Published August 19, 2021 | View complete press releases list |

Date: August 19, 2021

Categories: Financial Technology

Keywords:

KASIKORNBANK’s mobile banking platform, K Plus, integrates management information system and customer relationship management through its adobe intelligent marketing platform. It is also linked to Google analytics for monitoring user experience.

- KASIKORNBANK has the highest mobile penetration rate among its peers

- K Plus helped enhance the bank’s payment service

- KASIKORNBANK improved customer experience through leveraging digital innovations

Singapore, 3 June 2021 - KASIKORNBANK’s K Plus was recognised as the Best Mobile Banking Service at The Asian Banker International Excellence in Retail Financial Services Awards 2021.

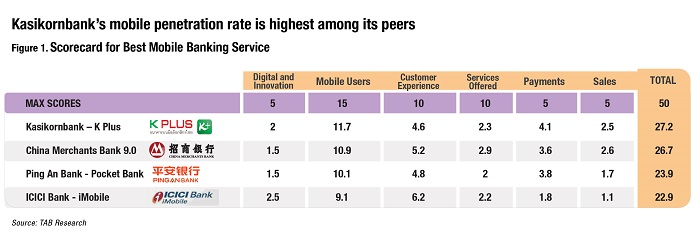

This year’s finalists for Best Mobile Banking Service are KASIKORNBANK’s K Plus, China Merchants Bank 9.0, Ping An Bank’s Pocket Bank, and ICICI Bank’s iMobile. KASIKORNBANK scored the highest in digital and innovation, mobile users, and payments categories.

Mobile Users: KASIKORNBANK has the highest mobile penetration rate among its peers

KASIKORNBANK has the highest mobile penetration rate among its peers. Its number of mobile users had a 19% growth year-on-year (YoY) and mobile transactions increased 71% YoY. It is the first bank in Thailand to seamlessly connect its existing infrastructure with a non-bank platform, LINE.

KASIKORNBANK’s K Plus customer support is available through mobile and via KASIKORNBANK LIVE's chatbot which is a text-based scripted platform. Customer can apply for personal loans via mobile which is powered by machine learning. The bank offers instant loan approval and disbursement for pre-approved customers. Thailand has 33 million mobile banking users. Of these, 48% or 16 million are K Plus users, making it the largest mobile banking platform among its peers.

CMB’s mobile user base grew 27% YoY in 2020. kakaobank increased its user base 18% YoY. kakaobank onboarded 600,000 new to bank customers in 2020.

Services Offered: K Plus helped enhance the bank’s payment service

In 2020, KASIKORNBANK enhanced its automatic credit card instalment features with its smart pay/smart cash on K Plus platform. Users can convert the spending transaction to an instalment plan with interest rates via K Plus (Smart Pay).

Customers can also transfer the available credit limit to cash and select instalment term via K Plus (Smart Cash). Users can immediately get the transaction result. Also, KASIKORNBANK collaborated with Facebook to enable seamless merchant service to accept Facebook Pay for the first time in Thailand.

In 2020, Kakaobank offered open banking service and provided prepayment schemes for teens who were unable to open bank accounts. CMB app expanded its platform business to include travel payments, financial and non-financial services.

Customer Experience: KASIKORNBANK improved customer experience through leveraging digital innovations

LINE BK, a social banking platform in Thailand, was formed through a collaboration between KASIKORNBANK and LINE Corporation (LINE). Its aims to disrupt traditional unsecured lending industry by leveraging both KASIKORNBANK’s financial and LINE’s behavioural data to find the right customer to lend and the right collection mode.

The bank acquired more than one million users within two months after official launch of LINE BK in October 2020. As of now, LINE BK has 2.8 million users in total. LINE BK has facilitated more than THB 50 billion ($1.5 billion) worth of transactions. In addition to banking product performance, number of loan application has reached 4 million app-in since official launch. Twenty-five percent of the approved applicants have never received loans from any other official institutions.

About The Asian Banker International

The Asian Banker is the region’s most authoritative provider of strategic business intelligence to the financial services community. The global research company has offices in Singapore, Malaysia, Manila, Hong Kong, Beijing and Dubai, as well as representatives in London, New York and San Francisco. It has a business model that revolves around three core business lines: publications, research services and forums. The company’s website is www.theasianbanker.com.

You may visit the Excellence in Retail Financial Services page at http://awards.asianbankerforums.com/retailfinancial/.

