Technology, the game changer in climate-risk disclosure by companies seeking ESG investors

By Chris Kapfer

The lack of a global standard for disclosure for companies reporting climate-related risks and opportunities have led central banks to propose technology to improve investment strategies

- Lack of reliable data merge is the biggest challenge in dealing with climate risk

- Technology can address the gap in reliable data and reduce ESG compliance cost

- Benefits the financial sector during its transition to sustainability

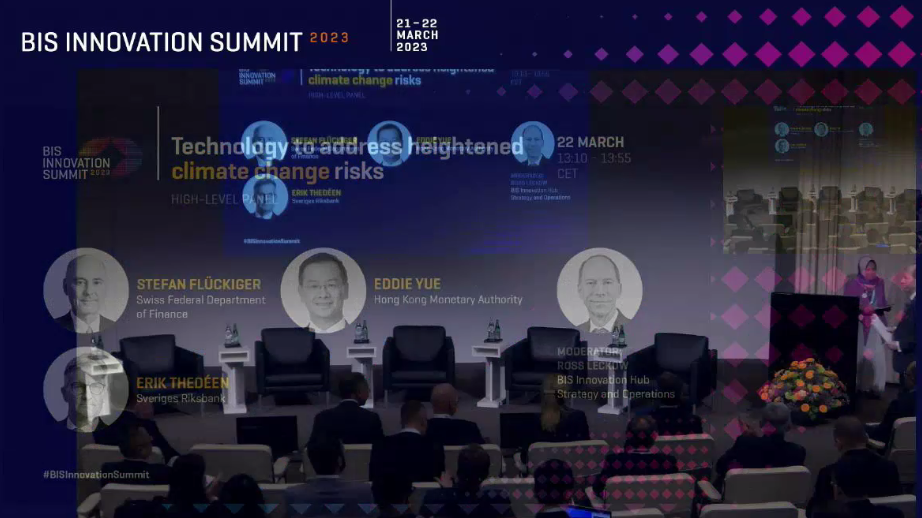

Banks and investment firms are recognising the importance of incorporating climate risk into their decision-making processes to achieve long-term financial stability. At the BIS Innovation Summit held in March 2023 delegates revealed that the biggest challenge when dealing with the subject of climate risk is the lack of reliable data.

This can be attributed to the lack of a global standard for disclosure and the cost for the private sector to fully disclose the data based on various climate taxonomies. Climate change is one of the most pressing issues of our time, and its impact on the global economy is becoming increasingly clear.

Erik Thedeen, governor of Riksbank said: “Many of the international organisations are lagging when it comes to taking initiatives in climate change.”

Lack of reliable data merge is the biggest challenge in dealing with climate risk

The lack of a global standard for disclosure means there is no consistent and uniform way for companies to report climate-related risks and opportunities. This makes it difficult for investors to compare and evaluate different companies to create investment strategies that adhere to environmental, social and governance (ESG) principles.

Without a common standard, companies may choose to disclose only information that is favourable to them, rather than providing a complete picture of their climate-related risks and opportunities. This hinders the ability of investors to make informed decisions based on reliable data around ESG initiatives

The cost of fully disclosing climate-related data is another major barrier. Many companies are reluctant to disclose such information due to the high costs involved. These are costs associated with data collection, analysis and reporting. For smaller companies, these costs can be particularly prohibitive.

Technology can address the lack of reliable data and lower ESG compliance cost

Technology could provide a centralised net-zero data platform that everyone can access. Such a platform could act as a hub for climate-related data that enables companies to report their data in a standardised format. Investors can compare the climate risks and opportunities of different companies more efficiently when the data provides a complete picture of individual companies.

Stefan Fluckiger, deputy state secretary for international finance at the Federal Department of Finance of Switzerland said: “The net-zero public data utility that everybody can access will be one of the game changers.”

In addition to providing a platform for data reporting, technologies such as artificial intelligence, machine learning and cloud computing can also help small banks to do modelling and data analytics. This can be particularly valuable for smaller institutions that may lack the resources to conduct comprehensive climate-related risk assessments. By leveraging technology, these institutions can better understand their exposure to climate risks.

Technology can benefit the financial sector during its transition to sustainability

The Hong Kong Monetary Authority (HKMA) has leveraged blockchain technology to facilitate green bond issuance. The platform enables issuers to demonstrate the authenticity and integrity of their green bond offerings, providing greater transparency and accountability to investors. This helps to build confidence in green bonds, that are a key instrument for financing the transition to a low-carbon economy.

Eddie Yue, chief executive of the HKMA said: “Technology-wise, it is easy, but there are still policies and organisational issues that we need to think about.”

Climate risk is not the only one that central banks need to consider. Other risks, including the unknown, could have a significant impact on the financial system. It is important to take a holistic approach to risk management and use technology to ensure that the financial system is resilient to a wide range of potential perils.

Keywords: Technology, Risk, AI, Machine Learning, Climate Change, ESG

Institution: Riksbank, HKMA

Country: Hong Kong, Switzerland

People: Erik Thedeen, Eddie Yue, Stefan Fluckiger

Leave your Comments