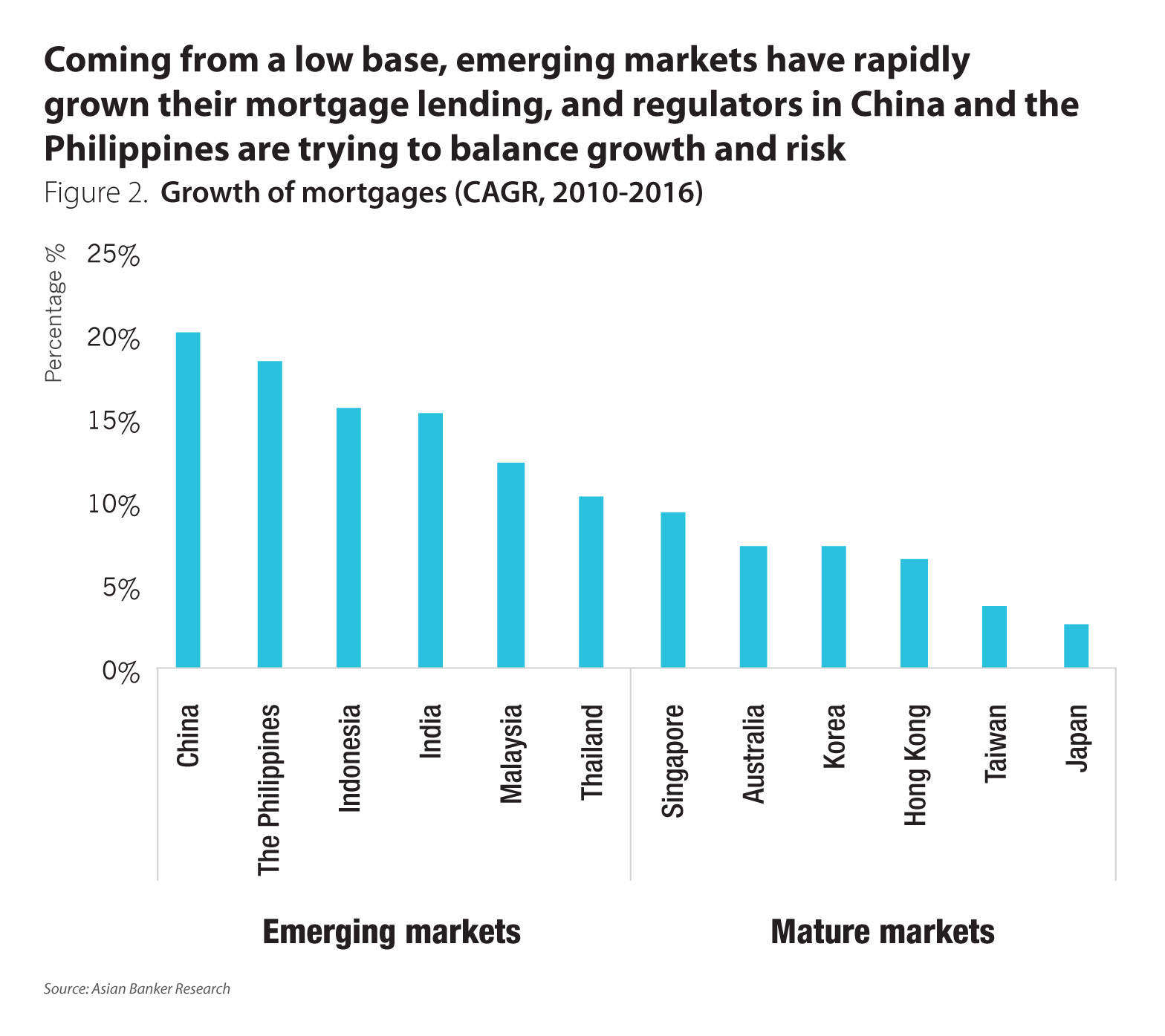

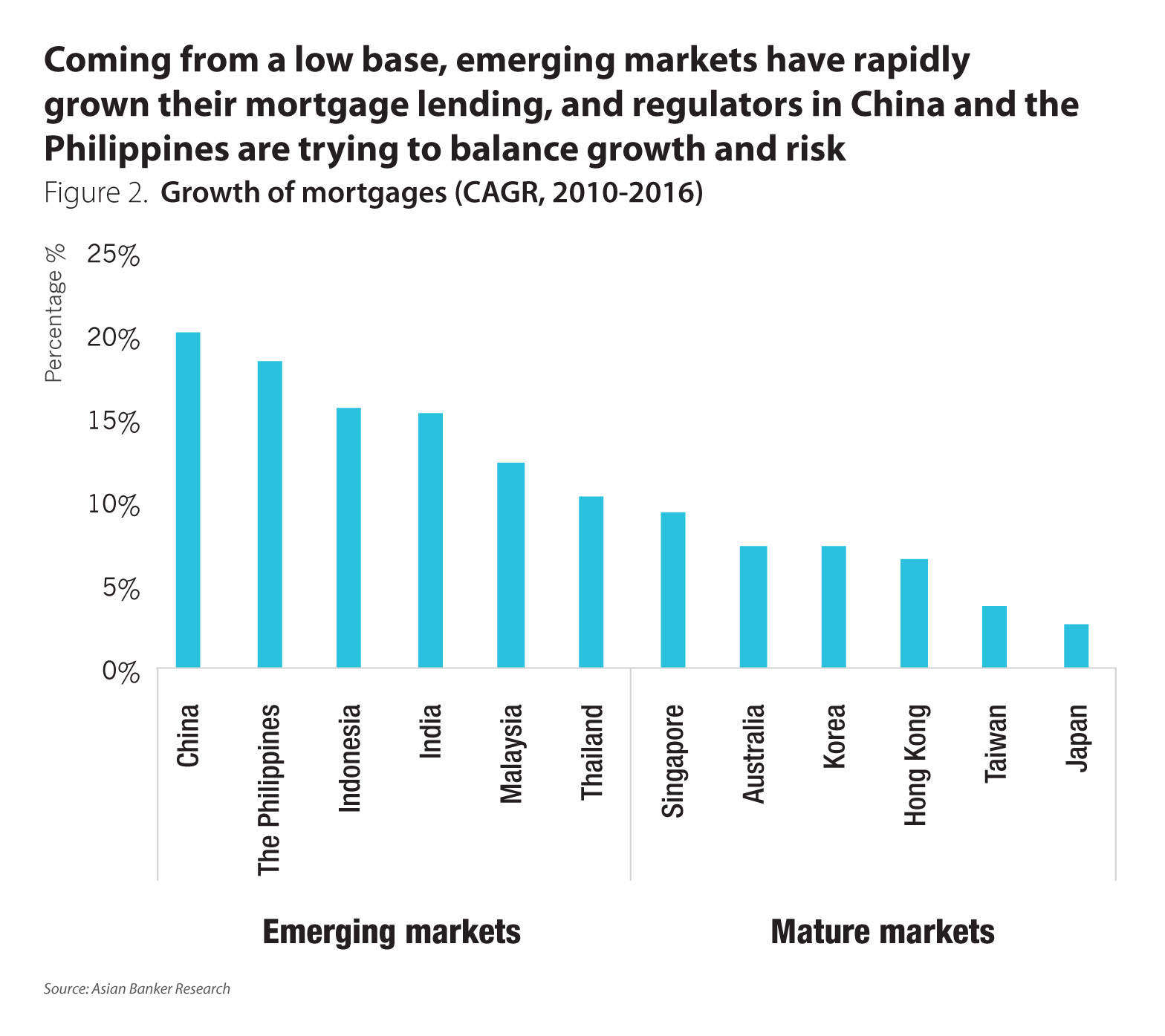

Banks in emerging markets have expanded their mortgage lending at double-digit rates between 2010 and 2016. This compares to single-digit rates for banks in mature markets (Figure 2). Going forward, mortgages will continue to grow in emerging markets, albeit at a slower pace. The rapid urbanisation, relatively younger population, and the growing middle class will continue to spur the demand for residential property. Among the six emerging markets, China has registered the fastest growth over the last six years, followed by the Philippines and Indonesia. Indian banks have seen robust growth in their mortgage lending in recent years, driven by the government’s efforts to boost affordable housing for urban poor and the cuts in repo rates by Reserve Bank of India, along with banks’ concerns over the rising level of non-performing assets and stressed assets in the corporate sector.

