Vietnam Eximbank struggles amid market volatility

The Asian Banker recently updated the bank profile of Vietnam Eximbank.

September 05, 2016 | Research- Vietnam’s banking sector undergoes a consolidation process as part of a restructuring scheme

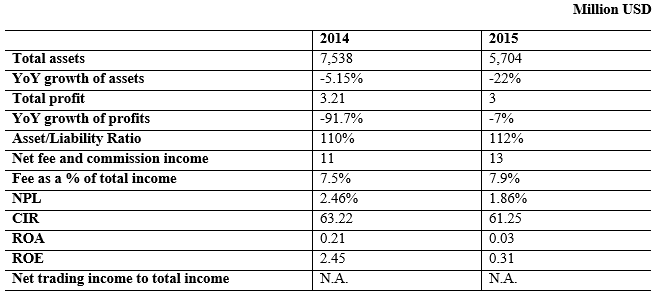

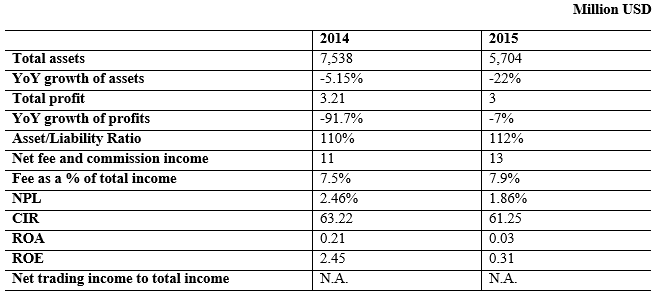

- Eximbank’s total assets fell from $7,538 million in 2014 to $5,704 million in 2015

- Eximbank’s spending on bad debt settlement in 2015 amounted to about VND1.2 trillion ($52 million)

Overview

- Vietnam’s banking sector – which had been fragmented into several small entities and plagued by high level of non-performing assets (NPAs) and other inefficiencies – has been undergoing a radical restructuring for the past four years. Under the banking restructuring scheme, the country aims to reduce the number of banks to less than 20 by 2020, and to form one to two large banks that have similar scales as other banks in Southeast Asia. The consolidation process has involved several mergers and acquisitions (M&As) and the number of banks has whittled down to 34 state-owned and commercial lenders from more than 40. Combined assets increased from VND5 quadrillion ($200 billion) to VND6.6 quadrillion ($264 billion) and the non-performing loan ratio reduced to 3.5% in 2015 from 10%.

- In 2016, the State Bank of Vietnam reduced the dong’s reference rate after it had decided to move to a more market-based methodology in setting a daily reference rate versus the dollar. The new methodology calculates the daily reference rate based on a weighted average of dong prices in the interbank market the previous trading day and prices of eight major foreign currencies at 7:00 a.m. in Hanoi. The eight currencies are from the U.S., China, European Union, Japan, Taiwan, South Korea, Thailand, and Singapore.

Eximbank

- Eximbank was established under the name of the Export-Import Bank of Vietnam (Vietnam Export Import Commercial Joint Stock Bank). The governor of the State Bank of Vietnam signed license No. 11 / NH-GP which allowed the bank to operate within 50 years with a registered chartered capital of VND50 billion.

- Eximbank has over 207 branches and transaction offices nationwide and has established correspondent relations with 869 banks in 84 countries.

Leadership profile – Le Minh Quoc, Chairman and Board Member

- He has been chairman at Eximbank since December 2015. He has also been deputy general director of Orient Commercial Joint Stock Bank since 2008.

- He has held executive positions in BNP Paribas in Canada, France, Singapore, and Taiwan. He served as chief executive officer of BNP Paribas Bank in Vietnam from 2005 to 2008.

- Quoc holds an MBA from the University of Lausanne - Switzerland.

Financial Performance of Eximbank in 2015

Analyst Comments and Ratings

- April 2016: Standard & Poor's Ratings Services placed its 'B+' long-term counterparty credit rating and 'axBB/axB' ASEAN regional scale ratings on Eximbank on CreditWatch with negative implications. At the same time, they affirmed the 'B' short-term counterparty credit rating.

Latest News on Eximbank

- March 2016: Eximbank appointed Le Van Quyet as new general director, with the nomination submitted to the State Bank of Vietnam (SBV) for final approval. It also moved Tran Tan Loc from the post of general director to the post of standing deputy general director. Quyet previously worked at SBV Dong Nai and was director of Vietcombank Dong Nai and director of Vietcombank Bien Hoa.

- December 2015: Eximbank’s spending on bad debt settlement amounted to about VND1.2 trillion ($52 million).The bank was expected to continue establishing provisional funds against non-performing loans after the soured loans reached VND1.54 trillion ($68 million) in 11 months. Bad loans fell by 28% from the figure recorded at the end of 2014, accounting for 1.8% of the bank's outstanding loans.

