The Asian Banker recently updated the bank profile of Asia Commercial Bank. The bank is focused on boosting its competitiveness in the Vietnamese market.

September 05, 2016 | Research- Vietnam’s banking sector has undergone a radical restructuring in the past four years

- ACB has focused on developing better customer experience and boosting competitiveness in the market

- ACB has struggled with bad loans although it expects to recover around VND2 trillion ($80 million) this year

Overview

- Vietnam’s banking sector – which had been fragmented into several small entities and plagued by high level of non-performing assets (NPAs) and other inefficiencies – has been undergoing a radical restructuring for the past four years. Under the banking restructuring scheme, the country aims to reduce the number of banks to less than 20 by 2020, and to form one to two large banks that have similar scales as other banks in Southeast Asia. The consolidation process has involved several mergers and acquisitions (M&As) and the number of banks has whittled down to 34 state-owned and commercial lenders from more than 40. Combined assets increased from VND5 quadrillion ($200 billion) to VND6.6 quadrillion ($264 billion) and the non-performing loan ratio reduced to 3.5% in 2015 from 10%.

- In 2016, the State Bank of Vietnam reduced the dong’s reference rate after it had decided to move to a more market-based methodology in setting a daily reference rate versus the dollar. The new methodology calculates the daily reference rate based on a weighted average of dong prices in the interbank market the previous trading day and prices of eight major foreign currencies at 7:00 a.m. in Hanoi. The eight currencies are from the U.S., China, European Union, Japan, Taiwan, South Korea, Thailand, and Singapore.

Asia Commercial Bank (ACB)

- Asia Commercial Joint Stock Bank (ACB) was founded in Ho Chi Minh City in 1993. The bank has over 350 branches and sub-branches nationwide with around 9,935 employees at the end of 2015.

- ACB stresses on the primary importance of the customer by developing better customer experience and boosting competitiveness on the basis of its core values. ACB is positioning itself as the leading bank over the next five years with a new brand image and breakthrough improvements in terms of product development, risk management, operation process, and IT.

Leadership Profile – Tran Hung Huy, Chairman

- Trần Hùng Huy was appointed chairman of the board on April 26, 2013. He is also chairman of the board personnel committee, bad debt write-off committee, and member of the board strategy committee.

- He joined ACB as marketing director in 2002 and was appointed executive vice president in 2008. He earned his experience in investment banking while working as an assistant to the manager of the M&A advisory team at Rothschild Group (UK) from 2010-2011.

- He gained his bachelor’s degree with three majors in business administration, finance, and international business in 2000 and MBA in 2002 at Chapman University (USA). In 2011, he received his DBA at Golden Gate University (USA).

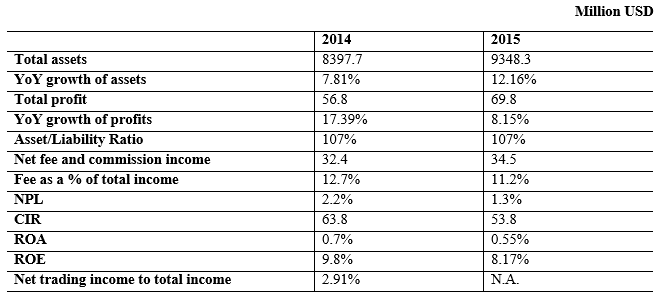

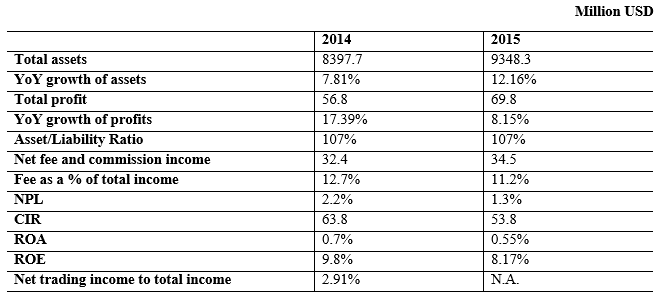

Financial Performance of ACB in 2015

Analyst Comments and Ratings

- April 2016: Fitch Ratings affirmed ACB at 'B’ with a stable outlook.

- October 2015: Moody's Investors Service upgraded the long-term deposit and issuer ratings of Asia Commercial Bank (ACB) to B2 from B3.

- Moody's also upgraded ACB's baseline credit assessment (BCA) and adjusted BCA to b3 from caa1.

- Moody's changed the outlook on the long-term deposit and issuer ratings to stable from positive.

Latest News on Asia Commercial Bank (ACB)

- June 2016: Asia Commercial Bank (ACB) has struggled with around VND5.7 trillion ($256.3 million) in bad debt caused by six enterprises associated with its former vice chairman Nguyen Duc Kien. Nevertheless, the bank announced that mortgaged assets of the six firms are enough to settle their loans. Debt settlement solutions were also approved by the central bank. The bank expects to recover around VND2 trillion ($80 million) this year. ACB also plans to set aside VND1 trillion ($40 million) for risk provisions for the six firms’ overdue loans, including VND200 billion ($8 million) in the first quarter of 2016.

- May 2016: ACB tapped Dimension Data to refresh its legacy infrastructure and improve workplace collaboration through a private cloud platform. Mobile, cloud, and social media technologies were also implemented to improve work productivity and employee satisfaction.

- April 2016: Asia Commercial Bank held its annual general meeting. According to the 2016 plan, ACB’s total assets are expected to grow by 18%. Total deposits and outstanding loans will increase by 18%. Profit before tax is expected to reach VND1, 503 billion ($60 million), increasing by 17% as compared to 2015, while NPL ratio will be below 3%.