Concerns over residential property markets

Australia

In Australia, there have been growing concerns about the surge in lending to property investors amid booming house prices and subdued household income growth. Despite the housing curbs, prices in the country’s biggest cities grew at the fastest pace in seven years, which raise property bubble risk.

The Australia Prudential Regulation Authority (APRA) has taken steps over the past few years to curb the housing market. One such step is the 10% annual limit on investor mortgage lending growth imposed in late 2014. If banks fail to stay beneath the 10% cap, APRA can require them to hold more capital. In addition, major banks have curbed mortgage lending to foreign investors without domestic incomes. These steps were effective in slowing the growth of mortgage lending to investors . However, there have been signs of resurgence in the growth of investment mortgages in recent months. APRA and Australian banks are expected to further tighten residential mortgage lending standards to control the rising risks to the financial system.

Digital mortgage has attracted a lot of attention in Australia. A growing number of mortgage customers prefer to apply for mortgage online. In late 2016, National Australia Bank (NAB) and real estate giant REA Group have entered into a five-year strategic partnership to bring home loans and online property search together, which aims at developing an innovative end-to-end digital property buying experience.

Hong Kong

The Hong Kong Monetary Authority (HKMA) has introduced several rounds of macro-prudential measures since October 2009 to cool down the overheated housing market. These measures were to some extent effective. The average loan-to-value ratio for new mortgages declined, as well as the debt-servicing ratio.

In order to maintain their market position, local banks have lowered mortgage rates last year to lure customers amid intensified competition for mortgage lending business. In November 2016, the stamp duty on residential property transactions has been raised to 15% for non first-time home buyers and 30% for non- Hong Kong permanent residents, as concerns grow over soaring housing prices.

Despite the property cooling measures, further increase in housing price is still expected. In 2017, the uncertainty over the pace and effect of interest rate hikes continues to pose downside risks to Hong Kong residential property market, as a majority of new mortgages in Hong Kong are tied to Hong Kong Interbank Offered Rate (HIBOR). In addition, HKMA is worry about bank lending to property developers, owing to the rapid increase in highly leveraged mortgage loans provided by these developers.

Singapore

In Singapore, a series of the macro-prudential policy measures has been imposed by the government to curb property market risks since 2011. As a result of these measures, property sales have dropped significantly. Meanwhile, property prices have declined over 11% from the peaks in the third quarter of 2013. The growth rate of mortgage lending decelerated sharply to 4% in 2015 and 2016 from 17% in 2011.

The easing of some property cooling measures has been announced by the government on 10 March 2017. However, the impacts of these changes, such as lower sellers’ stamp duty and shorter holding period, are estimated to be limited. Households are expected to face higher borrowing costs, as Singapore Interbank Offered Rate (SIBOR) is highly correlated with US interest rate.

Singapore mortgage market is very competitive. DBS holds a leading position among its peers in the residential mortgage services, as the stable-cost current and savings deposit base helps the bank offer more stable and attractive pricing packages. DBS is the first bank in Singapore to offer a mortgage loan pegged to the fixed deposit rate.

China

The potential housing bubble poses risks to China’s banking system and economy. In 2016, average new home prices in 70 major cities surged at the fastest pace since 2011. Prices in Beijing, Shanghai and Shenzhen rose 25.9%, 26.5% and 23.5% respectively, from a year earlier. Meanwhile, Chinese banks aggressively extended residential mortgage lending last year. China Construction Bank, the largest home loan provider in China, saw a considerable increase of 30.5% in its residential mortgage portfolio. Although the property boom helped boost the economic growth in China, there are growing concerns over soaring housing prices and the surge in loans to property developers and home buyers.

