Digital-only banks pose serious challenges to the traditional financial services industry with their entirely new banking experience. However, for most of them, licensing, scale and profitability are the three key issues they must face going forward.

June 01, 2018 | Wendy Weng- Compared to Europe and the US, most digital-only players in Asia and the Middle East and Africa have commercial banks behind them

- Digital-only banks have sufficient potential to transform the financial services landscapes of the countries in which they operate

- More digital-only banks are expected to be launched who will continue to add new features to their apps to make themselves more competitive in the current landscape

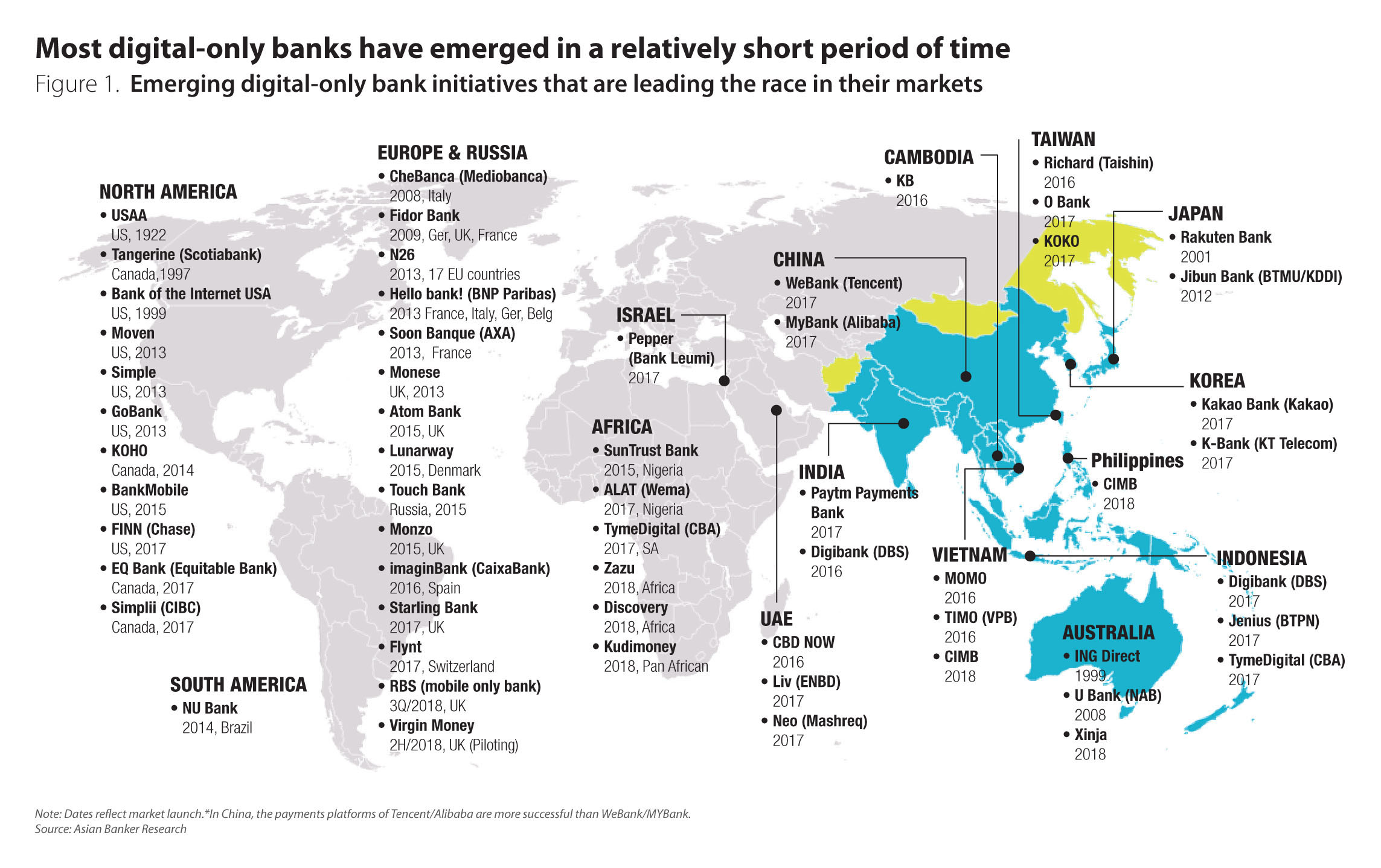

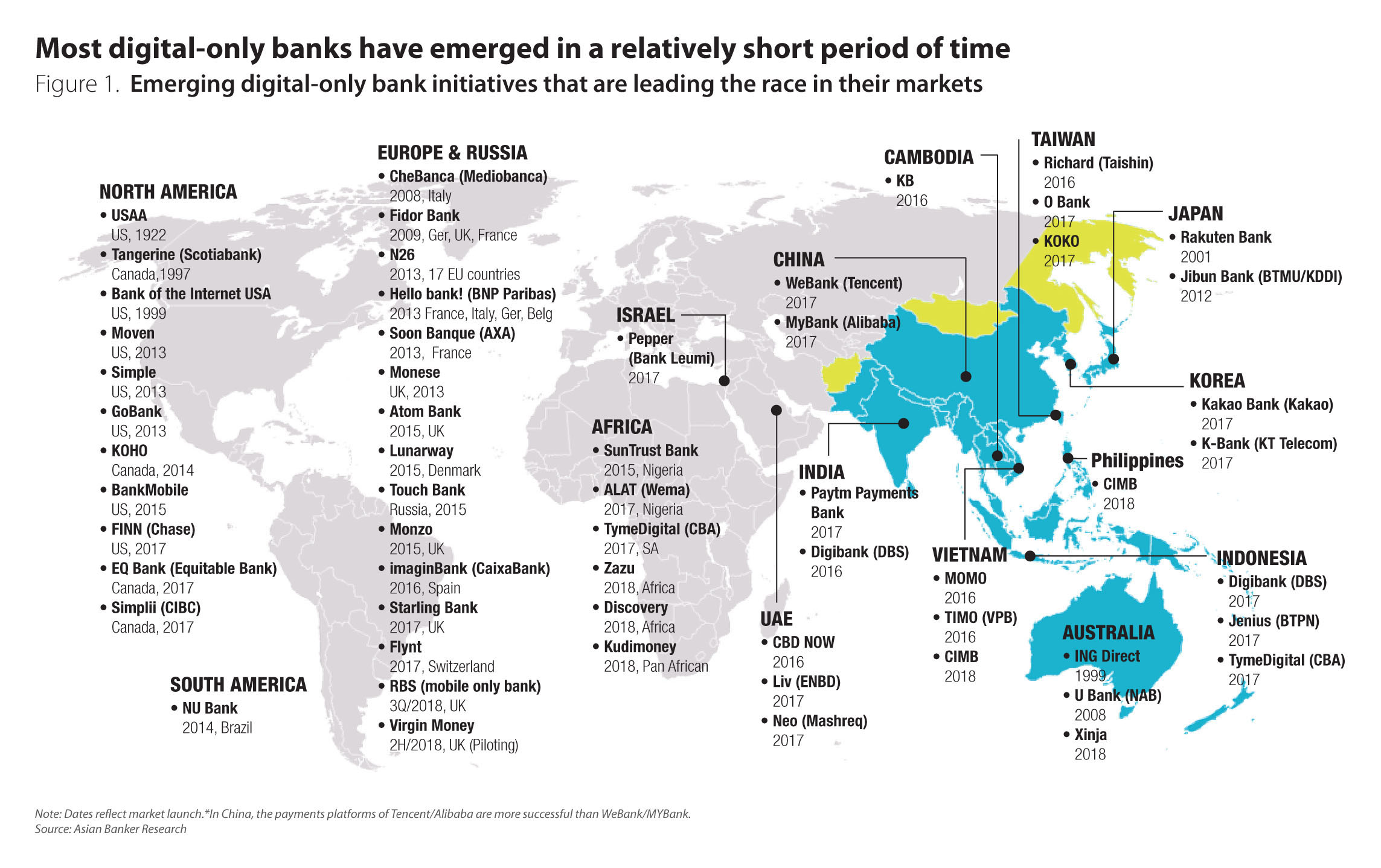

Digital-only banks come in a variety of forms - from pure digital banks to small store networks in the emerging markets - where electronic know your customer (e-KYC) is not yet fully approved. Outside Japan (most of them in Asia), these banks have emerged from nowhere in the last two years as the map illustrates (Figure 1).