For further information, you may get in touch with:

Mobasher Zein Kazmi

Head of Research

Tel: (+61) 452 514 145

KASIKORNBANK’s mobile banking platform, K Plus, integrates management information system and customer relationship management through its adobe intelligent marketing platform. It is also linked to Google analytics for monitoring user experience.

- KASIKORNBANK has the highest mobile penetration rate among its peers

- K Plus helped enhance the bank’s payment service

- KASIKORNBANK improved customer experience through leveraging digital innovations

Singapore, 3 June 2021 - KASIKORNBANK’s K Plus was recognised as the Best Mobile Banking Service at The Asian Banker International Excellence in Retail Financial Services Awards 2021.

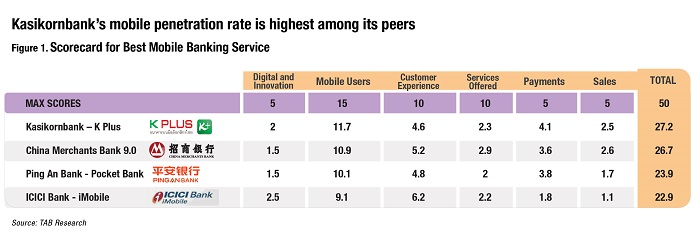

This year’s finalists for Best Mobile Banking Service are KASIKORNBANK’s K Plus, China Merchants Bank 9.0, Ping An Bank’s Pocket Bank, and ICICI Bank’s iMobile. KASIKORNBANK scored the highest in digital and innovation, mobile users, and payments categories.

Mobile Users: KASIKORNBANK has the highest mobile penetration rate among its peers

KASIKORNBANK has the highest mobile penetration rate among its peers. Its number of mobile users had a 19% growth year-on-year (YoY) and mobile transactions increased 71% YoY. It is the first bank in Thailand to seamlessly connect its existing infrastructure with a non-bank platform, LINE.

KASIKORNBANK’s K Plus customer support is available through mobile and via KASIKORNBANK LIVE's chatbot which is a text-based scripted platform. Customer can apply for personal loans via mobile which is powered by machine learning. The bank offers instant loan approval and disbursement for pre-approved customers. Thailand has 33 million mobile banking users. Of these, 48% or 16 million are K Plus users, making it the largest mobile banking platform among its peers.

CMB’s mobile user base grew 27% YoY in 2020. kakaobank increased its user base 18% YoY. kakaobank onboarded 600,000 new to bank customers in 2020.

Services Offered: K Plus helped enhance the bank’s payment service

In 2020, KASIKORNBANK enhanced its automatic credit card instalment features with its smart pay/smart cash on K Plus platform. Users can convert the spending transaction to an instalment plan with interest rates via K Plus (Smart Pay).

Customers can also transfer the available credit limit to cash and select instalment term via K Plus (Smart Cash). Users can immediately get the transaction result. Also, KASIKORNBANK collaborated with Facebook to enable seamless merchant service to accept Facebook Pay for the first time in Thailand.

In 2020, Kakaobank offered open banking service and provided prepayment schemes for teens who were unable to open bank accounts. CMB app expanded its platform business to include travel payments, financial and non-financial services.

Customer Experience: KASIKORNBANK improved customer experience through leveraging digital innovations

LINE BK, a social banking platform in Thailand, was formed through a collaboration between KASIKORNBANK and LINE Corporation (LINE). Its aims to disrupt traditional unsecured lending industry by leveraging both KASIKORNBANK’s financial and LINE’s behavioural data to find the right customer to lend and the right collection mode.

The bank acquired more than one million users within two months after official launch of LINE BK in October 2020. As of now, LINE BK has 2.8 million users in total. LINE BK has facilitated more than THB 50 billion ($1.5 billion) worth of transactions. In addition to banking product performance, number of loan application has reached 4 million app-in since official launch. Twenty-five percent of the approved applicants have never received loans from any other official institutions.

About The Asian Banker International

The Asian Banker is the region’s most authoritative provider of strategic business intelligence to the financial services community. The global research company has offices in Singapore, Malaysia, Manila, Hong Kong, Beijing and Dubai, as well as representatives in London, New York and San Francisco. It has a business model that revolves around three core business lines: publications, research services and forums. The company’s website is www.theasianbanker.com.

You may visit the Excellence in Retail Financial Services page at http://awards.asianbankerforums.com/retailfinancial/.

For further information, you may get in touch with:

Mobasher Zein Kazmi

Head of Research

Tel: (+61) 452 514 145