Published December 06, 2021 | View complete press releases list |

Date: December 06, 2021

Categories: Financial Technology

Keywords:

- BOCHK remained the strongest bank in Hong Kong and Asia Pacific

- BOCHK’s prudent credit risk management resulted in solid asset quality

- Maintaining robust capital and liquidity positions

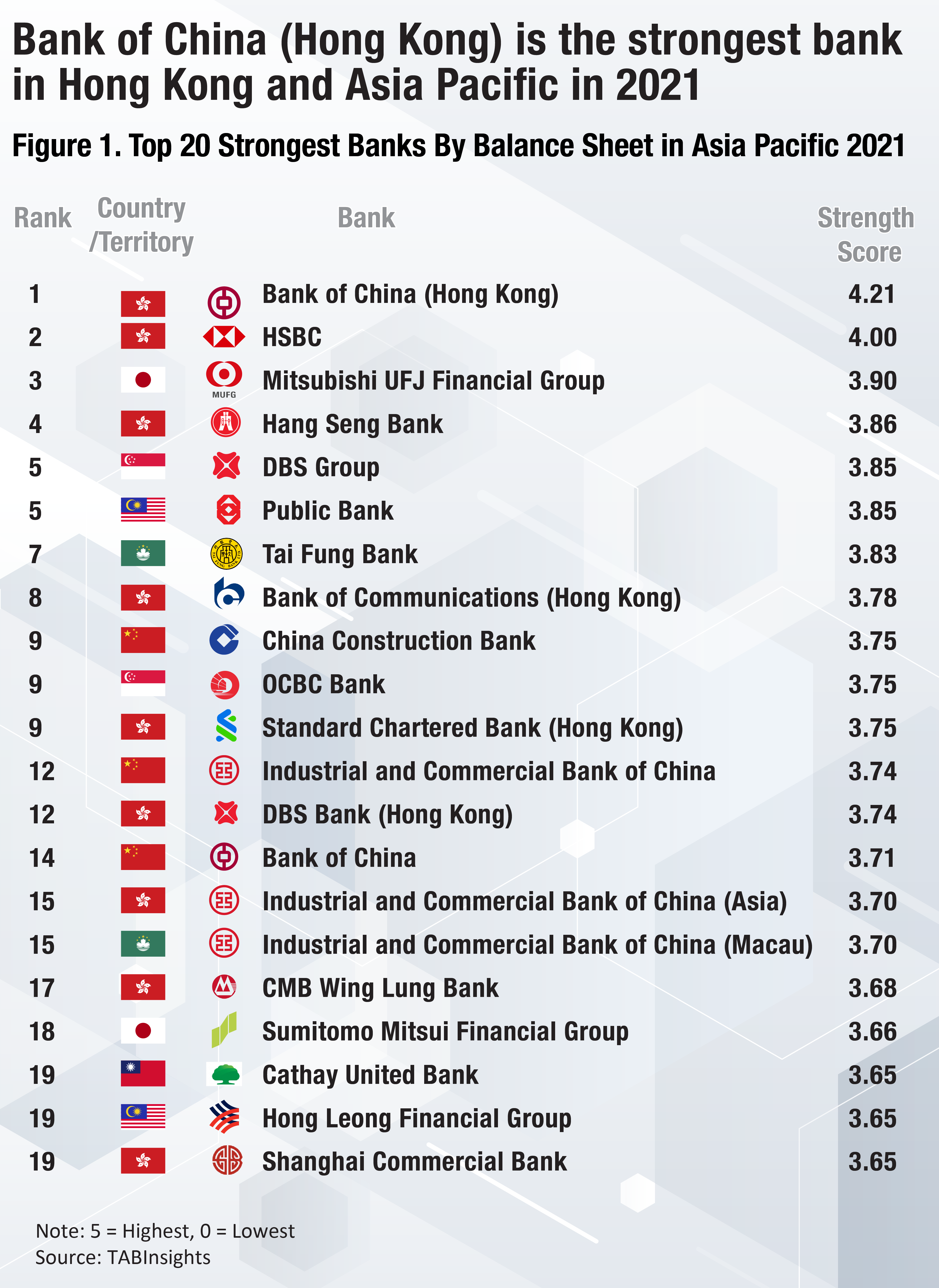

Singapore, 21 October 2021 – Bank of China (Hong Kong) (BOCHK) remains the top bank in Strongest Banks By Balance Sheet in Hong Kong and Asia Pacific (APAC) in 2021. BOCHK and other banks were recognised at The Asian Banker Strongest Banks By Balance Sheet Briefing and Recognition Virtual Ceremony 2021.

