Despite losing over $610 million worth of cryptocurrencies to a cyber hack, touted as the largest of its kind, Poly Network was able to recover all assets shortly after. What does the increasing number of cyber thefts, and this particular case, say about the security of decentralised finance?

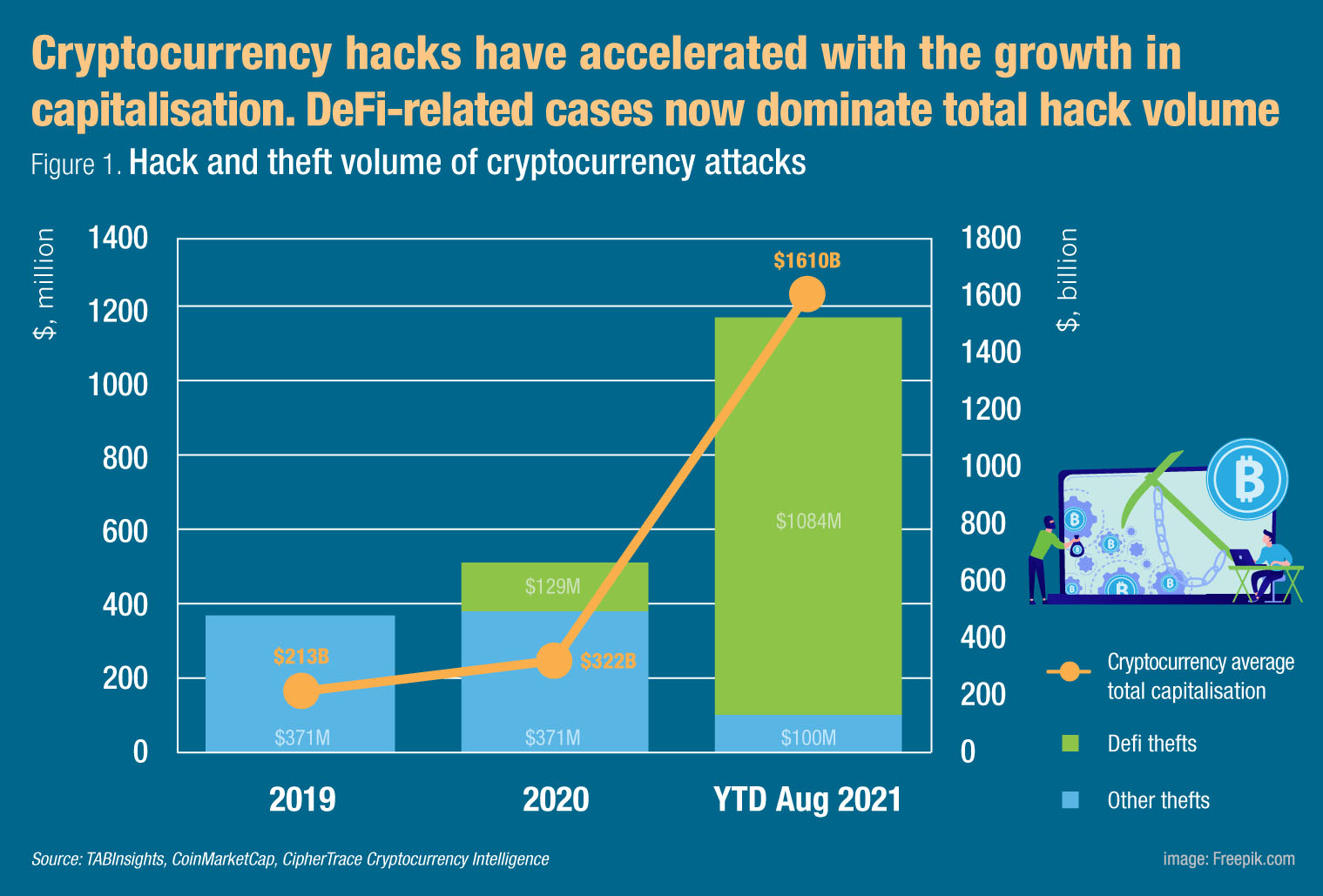

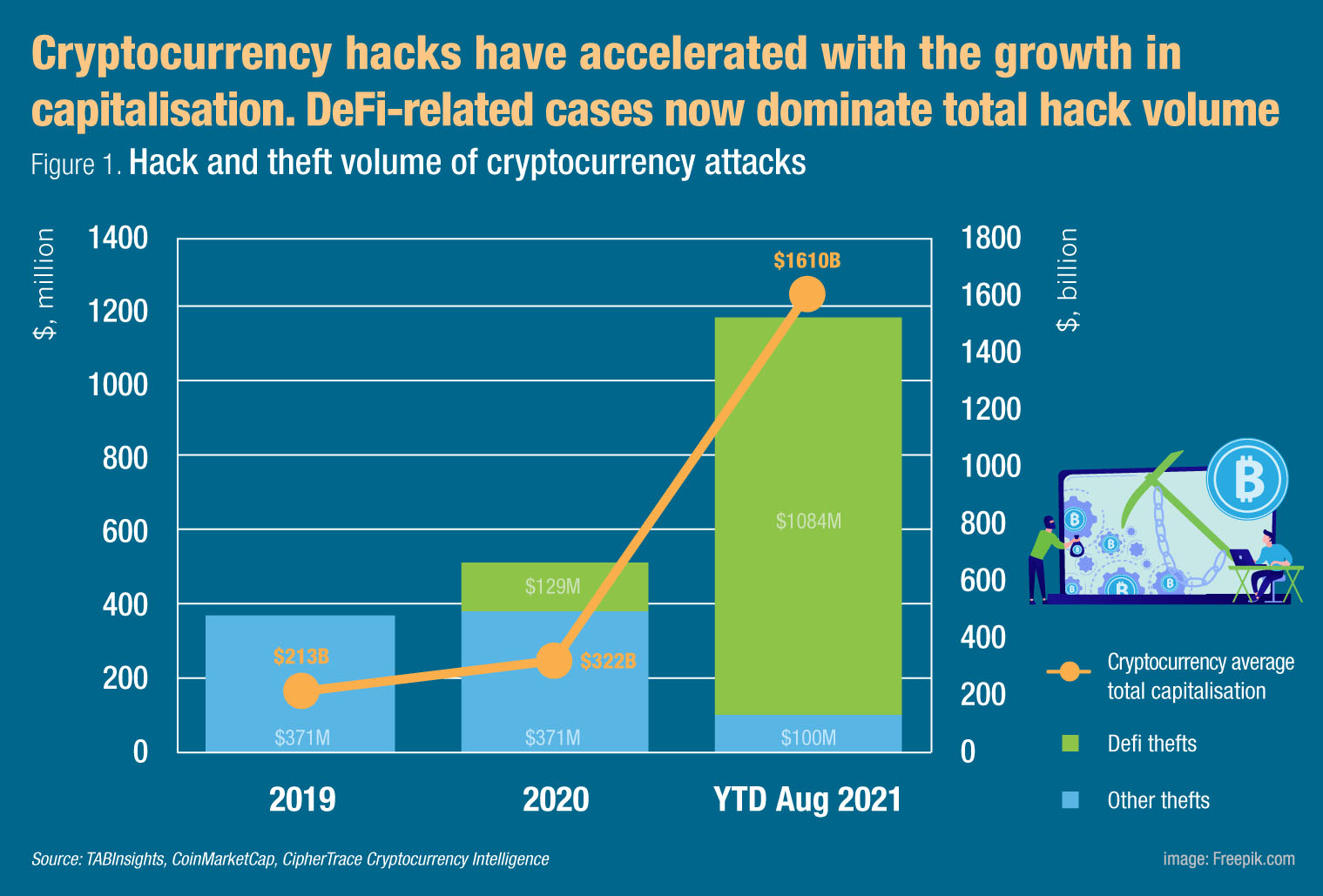

September 06, 2021 | Foo Boon PingThe explosive growth in cryptocurrency and digital token investment has seen the value of this new asset class reach record highs. According to crypto market reference data provider, CoinMarketCap, the average total capitalisation of all cryptoassets, including stablecoins and tokens, hit $1.6 trillion in August 2021, breaching the $2 trillion mark for the first time earlier in April.

Besides professional and institutional investors, cryptocurrency adoption has also surged among more grassroots users. Retail consumers concerned about the economic fallout of the pandemic, skyrocketing inflation and local currency depreciation, have resorted to cryptocurrencies for peer-to-peer transfers and savings.

Global cyrpto adoption spiked

Blockchain analytic firm Chainalysis reported that global crypto adoption grew by over 881% in 2020, especially in Asia. Vietnam and India ranked first and second while Thailand, China and the Philippines were among the top 15 adopter nations. The increase in adoption was driven apparently by the growth of decentralise finance (DeFi) in these markets. DeFi as the name suggests is a self-regulating decentralised form of finance that does not rely on traditional centralised financial intermediaries such as brokerages, exchanges, or banks but instead utilises smart contract protocols on blockchains to enable direct, open and public peer-to-peer transactions. Ultimately, the success of DeFi rests on the use of distributed ledger technology to provide a high level of transactional transparency and security that replicates, or supersedes the trusted platforms that centralised intermediaries were created to facilitate.

Hac...

Categories: Keywords:Blockchain, Cryptocurrency, Decentralise Finance, Distributed Ledger Technology

