Hong Kong’s economy remains sound but the Hong Kong Monetary Authority is tamping down property loans and issuance of long-term personal loans. With the stricter regulations, the challenge for Hong Kong banks is not asset quality but pricing.

January 05, 2016 | Shenming WangIndustry picture

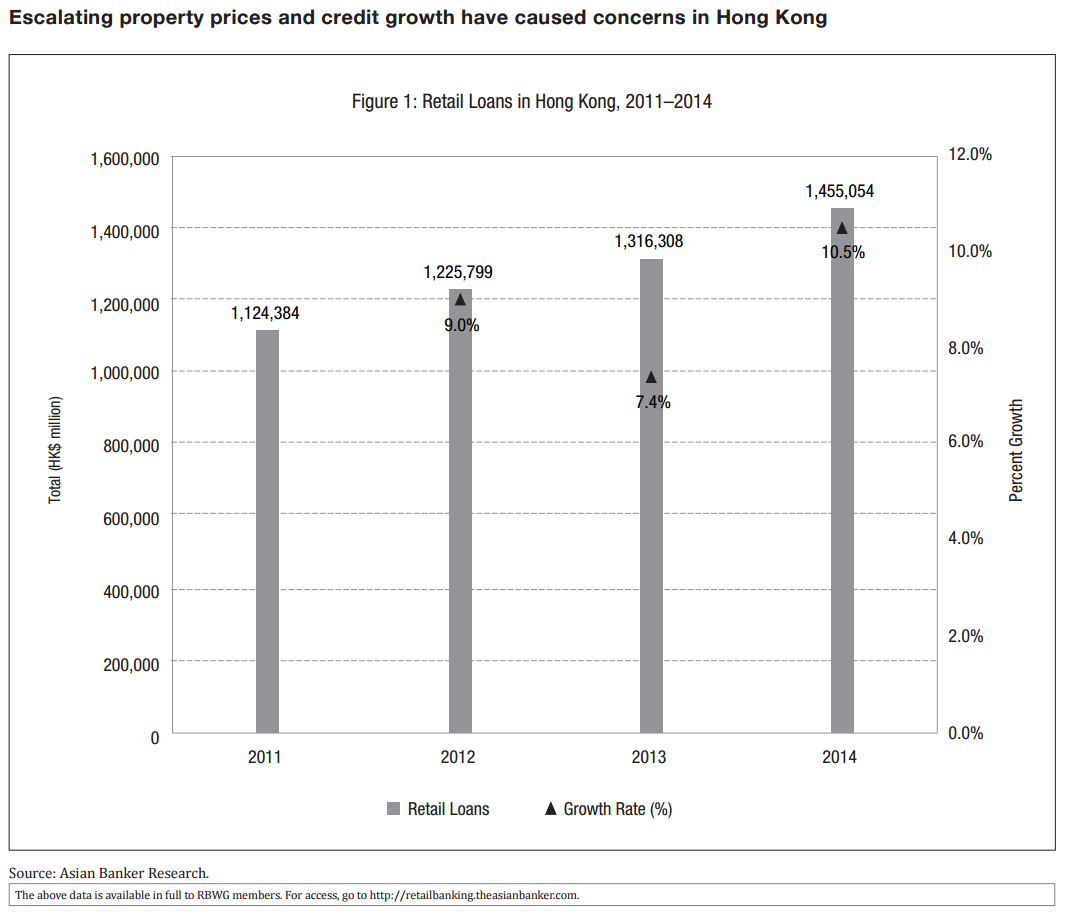

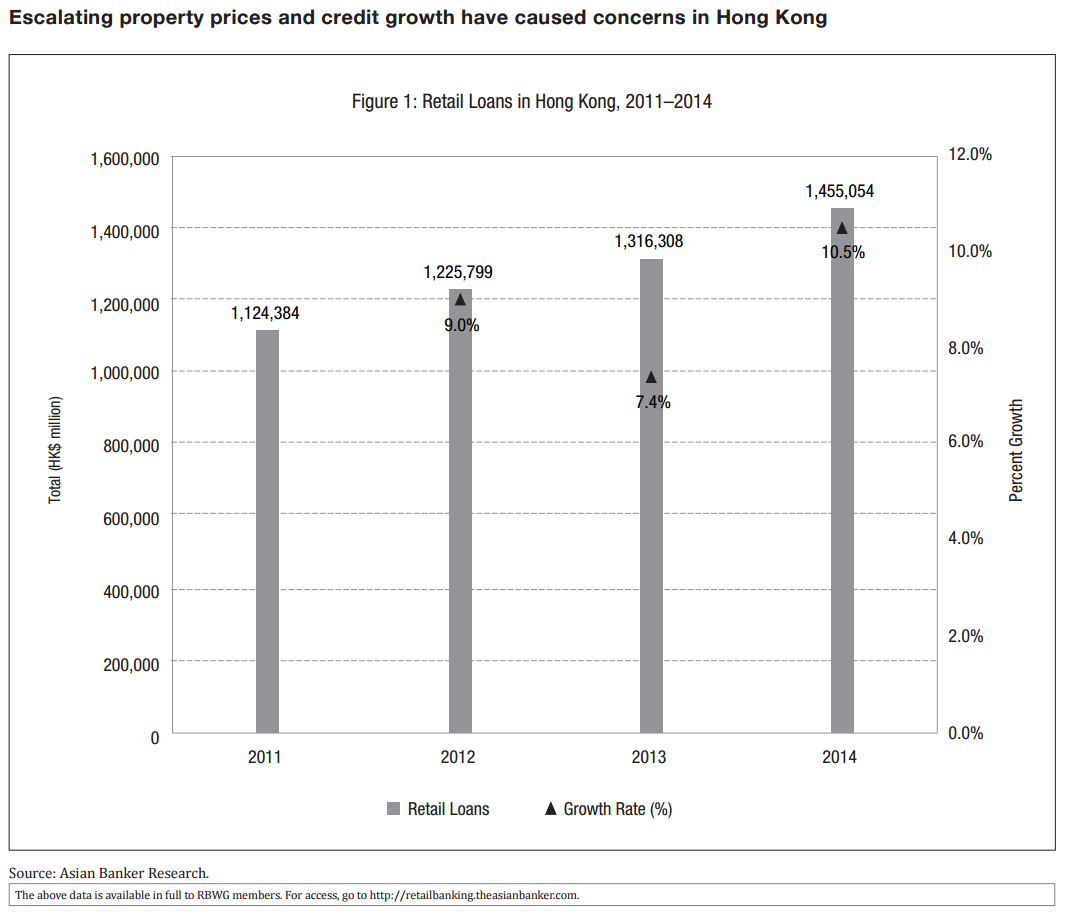

Retail banking in Hong Kong has displayed strength in a relatively mature economic environment, with a well-performing regulator and low susceptibility to potential risks. However, escalating property prices along with credit growth have caused concerns. Due to low interest rates and robust demand for personal property from mainland China, property prices have risen in Hong Kong since 2010. The Hong Kong Monetary Authority (HKMA) implemented new regulations in the second quarter of 2014 governing personal loans, debt-service ratio (DSR), and loan tenure over concerns that the current household debt-to-GDP ratio may rise to a significantly higher, and potentially unsustainable, level in the event of an economic downturn. Retail loans in Hong Kong experienced accelerating growth in 2014. Our research showed that there was a 10.5% increase in total retail loans outstanding compared to a 7.4% growth rate in 2013, reaching a total of HK$1455 billion ($188 billion) in 2014 (Figure 1).

