Indonesia is seeing exponential growth in mobile payments spurred by a robust fintech landscape, though usage remains uneven and limited

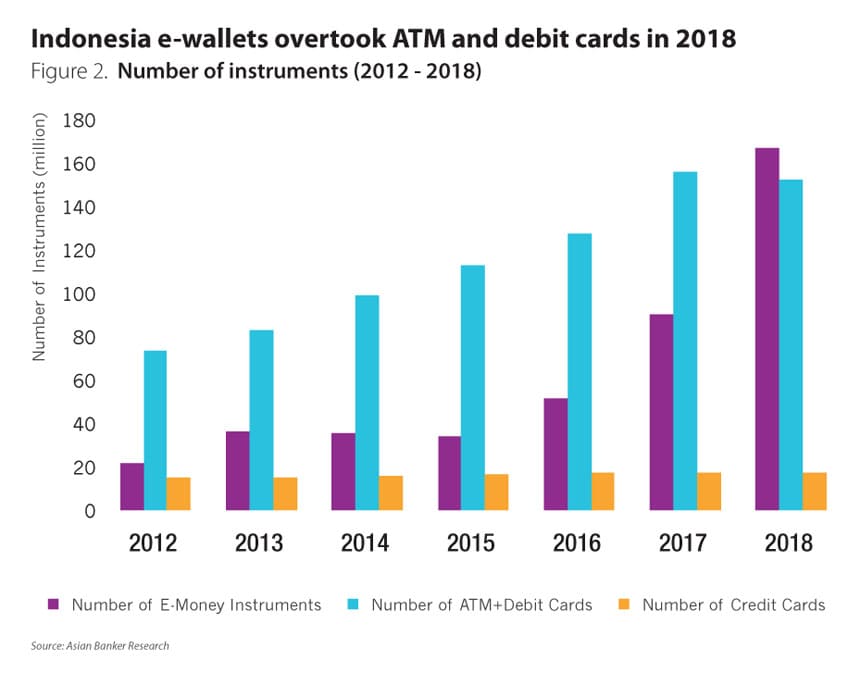

June 23, 2019 | Leo Timones- Number of e-wallet instruments overtook other card based instruments in 2018.

- E-wallet usage highly uneven with mobile phone and data package top-ups are the top use case for mobile payment transactions.

- Companies resort to heavy incentive and cash back themes to attract and retain users.

In 2018, Indonesia proved to be fertile ground for mobile payment growth driven by massive adoption of e-payments from the largest fintech platforms. E-money transaction projections were initially pegged at $1.5 billion in transaction value at the start of the year but ended up tripling, hitting $3.32 billion (Rp 47.2 trillion) by year-end, an increase of 380% compared to 2017. It is expected that the total value could exceed $15 billion by 2020.

Mobile or e-wallets essentially work like classic physical wallets and serve one purpose: to store money until such time it is accessed to pay for goods and services. According to the Indonesian Fintech Association, there are 31 e-payment providers that have secured licenses from Bank Indonesia.

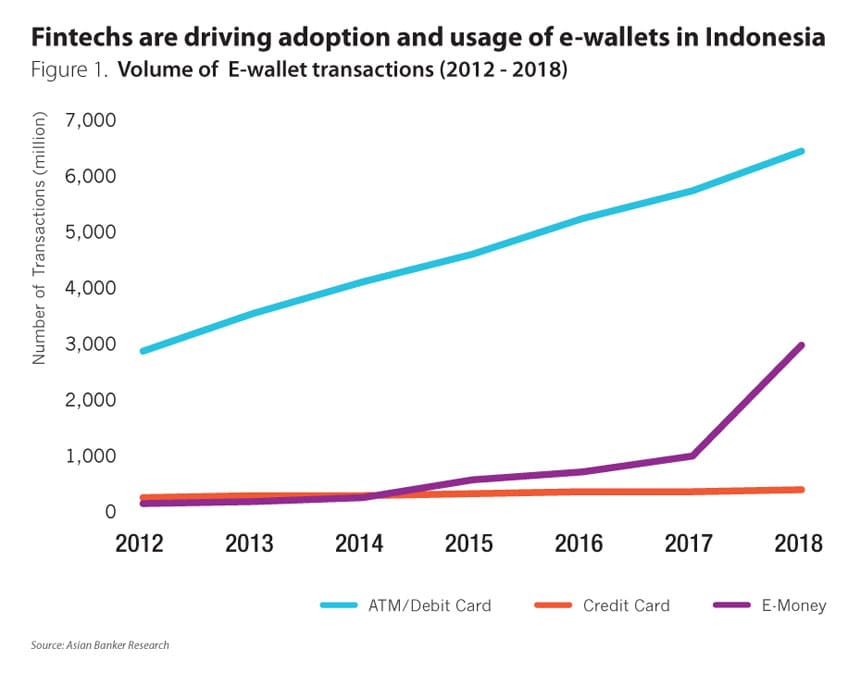

Fintechs are driving adoption and usage of e-wallets in Indonesia

Figure 1. Volume of E-wallet transactions (2012 - 2018)

Source: The Asian Banker

E-wallet adoption received a further important catalyst in May 2019, when the Bank Indonesia, the country’s central bank, introduced Quick Response Indonesia Standard (QRIS) code system, allowing QR-code payments to be interoperable through a single standardised code.

Indonesia e-wallets overtook ATM and debit cards in 2018

Figure 2. Number of instruments (2012 - 2018)

Source: The Asian Banker

With around 150 payments players, OVO by Grab, Go Pay, and LinkAja with OVO an...

Categories:

Keywords:E-wallet, Fintech, Mobile Banking, Mobile Payments, E-money, Qr, E-commerce, Online Shopping

Indonesia is seeing exponential growth in mobile payments spurred by a robust fintech landscape, though usage remains uneven and limited

June 23, 2019 | Leo Timones- Number of e-wallet instruments overtook other card based instruments in 2018.

- E-wallet usage highly uneven with mobile phone and data package top-ups are the top use case for mobile payment transactions.

- Companies resort to heavy incentive and cash back themes to attract and retain users.

In 2018, Indonesia proved to be fertile ground for mobile payment growth driven by massive adoption of e-payments from the largest fintech platforms. E-money transaction projections were initially pegged at $1.5 billion in transaction value at the start of the year but ended up tripling, hitting $3.32 billion (Rp 47.2 trillion) by year-end, an increase of 380% compared to 2017. It is expected that the total value could exceed $15 billion by 2020.

Mobile or e-wallets essentially work like classic physical wallets and serve one purpose: to store money until such time it is accessed to pay for goods and services. According to the Indonesian Fintech Association, there are 31 e-payment providers that have secured licenses from Bank Indonesia.

Fintechs are driving adoption and usage of e-wallets in Indonesia

Figure 1. Volume of E-wallet transactions (2012 - 2018)

Source: The Asian Banker

E-wallet adoption received a further important catalyst in May 2019, when the Bank Indonesia, the country’s central bank, introduced Quick Response Indonesia Standard (QRIS) code system, allowing QR-code payments to be interoperable through a single standardised code.

Indonesia e-wallets overtook ATM and debit cards in 2018

Figure 2. Number of instruments (2012 - 2018)

Source: The Asian Banker

With around 150 payments players, OVO by Grab, Go Pay, and LinkAja with OVO an...

Categories:

Keywords:E-wallet, Fintech, Mobile Banking, Mobile Payments, E-money, Qr, E-commerce, Online Shopping