Since October 2016, local authorities in more than 20 cities have imposed property curbs to cool the overheated property markets. Aside from higher minimum down payments and bans on second home purchasing, property developers’ access to alternative financing has been limited. In March 2017, banks in Beijing are required by China’s central bank to strengthen management of mortgage loan risks. Under the guidelines for Beijing, individuals who have been divorced for less than a year should not qualify as first-home buyers.

In 2017, China’s housing price growth is expected to slow down significantly. However, average housing price won’t fall, as inventories remain low in the largest cities. Those second-tier cities that recorded strong double-digit growth in house prices last year are at risk of price correction. In addition, the growth of residential mortgage will decelerate. Residential mortgages are expected to make up less than 30% of total new lending in 2017.

India

The residential mortgage of Indian banks has surged by annual average of 15% in the last six years. However, the Indian mortgage market is still small compared to other nations. There is massive growth potential for its mortgage industry, as rapid urbanisation and increasing disposable income will continue to drive the housing market.

Lack of affordable housing continues to be a major issue. In India, urban housing shortage is estimated at 18.8 million units, 95% of which are coming from economically weaker sections and lower-income groups. To meet the housing needs, the government has implemented various schemes and policies. One of them is Pradhan Mantri Awas Yojana, launched by Prime Minister Narendra Modi in June 2015 with an aim to provide affordable housing to urban poor by 2022. Under the scheme, 20 million houses for the urban poor are planned to be constructed over a seven-year period. An interest subsidy of 6.5% will be provided on housing loans of up to $9,222 (Rs 6 lakh) for a period of 15 years.

The growth of outstanding residential mortgage portfolio in the banking sector moderated to 15% in 2016 from 19% in the previous year, owing to the economic slowdown and the increase in asset prices. In 2017, the mortgage lending will be fueled by the prime minister’s push towards low-cost housing. The scheme was extended to cover home loans of up to $13,832 (Rs 9 lakh) and $18,443 (Rs 12 lakh), with interest subvention of 4% and 3%, respectively.

State Bank of India is the largest player in the residential mortgage market with a market share of 26% among all scheduled commercial banks. The total home loan portfolio of the bank grew by 18.3% year-on-year to reach $31.3 billion as of year-end 2016. State Bank of India has a long tradition of launching innovative home loan products. In August 2016, the bank introduced specially designed home products for government employees and defence personnel.

Demand for mortgages will continue to grow

The mortgage markets in different countries in Asia Pacific are at various stages of development. Emerging markets have a lower mortgage contribution than mature markets. However, going forward, rapid urbanisation, relatively younger population, and the growing middle class will continue to spur the demand for mortgages in emerging markets.

Categories:

Data & Analytics, Mortgage, Retail BankingKeywords:APRA, HKMA, HIBOR, SIBOR, DBS, Asset Structure

Composition of retail banking assets among Asia Pacific countries shows that mature markets have a higher average share of mortgages in retail lending than emerging markets, while banks in emerging markets have expanded their mortgage lending at a stronger pace.

May 15, 2017 | Wendy Weng- In Asia Pacific, mortgages as a share of retail lending, averaged 81% in mature markets and 51% in emerging markets in 2016

- Demand for residential mortgages in emerging markets will continue to grow, largely spurred by rapid urbanisation, relatively younger population, and the growing middle class

- Financial regulators have been introducing measures to control housing market risks

Residential mortgages represent the largest category of retail banking assets in most markets, but, there are significant variations between mature and emerging markets. In this report, Asian Banker Research compares the industry composition of retail banking assets among Asia Pacific markets and looks at some of the underlying industry trends that drive a specific composition. Banks recognise that when a customer apply for a mortgage, the experience can make or break a bank’s relationship with the customer because home purchases are often the most expensive, complex and emotional transactions people make in their lifetimes. The markets chosen for the comparative examination are Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, the Philippines, Singapore, Taiwan, and Thailand.