Compared to Europe and the US, most digital-only players in Asia and the Middle East and Africa have commercial banks behind them. For example, Vietnam's first digital bank Timo is powered by the back office of Vietnam Prosperity Bank. Jibun Bank in Japan is a joint venture between Bank of Tokyo-Mitsubishi UFJ and the mobile network operator, KDDI. Liv and Mashreq Neo in the United Arab Emirates, Tyme in South Africa and Jenius in Indonesia are set up and funded by commercial banks. Some of them have originated from popular messaging applications such as Kakao Talk in Korea and WeChat Pay in China.

Although there are some problems facing digital-only banks, they have sufficient potential to transform the financial services landscapes of the countries in which they operate. They have applied radical new technologies to ensure more accurate customer identities for authentication and to meet KYC obligations.

Gaining a banking licence is a tough process for digital-only banks. In the UK, the process has been streamlined in recent years to encourage competition. However, it still took Starling Bank 18 months to receive the restricted banking license and 25 months to obtain the full banking license. When the bank announced its plans in November 2014, it had hoped to receive its banking licence in six months.

In addition, acquiring new customers is a major priority for most of them rather than making a profit. Digital-only banks have taken various measures to attract new customers. The majority of them are still making losses and some are expected to be profitable in the near future. London-based Revolut, for instance, made a pre-tax loss of $9.8 million (£7.1 million) in 2016, and Monzo reported a pre-tax loss of $10.9 million (£7.9 million) for the same period.

N26

N26 is an online-only, traveller-friendly bank based in Berlin, Germany. N26 is using Mambu’s flagship core system, provided on a software-as-a-service basis. N26 migrated to Mambu’s platform once it obtained its own banking licence late in late 2016. Prior to that, it used the services of a partner bank.

Since its launch in 2015, N26 has expanded rapidly into 17 European countries including Austria, France, Portugal, Ireland, Italy, Spain, and the Netherlands. N26 has announced plans to launch in the UK and the US in 2018. The bank’s customer base reaches 500,000 in August 2017, up from 100,000 in January 2016. The growth is primarily based on referrals from existing customers, according to the bank. Valentin Stalf, the founder and chief executive officer (CEO) of N26, said that N26 expects to have a 5% to 10% share of the market in the main countries where it operates within three years.

The account opening process takes on average eight minutes and can be completed via a video chat with its customer support team. However, N26’s identity verification partner, IDnow, only supports certain passports and ID cards. The holders of other passports and ID cards have to visit a German post office if it is supported by Postident.

N26 offers a free basic current account and two different premium MasterCard products, N26 Black and N26 Metal, and has consistently expanded the product range surrounding its bank account. For a cost of $7.3 (€5.90) per month, the N26 Black card customers are offered fee-free foreign currency automated teller machine (ATM) withdrawals worldwide and a comprehensive insurance package from Allianz Global Assistance Europe that includes travel, health, mobile phone or cash theft, as well as extended warranty for electronic devices. The N26 Metal card comes with all the benefits of the black card, plus dedicated customer service and access to preferential rates and special partner offers like free co-working days with WeWork.

O-Bank Taiwan

O-Bank has become the first, all-digital, online-only bank in the Taiwan, and only serves customers via mobile, video, voice and other online banking channels. The bank was formerly known as Industrial Bank of Taiwan, and has transformed into a commercial bank since January 2017.

O-Bank is using Avaya’s multi-channel customer engagement technologies, such as Avaya Breeze. The new platform allows O-Bank to quickly and easily allocate internal resources to deliver the most appropriate and efficient services, thus creating sustainable improvements in the quality and consistency of the customer experience across channels.