Bank of China (Hong Kong) is the strongest bank in Hong Kong and Asia Pacific in 2021

The comprehensive annual evaluation captures the quality and sustainability of the balance sheets of banks in APAC, Middle East, and Africa regions. The ranking is based on a detailed and transparent scorecard that evaluates commercial banks and financial holding companies (banks) in six areas of balance sheet financial performance, namely the ability to scale, balance sheet growth, risk profile, profitability, asset quality, and liquidity.

BOCHK remained the strongest bank in Hong Kong and Asia Pacific

BOCHK has retained its strongest bank ranking in Asia Pacific driven by its excellent performance in the areas of scale, risk profile, asset quality and liquidity. With total assets of $428 billion at the end of 2020, its assets to gross domestic product (GDP) ratio reached 124%. The bank proactively managed its assets and liabilities, which led to solid credit growth and improved deposit mix. In addition to solid asset quality and strong capital and liquidity levels, the strengthened cost management enabled the bank to keep its cost to income ratio at a low level of 30%.

BOCHK said, “Despite the challenging market environment, the bank remained focused in Hong Kong, the Greater Bay Area and the Southeast Asian markets, while adhering to our customer-centric philosophy. During the year, we continued to transform our business, consolidate our strong franchise in RMB business and strengthen our digital and integrated service capabilities across the region. We also continued to follow our prudent risk management principles and push forward our low carbon transformation, striving for sustainable and high-quality development”.

BOCHK’s prudent credit risk management resulted in solid asset quality

The gross non-performing loan (GNPL) ratio of BOCHK was contained at 0.26% in 2020, compared with the average of 1.62% in Asia Pacific. Its loan loss reserves to gross non-performing loans (LLRs/GNPLs) ratio also improved to 230% from 219% in 2019. The bank demonstrated stronger asset quality than HSBC andMitsubishi UFJ Financial Group (MUFG), the second and the third strongest banks in Asia Pacific, respectively. HSBC saw its GNPL ratio up from 0.45% in 2019 to 0.97% in 2020 and its LLRs/GNPLs ratio declined from 105% to 81%. The GNPL ratio of MUFG weakened from 1% to 1.25% and its LLRs/GNPLs ratio stood at 82%.

The average GNPL ratio of all banks in the ranking rose only moderately to 1.62% in 2020 from 1.53% in the previous year, as the COVID-related relief measures have led to the deferred recognition of problem loans.With government support measures easing, the banking sector will face some further deterioration in asset quality.

Maintaining robust capital and liquidity levels

BOCHK remained strongly capitalised and highly liquid as reflected by the high capital adequacy ratio (CAR) of 22.1% and liquid assets to total deposits and borrowings ratio of 53%. Its CAR was the highest among the top 20 strongest banks in Asia Pacific. Most banks in the region maintained sound capital positions. The average CAR of banks in Indonesia, Hong Kong, Malaysia, Pakistan and Thailand were above 18%, while CAR in Vietnam and Bangladesh were considerably lower than other markets. Overall, banks in Brunei, Hong Kong, Japan, Kazakhstan and Pakistan remained highly liquid, as evidenced by the liquid assets to total deposits and borrowing ratio of over 50%.

For video of award presentation and the winner's acceptance speech, click here.

For video of the Strongest Banks by Balance Sheet Briefing, click here.

About the Strongest Banks By Balance Sheet programme

The Asian Banker Strongest Banks By Balance Sheet is an annual assessment of the financial and business performance of the banking industry in the Asia Pacific, Middle East, and Africa regions. The assessment ranks the top performing banks in each country or territory by strength, an evaluation that is based on a belief that a strong bank demonstrates long-term profitability from its core businesses.

The scope and coverage for The Asian Banker Strongest Banks By Balance Sheet come from both the mature markets and the most promising emerging markets in the regions. The focus of the assessment is on commercial banks and financial holding companies with a significant proportion of activity in commercial banking. The assessment does not include central banks, policy banks or finance companies.

The winners are determined using a scorecard approach based on six crucial performance indicators rated on a scale of 0-5: scale, balance sheet growth, risk profile, profitability, asset quality, and liquidity.

About The Asian Banker

The Asian Banker is the region’s most authoritative provider of strategic business intelligence to the financial services community. The global research company has offices in Singapore, Malaysia, Manila, Hong Kong, Beijing, and Dubai, as well as representatives in London, New York, and San Francisco. It has a business model that revolves around three core business lines: publications, research services and forums. The company’s website is www.theasianbanker.com.