- November 2015: Vietnam Eximbank and Infosys signed a contract to deploy Infosys Finacle Core Banking software solution to gradually replace the existing core banking system. The adoption of the new core banking solution will enable Eximbank to create breakthroughs in developing more banking products and services, while conducting stricter and more efficient internal management.

- July 2015: Eximbank posted a very modest pre-tax aggregated profit of VND68 billion ($3.12 million) last year, falling by 91.5% against 2013 and meeting only 3% of the 2014 year's projection. Eximbank said they would not pay dividends to shareholders in 2015 and attributed bad business results to unpredictable market difficulties, especially in property markets.

Categories:

Data & Analytics, Financial Institutions, Markets & Exchanges, Retail Banking, VietnamKeywords:Eximbank, Assets, Loans

Vietnam Eximbank struggles amid market volatility

The Asian Banker recently updated the bank profile of Vietnam Eximbank.

September 05, 2016 | Research- Vietnam’s banking sector undergoes a consolidation process as part of a restructuring scheme

- Eximbank’s total assets fell from $7,538 million in 2014 to $5,704 million in 2015

- Eximbank’s spending on bad debt settlement in 2015 amounted to about VND1.2 trillion ($52 million)

Overview

- Vietnam’s banking sector – which had been fragmented into several small entities and plagued by high level of non-performing assets (NPAs) and other inefficiencies – has been undergoing a radical restructuring for the past four years. Under the banking restructuring scheme, the country aims to reduce the number of banks to less than 20 by 2020, and to form one to two large banks that have similar scales as other banks in Southeast Asia. The consolidation process has involved several mergers and acquisitions (M&As) and the number of banks has whittled down to 34 state-owned and commercial lenders from more than 40. Combined assets increased from VND5 quadrillion ($200 billion) to VND6.6 quadrillion ($264 billion) and the non-performing loan ratio reduced to 3.5% in 2015 from 10%.

- In 2016, the State Bank of Vietnam reduced the dong’s reference rate after it had decided to move to a more market-based methodology in setting a daily reference rate versus the dollar. The new methodology calculates the daily reference rate based on a weighted average of dong prices in the interbank market the previous trading day and prices of eight major foreign currencies at 7:00 a.m. in Hanoi. The eight currencies are from the U.S., China, European Union, Japan, Taiwan, South Korea, Thailand, and Singapore.

Eximbank

- Eximbank was established under the name of the Export-Import Bank of Vietnam (Vietnam Export Import Commercial Joint Stock Bank). The governor of the State Bank of Vietnam signed license No. 11 / NH-GP which allowed the bank to operate within 50 years with a registered chartered capital of VND50 billion.

- Eximbank has over 207 branches and transaction offices nationwide and has established correspondent relations with 869 banks in 84 countries.

Leadership profile – Le Minh Quoc, Chairman and Board Member

- He has been chairman at Eximbank since December 2015. He has also been deputy general director of Orient Commercial Joint Stock Bank since 2008.

- He has held executive positions in BNP Paribas in Canada, France, Singapore, and Taiwan. He served as chief executive officer of BNP Paribas Bank in Vietnam from 2005 to 2008.

- Quoc holds an MBA from the University of Lausanne - Switzerland.

Financial Performance of Eximbank in 2015

Analyst Comments and Ratings

- April 2016: Standard & Poor's Ratings Services placed its 'B+' long-term counterparty credit rating and 'axBB/axB' ASEAN regional scale ratings on Eximbank on CreditWatch with negative implications. At the same time, they affirmed the 'B' short-term counterparty credit rating.

Latest News on Eximbank

- March 2016: Eximbank appointed Le Van Quyet as new general director, with the nomination submitted to the State Bank of Vietnam (SBV) for final approval. It also moved Tran Tan Loc from the post of general director to the post of standing deputy general director. Quyet previously worked at SBV Dong Nai and was director of Vietcombank Dong Nai and director of Vietcombank Bien Hoa.

- December 2015: Eximbank’s spending on bad debt settlement amounted to about VND1.2 trillion ($52 million).The bank was expected to continue establishing provisional funds against non-performing loans after the soured loans reached VND1.54 trillion ($68 million) in 11 months. Bad loans fell by 28% from the figure recorded at the end of 2014, accounting for 1.8% of the bank's outstanding loans.

- November 2015: Vietnam Eximbank and Infosys signed a contract to deploy Infosys Finacle Core Banking software solution to gradually replace the existing core banking system. The adoption of the new core banking solution will enable Eximbank to create breakthroughs in developing more banking products and services, while conducting stricter and more efficient internal management.

- July 2015: Eximbank posted a very modest pre-tax aggregated profit of VND68 billion ($3.12 million) last year, falling by 91.5% against 2013 and meeting only 3% of the 2014 year's projection. Eximbank said they would not pay dividends to shareholders in 2015 and attributed bad business results to unpredictable market difficulties, especially in property markets.

Categories:

Data & Analytics, Financial Institutions, Markets & Exchanges, Retail Banking, VietnamKeywords:Eximbank, Assets, Loans