O-Bank has established the video service centre with advanced technologies and is the first Taiwan bank to provide 24-hour full media with video for customer engagement. Avaya’s solutions enable O-Bank to easily integrate multi-channel communications into its mobile apps and web pages, with the flexibility to support different scenarios for various business processes and to accommodate regulatory requirements.

Stringent guidelines for identity authentication and security set by the Bankers Association of the Republic of China have been obstacles to O-bank’s mobile-focused strategy, said Jerry Sung, O-Bank chief retail banking officer and senior executive vice president. The limits imposed on digital accounts opened online makes it impossible for clients to send funds or pay bills on behalf of others. O-Bank has been in talks with the Bankers Association of the Republic of China since March 2017. It urged its peers to be more open to revising security rules, which will enable more services to be delivered via connected mobile devices.

The robo-advisory service has been launched, targeting young consumers who are often overlooked by major banks’ wealth management businesses. Consumers can participate with small amounts under its advisory management. O-bank’s products are focused on cash rewards and discounts to attract younger clients. More than 20% of new clients have been referred by existing customers. It’s expected that the bank will have 100,000 digital bank accounts in the near future, representing 30% of the market.

Paytm Payments Bank

Paytm, the India’s largest mobile payment & commerce platform, had announced a beta launch of its payments bank in May 2017. The bank was formally launched in November 2017. Paytm Payments Bank is a mobile-first bank with no minimum balance requirement and zero charges on all online transactions, and aims to turn into a vertically-integrated financial services company. The bank is expected to be profitable in the next two-three years and is targeting to achieve 500 million customers by 2020.

All Paytm wallet current users have been automatically transferred to the banks’ new facilities; except for those have not used their wallets in the last six months with zero balance. These users are required to login again to move to the Paytm Payments Bank. The bank will allow five free monthly cash withdrawals from any ATM in non-metro locations and charges of $0.3 (INR20) per transaction thereafter. Only three free monthly transactions will be allowed from any ATM in metro cities.

The payments banks can take deposits and remittances but cannot give out loans or issue credit cards like normal banks. Paytm Payments Bank will partner with other banks to offer various lending services as well as financial services products. The bank allows deposit of upto$ 1,550 (INR1 lakh) and offers cashbacks of $3.9 (INR250) on depositing $387.5 (INR25, 000) into the bank account, up to four times per month. The promotion is subject to change without prior notice, and thus this could be an introductory offer. The bank pays an interest rate of 4% on bank deposits, while Airtel Payments Bank and India Post Payments Bank offer 7.25% and 5.5% interest on saving accounts, respectively.

Paytm Payments Bank has partnered with Induslnd Bank, as the payments banks are also not permitted to keep over $1,550 (INR100, 000) in an account at the end of the day. They introduced first-of-its kind facility to create a fixed deposit when the customer balance exceeds $1,550at the end of day. The bank said customers can redeem their deposits instantly, anytime without paying any pre-closure or miscellaneous charges and earn up to 6.85% annual interest. In addition, the bank has partnered with online learning platform Start-up Village Collective (SV.CO) to support women to join leadership roles in technology and engineering companies, and with the Mumbai Dabbawala Association, the pioneers of home-cooked food delivery, to help dabbawalas collect instant payments for their Dabba service through Paytm QR.

In order to attract corporate entitiesthat are already using Paytm e-wallet services to shift employees’ salary accounts to the bank, Paytm Payments Bank also provides digital offerings such as food and gift wallets and reimbursement solutions for the employees. Customers are able to use their food and gift wallets issued by corporate entities through the app across the merchant base of Paytm.

Pepper

Bank Leumi officially launchedPepper in June 2017, Israel’s first digital-only bank. It was developed over two years at a cost of $42.6 million (ILS150 million). The bank hired over 150 employees, many of them are technological professions. The online on-boarding process takes only eight minutes and it requires no account management fees. However, to open a Pepper account, customer must already have an account at an existing institution.