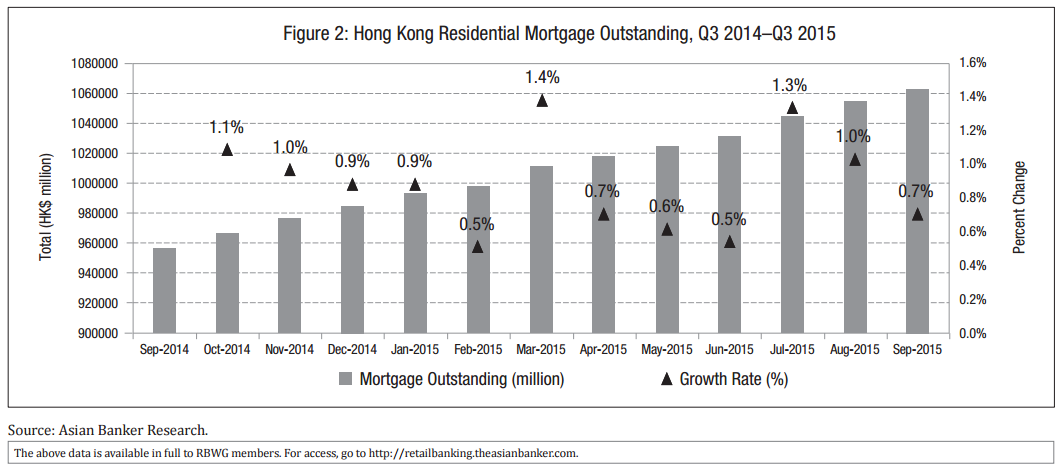

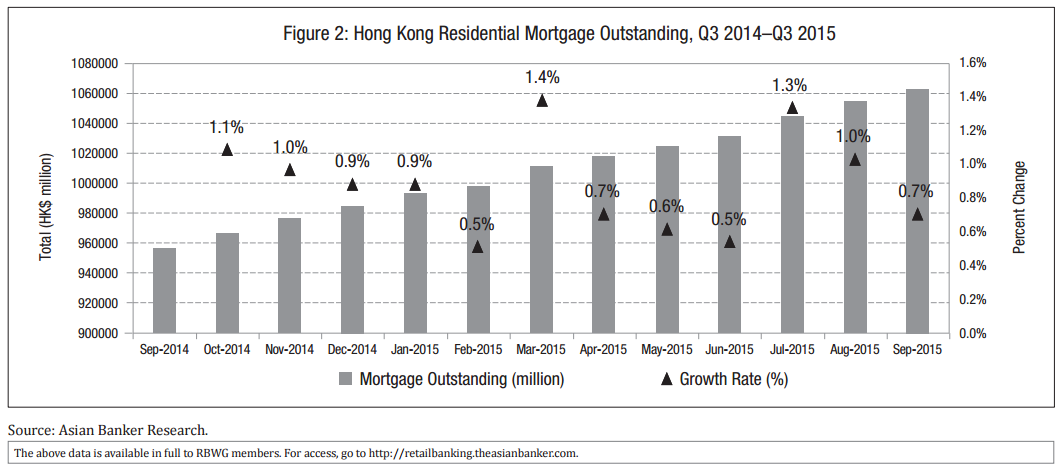

In February 2015, Hong Kong regulators continued placing controls to confront the risks in Hong Kong’s active property market. HKMA announced three more tightened countercyclical measures including lowering the maximum loan-to-value (LTV) ratio for self-use residential properties with value below $902,872 by a maximum of 10 percentage points to 60%. With these cooling measures, outstanding mortgage in February–June 2015 posted slower growth except in March, which displayed a surge as a result of temporary increases in IPO loans. Nevertheless, by July, the volume of transactions in the property market rebounded (Figure 2).

We selected two Hong Kong domestic banks, Bank of East Asia and Hang Seng Bank, to analyse their re...

Categories:

Consumer Credit, Credit Cards, Markets & Exchanges, Retail Banking, Retail Payments, Transaction BankingKeywords:HKMA, Bank Of East Asia, Hang Seng Bank, Credit, Retail Lending, Mortgage, Consumer Credit

Hong Kong’s economy remains sound but the Hong Kong Monetary Authority is tamping down property loans and issuance of long-term personal loans. With the stricter regulations, the challenge for Hong Kong banks is not asset quality but pricing.

January 05, 2016 | Shenming WangIndustry picture

Retail banking in Hong Kong has displayed strength in a relatively mature economic environment, with a well-performing regulator and low susceptibility to potential risks. However, escalating property prices along with credit growth have caused concerns. Due to low interest rates and robust demand for personal property from mainland China, property prices have risen in Hong Kong since 2010. The Hong Kong Monetary Authority (HKMA) implemented new regulations in the second quarter of 2014 governing personal loans, debt-service ratio (DSR), and loan tenure over concerns that the current household debt-to-GDP ratio may rise to a significantly higher, and potentially unsustainable, level in the event of an economic downturn. Retail loans in Hong Kong experienced accelerating growth in 2014. Our research showed that there was a 10.5% increase in total retail loans outstanding compared to a 7.4% growth rate in 2013, reaching a total of HK$1455 billion ($188 billion) in 2014 (Figure 1).

In February 2015, Hong Kong regulators continued placing controls to confront the risks in Hong Kong’s active property market. HKMA announced three more tightened countercyclical measures including lowering the maximum loan-to-value (LTV) ratio for self-use residential properties with value below $902,872 by a maximum of 10 percentage points to 60%. With these cooling measures, outstanding mortgage in February–June 2015 posted slower growth except in March, which displayed a surge as a result of temporary increases in IPO loans. Nevertheless, by July, the volume of transactions in the property market rebounded (Figure 2).

We selected two Hong Kong domestic banks, Bank of East Asia and Hang Seng Bank, to analyse their re...

Categories:

Consumer Credit, Credit Cards, Markets & Exchanges, Retail Banking, Retail Payments, Transaction BankingKeywords:HKMA, Bank Of East Asia, Hang Seng Bank, Credit, Retail Lending, Mortgage, Consumer Credit