Artificial intelligence (AI) is set to transform retail banking, impacting the customer journey from acquisition on through to retention.

December 06, 2018 | Richard Hartung- Customer service via chatbots is currently a key focus for AI usage

- AI in marketing, fraud risk management and automation may deliver even greater value

- AI delivers results by finding unknown unknowns and what people really want

Approaches to AI vary widely

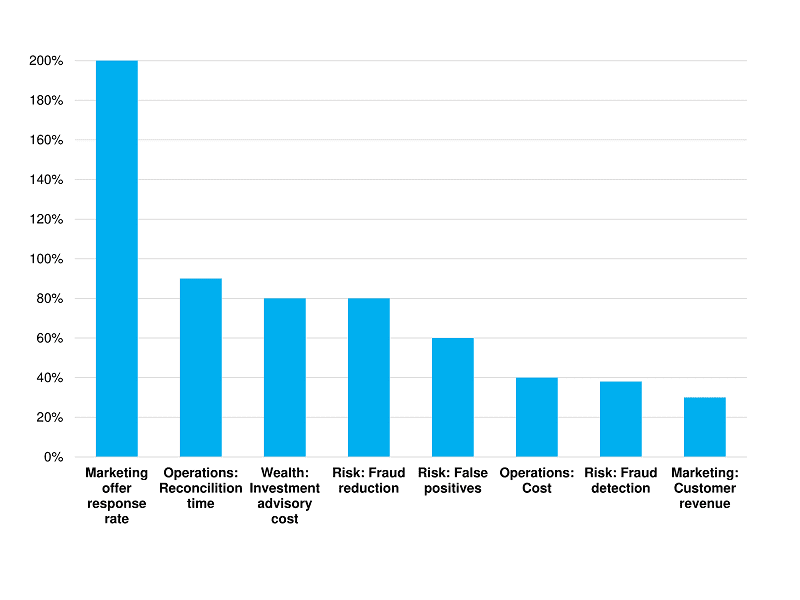

Even though usage of AI at most financial institutions (FIs) is still at a nascent stage, the impact on FIs that use it well are stunning. Marketing is tremendously more effective, as Table 1 below indicates, and fraud and operations costs can plummet.

Table 1: Improvements resulting from AI usage in retail banks

AI has resulted in massive improvements in retail banking, with some FIs even reporting improvements that are multiples of results in the table above. Experts expect the impact to grow substantially as banks gain more experience with it.

Source: Asian Banker research

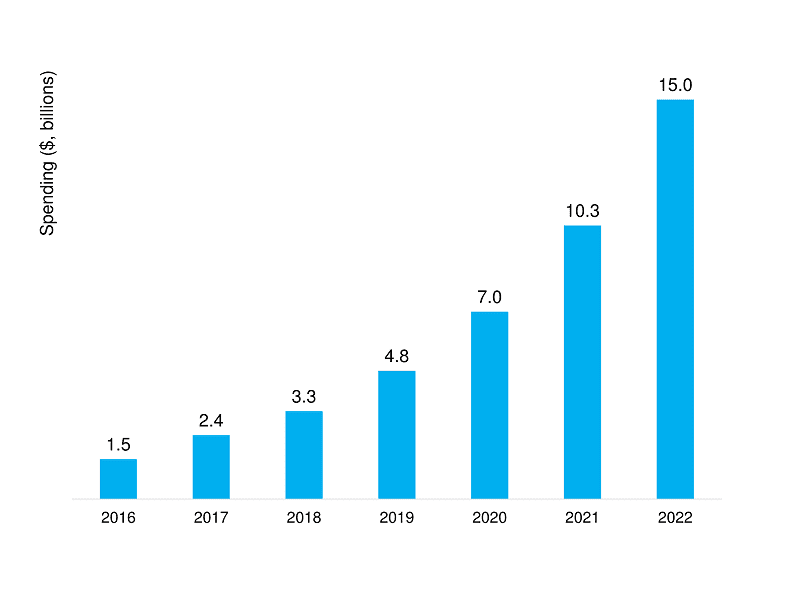

While spending on AI varies widely, with some banks spending $3 million or less annually and others spending billions, the total spent on AI is forecast to increase dramatically, as shown in Table 2. Goldman Sachs also estimates that AI-enabled cost savings and revenue growth could total £33 billion ($46 billion) annually by 2025.

Table 2: Forecast spending by banks on AI

spending on AI is already high and is likely to increase nearly 50% per year over the next several years, as banks strive to increase their competitiveness and improve the customer experience.

Source: Asian Banker Research...