Pepper doesn’t have its own banking license, and operates separately from Bank Leumi’s core business. It makes a profit by selling deposits, credit, securities, and other products. It is expected that Pepper will be profitable within two to three years.

Pepper will be three apps, including Pepper Banking, Pepper Pay and Pepper Invest. These apps are linked with a single sign-on. The Pepper Banking provides access to checking accounts, savings accounts, credit cards and loans. Pepper Pay, launched in February 2017, allows customers of all Israeli banks to transfer money to any beneficiary from their mobile phone contact list. Pepper Invest is due to launch by early 2018 and will enable trading in securities.

Pepper’s core banking processes run on Swiss banking software vendor Temenos’ core banking system. The Temenos’ T24 platform underpins the back-office operations, and the Temenos Connect digital channel software supports the front-end. Temenos drives the 24/7 real-time digital banking experience and enables Pepper to provide a user-friendly interface and personalised services along with immediate alerts about unusual activity.

Meanwhile, the bank partnered with the strategic design firm Design it to develop the entirely new product-service experience, using “design thinking” methodologies. The process involved intensive collaboration between Design it’s team of strategist, designers and technologists and Pepper’s product, marketing and development teams, and constant user-based feedback and typography.

Starling Bank

Starling Bank was founded in 2014 and granted a restricted UK banking license by the financial regulators in July 2016 and full banking licence in April 2017. Starling spent $11.4 million (£8.3 million) building its app-only banking platform in 2016, according to accounts filed with Companies House. The accounts show the start-up made a pre-tax loss of $5.9 million (£4.3 million) in 2016 and had an income of just $17,695 (£12, 834), mainly from interest on balances held at other banks. Starling Bank will definitely be profitable by the end of 2019 according to its CEO.

The partnership between Starling Bank and TransferWise allows Starling customers to make transfers from the UK to bank accounts in 35 currencies, including euros, rupees and dollars. The money transfer service requires a smaller upfront fee than traditional UK banks, and also use the real exchange rate.

Starling also intends to offer business accounts to entrepreneurs, small businesses and sole traders in early 2018. It announced its partnership with mobile invoice and expense platform Albert in December 2017. The integration of Starling accounts with the Albert platform will simplify daily bookkeeping tasks for consumers. The linked accounts will automatically match the transactions from Starling Bank with the invoices sent from the Albert app, and the two can be reconciled in a single tap.

Starling launched its Marketplace in September 2017, a concept which allows third-parties to add their products to an ecosystem accessible through the Starling app. In December 2017, it was granted permissions to offer a full product range through the Marketplace app. Starling has partnered with financial services providers such as PensionBee, Wealth simple, Kasko, and Habito, which will allow Starling customers to access products including pensions, savings, insurance and mortgage brokers via their smartphone. Starling is targeting 25 more partnerships in 2018.

Starling Bank has become the first of the UK digital-only banks to become direct member and participant of the single euro payments area (SEPA) payments system, which will stimulate their expansion into Europe. The system will support the bank’s payment services business for both retail and wholesale banking. Starling has secured its banking passport into Europe in June 2017, and is targeting expansion in Ireland in the first quarter of 2018. The bank plans a further $54 million (£40 million) fundraising in the middle of 2018 to help fuel expansion into markets beyond the UK.

More efforts needed to increase competitiveness

Digital-only banks are redefining the banking industry and are creating unique and differentiated customer experiences. Although they face a number of key issues as previously discussed, they are enjoying significant attention, experiencing continuous growth in terms of the number of customers signing up with them and many of their customers are interacting regularly with their apps. However, only a small proportion of customers prefer to use digital-only banks, which can also be partially attributed totraditional banks’ digital transformation efforts to keep up with the rapidly changing expectations of the customers Nonetheless, more digital-only banks are expected to be launched and they will continue to add new features to their apps to make themselves more competitive in the current landscape.

Categories:

Keywords:Digital Bank, Technology, KYC

Digital-only banks pose serious challenges to the traditional financial services industry with their entirely new banking experience. However, for most of them, licensing, scale and profitability are the three key issues they must face going forward.