Retail banking asset structure in mature versus emerging markets

Mature markets have higher proportion of residential mortgages in their retail lending, while banks in emerging markets tend to hold relatively larger proportion of unsecured loans (Figure 1). Among mature markets, mortgage loans as a share of retail lending averaged 81% in 2016, compared to 51% in emerging markets. Low income capacity among buyers and affordability, banks’ credit risk management tools, a deficient legal infrastructure that presents difficulties in foreclosing on property and registering title and land, and lack of access to long-term finance are some of the key factors in low mortgage contribution in emerging markets. Accordingly, mortgage penetration is low compared to mature markets. For instance, total mortgage lending of banks was equivalent to 91% of GDP in Australia and 48% in Hong Kong and Singapore in 2016, while it amounted to only 3% of GDP in Indonesia and 4% in the Philippines.

In contrast, in mature markets, mortgages have become low margin commodity like services. Banks are aiming to differentiate by reducing the processing time and offering value added services in the pre-purchase and post origination stage such as property evaluations and auto appraisal systems, better integration with housing related third parties, matchmaking services between buyers and sellers, transparency in payment terms or preapproved refinancing loans. Financial regulators have been introducing measures to cool down the housing markets since 2010 with the effect that growth in outstanding mortgages has slowed materially, in particular in Hong Kong and Singapore. In addition, banks in Korea, Taiwan and Japan are increasingly pursuing a coherent online appraisal, underwriting and origination platform for mortgages, though the current contribution to total mortgage sales is less than 5%.

Banks in emerging markets have expanded their mortgage lending at double-digit rates between 2010 and 2016. This compares to single-digit rates for banks in mature markets (Figure 2). Going forward, mortgages will continue to grow in emerging markets, albeit at a slower pace. The rapid urbanisation, relatively younger population, and the growing middle class will continue to spur the demand for residential property. Among the six emerging markets, China has registered the fastest growth over the last six years, followed by the Philippines and Indonesia. Indian banks have seen robust growth in their mortgage lending in recent years, driven by the government’s efforts to boost affordable housing for urban poor and the cuts in repo rates by Reserve Bank of India, along with banks’ concerns over the rising level of non-performing assets and stressed assets in the corporate sector.

Concerns over residential property markets

Australia

In Australia, there have been growing concerns about the surge in lending to property investors amid booming house prices and subdued household income growth. Despite the housing curbs, prices in the country’s biggest cities grew at the fastest pace in seven years, which raise property bubble risk.

The Australia Prudential Regulation Authority (APRA) has taken steps over the past few years to curb the housing market. One such step is the 10% annual limit on investor mortgage lending growth imposed in late 2014. If banks fail to stay beneath the 10% cap, APRA can require them to hold more capital. In addition, major banks have curbed mortgage lending to foreign investors without domestic incomes. These steps were effective in slowing the growth of mortgage lending to investors . However, there have been signs of resurgence in the growth of investment mortgages in recent months. APRA and Australian banks are expected to further tighten residential mortgage lending standards to control the rising risks to the financial system.

Digital mortgage has attracted a lot of attention in Australia. A growing number of mortgage customers prefer to apply for mortgage online. In late 2016, National Australia Bank (NAB) and real estate giant REA Group have entered into a five-year strategic partnership to bring home loans and online property search together, which aims at developing an innovative end-to-end digital property buying experience.

Hong Kong

The Hong Kong Monetary Authority (HKMA) has introduced several rounds of macro-prudential measures since October 2009 to cool down the overheated housing market. These measures were to some extent effective. The average loan-to-value ratio for new mortgages declined, as well as the debt-servicing ratio.

In order to maintain their market position, local banks have lowered mortgage rates last year to lure customers amid intensified competition for mortgage lending business. In November 2016, the stamp duty on residential property transactions has been raised to 15% for non first-time home buyers and 30% for non- Hong Kong permanent residents, as concerns grow over soaring housing prices.

Despite the property cooling measures, further increase in housing price is still expected. In 2017, the uncertainty over the pace and effect of interest rate hikes continues to pose downside risks to Hong Kong residential property market, as a majority of new mortgages in Hong Kong are tied to Hong Kong Interbank Offered Rate (HIBOR). In addition, HKMA is worry about bank lending to property developers, owing to the rapid increase in highly leveraged mortgage loans provided by these developers.

Singapore

In Singapore, a series of the macro-prudential policy measures has been imposed by the government to curb property market risks since 2011. As a result of these measures, property sales have dropped significantly. Meanwhile, property prices have declined over 11% from the peaks in the third quarter of 2013. The growth rate of mortgage lending decelerated sharply to 4% in 2015 and 2016 from 17% in 2011.