For further information, please contact:

Ms. Sue Kim

Marketing Manager

www.theasianbanker.com

- BOCHK remained the strongest bank in Hong Kong and Asia Pacific

- BOCHK’s prudent credit risk management resulted in solid asset quality

- Maintaining robust capital and liquidity positions

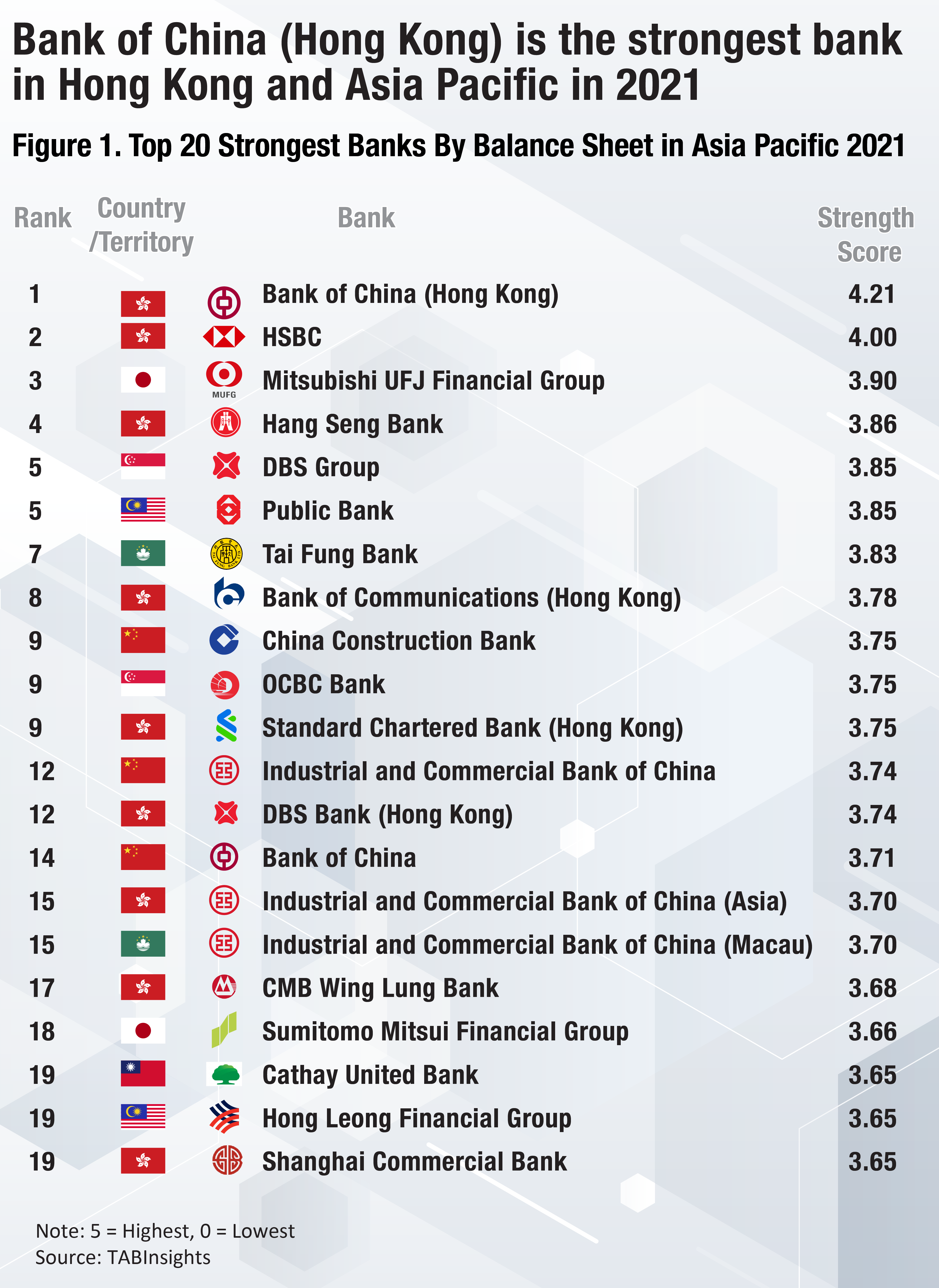

Singapore, 21 October 2021 – Bank of China (Hong Kong) (BOCHK) remains the top bank in Strongest Banks By Balance Sheet in Hong Kong and Asia Pacific (APAC) in 2021. BOCHK and other banks were recognised at The Asian Banker Strongest Banks By Balance Sheet Briefing and Recognition Virtual Ceremony 2021.