June 01, 2018 | Wendy Weng- Compared to Europe and the US, most digital-only players in Asia and the Middle East and Africa have commercial banks behind them

- Digital-only banks have sufficient potential to transform the financial services landscapes of the countries in which they operate

- More digital-only banks are expected to be launched who will continue to add new features to their apps to make themselves more competitive in the current landscape

Digital-only banks come in a variety of forms - from pure digital banks to small store networks in the emerging markets - where electronic know your customer (e-KYC) is not yet fully approved. Outside Japan (most of them in Asia), these banks have emerged from nowhere in the last two years as the map illustrates (Figure 1).

Compared to Europe and the US, most digital-only players in Asia and the Middle East and Africa have commercial banks behind them. For example, Vietnam's first digital bank Timo is powered by the back office of Vietnam Prosperity Bank. Jibun Bank in Japan is a joint venture between Bank of Tokyo-Mitsubishi UFJ and the mobile network operator, KDDI. Liv and Mashreq Neo in the United Arab Emirates, Tyme in South Africa and Jenius in Indonesia are set up and funded by commercial banks. Some of them have originated from popular messaging applications such as Kakao Talk in Korea and WeChat Pay in China.

Although there are some problems facing digital-only banks, they have sufficient potential to transform the financial services landscapes of the countries in which they operate. They have applied radical new technologies to ensure more accurate customer identities for authentication and to meet KYC obligations.

Gaining a banking licence is a tough process for digital-only banks. In the UK, the process has been streamlined in recent years to encourage competition. However, it still took Starling Bank 18 months to receive the restricted banking license and 25 months to obtain the full banking license. When the bank announced its plans in November 2014, it had hoped to receive its banking licence in six months.

In addition, acquiring new customers is a major priority for most of them rather than making a profit. Digital-only banks have taken various measures to attract new customers. The majority of them are still making losses and some are expected to be profitable in the near future. London-based Revolut, for instance, made a pre-tax loss of $9.8 million (£7.1 million) in 2016, and Monzo reported a pre-tax loss of $10.9 million (£7.9 million) for the same period.

N26

N26 is an online-only, traveller-friendly bank based in Berlin, Germany. N26 is using Mambu’s flagship core system, provided on a software-as-a-service basis. N26 migrated to Mambu’s platform once it obtained its own banking licence late in late 2016. Prior to that, it used the services of a partner bank.

Since its launch in 2015, N26 has expanded rapidly into 17 European countries including Austria, France, Portugal, Ireland, Italy, Spain, and the Netherlands. N26 has announced plans to launch in the UK and the US in 2018. The bank’s customer base reaches 500,000 in August 2017, up from 100,000 in January 2016. The growth is primarily based on referrals from existing customers, according to the bank. Valentin Stalf, the founder and chief executive officer (CEO) of N26, said that N26 expects to have a 5% to 10% share of the market in the main countries where it operates within three years.

The account opening process takes on average eight minutes and can be completed via a video chat with its customer support team. However, N26’s identity verification partner, IDnow, only supports certain passports and ID cards. The holders of other passports and ID cards have to visit a German post office if it is supported by Postident.

N26 offers a free basic current account and two different premium MasterCard products, N26 Black and N26 Metal, and has consistently expanded the product range surrounding its bank account. For a cost of $7.3 (€5.90) per month, the N26 Black card customers are offered fee-free foreign currency automated teller machine (ATM) withdrawals worldwide and a comprehensive insurance package from Allianz Global Assistance Europe that includes travel, health, mobile phone or cash theft, as well as extended warranty for electronic devices. The N26 Metal card comes with all the benefits of the black card, plus dedicated customer service and access to preferential rates and special partner offers like free co-working days with WeWork.

O-Bank Taiwan

O-Bank has become the first, all-digital, online-only bank in the Taiwan, and only serves customers via mobile, video, voice and other online banking channels. The bank was formerly known as Industrial Bank of Taiwan, and has transformed into a commercial bank since January 2017.