The easing of some property cooling measures has been announced by the government on 10 March 2017. However, the impacts of these changes, such as lower sellers’ stamp duty and shorter holding period, are estimated to be limited. Households are expected to face higher borrowing costs, as Singapore Interbank Offered Rate (SIBOR) is highly correlated with US interest rate.

Singapore mortgage market is very competitive. DBS holds a leading position among its peers in the residential mortgage services, as the stable-cost current and savings deposit base helps the bank offer more stable and attractive pricing packages. DBS is the first bank in Singapore to offer a mortgage loan pegged to the fixed deposit rate.

China

The potential housing bubble poses risks to China’s banking system and economy. In 2016, average new home prices in 70 major cities surged at the fastest pace since 2011. Prices in Beijing, Shanghai and Shenzhen rose 25.9%, 26.5% and 23.5% respectively, from a year earlier. Meanwhile, Chinese banks aggressively extended residential mortgage lending last year. China Construction Bank, the largest home loan provider in China, saw a considerable increase of 30.5% in its residential mortgage portfolio. Although the property boom helped boost the economic growth in China, there are growing concerns over soaring housing prices and the surge in loans to property developers and home buyers.

Since October 2016, local authorities in more than 20 cities have imposed property curbs to cool the overheated property markets. Aside from higher minimum down payments and bans on second home purchasing, property developers’ access to alternative financing has been limited. In March 2017, banks in Beijing are required by China’s central bank to strengthen management of mortgage loan risks. Under the guidelines for Beijing, individuals who have been divorced for less than a year should not qualify as first-home buyers.

In 2017, China’s housing price growth is expected to slow down significantly. However, average housing price won’t fall, as inventories remain low in the largest cities. Those second-tier cities that recorded strong double-digit growth in house prices last year are at risk of price correction. In addition, the growth of residential mortgage will decelerate. Residential mortgages are expected to make up less than 30% of total new lending in 2017.

India

The residential mortgage of Indian banks has surged by annual average of 15% in the last six years. However, the Indian mortgage market is still small compared to other nations. There is massive growth potential for its mortgage industry, as rapid urbanisation and increasing disposable income will continue to drive the housing market.

Lack of affordable housing continues to be a major issue. In India, urban housing shortage is estimated at 18.8 million units, 95% of which are coming from economically weaker sections and lower-income groups. To meet the housing needs, the government has implemented various schemes and policies. One of them is Pradhan Mantri Awas Yojana, launched by Prime Minister Narendra Modi in June 2015 with an aim to provide affordable housing to urban poor by 2022. Under the scheme, 20 million houses for the urban poor are planned to be constructed over a seven-year period. An interest subsidy of 6.5% will be provided on housing loans of up to $9,222 (Rs 6 lakh) for a period of 15 years.

The growth of outstanding residential mortgage portfolio in the banking sector moderated to 15% in 2016 from 19% in the previous year, owing to the economic slowdown and the increase in asset prices. In 2017, the mortgage lending will be fueled by the prime minister’s push towards low-cost housing. The scheme was extended to cover home loans of up to $13,832 (Rs 9 lakh) and $18,443 (Rs 12 lakh), with interest subvention of 4% and 3%, respectively.

State Bank of India is the largest player in the residential mortgage market with a market share of 26% among all scheduled commercial banks. The total home loan portfolio of the bank grew by 18.3% year-on-year to reach $31.3 billion as of year-end 2016. State Bank of India has a long tradition of launching innovative home loan products. In August 2016, the bank introduced specially designed home products for government employees and defence personnel.

Demand for mortgages will continue to grow

The mortgage markets in different countries in Asia Pacific are at various stages of development. Emerging markets have a lower mortgage contribution than mature markets. However, going forward, rapid urbanisation, relatively younger population, and the growing middle class will continue to spur the demand for mortgages in emerging markets.

Categories:

Data & Analytics, Mortgage, Retail BankingKeywords:APRA, HKMA, HIBOR, SIBOR, DBS, Asset Structure