Despite losing over $610 million worth of cryptocurrencies to a cyber hack, touted as the largest of its kind, Poly Network was able to recover all assets shortly after. What does the increasing number of cyber thefts, and this particular case, say about the security of decentralised finance?

September 06, 2021 | Foo Boon PingThe explosive growth in cryptocurrency and digital token investment has seen the value of this new asset class reach record highs. According to crypto market reference data provider, CoinMarketCap, the average total capitalisation of all cryptoassets, including stablecoins and tokens, hit $1.6 trillion in August 2021, breaching the $2 trillion mark for the first time earlier in April.

Besides professional and institutional investors, cryptocurrency adoption has also surged among more grassroots users. Retail consumers concerned about the economic fallout of the pandemic, skyrocketing inflation and local currency depreciation, have resorted to cryptocurrencies for peer-to-peer transfers and savings.

Global cyrpto adoption spiked

Blockchain analytic firm Chainalysis reported that global crypto adoption grew by over 881% in 2020, especially in Asia. Vietnam and India ranked first and second while Thailand, China and the Philippines were among the top 15 adopter nations. The increase in adoption was driven apparently by the growth of decentralise finance (DeFi) in these markets. DeFi as the name suggests is a self-regulating decentralised form of finance that does not rely on traditional centralised financial intermediaries such as brokerages, exchanges, or banks but instead utilises smart contract protocols on blockchains to enable direct, open and public peer-to-peer transactions. Ultimately, the success of DeFi rests on the use of distributed ledger technology to provide a high level of transactional transparency and security that replicates, or supersedes the trusted platforms that centralised intermediaries were created to facilitate.

Hac...

Categories: Keywords:Blockchain, Cryptocurrency, Decentralise Finance, Distributed Ledger Technology