Bank of China (Hong Kong) is the strongest bank in Hong Kong and Asia Pacific in 2021

The comprehensive annual evaluation captures the quality and sustainability of the balance sheets of banks in APAC, Middle East, and Africa regions. The ranking is based on a detailed and transparent scorecard that evaluates commercial banks and financial holding companies (banks) in six areas of balance sheet financial performance, namely the ability to scale, balance sheet growth, risk profile, profitability, asset quality, and liquidity.

BOCHK remained the strongest bank in Hong Kong and Asia Pacific

BOCHK has retained its strongest bank ranking in Asia Pacific driven by its excellent performance in the areas of scale, risk profile, asset quality and liquidity. With total assets of $428 billion at the end of 2020, its assets to gross domestic product (GDP) ratio reached 124%. The bank proactively managed its assets and liabilities, which led to solid credit growth and improved deposit mix. In addition to solid asset quality and strong capital and liquidity levels, the strengthened cost management enabled the bank to keep its cost to income ratio at a low level of 30%.

BOCHK said, “Despite the challenging market environment, the bank remained focused in Hong Kong, the Greater Bay Area and the Southeast Asian markets, while adhering to our customer-centric philosophy. During the year, we continued to transform our business, consolidate our strong franchise in RMB business and strengthen our digital and integrated service capabilities across the region. We also continued to follow our prudent risk management principles and push forward our low carbon transformation, striving for sustainable and high-quality development”.

BOCHK’s prudent credit risk management resulted in solid asset quality

The gross non-performing loan (GNPL) ratio of BOCHK was contained at 0.26% in 2020, compared with the average of 1.62% in Asia Pacific. Its loan loss reserves to gross non-performing loans (LLRs/GNPLs) ratio also improved to 230% from 219% in 2019. The bank demonstrated stronger asset quality than HSBC andMitsubishi UFJ Financial Group (MUFG), the second and the third strongest banks in Asia Pacific, respectively. HSBC saw its GNPL ratio up from 0.45% in 2019 to 0.97% in 2020 and its LLRs/GNPLs ratio declined from 105% to 81%. The GNPL ratio of MUFG weakened from 1% to 1.25% and its LLRs/GNPLs ratio stood at 82%.

The average GNPL ratio of all banks in the ranking rose only moderately to 1.62% in 2020 from 1.53% in the previous year, as the COVID-related relief measures have led to the deferred recognition of problem loans.With government support measures easing, the banking sector will face some further deterioration in asset quality.

Maintaining robust capital and liquidity levels

BOCHK remained strongly capitalised and highly liquid as reflected by the high capital adequacy ratio (CAR) of 22.1% and liquid assets to total deposits and borrowings ratio of 53%. Its CAR was the highest among the top 20 strongest banks in Asia Pacific. Most banks in the region maintained sound capital positions. The average CAR of banks in Indonesia, Hong Kong, Malaysia, Pakistan and Thailand were above 18%, while CAR in Vietnam and Bangladesh were considerably lower than other markets. Overall, banks in Brunei, Hong Kong, Japan, Kazakhstan and Pakistan remained highly liquid, as evidenced by the liquid assets to total deposits and borrowing ratio of over 50%.

For video of award presentation and the winner's acceptance speech, click here.

For video of the Strongest Banks by Balance Sheet Briefing, click here.

About the Strongest Banks By Balance Sheet programme

The Asian Banker Strongest Banks By Balance Sheet is an annual assessment of the financial and business performance of the banking industry in the Asia Pacific, Middle East, and Africa regions. The assessment ranks the top performing banks in each country or territory by strength, an evaluation that is based on a belief that a strong bank demonstrates long-term profitability from its core businesses.

The scope and coverage for The Asian Banker Strongest Banks By Balance Sheet come from both the mature markets and the most promising emerging markets in the regions. The focus of the assessment is on commercial banks and financial holding companies with a significant proportion of activity in commercial banking. The assessment does not include central banks, policy banks or finance companies.

The winners are determined using a scorecard approach based on six crucial performance indicators rated on a scale of 0-5: scale, balance sheet growth, risk profile, profitability, asset quality, and liquidity.

About The Asian Banker

The Asian Banker is the region’s most authoritative provider of strategic business intelligence to the financial services community. The global research company has offices in Singapore, Malaysia, Manila, Hong Kong, Beijing, and Dubai, as well as representatives in London, New York, and San Francisco. It has a business model that revolves around three core business lines: publications, research services and forums. The company’s website is www.theasianbanker.com.

For further information, please contact:

Ms. Sue Kim

Marketing Manager

www.theasianbanker.com