- December 2015: ACB and JCBI launched the ACB-JCB Prepaid Card to meet the demands of customers in Vietnam. Holders of the ACB-JCB Prepaid Card are able to access the JCB acceptance network with about 29 million merchants and over one million ATMs in 190 countries and territories. With ACB-JCB Prepaid card, customers can spend their money in the card account without a minimum deposit requirement.

Categories:

Data & Analytics, Financial Institutions, Markets & Exchanges, Retail Banking, VietnamKeywords:ACB, Loans, Retail Banking

The Asian Banker recently updated the bank profile of Asia Commercial Bank. The bank is focused on boosting its competitiveness in the Vietnamese market.

September 05, 2016 | Research- Vietnam’s banking sector has undergone a radical restructuring in the past four years

- ACB has focused on developing better customer experience and boosting competitiveness in the market

- ACB has struggled with bad loans although it expects to recover around VND2 trillion ($80 million) this year

Overview

- Vietnam’s banking sector – which had been fragmented into several small entities and plagued by high level of non-performing assets (NPAs) and other inefficiencies – has been undergoing a radical restructuring for the past four years. Under the banking restructuring scheme, the country aims to reduce the number of banks to less than 20 by 2020, and to form one to two large banks that have similar scales as other banks in Southeast Asia. The consolidation process has involved several mergers and acquisitions (M&As) and the number of banks has whittled down to 34 state-owned and commercial lenders from more than 40. Combined assets increased from VND5 quadrillion ($200 billion) to VND6.6 quadrillion ($264 billion) and the non-performing loan ratio reduced to 3.5% in 2015 from 10%.

- In 2016, the State Bank of Vietnam reduced the dong’s reference rate after it had decided to move to a more market-based methodology in setting a daily reference rate versus the dollar. The new methodology calculates the daily reference rate based on a weighted average of dong prices in the interbank market the previous trading day and prices of eight major foreign currencies at 7:00 a.m. in Hanoi. The eight currencies are from the U.S., China, European Union, Japan, Taiwan, South Korea, Thailand, and Singapore.

Asia Commercial Bank (ACB)

- Asia Commercial Joint Stock Bank (ACB) was founded in Ho Chi Minh City in 1993. The bank has over 350 branches and sub-branches nationwide with around 9,935 employees at the end of 2015.

- ACB stresses on the primary importance of the customer by developing better customer experience and boosting competitiveness on the basis of its core values. ACB is positioning itself as the leading bank over the next five years with a new brand image and breakthrough improvements in terms of product development, risk management, operation process, and IT.

Leadership Profile – Tran Hung Huy, Chairman

- Trần Hùng Huy was appointed chairman of the board on April 26, 2013. He is also chairman of the board personnel committee, bad debt write-off committee, and member of the board strategy committee.

- He joined ACB as marketing director in 2002 and was appointed executive vice president in 2008. He earned his experience in investment banking while working as an assistant to the manager of the M&A advisory team at Rothschild Group (UK) from 2010-2011.

- He gained his bachelor’s degree with three majors in business administration, finance, and international business in 2000 and MBA in 2002 at Chapman University (USA). In 2011, he received his DBA at Golden Gate University (USA).

Financial Performance of ACB in 2015

Analyst Comments and Ratings

- April 2016: Fitch Ratings affirmed ACB at 'B’ with a stable outlook.

- October 2015: Moody's Investors Service upgraded the long-term deposit and issuer ratings of Asia Commercial Bank (ACB) to B2 from B3.

- Moody's also upgraded ACB's baseline credit assessment (BCA) and adjusted BCA to b3 from caa1.

- Moody's changed the outlook on the long-term deposit and issuer ratings to stable from positive.

Latest News on Asia Commercial Bank (ACB)

- June 2016: Asia Commercial Bank (ACB) has struggled with around VND5.7 trillion ($256.3 million) in bad debt caused by six enterprises associated with its former vice chairman Nguyen Duc Kien. Nevertheless, the bank announced that mortgaged assets of the six firms are enough to settle their loans. Debt settlement solutions were also approved by the central bank. The bank expects to recover around VND2 trillion ($80 million) this year. ACB also plans to set aside VND1 trillion ($40 million) for risk provisions for the six firms’ overdue loans, including VND200 billion ($8 million) in the first quarter of 2016.

- May 2016: ACB tapped Dimension Data to refresh its legacy infrastructure and improve workplace collaboration through a private cloud platform. Mobile, cloud, and social media technologies were also implemented to improve work productivity and employee satisfaction.

- April 2016: Asia Commercial Bank held its annual general meeting. According to the 2016 plan, ACB’s total assets are expected to grow by 18%. Total deposits and outstanding loans will increase by 18%. Profit before tax is expected to reach VND1, 503 billion ($60 million), increasing by 17% as compared to 2015, while NPL ratio will be below 3%.

- December 2015: ACB and JCBI launched the ACB-JCB Prepaid Card to meet the demands of customers in Vietnam. Holders of the ACB-JCB Prepaid Card are able to access the JCB acceptance network with about 29 million merchants and over one million ATMs in 190 countries and territories. With ACB-JCB Prepaid card, customers can spend their money in the card account without a minimum deposit requirement.

Categories:

Data & Analytics, Financial Institutions, Markets & Exchanges, Retail Banking, VietnamKeywords:ACB, Loans, Retail Banking