O-Bank is using Avaya’s multi-channel customer engagement technologies, such as Avaya Breeze. The new platform allows O-Bank to quickly and easily allocate internal resources to deliver the most appropriate and efficient services, thus creating sustainable improvements in the quality and consistency of the customer experience across channels.

O-Bank has established the video service centre with advanced technologies and is the first Taiwan bank to provide 24-hour full media with video for customer engagement. Avaya’s solutions enable O-Bank to easily integrate multi-channel communications into its mobile apps and web pages, with the flexibility to support different scenarios for various business processes and to accommodate regulatory requirements.

Stringent guidelines for identity authentication and security set by the Bankers Association of the Republic of China have been obstacles to O-bank’s mobile-focused strategy, said Jerry Sung, O-Bank chief retail banking officer and senior executive vice president. The limits imposed on digital accounts opened online makes it impossible for clients to send funds or pay bills on behalf of others. O-Bank has been in talks with the Bankers Association of the Republic of China since March 2017. It urged its peers to be more open to revising security rules, which will enable more services to be delivered via connected mobile devices.

The robo-advisory service has been launched, targeting young consumers who are often overlooked by major banks’ wealth management businesses. Consumers can participate with small amounts under its advisory management. O-bank’s products are focused on cash rewards and discounts to attract younger clients. More than 20% of new clients have been referred by existing customers. It’s expected that the bank will have 100,000 digital bank accounts in the near future, representing 30% of the market.

Paytm Payments Bank

Paytm, the India’s largest mobile payment & commerce platform, had announced a beta launch of its payments bank in May 2017. The bank was formally launched in November 2017. Paytm Payments Bank is a mobile-first bank with no minimum balance requirement and zero charges on all online transactions, and aims to turn into a vertically-integrated financial services company. The bank is expected to be profitable in the next two-three years and is targeting to achieve 500 million customers by 2020.

All Paytm wallet current users have been automatically transferred to the banks’ new facilities; except for those have not used their wallets in the last six months with zero balance. These users are required to login again to move to the Paytm Payments Bank. The bank will allow five free monthly cash withdrawals from any ATM in non-metro locations and charges of $0.3 (INR20) per transaction thereafter. Only three free monthly transactions will be allowed from any ATM in metro cities.

The payments banks can take deposits and remittances but cannot give out loans or issue credit cards like normal banks. Paytm Payments Bank will partner with other banks to offer various lending services as well as financial services products. The bank allows deposit of upto$ 1,550 (INR1 lakh) and offers cashbacks of $3.9 (INR250) on depositing $387.5 (INR25, 000) into the bank account, up to four times per month. The promotion is subject to change without prior notice, and thus this could be an introductory offer. The bank pays an interest rate of 4% on bank deposits, while Airtel Payments Bank and India Post Payments Bank offer 7.25% and 5.5% interest on saving accounts, respectively.

Paytm Payments Bank has partnered with Induslnd Bank, as the payments banks are also not permitted to keep over $1,550 (INR100, 000) in an account at the end of the day. They introduced first-of-its kind facility to create a fixed deposit when the customer balance exceeds $1,550at the end of day. The bank said customers can redeem their deposits instantly, anytime without paying any pre-closure or miscellaneous charges and earn up to 6.85% annual interest. In addition, the bank has partnered with online learning platform Start-up Village Collective (SV.CO) to support women to join leadership roles in technology and engineering companies, and with the Mumbai Dabbawala Association, the pioneers of home-cooked food delivery, to help dabbawalas collect instant payments for their Dabba service through Paytm QR.

In order to attract corporate entitiesthat are already using Paytm e-wallet services to shift employees’ salary accounts to the bank, Paytm Payments Bank also provides digital offerings such as food and gift wallets and reimbursement solutions for the employees. Customers are able to use their food and gift wallets issued by corporate entities through the app across the merchant base of Paytm.

Pepper

Bank Leumi officially launchedPepper in June 2017, Israel’s first digital-only bank. It was developed over two years at a cost of $42.6 million (ILS150 million). The bank hired over 150 employees, many of them are technological professions. The online on-boarding process takes only eight minutes and it requires no account management fees. However, to open a Pepper account, customer must already have an account at an existing institution.

Pepper doesn’t have its own banking license, and operates separately from Bank Leumi’s core business. It makes a profit by selling deposits, credit, securities, and other products. It is expected that Pepper will be profitable within two to three years.

Pepper will be three apps, including Pepper Banking, Pepper Pay and Pepper Invest. These apps are linked with a single sign-on. The Pepper Banking provides access to checking accounts, savings accounts, credit cards and loans. Pepper Pay, launched in February 2017, allows customers of all Israeli banks to transfer money to any beneficiary from their mobile phone contact list. Pepper Invest is due to launch by early 2018 and will enable trading in securities.

Pepper’s core banking processes run on Swiss banking software vendor Temenos’ core banking system. The Temenos’ T24 platform underpins the back-office operations, and the Temenos Connect digital channel software supports the front-end. Temenos drives the 24/7 real-time digital banking experience and enables Pepper to provide a user-friendly interface and personalised services along with immediate alerts about unusual activity.

Meanwhile, the bank partnered with the strategic design firm Design it to develop the entirely new product-service experience, using “design thinking” methodologies. The process involved intensive collaboration between Design it’s team of strategist, designers and technologists and Pepper’s product, marketing and development teams, and constant user-based feedback and typography.

Starling Bank

Starling Bank was founded in 2014 and granted a restricted UK banking license by the financial regulators in July 2016 and full banking licence in April 2017. Starling spent $11.4 million (£8.3 million) building its app-only banking platform in 2016, according to accounts filed with Companies House. The accounts show the start-up made a pre-tax loss of $5.9 million (£4.3 million) in 2016 and had an income of just $17,695 (£12, 834), mainly from interest on balances held at other banks. Starling Bank will definitely be profitable by the end of 2019 according to its CEO.

The partnership between Starling Bank and TransferWise allows Starling customers to make transfers from the UK to bank accounts in 35 currencies, including euros, rupees and dollars. The money transfer service requires a smaller upfront fee than traditional UK banks, and also use the real exchange rate.

Starling also intends to offer business accounts to entrepreneurs, small businesses and sole traders in early 2018. It announced its partnership with mobile invoice and expense platform Albert in December 2017. The integration of Starling accounts with the Albert platform will simplify daily bookkeeping tasks for consumers. The linked accounts will automatically match the transactions from Starling Bank with the invoices sent from the Albert app, and the two can be reconciled in a single tap.

Starling launched its Marketplace in September 2017, a concept which allows third-parties to add their products to an ecosystem accessible through the Starling app. In December 2017, it was granted permissions to offer a full product range through the Marketplace app. Starling has partnered with financial services providers such as PensionBee, Wealth simple, Kasko, and Habito, which will allow Starling customers to access products including pensions, savings, insurance and mortgage brokers via their smartphone. Starling is targeting 25 more partnerships in 2018.

Starling Bank has become the first of the UK digital-only banks to become direct member and participant of the single euro payments area (SEPA) payments system, which will stimulate their expansion into Europe. The system will support the bank’s payment services business for both retail and wholesale banking. Starling has secured its banking passport into Europe in June 2017, and is targeting expansion in Ireland in the first quarter of 2018. The bank plans a further $54 million (£40 million) fundraising in the middle of 2018 to help fuel expansion into markets beyond the UK.

More efforts needed to increase competitiveness

Digital-only banks are redefining the banking industry and are creating unique and differentiated customer experiences. Although they face a number of key issues as previously discussed, they are enjoying significant attention, experiencing continuous growth in terms of the number of customers signing up with them and many of their customers are interacting regularly with their apps. However, only a small proportion of customers prefer to use digital-only banks, which can also be partially attributed totraditional banks’ digital transformation efforts to keep up with the rapidly changing expectations of the customers Nonetheless, more digital-only banks are expected to be launched and they will continue to add new features to their apps to make themselves more competitive in the current landscape.

Categories:

Keywords:Digital Bank, Technology, KYC