Categories:

Artificial intelligence (AI) is set to transform retail banking, impacting the customer journey from acquisition on through to retention.

December 06, 2018 | Richard Hartung- Customer service via chatbots is currently a key focus for AI usage

- AI in marketing, fraud risk management and automation may deliver even greater value

- AI delivers results by finding unknown unknowns and what people really want

Approaches to AI vary widely

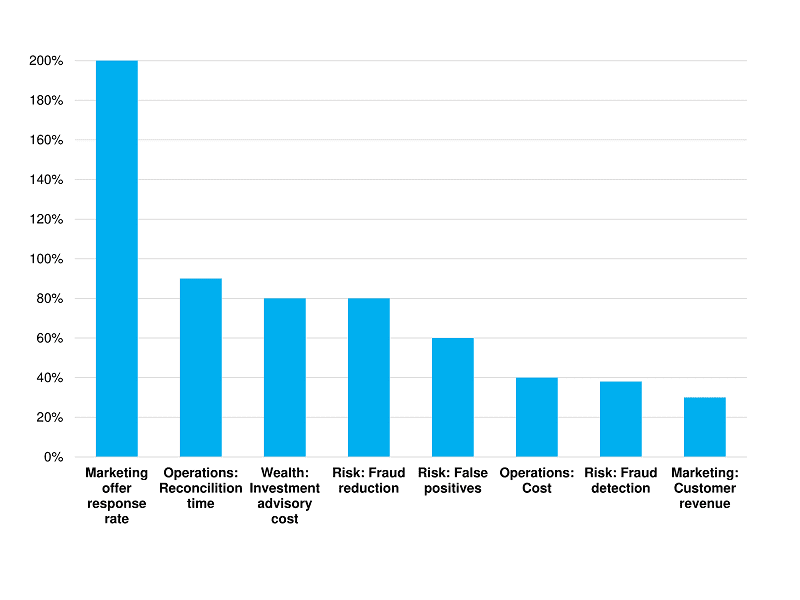

Even though usage of AI at most financial institutions (FIs) is still at a nascent stage, the impact on FIs that use it well are stunning. Marketing is tremendously more effective, as Table 1 below indicates, and fraud and operations costs can plummet.

Table 1: Improvements resulting from AI usage in retail banks

AI has resulted in massive improvements in retail banking, with some FIs even reporting improvements that are multiples of results in the table above. Experts expect the impact to grow substantially as banks gain more experience with it.

Source: Asian Banker research

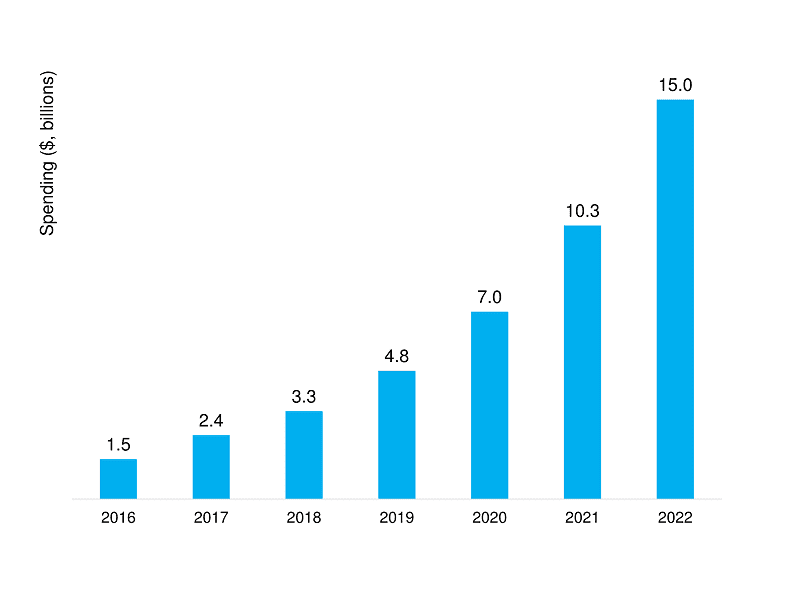

While spending on AI varies widely, with some banks spending $3 million or less annually and others spending billions, the total spent on AI is forecast to increase dramatically, as shown in Table 2. Goldman Sachs also estimates that AI-enabled cost savings and revenue growth could total £33 billion ($46 billion) annually by 2025.

Table 2: Forecast spending by banks on AI

spending on AI is already high and is likely to increase nearly 50% per year over the next several years, as banks strive to increase their competitiveness and improve the customer experience.

Source: Asian Banker Research...

Categories: